Author: Prathik Desai

Original title: Crypto's Revenue Recipe

Compiled and edited by: BitpushNews

I've always enjoyed the "seasonal" traditions within the crypto community, like Uptober (the October surge ) or Recktober (the October crash). Community members always seem to love throwing out tons of statistics around these milestones. After all, humans are naturally drawn to obscure facts, aren't they?

The trend analyses and reports surrounding this data are even more interesting. You'll often hear arguments like, "This time, ETF fund flows are completely different"; "Crypto funding has finally matured this year"; "BTC is ready for this year's surge," and so on.

Recently, while reading a report called State of DeFi 2025, I was drawn to several charts showing how crypto protocols generate “real revenue.”

These charts showcase the top-grossing protocols across the industry over the past year. They confirm a fact that has been repeatedly discussed within the industry over the past year: the crypto industry is finally starting to find "generating revenue" sexy. But what exactly is reshaping this revenue landscape?

Hidden behind these charts is a little-known story worth exploring: where do these collected fees ultimately go?

I delved into DefiLlama ’s fee and revenue data (revenue refers to the retained fees after deducting payments to liquidity providers and suppliers) in an attempt to find the answer.

In this quantitative analysis, I will attempt to add some dimensions to these figures to show you how funds flow in the crypto world and where they go.

2025: Revenue doubles, established dominance remains intact.

Last year, crypto protocols generated more than $16 billion in total revenue, more than double the approximately $8 billion generated in 2024.

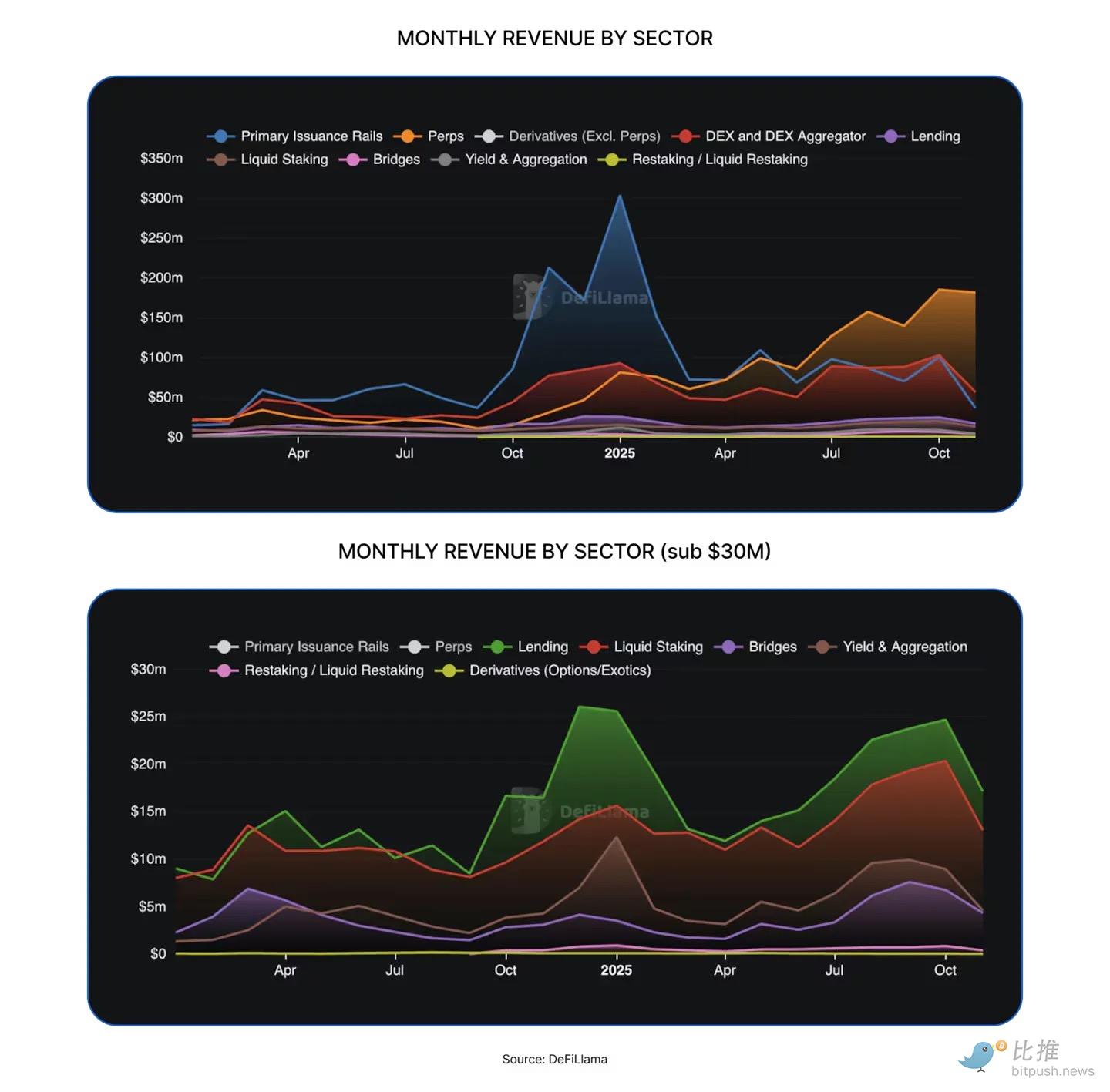

Value capture capabilities continue to expand across the crypto industry, with many new categories emerging in decentralized finance (DeFi) over the past 12 months, such as decentralized exchanges (DEXs), launchpads, and perpetual contract exchanges (Perp DEXs).

However, the "profit centers" that generate the highest revenue remain concentrated in those established categories—most notably stablecoin issuers.

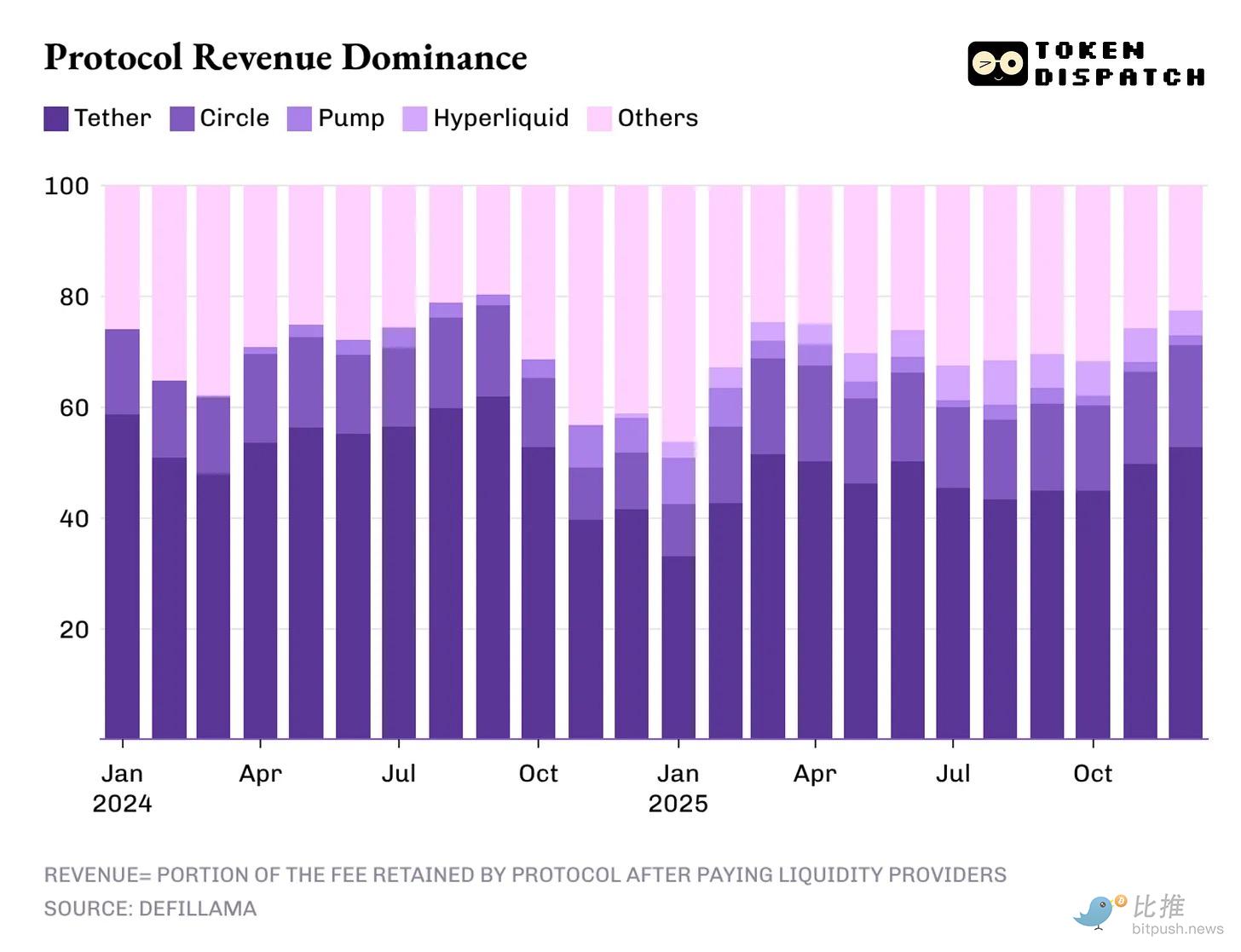

The two major stablecoin giants, Tether and Circle, accounted for over 60% of the total annual revenue of the crypto industry. By 2025, this proportion had only slightly declined from approximately 65% the previous year to 60%.

However, the achievements of perpetual contract exchanges (Perp DEXs) in 2025 are absolutely remarkable—considering they were virtually nonexistent in 2024. Hyperliquid , EdgeX, Lighter, and Axiom collectively contributed 7% to 8% of the industry's total revenue, a proportion far exceeding the combined share of established DeFi categories such as lending, staking, cross-chain bridges, and DEX aggregators.

Revenue engines for 2026: Spread, execution, and distribution

So, what will drive revenue in 2026? I found the answer in the three core elements that influenced last year's revenue concentration: Carry, Execution, and Distribution .

1. Carry trade

Carry trades mean that whoever holds and transfers funds can earn a return through this holding and transfer.

The revenue model of stablecoin issuers is both "structural" and "fragile".

Structural: Because it expands with the growth of supply and circulation. Every digital dollar they hold is backed by Treasury bonds, which can generate interest.

Vulnerability: This is because the model relies on a macroeconomic variable that issuers have virtually no control over: the Federal Reserve's interest rates. And the "rate-cutting wave" has only just begun. As interest rates fall further this year, the revenue dominance of stablecoin issuers will be weakened.

2. Execution

This is where DeFi protocols build perpetual contracts (Perp DEXs), and it was the most successful DeFi category in 2025.

The simplest way to understand why perpetual contract exchanges have been able to capture market share so quickly is to look at how they help users execute actions. They create a space that allows users to enter or exit risk at any time with minimal friction, based on their needs. Even when market volatility is low, users can still hedge, leverage, arbitrage, rotate funds, or simply research and open positions for future positioning.

Unlike spot DEXs, they allow users to conduct continuous, high-frequency trading without the inconvenience of moving the underlying assets.

While "execution" sounds simple and extremely fast, there's a lot more to it than meets the eye. These contract exchanges must build a robust trading interface that won't crash under heavy load, host a matching and clearing system that can withstand market chaos, and provide sufficient liquidity depth to retain traders. In perpetual contract exchanges, liquidity is the "secret sauce." Whoever can provide continuous and ample liquidity will attract the highest trading activity.

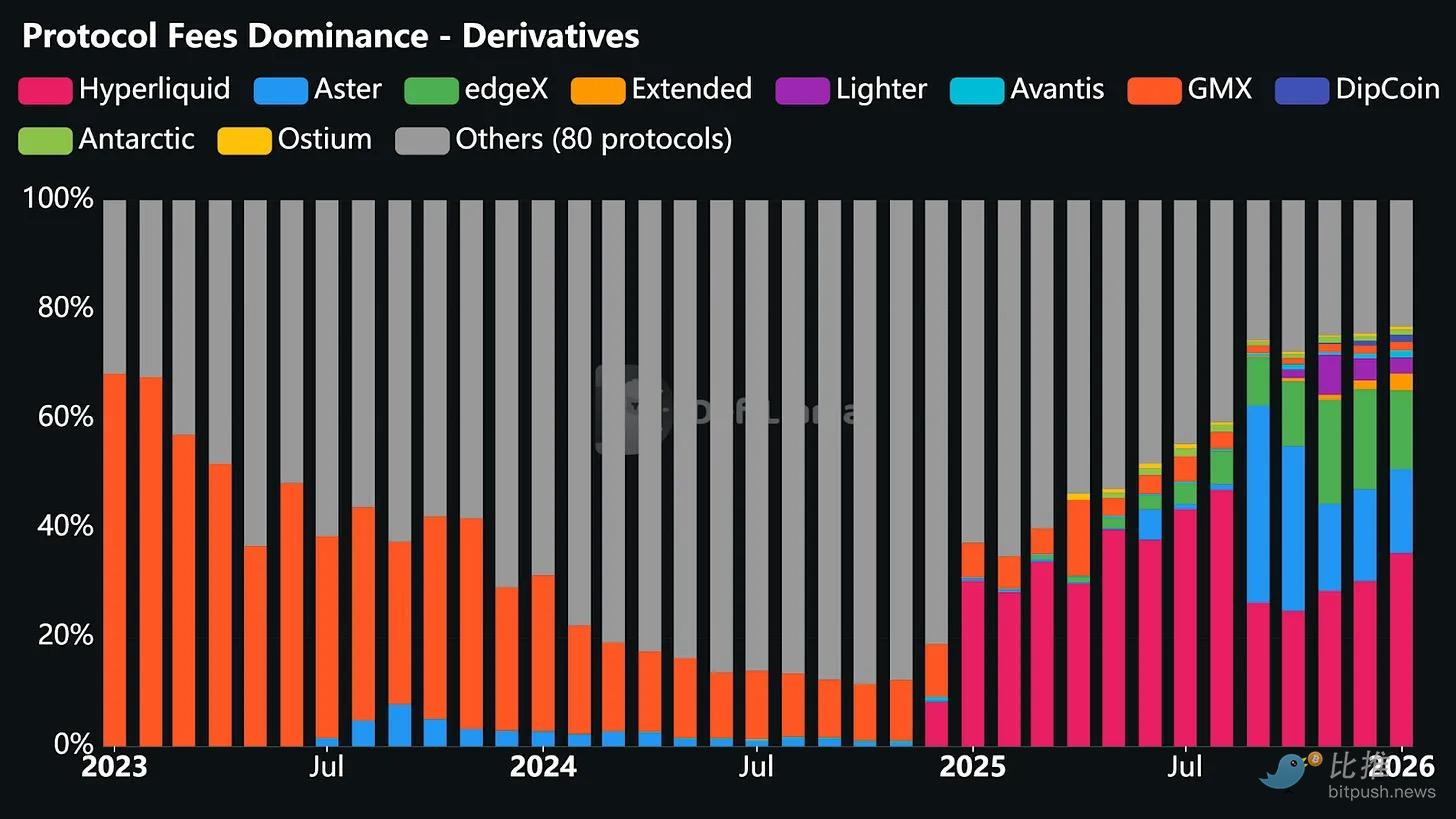

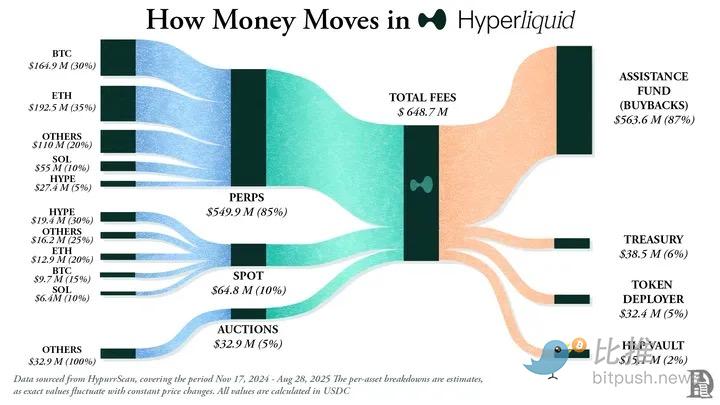

In 2025, Hyperliquid dominated the futures exchange market by attracting the largest number of market makers on its platform to provide ample liquidity. As a result, Hyperliquid held a dominant position in fee collection for 10 out of the last 12 months.

Ironically, the reason these DeFi-related contract exchanges are successful is precisely because they don't require traders to understand blockchain and smart contracts; instead, they operate more like familiar traditional exchanges.

Once these issues are resolved, exchanges can generate revenue through "autopilot" by charging marginal fees on traders' high-frequency, high-volume trading activities. This will continue even if spot prices remain flat, simply because the platform offers traders a wide variety of options.

This is why I believe that, despite contract exchanges accounting for only a single-digit percentage of revenue last year, they are the only category capable of challenging the dominance of stablecoin issuers from afar.

3. Distribution

The third factor—distribution—has driven incremental revenue for crypto projects such as token issuance infrastructure. Think of pump.fun and LetsBonk.

This isn't too different from what we've seen in Web2 companies. While Airbnb and Amazon don't own any inventory, their powerful distribution capabilities help them transcend the role of "aggregator" and reduce the marginal cost of adding new supply.

Crypto issuance infrastructures also do not own the assets (such as Memecoins, tokens, and micro-communities) created through their platforms. However, by making the user journey frictionless, automating the launch process, providing ample liquidity, and simplifying transactions, they can become the default place for people to create crypto assets.

In 2026, two questions may determine the trajectory of these revenue drivers: Will stablecoin revenue share fall below 60% as interest rate cuts erode carry trades? And can futures exchanges break through their 7-8% dominance as execution layers consolidate?

Transforming "revenue" into "ownership"

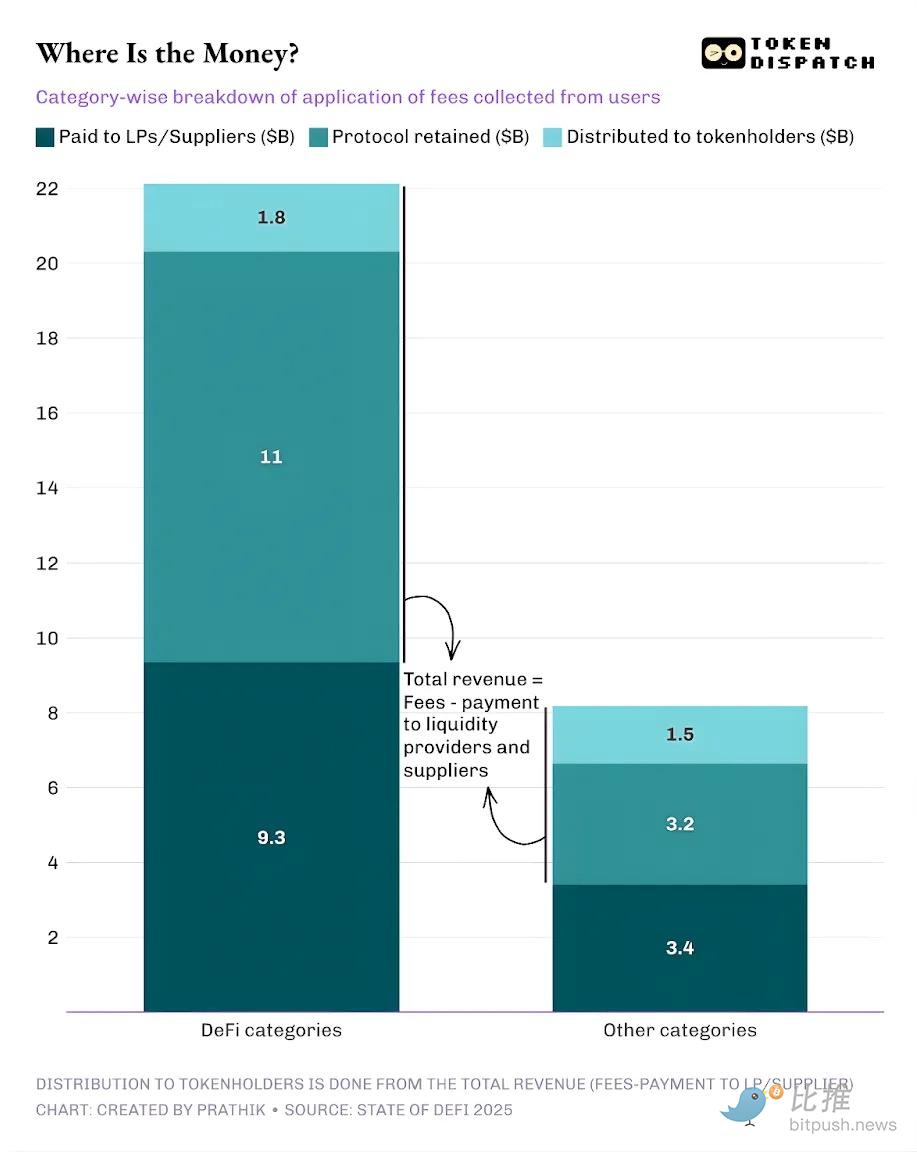

The spread, execution, and distribution reveal how crypto revenue is generated. But that's only part of the story. Equally important (and perhaps even more important) is: what percentage of the total gross fee is distributed to token holders before the protocol retains net revenue?

The value transfer achieved through token buybacks, token burns, and fee sharing signifies that a token is an "economic ownership claim," rather than merely a "governance badge."

In 2025, users of DeFi and other protocols paid approximately $30.3 billion in fees. Of this, $17.6 billion was retained by the protocols as revenue after being paid to liquidity providers and suppliers. Approximately $3.36 billion in total revenue was returned to token holders through staking rewards, fee sharing, buybacks, and token burns.

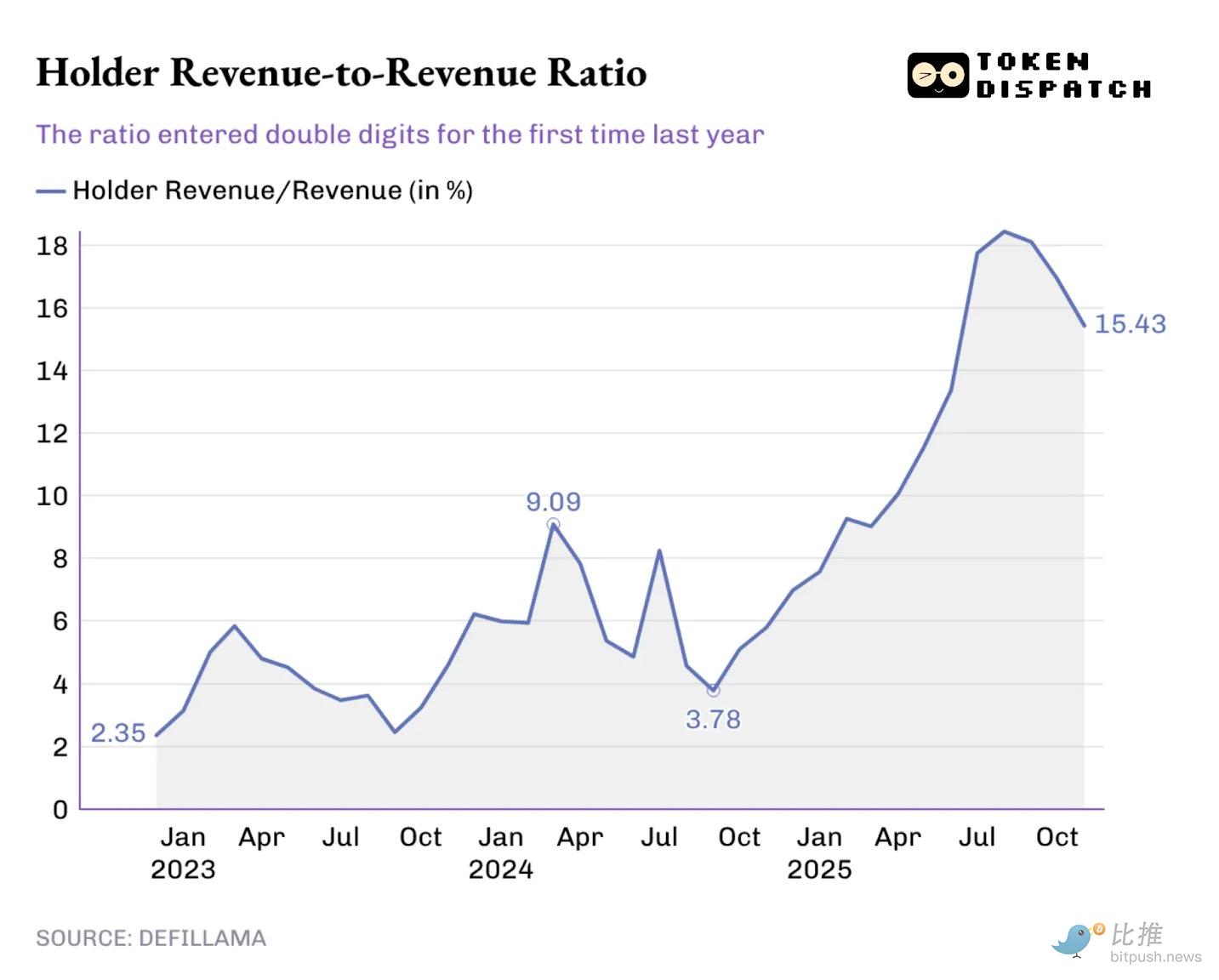

This means that 58% of the transaction fees were converted into protocol revenue, while approximately 19% of the revenue was captured by token holders.

This represents a significant shift compared to the previous cycle. We're seeing more and more protocols attempting to make tokens behave like claims on operating results. This provides investors with a tangible incentive to hold onto projects they believe in for the long term.

I wrote about how Hyperliquid and pump.fun did this last year: "Destroy it, baby" .

The crypto world is far from perfect; most protocols still don't distribute any rewards to token holders. But if you zoom out, you'll see the pointer has moved quite a bit, a signal that times have changed.

2026 Outlook: A Return to Fundamentals

Over the past year, holders' returns as a percentage of the protocol's total revenue have been steadily increasing. It broke the previous all-time high of 9.09% at the beginning of last year and even peaked at over 18% in August 2025.

This impact is directly reflected in token trading. If I hold a token that never rewards me, my trading decisions will be based solely on the media narrative surrounding it. But when I hold a token that pays me (whether through buybacks or dividends), I start to treat it as an interest-bearing asset. Even if it's not as safe or reliable, it still changes how the market prices that token. Its valuation is pulled towards "fundamentals," rather than simply dancing to the tune of media narratives.

When investors look back at 2025 to try and understand where money will go in 2026, they will focus on "incentives." Teams that prioritized value transfer did indeed stand out last year.

Hyperliquid has cultivated a culture where approximately 90% of its revenue is returned to users through its "Hyperliquid Assistance Fund".

Among token launch platforms, pump.fun reinforces the concept of rewarding an active community. It has already offset 18.6% of the circulating supply of its native token $PUMP through daily buybacks.

In 2026, "value transfer" is expected to cease to be a niche option and become a "table stake" for any protocol hoping its token will trade on fundamentals. Last year, the market learned to separate protocol revenue from the value held by token holders. Once token holders have seen tokens function like ownership claims, going back to the old model would be extremely unwise.

Conclusion

I don't believe State of DeFi 2025 reveals any entirely new insights into crypto revenue—"revenue discovery" has been a widely discussed topic in the industry for the past few months. The real value of this report lies in its use of data to illuminate reality, and by further examining these figures, we can see the paths most likely to lead to revenue success in the crypto world.

By deeply analyzing the revenue concentration trends of various protocols, the report clearly points out a fact: whoever controls the "pipeline"—whether it's interest rate spreads, trade execution, or traffic distribution—earns the most revenue.

Looking ahead to 2026, I anticipate more projects will begin to transform protocol fees into sustainable, disciplined revenue-sharing mechanisms to reward token holders. This trend will be even more pronounced, especially given the global trend of interest rate cuts and the diminishing appeal of arbitrage trading.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush