Entering the third week of January, the total amount of liquidated assets across the market has reached nearly $900 million. Negative volatility, primarily due to the impact of Trump's tariff policies on the EU, has caused this figure to surge. This number could continue to rise as many altcoins are showing warning signs.

XRP, Axie Infinity (AXS), and Dusk (DUSK) are attracting and being capitalized on this week for various reasons. However, they could become traps for retail investors without a sound risk management plan.

1. XRP

On January 19, 2024, XRP dropped to $1.85 before recovering to $1.95. This drop almost wiped out the recovery efforts since the beginning of the year.

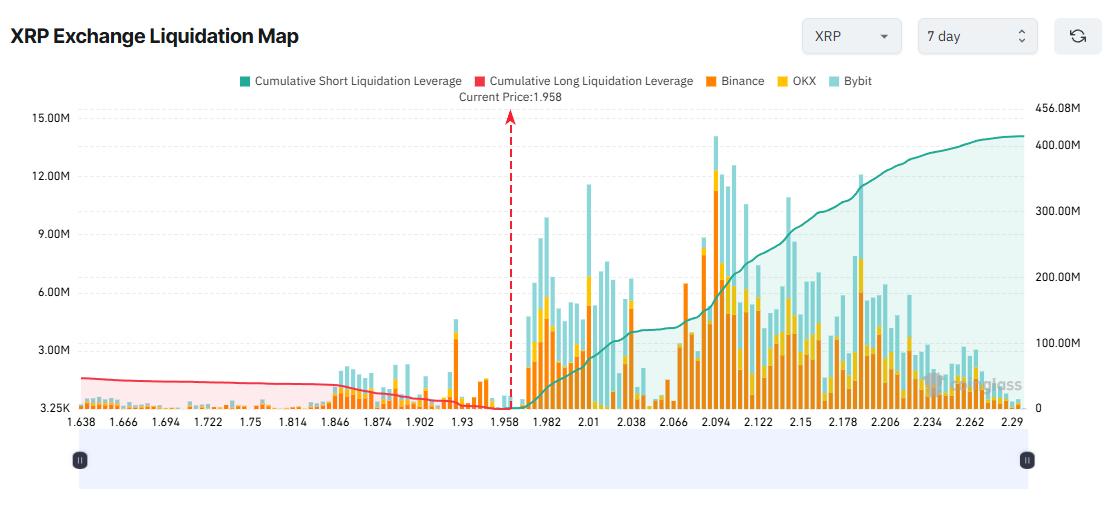

Short-term traders tend to become increasingly pessimistic. Many are betting that prices will fall further. The 7-day liquidation map data shows that the likelihood of liquidating Short positions significantly outweighs that of Longing positions.

XRP exchange liquidation map. Source: Coinglass

XRP exchange liquidation map. Source: CoinglassLiquidation data suggests that if XRP rebounds to $2.29 this week, the amount of liquidated Short positions could exceed $600 million.

This scenario could unfold if concerns about Trump's new tariffs quickly subside. Strong buying around the $1.80 mark would also support a recovery.

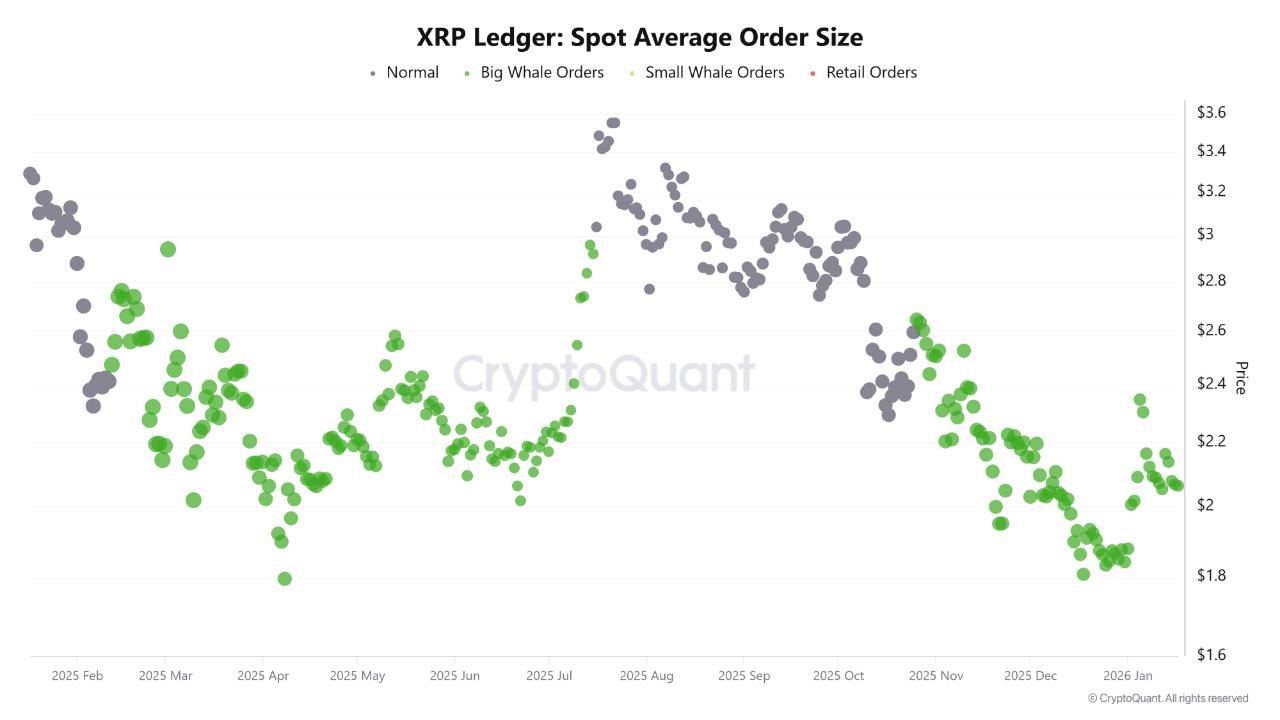

Another crucial indicator is the Medium order size in the XRP spot market. According to data from CryptoQuant, when the XRP price is below $2.4, there are many large buy orders from whales. This indicates strong whale demand at low price levels.

Medium order size in the XRP spot market. Source: CryptoQuant .

Medium order size in the XRP spot market. Source: CryptoQuant .“Whal interest is at its highest level since 2026. Large orders are dominant, indicating that 'Smart Money' is getting ahead in preparation for the next bull run.” – A CryptoQuant analyst commented .

If accumulated buying pressure from whales outweighs short-term market concerns, XRP could recover very quickly, forcing Short traders to liquidate their positions.

2. Axie Infinity (AXS)

Axie Infinity (AXS) unexpectedly returned to the top of the most talked-about cryptocurrencies in the third week of January. YTD, this Token has increased by over 120% .

The price surge in January was primarily driven by the Axie founding team's plan to convert rewards into a new utility Token called bAXS. This is part of a planned tokenomics overhaul expected to be implemented in 2026.

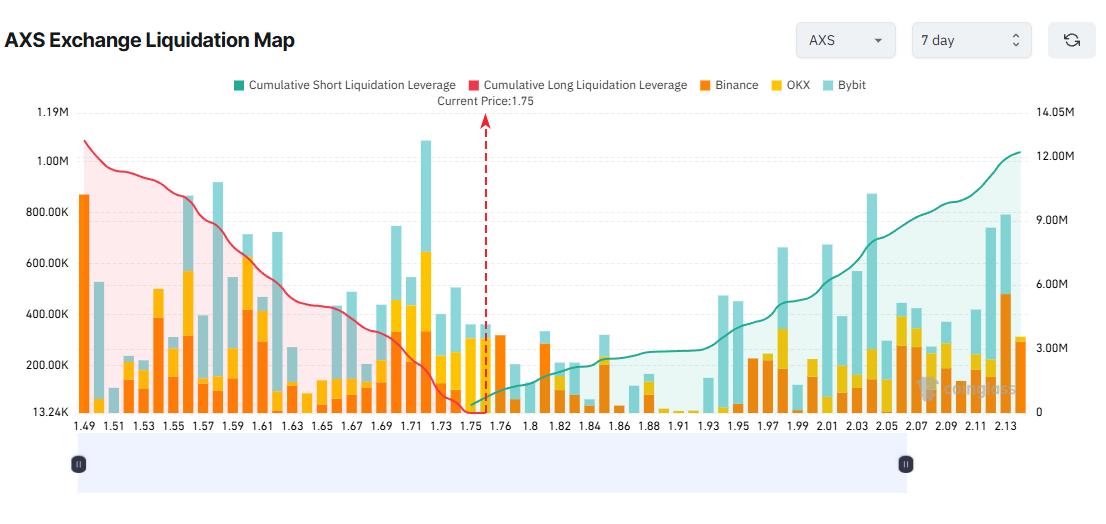

AXS 's 7-day liquidation map also shows potential liquidation amounts close to $12 million. However, the price range that could trigger liquidation of Longing positions is narrower than that of Short positions, suggesting that many traders still expect prices to rise in the short term.

AXS exchange liquidation map. Source: Coinglass

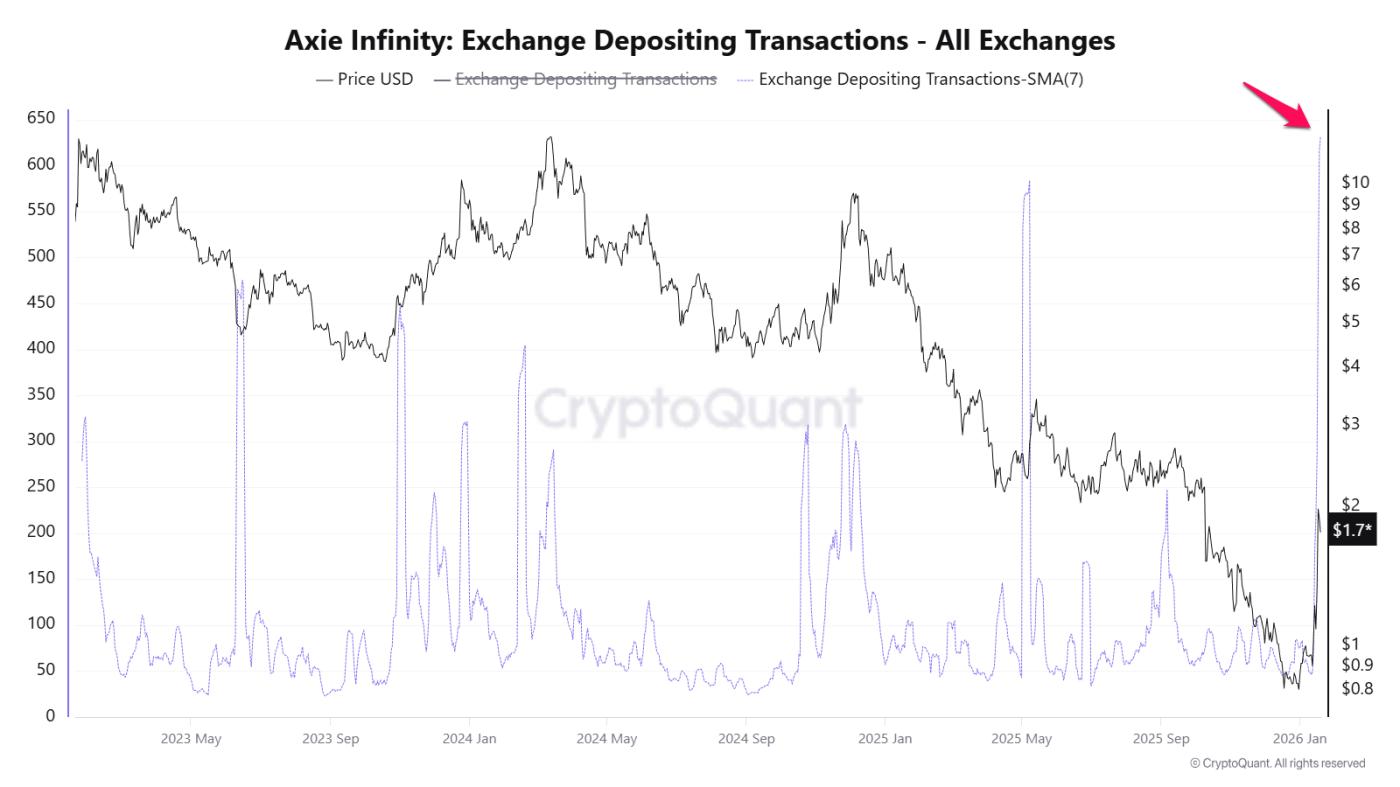

AXS exchange liquidation map. Source: CoinglassIn addition, data shows that AXS 's upward trend in January was accompanied by a sharp increase in Token deposits to the exchange. The number of deposit transactions in the past 7 days reached its highest level in the last 3 years.

Transaction volume deposited into Axie Infinity exchange. Source: CryptoQuant .

Transaction volume deposited into Axie Infinity exchange. Source: CryptoQuant .This trend suggests that many investors are looking to take profits as prices recover, which could create selling pressure at any time and make Longing positions riskier.

3. Dusk

Dusk has become a prominent new name in the trend of interest in cryptocurrency. This surge reflects a shift of Capital from large-cap Capital to smaller Capital options.

Despite having increased nearly sixfold since the beginning of the year, DUSK has also triggered several Short position liquidations over the past four days. Short-term traders continue to pour in Capital and use leverage for buy orders.

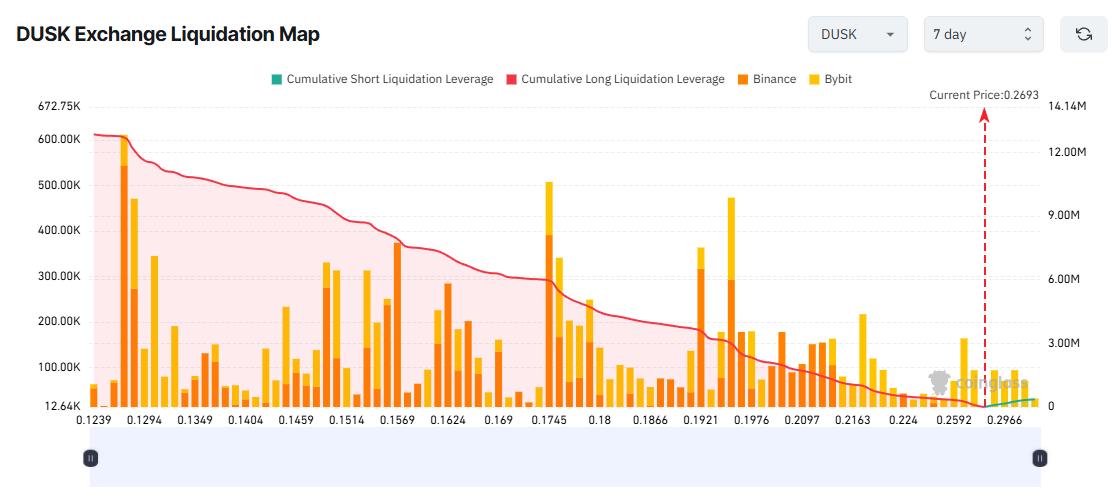

DUSK liquidation map on the exchange. Source: Coinglass

DUSK liquidation map on the exchange. Source: CoinglassThe liquidation map for DUSK shows that Longing positions are the largest and also face the highest risk of liquidation. If DUSK corrects downwards this week, Longing positions will be seriously threatened.

A recent report by BeInCrypto indicates an increasing amount of DUSK being deposited on exchanges . This development reflects existing profit-taking pressure. Furthermore, the price of DUSK has surged amidst renewed market anxiety due to Trump's new tax policies on Europe. These factors may make the current upward trend unsustainable in the long term.

Last October, DASH surged sixfold after Capital shifted from ZEC to smaller- Capital privacy coins. But just a week later, DASH plummeted 60% . DUSK is now facing similar risks.

If FOMO (fear of missing out) on DUSK subsides and the price falls below $0.13, the total value of Longing positions that could be liquidated could reach $12 million.

The three altcoins below clearly demonstrate the differences – even contradictions – in the expectations of short-term traders. This complexity stems from geopolitical pressures intertwined with internal market volatility. Without a strict stop-loss strategy, both Longing and Short positions risk significant liquidation.