Written by: Seed.eth

$200 million is a figure that was just released.

BitMine Immersion Technologies (BMNR), chaired by renowned Wall Street analyst Tom Lee, announced an investment in Beast Industries, the holding company behind global superstar influencer MrBeast. Meanwhile, Beast Industries stated in an official announcement that the company will explore how to integrate DeFi into its upcoming financial services platform.

If you only look at the news, it seems like another familiar crossover: traditional, crypto, internet celebrities, and startups. On one side is YouTube, the global subscriber giant with over 400 million subscribers, where a single video can automatically boost your rating through algorithms; on the other side are top analysts on Wall Street who are best at telling crypto narratives, adept at writing grand blockchain concepts into balance sheets. Everything seems to make perfect sense.

The Way Mr. Beast Came

Looking back at MrBeast's early videos, it's hard to connect them with today's $5 billion Beast Industries.

In 2017, Jimmy Donaldson, who had just graduated from high school, uploaded a video of himself counting for 44 hours straight—"The Challenge of Counting from 1 to 100,000!" The content was so simple that it was almost childish. There was no plot or editing. He was just one person facing the camera, repeating numbers over and over again. But it became a turning point in his content career.

At that time, he was not yet 19 years old, and his channel had only about 13,000 subscribers. After the video was released, it quickly surpassed one million views, becoming the world's first phenomenal dissemination case.

He later recalled that period in an interview and said something like this:

“I didn’t actually want to become famous. I just wanted to know if the outcome would be different if I was willing to dedicate all my time to something that nobody else was willing to do.”

Jimmy Donaldson succeeded in adopting the nickname "Mr. Beast," which became widely known. But more importantly, from that moment on, he developed an almost obsessive belief: attention is not a gift of talent, but rather something earned through dedication and perseverance.

Treat YouTube like a company, not a content creation platform.

Many creators choose to become "conservative" after gaining popularity: reduce risk, increase efficiency, and turn content into a stable cash flow.

MrBeast chose the opposite path.

He repeatedly emphasized one thing in multiple interviews:

"I spend almost all the money I earn on the next video."

This is the core of his business model.

By 2024, his main channel had over 460 million subscribers and over 100 billion video views. But behind this success lay extremely high costs:

- The production cost of a single headline video is typically between $3 million and $5 million.

- Some large-scale challenges or public welfare projects can cost more than $10 million;

- The first season of "Beast Games" on Amazon Prime Video was described by him as "completely out of control," and he admitted in an interview that it lost tens of millions of dollars.

He did not show any remorse when he said this:

"If I don't do this, the audience will go to watch someone else."

At this level, you can't possibly save money and still expect to win.

This statement can almost be considered the key to understanding Beast Industries.

Beast Industries: Annual revenue of $400 million, but with thin profit margins.

By 2024, MrBeast will consolidate all its businesses under the name Beast Industries.

Based on publicly available information, this company has far exceeded the scope of "side hustle for creators":

- Annual revenue exceeds $400 million;

- Its business spans content creation, FMCG retail, licensed merchandise, and utility products;

- Following its latest round of financing, the market generally expects its valuation to be around $5 billion.

But it wasn't easy.

Mr. Beast's main YouTube channel and Beast Games brought huge exposure, but almost all of the profits were eaten up.

