Written by: willthetrill

Compiled by: Chopper, Foresight News

Original title: Recruitment volume plummets by 80%, is the crypto talent market saturated?

Is the cryptocurrency hiring market saturated? The answer is both yes and no. While there were sporadic layoffs in December, overall, the hiring momentum in the fourth quarter remains strong.

To uncover the truth, I specifically retrieved relevant data from major crypto industry vertical recruitment websites in the first two weeks of January 2026 (this data does not include official company recruitment pages). The results showed that only 85-90 new independent job postings were added during this period.

The start of this year has been rather sluggish. In contrast, the data for January 2025 is quite impressive, with a total of 1,192 job postings, making it the month with the highest number of job openings in the entire year of 2025.

Data as of January 12, 2026

In the first two weeks of January 2025, the average number of job postings per day was about 38; while in the same period of 2026, the average number of job postings per day was only about 6.5.

Recruiting activity in early January was down about 80% compared to the same period last year. This data confirms the widespread speculation in the market that the industry's start to the year was far less enthusiastic than last year.

Based on the detailed analysis of the job data above, the main characteristics of the current job market are as follows:

Job type distribution: Technical/engineering positions account for 60%, and non-technical/market development positions account for 40%.

Job level distribution: Mid-to-high-level positions such as specialists, senior specialists, supervisors, and department heads account for about 65%, which indicates that companies are prioritizing the recruitment of experienced talents to lead key projects related to core product development and business growth.

Experience requirements: Most positions require applicants to have more than 5 years of relevant experience; management positions require more than 7 years of experience.

When conducting screening interviews with candidates, I often ask them: What currently attracts you to the crypto industry? The answers invariably fall into two categories: prediction markets and stablecoins. Therefore, it's not surprising that data shows approximately 60% of hiring demand is concentrated in infrastructure teams, stablecoin projects, and payment/fintech infrastructure startups. Furthermore, the talent war between Kalshi and Polymarket continues, and this competition is expected to continue.

The most aggressive recruiters right now are companies in their growth stage (i.e., those that have completed Series A or later funding rounds). A quick glance at the job postings of several companies and information on the Ashby platform confirms this conclusion.

Companies that have raised Series A funding: Lifi Protocol has 13 open positions, Privy IO (which has been acquired) has 10 open positions, Crossmint has 10 open positions, and Coinflow Labs has 14 open positions.

TurnkeyHQ, a company that has raised Series B funding, is opening 12 positions.

Raincards, a company that has raised Series C funding, is opening 49 positions.

Anchorage, a company that has raised Series D funding, is offering 66 positions.

However, what is perhaps more intriguing is the change in the flow of talent.

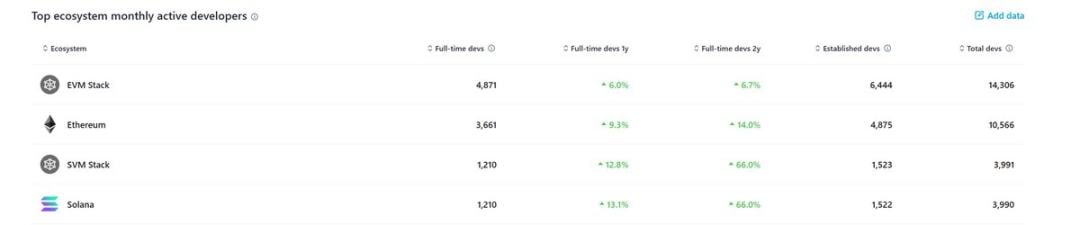

Having worked full-time in crypto recruiting for five years, I couldn't help but wonder: "Has any public blockchain ecosystem ever challenged Ethereum's dominance in recruiting and developer growth like Solana has?" The answer is: no, at least not on this scale.

Looking back at history, other public chains such as Polkadot and Cosmos have all experienced a period of rapid growth in the number of developers, but they have never been able to make an impact on Ethereum in terms of market share and continuous recruitment scale.

Solana is the first ecosystem to truly rival Ethereum. In 2024, it set a historic record, achieving for the first time since 2016 that the percentage of new contributing developers surpassed Ethereum's. Solana attracted over 22% of new developers in the crypto industry, compared to approximately 16% for Ethereum. This is a rare phenomenon, considering that Ethereum has historically absorbed the vast majority of new talent.

Data source: Electric Capital Developer Report, as of January 14, 2026

In the third quarter of 2025 alone, 23 Solana ecosystem projects completed financing, raising a total of US$211 million, representing a 70% year-on-year increase in ecosystem financing.

For example, after a project completes a $13.5 million funding round (such as Raikucom's funding in Q3 2025), its primary task is to recruit 5-10 senior engineers to build a core engineering and marketing team. These positions are typically not advertised on public job websites, but rather recruited through investor/angel investor networks, hackathons, and targeted headhunters.

The crypto industry is constantly evolving, and the job market landscape will change accordingly. While crypto technology has driven the internet capital market to its maximum potential through token issuance, the reality is that the vast majority of tokens issued in the past two years have seen their prices decline.

I believe that by 2026, the chain reaction of this phenomenon will gradually emerge, affecting companies' risk financing methods, market expansion strategies, and of course, talent recruitment strategies.

The projects that will stand out this year will be those with solid business fundamentals, a real user base, that solve real needs, and most importantly, those that can generate revenue.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush