Author: Curry, TechFlow TechFlow

Original title: a16z raises $15 billion, saying it will make America win.

Last Friday, a16z announced the completion of a $15 billion fundraising round.

Note that this is fundraising, not investment . It means that LPs give them money so they can invest in other people's investments.

How outrageous is this number?

In 2025, total venture capital (VC) funding in the United States reached $66.1 billion, the lowest in eight years. a16z alone accounted for nearly 20% of this.

The industry is going through a downturn, and they are stockpiling goods.

But why are LPs willing to entrust their money to them during a downturn?

Perhaps it's because they have a history of making money in winter.

In 2009, they invested in Facebook, just after the financial crisis, and nobody dared to invest. In 2013, they invested in Coinbase, when most people thought Bitcoin was a geek toy. In May 2022, Bitcoin fell by 55%, Coinbase's stock price fell by 80%, and a16z had raised a $4.5 billion Crypto fund at that time.

At the time, the comments section was full of people laughing at them for taking over the business.

Last year, The Information published an article saying that this fund's returns had skyrocketed. The reason was simple: their investment in Solana had increased from $8 to $180 at the time.

"Be greedy when others are fearful" is often just a motivational quote.

But if you are greedy every time you are fearful, and you bet right every time, it becomes a kind of:

Credit history.

Back to the topic of $15 billion, how will a16z spend it?

Of the total, 6.75 billion will be invested in growth-stage companies, providing additional support to projects that have already achieved success and are poised for further expansion. 1.7 billion will be invested in application layer technologies, 1.7 billion in underlying technologies, and 700 million in biopharmaceuticals.

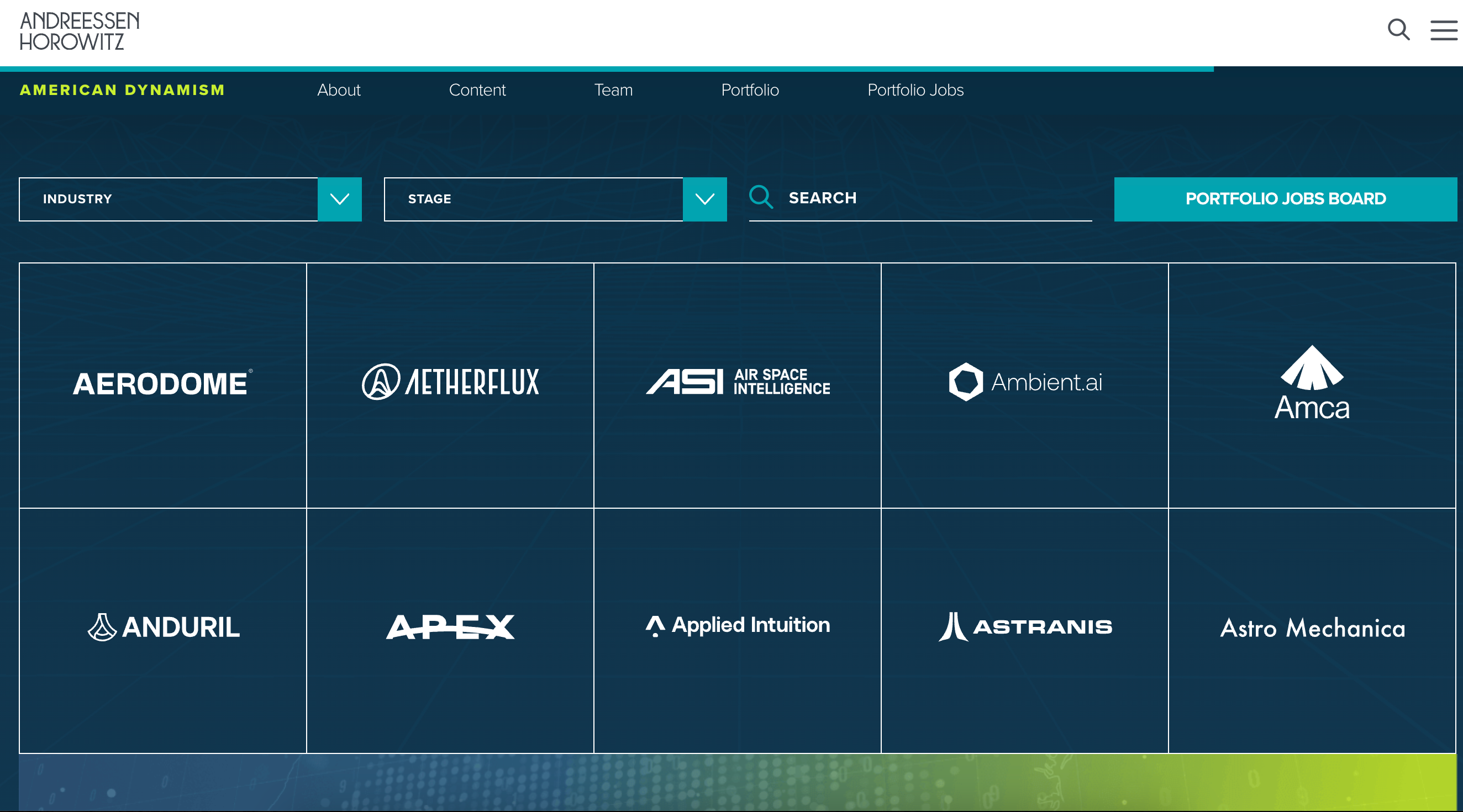

There's also 1.176 billion to invest in a theme called "American Dynamism".

The direct translation is "American Vitality," which sounds like a slogan created by a high-end think tank. Looking at what they've already voted on under this theme reveals the true meaning of the term:

To enable America to manufacture things again.

What to build? Weapons.

Companies in this part of the portfolio, such as Anduril (autonomous weapon systems), Shield AI (military drones), Saronic (unmanned warships), and Castelion (hypersonic missiles), share a common characteristic: their largest customer is the Pentagon.

a16z himself stated that if a war were to break out with China in the Taiwan Strait, the United States' missile stockpile would be depleted in 8 days and would then require 3 years to replenish.

In the eyes of Americans, this is not alarmist talk, it's business.

The US military-industrial complex is aging; Lockheed Martin and similar companies are too slow and expensive, and the Pentagon needs new suppliers. a16z is betting on this gap, using VC funding to incubate a group of "software-defined weapons" companies, which will then be sold to the Department of Defense once they mature.

$1.176 billion isn't a lot, but it represents a gamble on a prediction. The US is going to rebuild its manufacturing sector, starting with the military industry.

To succeed in the military industry, money alone is not enough; you also need connections.

a16z doesn't need this.

In late 2024, Marc Andreessen claimed to be an "unpaid intern" at the DOGE (Department for Government Efficiency), helping the department recruit people, and reportedly spent half his time at Mar-a-Lago advising Trump.

DOGE was dissolved early last November, but the network of a16z members remained. Their first employee, Scott Kupor, is now the Director of the Office of Personnel Management in the United States.

Trump just said this week that the defense budget will be increased to $1.5 trillion next year.

There are many VCs investing in the military industry, but very few can simultaneously invest in companies and influence policy.

This may also be one of A16Z's true competitive advantages: it's not just about investing, but also about participating in rule-making. It invests in missile companies and simultaneously helps governments decide who gets contracts.

It's a bit like being both the referee and the player.

You can call it a conflict of interest, or you can call it resource integration. LPs don't care; they only care about returns.

Many people know a16z because of Crypto.

Crypto was not listed separately in this 15 billion figure; it was included in the 3 billion "other" category.

Has encryption been abandoned?