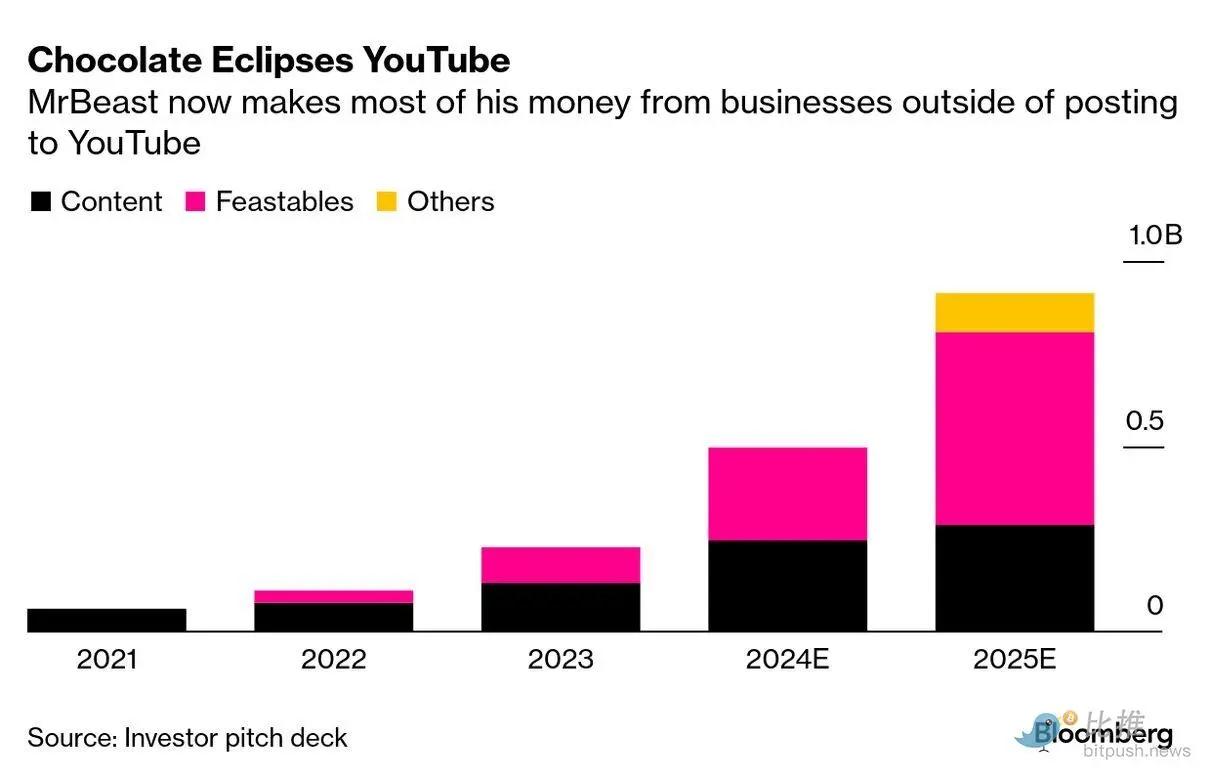

In stark contrast to its content is its chocolate brand, Feastables. Public data shows that in 2024, Feastables generated approximately $250 million in sales and contributed over $20 million in profit. This marks the first time Beast Industries has achieved a stable and replicable cash flow business. By the end of 2025, Feastables will have entered over 30,000 physical retail stores in North America (including Walmart, Target, 7-Eleven, etc.), covering the United States, Canada, and Mexico, significantly enhancing the brand's offline sales capabilities.

MrBeast has admitted on multiple occasions that the cost of video production is getting higher and higher, and it is even "getting harder and harder to break even." However, he still insists on investing a lot of money in content production because, in his view, this is not simply paying for the videos, but buying traffic for the entire business ecosystem.

The core barrier to entry in the chocolate business isn't production, but the ability to reach consumers. While other brands spend huge sums on advertising exposure, this business only needs to release a single video. Whether the video itself is profitable is irrelevant; as long as Feastables continue to sell, this business cycle can continue to operate.

"I'm actually penniless."

In early 2026, MrBeast revealed in an interview with The Wall Street Journal that he was penniless, sparking heated discussion.

“I’m basically in a ‘negative cash’ situation right now. Everyone says I’m a billionaire, but I don’t have much money in my bank account.”

This statement is not a reference to "Versailles," but rather a natural consequence of his business model.

Mr. Beast's wealth is highly concentrated in unlisted equity holdings; despite owning slightly more than 50% of Beast Industries, the company continues to expand and pays almost no dividends; he even deliberately avoids keeping cash on hand.

In June 2025, he admitted on social media that he had poured all his savings into video production and even had to borrow money from his mother to pay for his wedding.

As he later explained more bluntly:

“I don’t look at my bank account balance—that would affect my decision-making.”

The sectors he has invested in are no longer limited to content and consumer products.

In fact, back in 2021 during the NFT craze, on-chain records showed that he had purchased and traded multiple CryptoPunks, some of which were sold for 120 ETH per piece (equivalent to hundreds of thousands of US dollars at the time).

However, as the market entered a correction phase, his attitude became more cautious.

The real turning point came when "Mr. Beast" itself reached the brink of collapse in its business model.

When someone controls a top global traffic portal but is constantly in a state of high investment, cash shortage, and reliance on financing for expansion, finance is no longer just an investment option, but becomes an infrastructure that must be restructured.

The question that Beast Industries has been repeatedly discussing in recent years has gradually become clear: how to get users to move beyond simply "watching content and buying goods" and enter into a long-term, stable, and sustainable economic relationship?

This is precisely the direction that traditional internet platforms have been trying to achieve for many years: payment, accounts, and credit systems. At this juncture, the emergence of Tom Lee and BitMine Immersion (BMNR) has led this path toward more structural possibilities.

Teaming up with Tom Lee to build the DeFi foundation

On Wall Street, Tom Lee has consistently played the role of a "narrative architect." From explaining the value logic of Bitcoin in its early days to emphasizing the strategic significance of Ethereum on corporate balance sheets, he excels at translating technological trends into financial language. BMNR's investment in Beast Industries is not about chasing viral trends, but rather betting on a programmable future of attention gateways.

So, what exactly does DeFi mean here?

The publicly available information is extremely restrained: there has been no token issuance, no promised returns, and no exclusive wealth management products for fans. However, the statement "integrating DeFi into financial services platforms" points to several possibilities:

- Lower cost payment and settlement layer;

- A programmable account system for creators and fans;

- Asset records and equity structure based on decentralized mechanisms.

The potential is vast, but the real challenges are also clearly visible. In the current market, whether it's native DeFi projects or traditional institutions exploring transformation, most have yet to truly establish a sustainable model. If a differentiated path cannot be found in this fierce competition, the complexity of financial business may erode the core capital he has accumulated over the years: fan loyalty and trust. After all, he has repeatedly stated publicly:

"If one day I do something that hurts the audience, I would rather do nothing at all."

This statement will likely be repeatedly tested in every future attempt at financialization.

So, when the world's most powerful attention machine begins to seriously build financial infrastructure, will it become a new generation platform, or an "overly bold" crossover?

The answer won't be revealed anytime soon.

But there was one thing he understood better than anyone: his greatest asset was not past glories, but the right to "start over".

After all, he's only 27 years old.