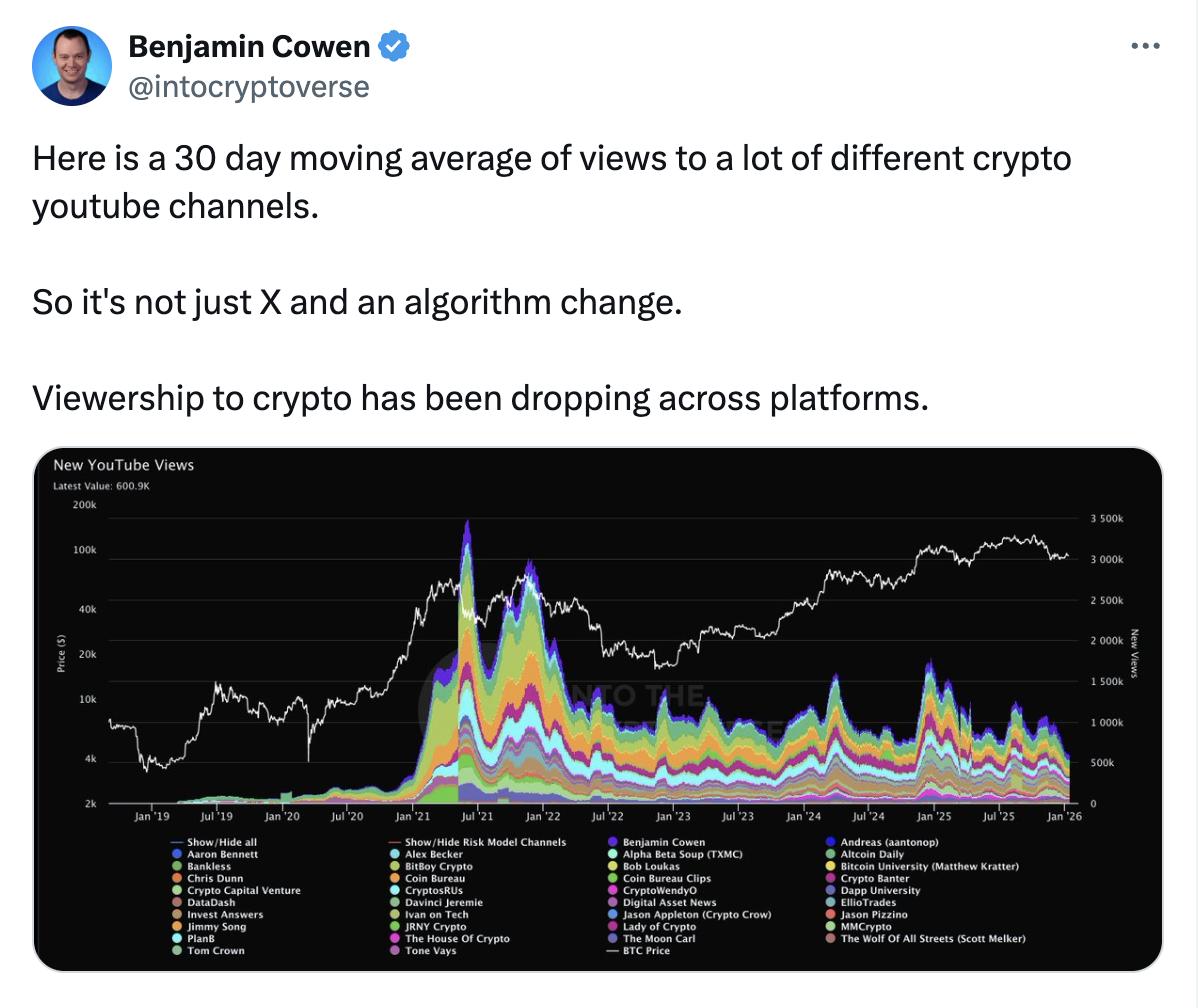

Data tracking individual investor behavior shows that XEM on cryptocurrency-related YouTube channels are plummeting, falling to their lowest level since January 2021.

Data tracking individual investor behavior shows that XEM on cryptocurrency-related YouTube channels are plummeting, falling to their lowest level since January 2021.

Over the past three months, this trend has become increasingly evident, reflecting a slowdown in the crypto market and a shift in investor sentiment.

According to analyst Benjamin Cowen, the Medium 30-day XEM on top crypto channels is steadily declining, and this is not an isolated phenomenon.

He emphasized that this decline is structural, affecting most cryptocurrency content creators, not just a few individual channels.

The "bear market" sentiment is back.

Echoing this sentiment, commentator Tom Crown noted that interest in crypto content has plummeted since October 2025, not only on YouTube but also across many other social media platforms.

According to experts, this decline in social interaction is a familiar sign that the market is entering a "bear market" phase.

Tom Crown noted: "Social interest has fallen to its lowest level since 2021," suggesting that individual investors are withdrawing, rather than continuing to participate actively as in previous periods of euphoria.

Retail investors are tired, while institutions are in control.

Commentators suggest that the fatigue of individual investors stems from several factors: persistent scams, pump-and-dump schemes that manipulate prices, and declining confidence following periods of high volatility.

In this context, many retail investors are shifting to gold and silver, instead of continuing to bet on digital assets.

Conversely, institutional investors are playing an increasingly decisive Vai , with longer-term strategies and a higher risk tolerance.

The current picture suggests that the crypto cycle is being driven primarily by institutions, while private capital is temporarily standing on the sidelines.

This could be a sign of a quiet period of re-accumulation before the market enters a new cycle.