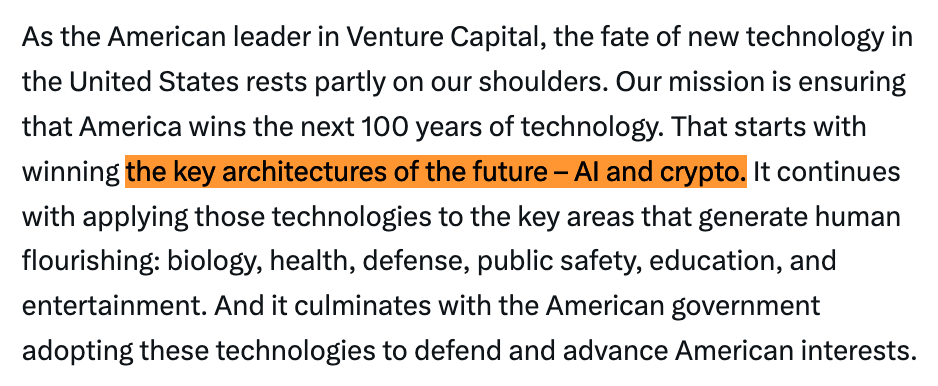

No. Ben Horowitz clearly wrote in his blog, "AI and Crypto are the key architectures of the future."

For a16z, Crypto no longer needs to raise a separate fund.

In 2018, their first Crypto fund was $350 million. By 2022, it had grown to $4.5 billion. And now? They invest directly from their main fund, putting it in the same pool as AI, military, and energy.

What does this tell us?

This shows that in their eyes, Crypto has transformed from a "new track" into infrastructure.

Exchanges are infrastructure, public blockchains are infrastructure, and DeFi protocols are also infrastructure. Like AWS, Nvidia, and missiles, they are all underlying infrastructure.

Previously, we were VCs investing in crypto; now we're VCs investing in infrastructure.

The scope has been broadened.

This is actually good news for the cryptocurrency industry. Being categorized as "other" might seem like a downgrade, but it's more like graduation. It means that this concept no longer needs separate explanation; limited partners (LPs) understand it, and Western regulators are beginning to accept it.

Of course, this also means that the Crypto project will be competing with AI and military industries for the same funding pool.

The competition has become more intense.

Ben also wrote something on his blog that Sequoia might not like to hear:

"As leaders in American venture capital, we bear part of the responsibility for the fate of new technologies."

Sequoia has been in business for 50 years, while A16Z has only been in business for 16 years. Yet, both now manage around $90 billion, ranking them tied for first place globally.

On what grounds?

In essence, venture capital (VC) sells two things: vision and resources.

Foresight is hard to prove. You might say you have a good eye, but it will take ten years to see. But resources are different; resources can be accumulated.

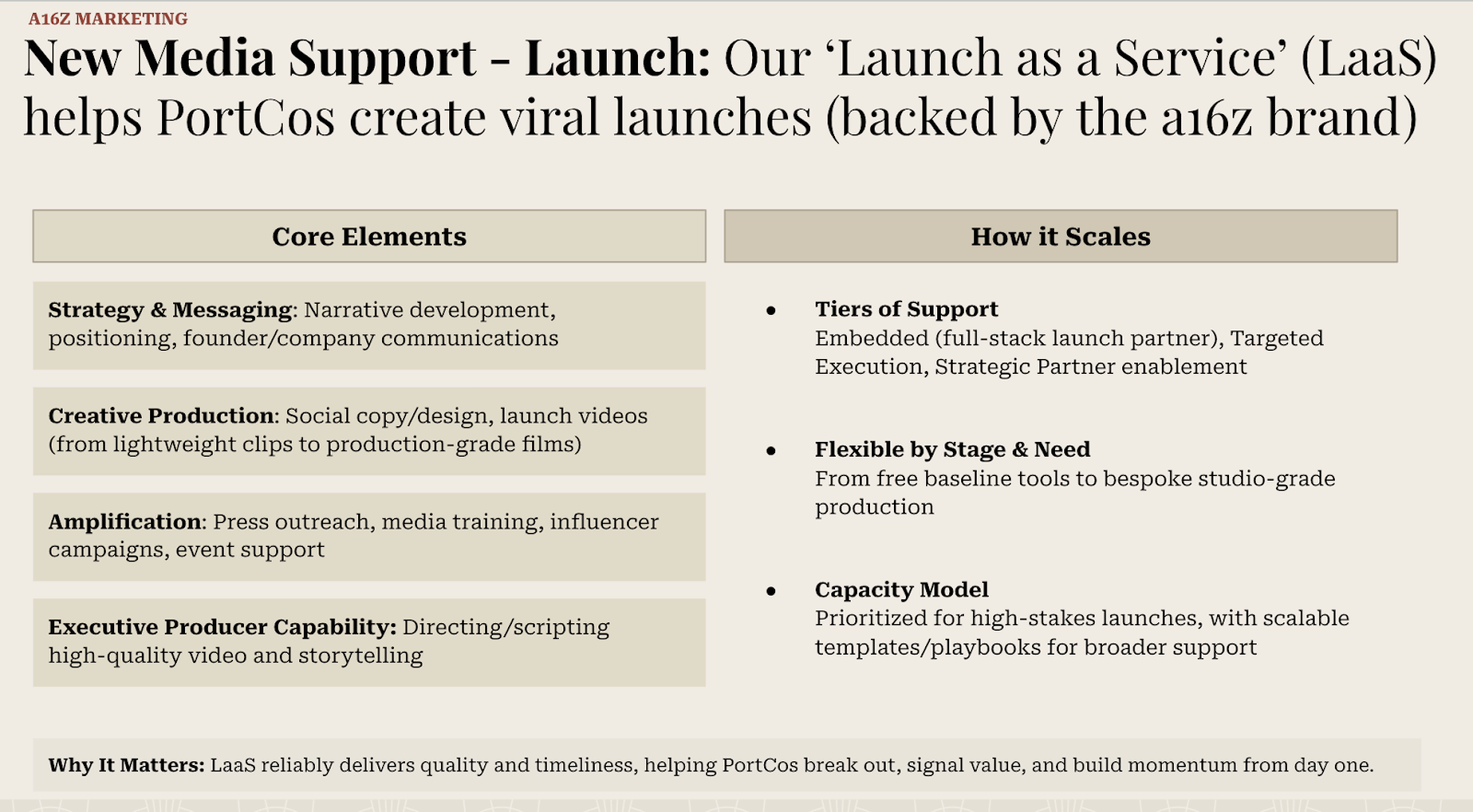

What a16z has been doing all these years is building up its resources.

They have the strongest content team in the industry, producing podcasts, blogs, and newsletters with output comparable to media companies. Before even securing funding, entrepreneurs are already being thoroughly influenced by a16z's worldview.

They have connections in Washington. They don't just know a few politicians; they directly put people into the government.

They also have the advantage of scale. When managing $90 billion, you can write a $1 billion check to SpaceX, something smaller funds simply can't do.

It's not just about making accurate shots, it's about making yourself irreplaceable.

Entrepreneurs come to you not because you have a lot of money, but because you can help them secure government contracts. Limited partners (LPs) come to you not because of your high returns, but because others don't have your policy influence.

This approach is difficult for other venture capitalists to replicate.

Of course, there are risks involved.

a16z's current strategy is partly tied to the fate of the United States. They believe that AI will win, the military industry will rise, and American manufacturing will revive. If these predictions are wrong, a large portion of the $15 billion will be wasted.

a16z is betting not just on the technology cycle, but on the political cycle. This cycle is probably even more difficult to predict than the technology cycle.

However, the fact that LPs are willing to entrust them with 15 billion shows that the market believes in this assessment.

Or rather, in an uncertain world, a16z provides a kind of certainty:

We know how to turn money into influence, and influence into returns. Invest when others are hesitant, and bet when others don't understand. Then wait for the cycle to turn around and reap the rewards of their trust.

Therefore, you can understand this 15 billion as a vote of confidence from LPs to a16z.

Next, we'll see how the A16Z is voted for by the United States.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush