By Nicky, Foresight News

Original title: Will U be the stablecoin Binance needs?

On January 13, Binance announced the listing of United Stables (U) and opened spot trading pairs for U/USDT and U/USDC, while also launching a zero-fee promotion for spot and leveraged trading of these pairs. Within 30 minutes of the launch, the trading volume exceeded $4.5 million.

Given the current highly mature stablecoin landscape and the continuously tightening regulatory environment, Binance's decision to launch a new USD stablecoin at this juncture carries significant symbolic meaning. Since the gradual withdrawal of BUSD, centralized exchanges have faced significantly increased compliance costs and regulatory pressures in directly issuing stablecoins, while the demand for stable assets in trading, DeFi, and on-chain settlement scenarios has not diminished. How to introduce a stablecoin that highly synergizes with their own ecosystem without directly assuming issuance responsibility has become a real challenge that exchanges must address.

The emergence of United Stables (U) may perfectly meet this need. U is issued by an independent legal entity, United Stables Limited, and Binance is not its legal issuer. However, the stablecoin has been quickly integrated into BNB Chain, Binance Wallet, Binance Exchange, and multiple ecosystem protocols, making it highly integrated with the Binance ecosystem in terms of usage.

Binance not only provides U with spot and leveraged trading pairs, but also launched a zero-fee campaign to create conditions for U to quickly build liquidity and usage depth in the early stages.

On December 18, 2025, Binance founder CZ mentioned the latest developments of U in the "2025 Year-End Q&A AMA" hosted by BNB Chain, and said that it "has certain potential". However, the project has not disclosed any financing progress, and YZi Labs has not disclosed any relevant investment information.

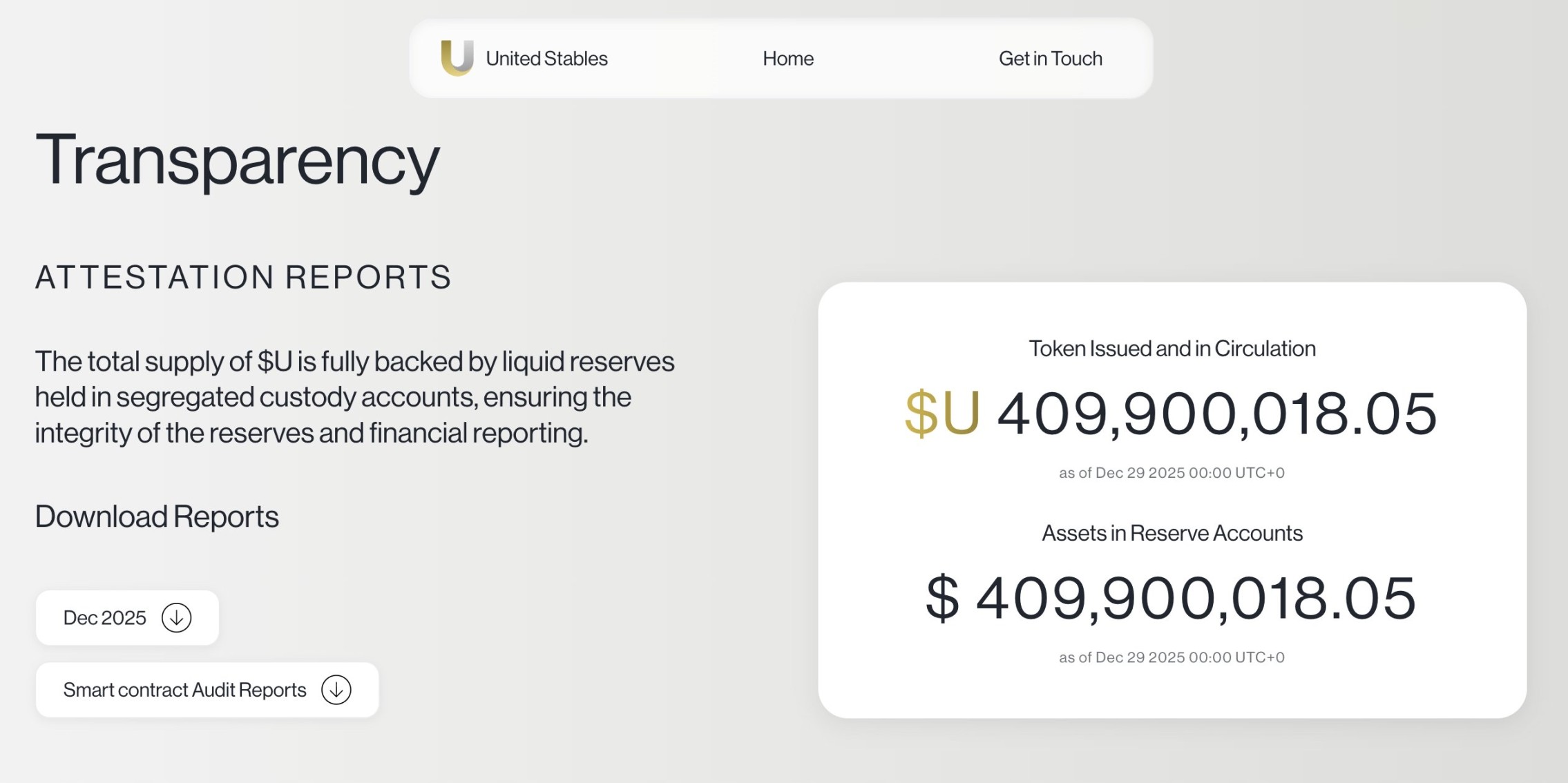

United Stables (U) is issued by United Stables Limited, a company registered in the British Virgin Islands (BVI). According to the project's official website, U is pegged to the US dollar and uses a 1:1 reserve backing mechanism. The reserve assets are held in custody through an independent trust structure to achieve legal separation from the issuer's assets. Fiat currency reserves are held in compliant banking institutions, while digital asset reserves are managed by a licensed custodian.

Previously, digital asset custody platform Ceffu issued the latest custody balance certificate for the project on December 29, 2025, and PeckShield has issued a smart contract audit report.

In contrast, the reserve management models of mainstream stablecoins in the current market vary. Tether (USDT), issued by Tether Limited, primarily holds reserve assets in the form of US Treasury bonds, money market instruments, reverse repurchase agreements, and cash. These assets are held by multiple financial institutions and custodians, and Tether regularly publishes reserve verification reports issued by third-party accounting firms. Circle (USDC), on the other hand, manages its reserve assets through regulated bank accounts and a US-registered government money market fund, and continuously discloses reviewed or audited reserve reports.

It is important to note that United Stables Limited explicitly states on its website that U has not yet been registered or licensed under the EU MiCA, Hong Kong's Stablecoin Ordinance, the US GENIUS Act, or any other relevant securities or stablecoin regulatory frameworks in the US or EU. This means that the stablecoin is currently not included in the stablecoin regulatory systems of any major jurisdiction.

Publicly available information shows that its core members include Athena Y and Charles W., among others. Athena Y is currently the CEO of United Stables, and previously co-founder of the payment platform Wello. She also served as head of Binance's NFT business and CEO of the institutional digital asset custody platform Ceffu. Charles W. is currently studying at the London School of Economics (LSE) and is participating in community communication and external collaboration at United Stables as an intern. His past experience includes internships at Goldman Sachs and Citadel.

Further background checks on the project revealed that, apart from the CEO's publicly available information, United Stables has not yet systematically disclosed the complete management team structure, including the configuration of key positions such as compliance, risk control, finance, or reserve management.

In terms of product positioning, U does not describe itself as a direct replacement for mainstream stablecoins such as USDT and USDC, but rather attempts to exist as a "unified liquidity layer." Its core idea is to accept fiat currency or mainstream stablecoins for minting, giving different stablecoins a unified settlement and circulation medium when used on-chain, thereby reducing the friction costs associated with cross-protocol and cross-scenario operations. The official statement also mentions that U's target use cases cover exchanges, DeFi, payment networks, and AI-automated agents.

According to on-chain data, as of January 13th, the total supply of U was approximately 410 million, with nearly 14,000 holding addresses and over 1.8 million cumulative transactions.

In terms of ecosystem development, U quickly integrated with multiple applications and protocols centered around BNB Chain after its launch. On December 18, 2025, HTX listed U and opened deposit and withdrawal services, Aster opened the U/USDT trading pair at the same time, and Binance Wallet also supported trading U on the BNB Chain and Ethereum networks on the same day.

On the same day, Four.Meme announced that it would use U as one of the stablecoins for fundraising and trading on the platform. However, based on the current on-chain data, the overall size of Meme tokens using U as liquidity is still limited. UDOG is currently among the top with a market value of about $900,000, but it was not launched by the Four.Meme platform.

In the DeFi arena, Lista DAO has launched U Vault and multiple lending markets. As of January 13th, the U Vault had approximately 3.51 million deposits, with an annualized yield of approximately 3.3%. In the payments sector, AEON announced a partnership with United Stables, enabling its AEON Pay to support offline QR code payments using U, and designating U as one of the settlement assets for x402 AI-native payments and automated transactions on the BNB Chain.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush