Disclaimer : This article is based on research using publicly available market channels and information. IOSG does not endorse any third-party service providers, individuals, or media mentioned in this article. This article is for informational purposes only and does not constitute investment advice. Thanks to Yuanjie @forgivenever and Jocy @jocyiosg

Structural suggestions provided. Thanks to Heechang @xparadigms , Jeff Kim @jeefeekim , Bingo @Bingo_z9 , Tae Hee @taeheecrypto , 0xDaniel @0xDaniel_kr , Uno @chillguyuno , and Harry @harrychjin for their suggested modifications.

Structural suggestions provided. Thanks to Heechang @xparadigms , Jeff Kim @jeefeekim , Bingo @Bingo_z9 , Tae Hee @taeheecrypto , 0xDaniel @0xDaniel_kr , Uno @chillguyuno , and Harry @harrychjin for their suggested modifications.

Author | Shirley @0x_Shirleyyy

Recently, a16z crypto opened an office in Seoul to provide go-to-market assistance to its portfolio companies, covering the entire Asia-Pacific region, and recruited regional managers to provide comprehensive support to projects.

Following our previous research on " Focusing on the Chinese Crypto Market: A Quick Look at the Web3 KOL and Agency Marketing Ecosystem , " this article will focus on the South Korean market. Given South Korea's unique economic environment, rapid adoption of digital assets, and emerging regulatory framework, this report on local exchanges, media, institutions, research firms, and blockchain activities aims to provide valuable resources for investors, startups, community builders, and stakeholders.

Why is the South Korean market becoming increasingly important in the crypto space?

South Korea is widely considered a global cryptocurrency hotspot, with crypto trading deeply ingrained in its financial culture. It has become one of the world's most dynamic cryptocurrency markets. 2025 is poised to be a defining year for the industry. With over 16 million crypto users, strong mobile adoption, and a tech-savvy population, South Korea's crypto landscape is booming at an unprecedented pace.

Adoption side analysis is used.

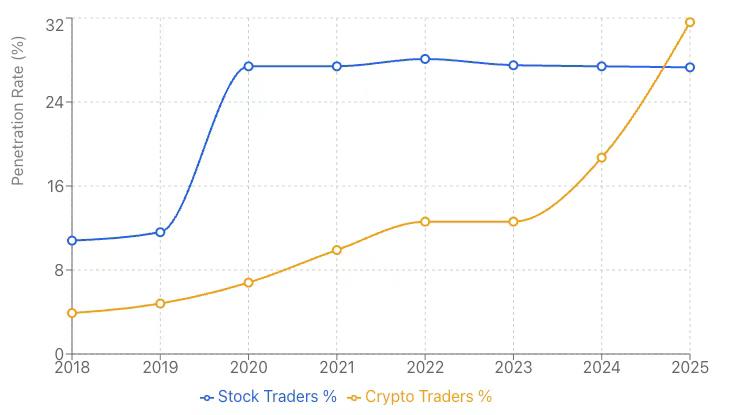

Analysis of South Korean Stock and Cryptocurrency Traders (2018-2025)

From 2018 to 2025, South Korea has witnessed a significant shift in its investment patterns. The number of stock traders increased by 152%, from 5.6 million (10.8% of the population) to 14.1 million (27.3%). More notably, cryptocurrency traders surged from 2 million (3.9%) to 16.3 million (31.6%), marking a growth of 715%. By 2025, cryptocurrency traders will surpass stock traders for the first time, reflecting a major shift in retail investor preferences.

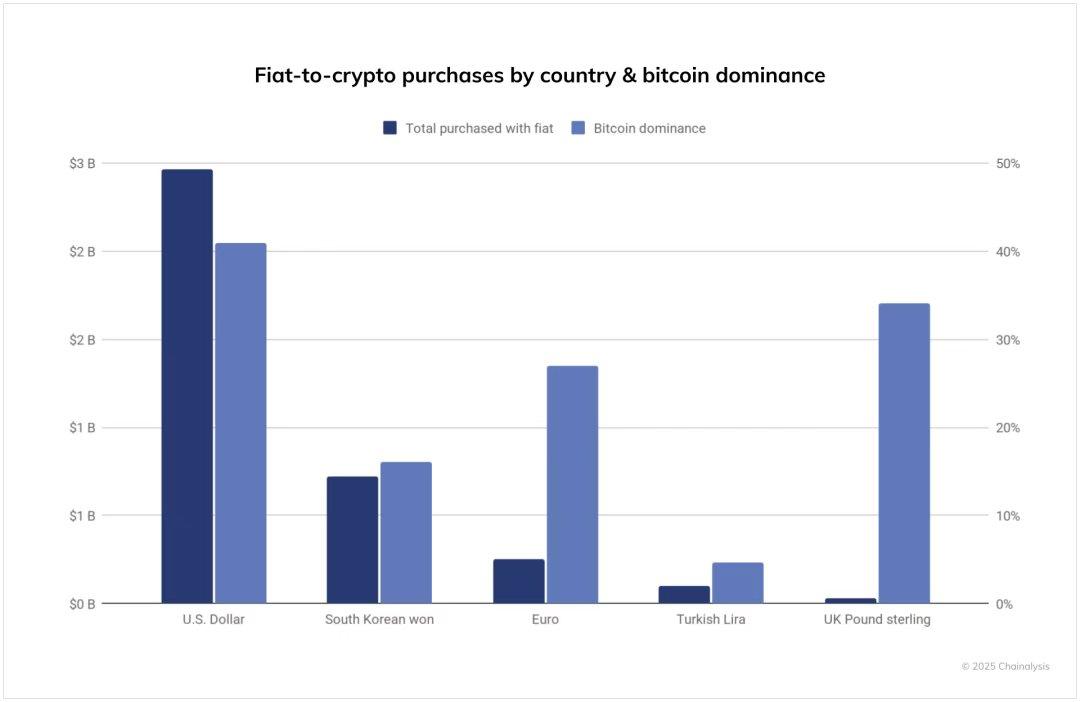

Compared to major global markets, South Korea maintains its leading position as a global fiat-to-crypto gateway and leads in transaction value in the Asia-Pacific region, thanks to an exceptionally high per capita adoption rate (30% vs. 6.8% globally) and a highly active retail trading culture.

Regulatory impact

South Korea was one of the first countries to establish a clear framework for trading and compliance. The government's stance has evolved through different phases in its regulatory process, each responding to market developments:

- 2017-2018: Suppression and Stability : Viewing crypto as a speculative threat, authorities implemented bans on ICOs, margin trading, and anonymous accounts to safeguard financial stability.

- 2019-2021: Pragmatic Regulation : A shift towards controlled acceptance emerged. A strict AML/KYC framework was implemented, culminating in the enactment of the 2020 Financial Transaction Information Reporting and Use Act, which established key reporting standards for Virtual Asset Service Providers (VASPs).

- 2022-2023: Investor Protection Priorities : Triggered by major events such as the Terra-Luna crash, consumer protection will be a top priority during this period. The government will introduce token security guidelines and over-the-counter brokerage rules, laying the foundation for future institutional products.

- 2024-Present: Institutional Consolidation : Cryptocurrencies have become a mainstream political and financial issue. The landmark Digital Asset Basic Act (DABA), passed in June 2025, established a comprehensive regulatory framework covering asset classification, issuance rules, stablecoins, and taxation. This period is characterized by a pursuit of balanced growth, with laws such as the Virtual Asset Users Protection Act imposing severe penalties for misconduct.

This evolution reflects the government's ongoing learning process as it responds to crises, matures technologically, and recognizes that cryptocurrencies have become a permanent part of the financial landscape. To date, public figures, companies, and exchanges are subject to disclosure and rigorous monitoring. South Korea is unlikely to deregulate quickly but will continue to refine policy standards gradually, striking a balance between investor protection and market growth. Over time, this could lead to increased institutional participation, including banks offering digital asset services and securities firms participating in tokenized financial products.

With 16 million users holding approximately $70.3 billion (102.6 trillion won) in crypto assets, South Korea's market depth is undeniable. For any crypto project, entering the South Korean market is shifting from an option to a strategic necessity, especially ahead of the Token Generation Event (TGE). Language and cultural barriers are significant challenges in market promotion. Therefore, collaborating with local crypto players is essential, particularly with media, GTM agencies, research firms, and even key opinion leaders (KOLs).

Key to Long-Term Marketing Success in the South Korean Market

The anticipated long-term success in South Korea hinges on coordinated marketing with clear milestones. The institution emphasizes that at least 2-3 months are needed to build brand awareness and community engagement before listing; expecting a rapid increase in trading volume within the first two months is unrealistic. Events lasting longer than three months and maintaining user attention may lose focus due to market congestion and fast-moving retail traders. The institution aims to maintain momentum without dragging the event out too long. Focusing on brand awareness and community building— building brand awareness, attracting key opinion leaders (KOLs), issuing press releases, and community building—rather than simply increasing trading volume, can yield longer-term followers and project token holders. KOL engagement and building strong, meaningful relationships with KOLs require events, translations, and incentives such as whitelisting to foster better project understanding and advocacy. Customized marketing services are tailored for different client types: Pre-TGE (before the token generation event), post-TGE, and B2B institutional clients require 2-3 months of intensive, focused marketing support to establish market readiness in South Korea. Post-TGE, the project continues marketing to maintain momentum and assess team strength. B2B clients focus on institutional outreach, gaining exposure and professional events beyond retail channels.

According to institutions, projects like 0G and Sahara AI have benefited from institutional support, with institutions contributing up to 40% of their node sales. SUI's growth from $0.4 to $4 in two years highlights the importance of close coordination between internal marketing, institutional support, and market-making strategies. The South Korean crypto market has a fragmented institutional and research landscape, with a few dominant players and varying reputations. In the following sections, I will briefly introduce the major local media, institutions, and research firms.

Introduction of major media organizations

South Korean crypto media plays a crucial role in helping projects navigate the local market, offering a unique advantage due to their deep understanding of Korean trends, regulatory environment, and cultural nuances. With highly engaged and tech-savvy audiences, South Korean crypto media deliver tailored content that resonates with both retail investors and institutional participants. The combination of broad coverage and localized expertise, along with active community engagement, makes them an essential partner for projects hoping to successfully enter and thrive in South Korea. This section highlights several leading media outlets to help projects better understand the media landscape of this key market. (In no particular order)

Followin is an AI-powered crypto news platform that aggregates news, Twitter/X, KOL opinions, and on-chain signals from across the crypto internet, transforming them into a real-time trading intelligence source for retail investors. Founded in 2022, Followin has grown into a leading crypto information infrastructure in Asia, boasting over 3 million users in the Asia-Pacific market and gaining momentum in South Korea. The platform differentiates itself with a smarter AI news engine, providing trending topics and the fastest market movement signals.

Main functions

- Real-time news : Sub-second market change news and price-sensitive event alerts

- Alpha Signals : Early Narratives, Whale Activity, and Breakthrough Opportunities Curated by AI

- Social Sentiment Analysis : Tracking X/TG data and top KOL transaction notifications to detect sentiment shifts.

- Earn and Reward : Participate in airdrop events, earn token rewards, and complete missions.

Leveraging its massive retail traffic and extensive regional resource network, Followin has successfully supported numerous crypto projects in achieving zero-to-one marketing growth in the Asia-Pacific market. Followin provides an integrated Go-To-Market service layer for crypto projects across the Asia-Pacific region, combining real-time media distribution, localized user growth solutions, and a deep KOL network into a unified launch and growth engine.

- PR Services : Breaking News, PR Distribution, Online Events

- Asia Pacific User Growth : A One-Stop Solution with Localized Marketing Strategies

- KOL Services : KOL, Community, and Exchange Relationships. Followin emphasizes regional partnerships, co-hosting events, and supporting the Web3 ecosystem. These collaborations help expand media reach, strengthen crypto brands, and foster community building throughout Asia. The platform's PR services, professional KOL connections, and multilingual channels support crypto projects in reaching new audiences and increasing brand awareness.

Core competitive advantages

- High-quality retail trading users : 3 million+ users on the app and web, 1.7 million+ users on social media channels

- Regional and Multilingual Focus : Supports real-time translation in English, Chinese, Korean, and Vietnamese, covering key markets in South Korea, Vietnam, Taiwan, and China.

- Asia Pacific Network : Deep Connections with KOLs, Media and Communities

Followin is Asia's leading mobile AI aggregator, leveraging the region's high mobile penetration and the multilingual needs of retail traders. By integrating a vast array of information sources, Followin perfectly caters to traders who prioritize speed over analytics. With strong regional partnerships, the platform demonstrates effective community building and ecosystem support. ( 📲App :) )

Founded in 2018, Coinness is South Korea's largest crypto media and community platform by user base, operating as a leading real-time news outlet in the industry. With over 1 million monthly active users, 150,000+ daily active users, and 300,000 registered community members , the platform is the premier source for breaking crypto news and project exposure. Coinness operates web services while maintaining a mobile app-centric approach, successfully building a large-scale, app-based crypto news and community platform—an achievement unmatched by traditional web-centric media in South Korea. In terms of mobile app traffic, Coinness ranks only behind the country's two largest exchanges, Upbit and Bithumb, and leads among non-exchange crypto platforms.

Main functions and services

- Breaking News : 24/7 real-time news updates on the homepage, ensuring concise and impactful news dissemination.

- News Section PR : Traditional PR articles with in-depth insights, pinned to the top of the news section for enhanced visibility.

- Research : Detailed articles exploring the technical aspects of cryptographic projects

- Interview : An interview conducted in written form, in the form of answering pre-set questions.

- Pop-up banners : Partners can display promotional banners on the platform to increase visibility.

- CoinNess Night Live (CNL) : An interactive AMA event held on the Coinness Telegram community, with an average of over 1000 KYC-verified participants.

- Price aggregation : Real-time digital asset prices, including detailed market data on liquidation rates, long/short ratios, funding rates, and open interest.

Core competitive advantages

- Real-time Asian Market Intelligence : Coinness focuses on minute-by-minute coverage of South Korean exchange activities (such as Bithumb and Upbit) and tracks regulatory developments across Asia. This provides traders with a competitive edge, particularly in arbitrage and market regulatory insights.

- Integrating news into the trading process : By combining breaking news alerts with real-time trading (spot and futures), Coinness provides a seamless user experience from news discovery to position execution.

- Deep expertise in the Korean market : With over 7 years of experience focused on the Korean market, Coinness possesses unparalleled depth in local crypto culture, regulatory nuances, and community preferences that is difficult for global competitors to replicate.

- Mobile-first architecture : The platform is optimized for mobile devices, offering push notifications, customizable alerts, and offline reading, catering to Asia's high mobile penetration rate and outperforming web-based competitors in the region.

A key differentiator from traditional web-based media is Coinness's application of a rigorous monthly active user (MAU) metric, counting only actually engaged users, not one-off page visitors. This approach delivers stronger and more reliable performance in terms of traffic, pageviews, and user engagement, establishing a clear data-driven advantage in the domestic crypto media landscape. This data credibility has been recognized by leading institutions, enabling Coinness to partner with major companies such as Kakao Bank, Hanwha Investment & Securities, and Bithumb for advertising campaigns—a distinction rarely achieved by Web3 native media platforms.

Coinness provides 24/7 coverage of cryptocurrency and blockchain developments, offering real-time breaking news, market analysis, price indices, and expert insights. Its breaking news is distributed through over 30 API partners , including exchanges and media platforms, and is widely and naturally cited by traditional media and crypto KOLs, enabling information to spread rapidly throughout the industry.

As Asia's leading mobile-first encrypted media aggregator, Coinness combines speed, cultural relevance, and integrated trading functionality to capture regional markets. The platform's success lies in its ability to provide active Asian traders with real-time, actionable information. Coinness's deep roots in local markets and seamless integration of news and trading tools make it Asia's leading real-time encrypted media platform.

Launched in 2017, Blockmedia positions itself as South Korea's premier blockchain media outlet, leading the market in the crypto space and consistently ranking among the top in its category. It is a media organization dedicated to educating and engaging a blockchain and cryptocurrency audience. Initially an online media platform, Blockmedia now engages with investors through various channels, including YouTube, Telegram, and X. The platform has gained widespread recognition through its annual "BlockFesta" conference, which attracts blockchain projects from around the world. With over 36,000 social media followers and 58.7,000 YouTube subscribers , Blockmedia maintains 4 million monthly active users and solidifies its market leadership in the region, distinguished by its comprehensive, live coverage, global project interviews, and original research.

Main services and functions

- Press Releases : Publish press releases on Blockmedia and distribute them on Telegram (35K followers), including translation and editing. Enhance exposure through Google SEO, Naver, and Telegram.

- Featured Articles : Internal research articles produced by the Blockmedia team, providing in-depth insights into partner projects, published on official Blockmedia channels and CoinMarketCap.

- Interviews (video/text) : Video and text interviews with the production team. Published on YouTube (58.7K subscribers) and shared on Telegram and Twitter.

- External dissemination : Distribution through other Web3 media outlets to maximize reach and visibility for retail traders and users.

- KOL Bridging : Blockmedia selects top KOLs for collaboration to enhance content promotion and marketing campaigns, tailoring content and budgets to each KOL.

Platform Highlights

- News and Market Coverage: Real-time encrypted and stock market updates, in-depth coverage of technology, industry trends, and major announcements.

- Regulatory expertise : Detailed coverage of South Korean regulations, including updates on stablecoins and local market policies.

- Interviews/People : CEO interviews, on-site events, and market analysis from industry leaders.

- Research : Proprietary reports on token analysis, investment insights, DeFi protocol security, market dynamics, and forecasts, developed in collaboration with other research firms.

- Excellent video content : The YouTube channel maintains 58.7K subscribers, with 3,744 videos and a total of 9.65 million views, including daily content such as Federal Reserve interest rate analysis and in-depth analysis of agreements.

- Real-time news feed : Hourly news updates via Telegram, delivering market data and breaking news alerts in real time.

competitive advantage

- Exceptional Regulatory Coverage : Blockmedia delivers exceptional in-depth coverage of South Korean regulations, real-time event updates, and institutional intelligence. Its regulatory analysis goes beyond simple news aggregation, offering insights unmatched by competitors.

- Original Research : Blockmedia delivers targeted research through its team of professional analysts, providing exclusive market reports and insights.

- Video Content Leadership : With its "블미TV" channel, Blockmedia is a leader in video content, offering daily updates and in-depth technical analysis on global projects, Federal Reserve interest rates, and more, setting it apart from local competitors.

- Comprehensive multimedia coverage : Unlike other leading mobile-first media platforms, Blockmedia excels in web-based multimedia content, combining traffic performance with content depth.

Blockmedia's balanced strategy, combining high traffic performance, proprietary research, and multimedia engagement, has made it a leading platform for institutional and retail cryptocurrency audiences in South Korea. Its superior regulatory coverage and original research make it a preferred source for sophisticated investors and Web3 projects seeking broad exposure and in-depth insights. Blockmedia continues to lead in web-based reporting, serving a diverse audience with comprehensive news, interviews, videos, and research content.

Bloomingbit (블루밍비트) is a leading South Korean cryptocurrency and blockchain media platform. Established as part of Hankyung Media Group (whose core publication is The Korea Economic Daily), South Korea's largest financial media group, Bloomingbit focuses on providing crypto investors with credible, real-time news and insights, emphasizing clarity and ease of use to help users make informed decisions without sifting through fragmented information. Positioning itself as a starting point for cryptocurrency investment, the platform offers carefully curated reporting by dedicated blockchain journalists, targeting both Korean and international audiences with bilingual content. Its team comprises writers and editors, targeting English-speaking markets worldwide. They translate complex stories into clear and understandable English to share with readers.

Main features

- Real-time news updates, expert-curated market trend analysis, and an easy-to-use interface allow users to easily access cryptocurrency information.

- By enabling mobile access through its app, it transforms complex stories into actionable insights and integrates social media sharing capabilities to expand its reach.

- In-depth analysis, such as Bitcoin predictions for 2026, reports on major transactions, and analysis of economic crossroads.

- It offers a variety of cryptocurrency content: startups issuing tokens, exchange-listed cryptocurrencies, developers launching products, PR firms collaborating with crypto clients, projects conducting IDOs or ICOs, DAO governance, and more.

Bloomingbit's main services

- Organic news releases : Editorially selected content (not advertising-driven). (e.g., token launches, technology updates, industry collaborations, public events, and reports)

- Paid content placement : Promotional or time-sensitive content (such as exchange listings, token sales, product launches, AMA announcements, etc.)