Author: CoinGecko

Compiled by: TechFlow TechFlow

Original link:

https://www.coingecko.com/research/publications/2025-annual-crypto-report

The crypto market experienced a dramatic correction in the final quarter of 2025, with total market capitalization plummeting 23.7% to close at $3 trillion. This marked the first annual decline in the crypto market since 2022, down 10.4% year-over-year. While the quarter saw a record high of $4.4 trillion, a historic $19 billion liquidation event in October caused a significant price drop. Despite the price correction, market volatility drove daily trading volume to an annual high of $161.8 billion, while the stablecoin market grew 48.9% year-over-year, reaching a record high of $311 billion.

This year, the crypto market exhibited a trend of decoupling from traditional assets, with gold rising 62.6%, the US stock market performing exceptionally well, while Bitcoin fell 6.4%. However, institutional adoption deepened further, with Digital Asset Treasury Companies (DATCos) deploying at least $49.7 billion by 2025 to acquire over 5% of the total Bitcoin and Ethereum supply. Other highlights included a 302.7% surge in prediction market trading volume and a record high of $86.2 trillion in annual perpetual contract trading volume on centralized exchanges. These figures indicate that even with price declines, market infrastructure and utility continue to expand.

Our 2025 Crypto Industry Report provides a comprehensive overview of the crypto market, in-depth analysis of Bitcoin and Ethereum, a deep dive into the decentralized finance (DeFi) and non-fungible token (NFT) ecosystems, and a review of the performance of centralized exchanges (CEXs) and decentralized exchanges (DEXs).

The following are the key highlights of the report, but please be sure to read the full 60-page report.

Seven Highlights of CoinGecko's 2025 Crypto Industry Report

- The total market capitalization of the crypto market is projected to decline by 10.4% in 2025, ending at $3 trillion.

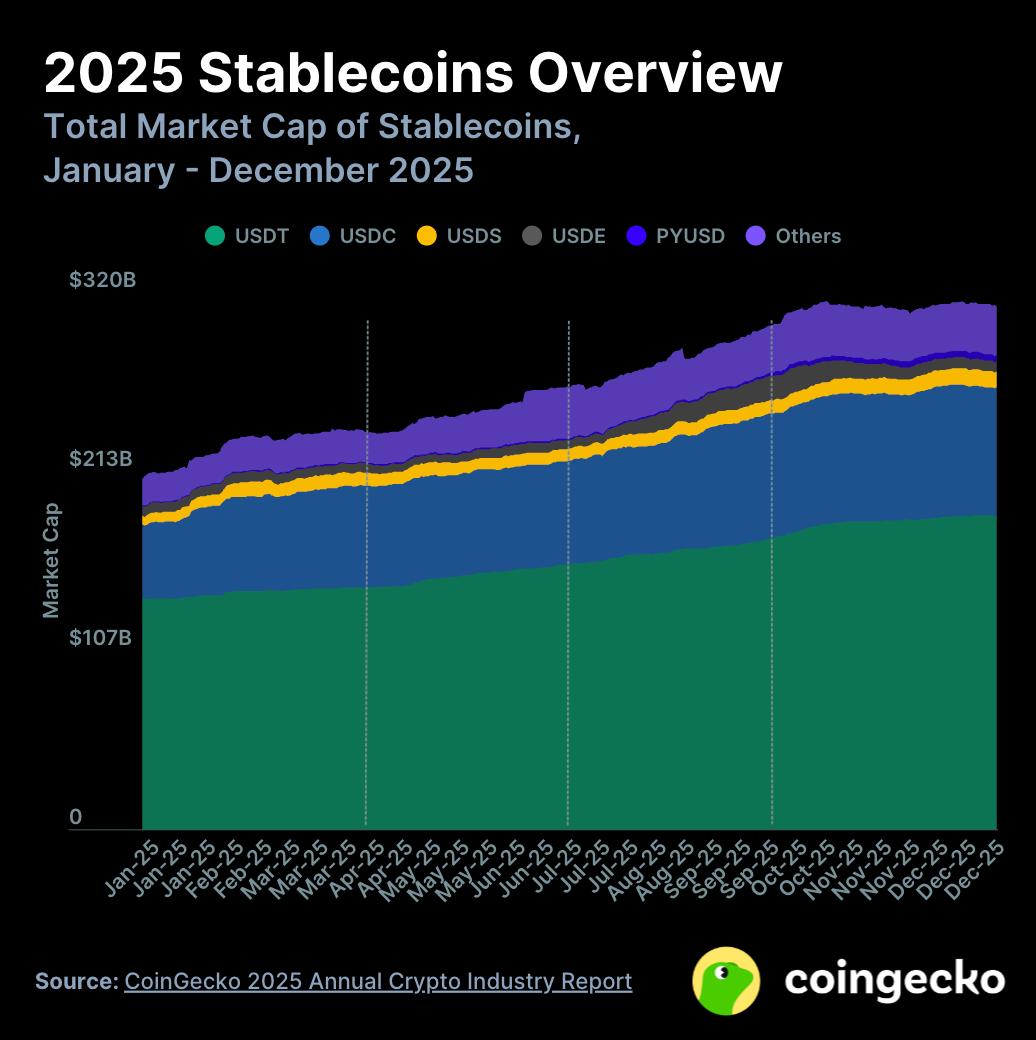

- The market capitalization of stablecoins is projected to surge by $102.1 billion (+48.9%) in 2025, reaching a record high of $311 billion.

- Gold performed exceptionally well in 2025, surging 62.6%, while Bitcoin lagged behind, falling 6.4%, and the US dollar and oil also underperformed.

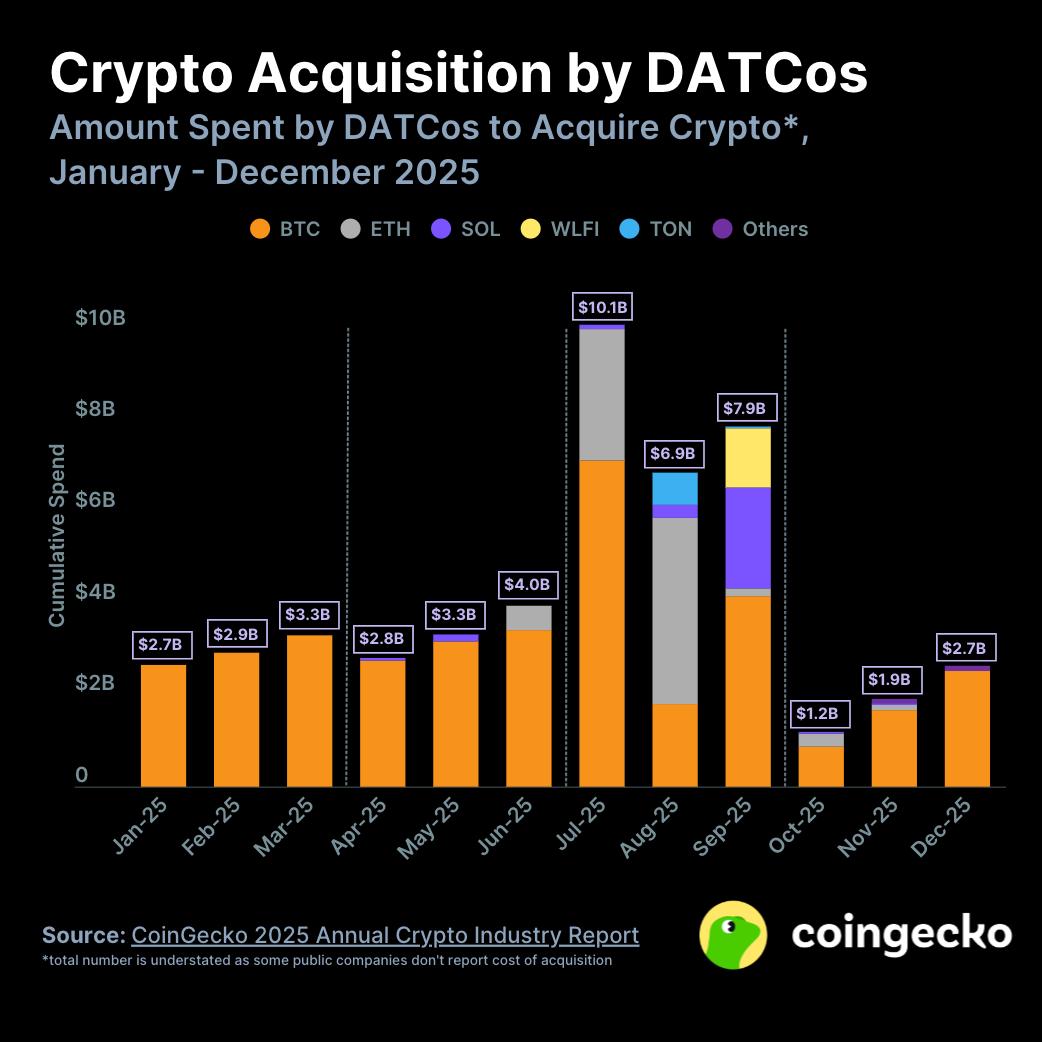

- Digital Asset Treasury Corporation (DATCos) invests at least $49.7 billion in 2025, with approximately 50% concentrated in the third quarter.

- Market trading volume is projected to grow by 302.7% to reach $63.5 billion by 2025.

- Trading volume of perpetual contracts on centralized exchanges grew by 47.4% in 2025, reaching a record high of $86.2 trillion.

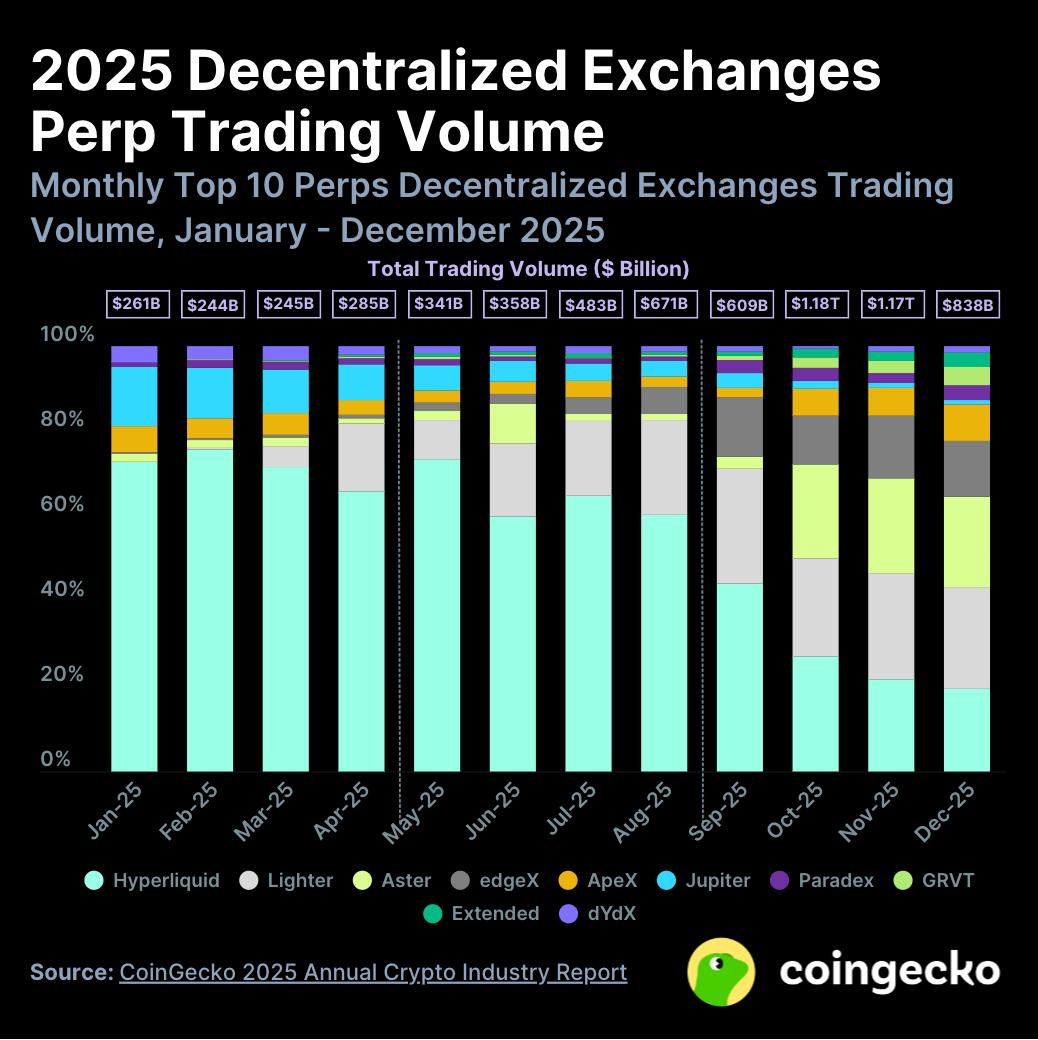

- The trading volume of perpetual contracts on decentralized exchanges grew by 346% in 2025, reaching $6.7 trillion, setting a new record.

The total market capitalization of the crypto market plummeted by 23.7% in Q4 2025 (a decrease of $946 billion), closing the year at $3 trillion.

The total market capitalization of the crypto market declined by 23.7% in the fourth quarter, a decrease of $946 billion, ending the year at $3 trillion, a year-on-year decrease of 10.4%. This is the first annual decline in the crypto market since 2022.

At the start of the fourth quarter of 2025, the cryptocurrency market performed strongly, with its total market capitalization reaching a record high of $4.4 trillion. However, this peak did not last, and prices continued to fall until the end of November, subsequently entering a period of fluctuation until the end of the year. The trigger for this decline was the historic $19 billion liquidation event following the US announcement on October 10th of a 100% tariff on China.

Meanwhile, average daily trading volume in the fourth quarter rose to $161.8 billion, a new annual high and a 4.4% increase quarter-over-quarter. This growth was primarily driven by liquidation events and subsequent high volatility. However, trading volume gradually declined as the market entered a period of consolidation.

The market capitalization of stablecoins is projected to surge by $102.1 billion (+48.9%) in 2025, reaching a record high of $311 billion.

In the fourth quarter of 2025, the total market capitalization of stablecoins increased by $6.3 billion, reaching a record high of $311 billion at the end of the quarter. For the full year, the stablecoin market grew by 48.9%, adding $102.1 billion.

The biggest change in the fourth quarter came from USDe, the Ethereum ecosystem stablecoin Ethena, whose market capitalization plummeted by 57.3% (a reduction of $8.4 billion) after rapid deleveraging in mid-October. Due to the de-pegging event on the Binance platform, the supply of USDe dropped from a peak of nearly $15 billion to $6.3 billion, severely damaging investor confidence in high-yield cyclical strategies.

Meanwhile, PayPal's stablecoin PYUSD surged, with its market capitalization soaring 48.4% (an increase of $1.2 billion) to $3.6 billion, successfully becoming the fifth largest stablecoin and replacing World Liberty Financial's USD1. Its growth was attributed to YouTube's creator earnings payment feature and the approximately 4.25% yield offered by Spark Savings Vault.

Gold leads the 2025 trend: up 62.6%, Bitcoin lags behind, down 6.4%, the US dollar and oil are also weak.

In 2025, gold was the best-performing asset, with a year-to-date gain of 62.6%. In contrast, Bitcoin underperformed, falling 6.4%, mirroring the weakness of the US dollar and oil.

In 2025, gold performed exceptionally well, rising 62.6% for the year. In the fourth quarter alone, gold increased by 11.4%, primarily driven by continued central bank buying and tariff-related uncertainties. Following closely behind were US stocks, with the Nasdaq rising 20.5% and the S&P 500 rising 16.6%, benefiting from the ongoing narrative surrounding artificial intelligence.

In contrast, commodities and stocks performed strongly, while Bitcoin (BTC) underperformed, falling 6.4% for the year. Assets that underperformed Bitcoin included the US dollar index (down 10.0%, affected by interest rate cuts and political changes) and crude oil (down 21.5%, due to global oversupply and record production from non-OPEC countries).

Digital Asset Treasury Corporation (DATCos) will invest at least $49.7 billion in 2025, with approximately 50% concentrated in the third quarter.

Digital Asset Treasury Companies (DATCos) became significant players in the market in 2025, investing at least $49.7 billion in cryptocurrencies throughout the year. The third quarter was the peak of investment, accounting for half of the total annual investment, mainly due to the emergence of a wave of new Altcoin, DATCOs.

However, the pace of investment slowed significantly in the fourth quarter, with only $5.8 billion invested. The plunge in the crypto market dragged down the share price of DATCOs, causing the adjusted net asset value (mNAV) of many DATCOs to fall below 1.0. This forced them to use the funds for share buybacks rather than continuing to accumulate cryptocurrency.

As of January 1, 2026, DATCos held a total of $134 billion in crypto assets, a 137.2% increase from $56.5 billion on January 1, 2025. DATCos currently holds more than 1 million Bitcoins and 6 million Ethereums, representing more than 5% of their total supply.

Market trading volume is projected to surge 302.7% to $63.5 billion by 2025.

In 2025, the prediction market experienced explosive growth, with trading volume increasing by 302.7% year-on-year to a record high of $63.5 billion.

The nominal trading volume in the prediction market is expected to surge from $15.8 billion in 2024 to $63.5 billion in 2025, a year-on-year increase of 302.7%.

In early 2025, Polymarket held an 85.6% market share in the first quarter, but was overtaken by Kalshi in the fourth quarter. Kalshi's market share reached 39.6% in the fourth quarter, while Polymarket came in second with 32.4%. Meanwhile, Opinion, backed by Yzi Labs and based on the BNB blockchain, launched in November, becoming a strong competitor to the existing market. Opinion's trading volume reached $7 billion in December, matching Kalshi's, but current trading volume may be affected by airdrop activities.

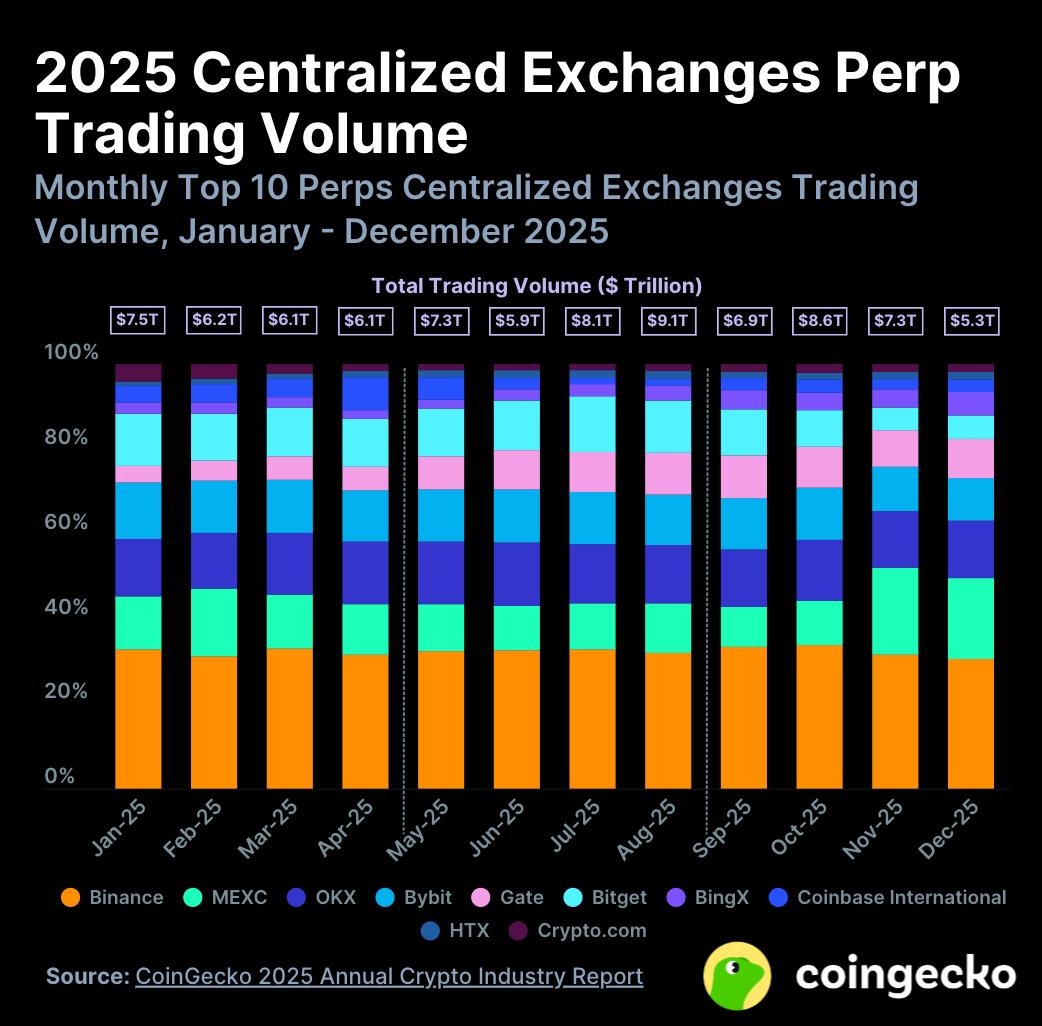

Trading volume of perpetual contracts on centralized exchanges grew by 47.4% in 2025, reaching a record high of $86.2 trillion.

In the fourth quarter of 2025, the top ten centralized perpetual contract exchanges (Perp CEXes) recorded a trading volume of $21.2 trillion, a 12.0% decrease from $24.0 trillion in the third quarter. The total trading volume for the year reached $86.2 trillion, a 47.4% increase compared to 2024, setting a new record.

October 2025 is projected to be the second-highest trading month in history, second only to August, when Bitcoin hit its latest all-time high. In contrast, December is the quietest trading month of the year, with a trading volume of only $5.3 trillion.

Throughout 2025, the market share of the top ten centralized perpetual contract exchanges remained relatively stable. The only significant change was MEXC's surge in trading volume in November and December, leaping over OKX, Bybit, and Bitget to claim second place. Outside the top ten, KuCoin performed exceptionally well in 2025, becoming the only non-top ten perpetual contract exchange to surpass $1 trillion in trading volume.

The trading volume of perpetual contracts on decentralized exchanges grew by 346% in 2025, reaching a record high of $6.7 trillion.

Trading volume on decentralized perpetual contract exchanges (Perp DEXes) grew by 80.8% in Q4 2025, from $1.8 trillion in Q3 to $3.2 trillion in Q4.

In 2025, the total trading volume of the top ten decentralized perpetual contract exchanges reached $6.7 trillion, a significant increase of 346% compared to $1.5 trillion in 2024. The trading volume ratio of Perp DEX to centralized perpetual contract exchanges (CEX) jumped from 2.5% a year earlier to 7.8%.

The growth in trading volume was primarily driven by incentives and airdrops offered by exchanges such as Lighter, Aster, edgeX, GRVT, and Paradex. Hyperliquid remained the most active perpetual contract decentralized exchange overall in 2025, but was overtaken by Lighter in the fourth quarter. Hyperliquid and Lighter are now among the top ten perpetual contract exchanges by annual trading volume, recording $2.9 trillion and $1.3 trillion in trading volume, respectively.