The rise of Polymarket is more than just the success of a cryptocurrency application; it represents a deeper social transformation: the assetization of information. By encapsulating the "future" in code and transforming "judgment" into "transactions," Polymarket is building a decentralized truth machine.

Article author and source: Yokiya Stablehunter

Today we continue our in-depth analysis of Polymarket's product logic and technical architecture, setting aside complex financial jargon and obscure code, and explaining it in plain language. Key topics include: how it uses blockchain technology to ensure fairness, how it designs incentive mechanisms to encourage thousands of traders to spontaneously maintain market order, and how it reshapes our understanding of "prediction" through its decentralized technological moat amidst fierce competition from traditional financial giants like Robinhood. A glossary of related terms is provided at the end.

I. The Revival of Prediction Markets and the Information Revolution

1.1 What is a prediction market?

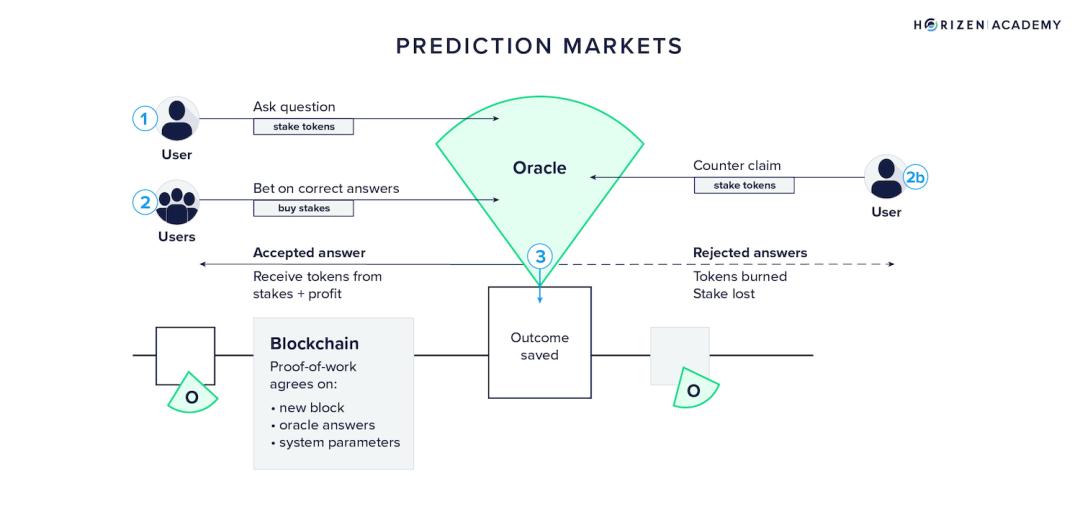

To understand Polymarket, we first need to establish a core understanding: the essence of predictive market trading is ownership of future facts.

In daily life, everyone has made bets with friends. For example, Zhang San thinks it will rain this weekend, while Li Si thinks it won't. They agree that the loser will give the winner 100 yuan. This primitive betting method has several obvious flaws: First, the funds are not guaranteed, and the loser may renege on the bet; second, since only two people participate, this bet cannot reflect the objective probability of rain—Zhang San may only think it will rain because he just washed his car, and this judgment is highly subjective and limited.

Polymarket has highly standardized and financialized this primitive social interaction.

On Polymarket, the aforementioned "bet" was transformed into a binary option contract. The system abstracted the question of "whether it will rain this weekend" into an asset package with a constant total value of $1. This asset package was split into two independent shares:

- "Yes" Share: This voucher can be redeemed for $1 if it rains over the weekend.

- "No" share: If it doesn't rain over the weekend, this voucher can be redeemed for $1.

Regardless of the final outcome, one and only one of Yes and No will be redeemed for $1, while the other will become zero. Therefore, at any given moment, the price of Yes plus the price of No should theoretically be infinitely close to $1 (ignoring transaction wear and tear).

The most ingenious aspect of this design is that price equals probability. If the market price for the "Yes" share is $0.65, it means that market participants are willing to spend real money—$0.65—to buy an opportunity that "may become $1, or it may become 0." This underlying group subconscious suggests that the market believes the probability of rain is 65%.

This probability, built upon the hard-earned money of millions, is often more accurate than a single prediction by opinion poll experts or weather stations because it filters out the noise of "cheap talk"—as the old Wall Street adage goes: "Put your money where your mouth is."

1.2 Why is it becoming popular now?

The concept of prediction markets was proposed by economists decades ago, and early decentralized attempts such as Augur were short-lived. But why did it not until Polymarket that it truly achieved large-scale mainstream adoption? This is due to the dual maturity of technological infrastructure and market demand.

From a technical perspective, Polymarket addresses the fatal flaws of early blockchain applications: slowness, high cost, and difficulty. Early prediction markets were built on the Ethereum mainnet, where placing a bet could require paying tens of dollars in gas fees, and confirmation times could take several minutes, which was unacceptable for high-frequency event trading.

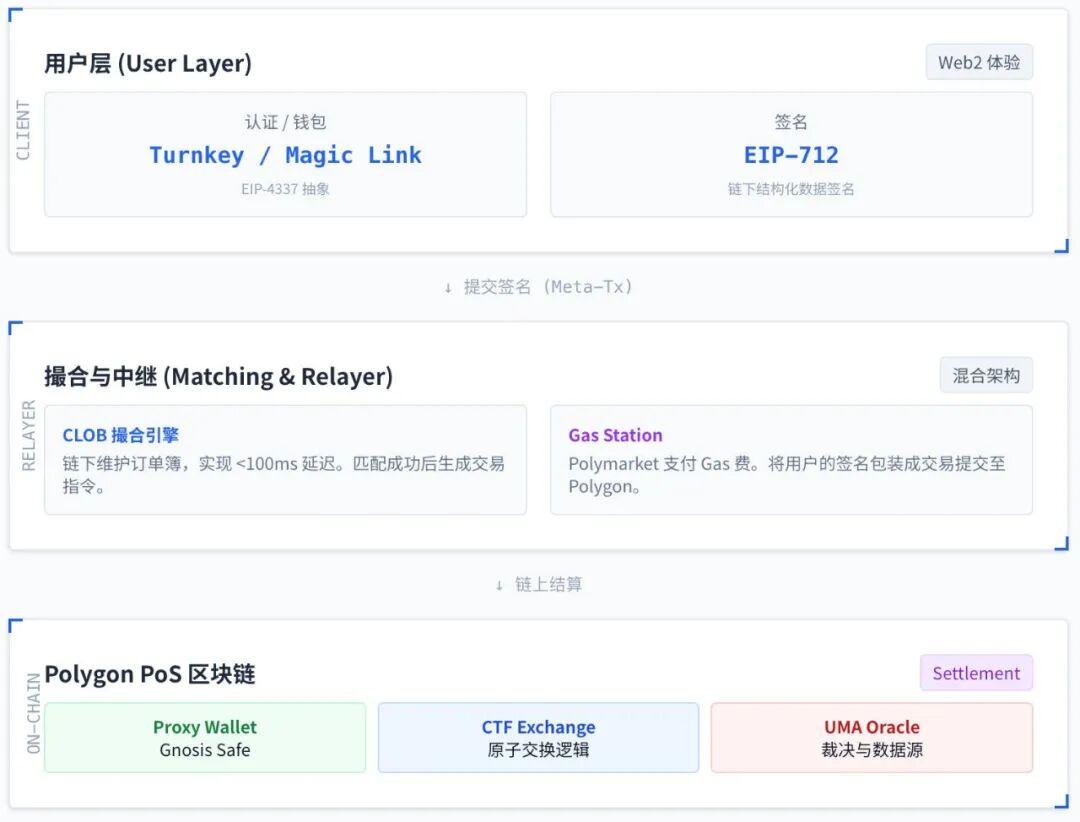

Polymarket creatively employs a hybrid architecture combining a Layer 2 scaling solution (Polygon) with a centralized limit order book (CLOB), resulting in near-zero transaction costs and millisecond-level transaction speeds. At the same time, account abstraction technology allows users to log in without needing to understand private keys or seed phrase.

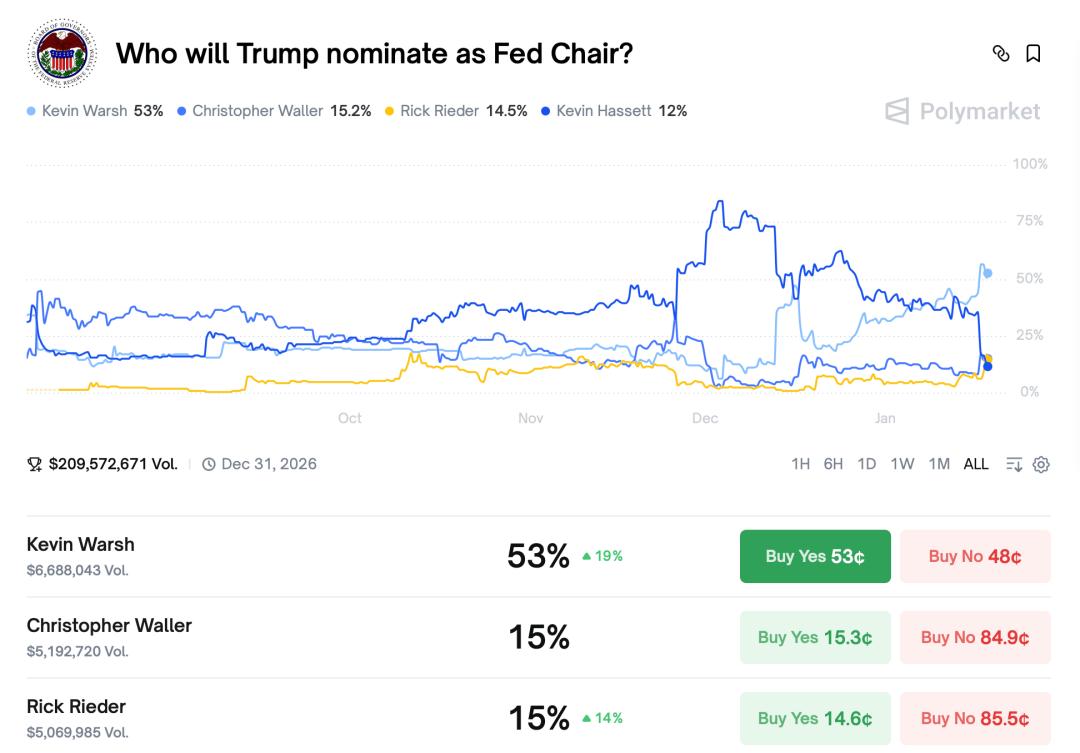

From the demand side, the global macroeconomic environment in 2024 and 2025 is fraught with uncertainty. The close US election, geopolitical turmoil, the shift in the Federal Reserve's monetary policy, and the dramatic fluctuations in the cryptocurrency market have brought the public's thirst for "certainty" to a peak.

Financial reports from fintech giants like Robinhood show that retail investor activity is at an all-time high, with a growing inclination to participate in "event contract" trading, which has a binary, adversarial nature. Vlad Tenev points out that prediction markets are evolving from a niche experimental field into a mainstream asset class alongside stocks and futures, marking the arrival of a supercycle.

II. Core Product Logic and User Interaction Mechanism

2.1 Core Product Logic: Binary Options and Conditional Tokens

Polymarket's product design philosophy is minimalism. Although complex smart contracts run in the background, what is always presented to users on the front end is a simple and intuitive interface: a question, two buttons (Yes/No), and a curve reflecting the probability trend.

2.1.1 Standardized Encapsulation of Binary Options

In Polymarket's product logic, any event with a definitively verifiable result can be encapsulated as a market. This market is represented on-chain as a smart contract address. When users participate in transactions, they are actually buying and selling a special type of crypto asset called a "Conditional Token."

These tokens adhere to the ERC-1155 standard, a more advanced standard than the common ERC-20 (such as USDT). If ERC-20 is likened to individual banknotes, then ERC-1155 is like a container that can hold various items with different attributes. Thousands of different prediction event tokens can coexist within the same smart contract without requiring a separate contract for each event, significantly reducing system resource consumption and user interaction costs.

2.1.2 Price Discovery Mechanism: The Evolution from AMM to CLOB

For novice users, understanding "who is selling me this token" is crucial. Polymarket has undergone a key transformation from "machine pricing" to "human pricing".

Early Stage (AMM Model) : Initially, Polymarket used an Automated Market Maker (AMM) mechanism. This is similar to a vending machine, where the price is determined by a fixed mathematical formula (constant product formula). When more people buy "Yes," the pool of "Yes" decreases, and the price automatically rises. The advantage of this model is constant liquidity, but it suffers from significant slippage when dealing with large sums of money and low capital utilization.

Current Stage (CLOB Model) : To accommodate the entry of institutional funds, Polymarket has transitioned to a centralized limit order book (CLOB). The current trading interface resembles a stock exchange, where users can see the order book depth for the best bid and ask prices. If you want to buy "Yes," your counterparty is no longer a machine, but another real user or market maker who believes the event will not occur (selling "Yes" or buying "No"). This mechanism not only makes price discovery more accurate but also allows users to place limit orders, thereby gaining pricing power.

2.2 Money Printer: Automatic Correction System

Within Polymarket's advanced player community, there's a feature known as the "Money Printer," namely Split and Merge. This is not merely a technical function, but also the economic cornerstone that maintains Polymarket's robust pricing logic.

Let's use ETFs to explain why this mechanism is needed.

Why do ETF prices in the stock market usually not deviate too far from their net asset value (NAV)? It's all about "creation/redemption":

- ETF prices are too high: Institutions exchange a basket of stocks for ETFs (subscribe), and then sell the ETFs, thus driving down the ETF price.

- ETFs are too cheap: Institutions buy ETFs and then use them to exchange for the basket of stocks (redemption), which drives up the price of ETFs.

This is almost identical to the logic of Split/Merge: both anchor the price to "createable/redeemable". The only difference is that Polymarket anchors the sum of Yes + No approximately to 1, while ETF anchors the price approximately to the net asset value.

In other words, in a binary prediction market like Polymarket, the contract provides a "perpetually available official exchange window," allowing you to convert 1 USDC into a pair of complementary positions (Yes + No), or to exchange this pair of complementary positions back into 1 USDC at any time. Once this window opens, arbitrageurs will vote with their feet, automatically pulling the market price back to "where it should logically be."

The reason why Split/Merge is considered the "economic cornerstone of maintaining the rigorous price logic of the Polymarket" is primarily because it transforms the market from a "pure secondary exchange" (where one can only buy shares sold by others) into a structured market with a "creation/redemption mechanism." As long as there is creation/redemption, the price will be locked in by a hard constraint, and arbitrageurs will automatically pull the deviation back.

Suppose that at a certain moment, the market is in a state of extreme panic, and someone sells Yes at 0.60, while someone else sells No at 0.35.

At this point: $0.60 + 0.35 = 0.95

A savvy arbitrageur (or bot) will immediately do the following:

- Buy Yes for 0.60 and No for 0.35 in the market, for a total cost of 0.95 USDC.

- Immediately invoke the "Merge" function to exchange this pair of tokens for 1.00 USDC.

- Net profit of 0.05 USDC (risk-free profit).

This arbitrage behavior involves instantly driving up the prices of Yes and No until their sum returns to around 1.00. Conversely, if the sum of the prices is greater than 1 (e.g., Yes 0.7 + No 0.4 = 1.1), the arbitrageur will perform a "split" operation: spending 1 USDC to mint a pair of tokens, and then selling them at 0.7 and 0.4 respectively, making a profit of 0.1.

In the prediction market community, this type of mechanism already exists in the Conditional Tokens framework of Augur and Gnosis/Omen; Polymarket has turned it into a scalable and robot-participable "automatic correction system", making it truly serve as market infrastructure.

The core problem it truly solves can be summed up in three words: self-consistency.

1) Supply self-sufficiency: Even without sellers, market share can be created, and the market will not be blocked due to shortages.

2) Price self-consistency: The hard constraint of Yes+No can be used for arbitrage, and the price will be pulled back to the logical range.

3) Self-consistent governance: No centralized administrator is needed to monitor and correct deviations; the correction is automatically driven by arbitrage motives.

Taken together, its "core function" is to upgrade the price prediction market from "barely maintained by human sentiment and matching" to "automatically maintained by enforceable arbitrage constraints." The platform does not need to assign a centralized administrator to monitor and correct prices, nor does it need to rely on the morality and financial strength of a single market maker; all arbitrageurs are the free correction system.

2.3 Smooth and seamless user experience design

For novice users accustomed to Web2 applications (such as Robinhood and Alipay), the learning curve for Web3 is often daunting: it requires downloading a wallet plugin, saving 12 seed phrase, purchasing ETH for gas fees, and understanding complex signature mechanisms. Polymarket's success is largely attributed to its technical means of "hiding" these complexities.

2.3.1 Email Login and Hosted Wallet

Polymarket integrates with Magic Link or similar account abstraction technologies. Users simply enter their email address and click a verification link, and the system automatically generates a non-custodial Ethereum wallet for them in the background. For users, this is no different from logging into a regular website, but in reality, they already have their own on-chain address. The wallet's private key is typically segmented and encrypted for storage, ensuring security while preventing the risk of users losing their private keys.

2.3.2 Relayer and Gas-Free Transactions

On the blockchain, every operation (placing an order, canceling an order, merging tokens) theoretically requires paying a mining fee. To provide a seamless experience, Polymarket introduced a Relayer architecture.

When a user clicks "Buy," the front-end does not directly initiate an on-chain transaction. Instead, it prompts the user to sign a data packet containing the transaction intent (EIP-712 standard signature). This signing is free.

The user's browser sends this signature to Polymarket's Relayer server. After verifying the signature, Relayer packages it into a genuine transaction, pays MATIC tokens as miner fees, and sends it to the Polygon network for execution.

In this way, users experience "click-to-transaction" without worrying about gas fees or on-chain congestion. This is a typical "Web2 experience, Web3 settlement" architecture.

III. In-depth technical architecture analysis

3.1 Infrastructure Layer: Why choose Polygon?

Polymarket is not built directly on the Ethereum mainnet (Layer 1), but instead uses the Polygon PoS sidechain (currently migrating to more advanced Layer 2 solutions such as zkEVM). This choice is based on a trade-off between cost and speed.

Cost considerations: Individual transaction amounts in the prediction market can be very small (a few dollars or even cents). Using the Ethereum mainnet, a single gas fee could be as high as $5-10, directly destroying market liquidity. Polygon's gas fees are typically only a few cents or even less, making the Relayer payment model economically sustainable.

Speed considerations: Polygon's block time is approximately 2 seconds, significantly faster than the Ethereum mainnet. While 2 seconds is still too slow for high-frequency transactions, it is sufficient to meet settlement requirements when combined with an off-chain matching engine.

3.2 Asset Layer: Gnosis Conditional Token Framework (CTF)

This is the core engine of Polymarket, a set of smart contract code running on the blockchain. The Gnosis CTF framework solves the most challenging problems in prediction markets: path dependence and combined prediction.

3.2.1 Conditions and their combinations

In the simplest binary market, CTF deals with Condition A (such as Trump's victory). But in more complex markets, CTF demonstrates its powerful ability to nest logic.

For example, we can create a combined market: "If interest rates are cut in 2025 (Condition A) and the S&P 500 rises (Condition B)." CTF allows the Outcome Token of Condition A to be used as collateral to further split into tokens based on Condition B. This is like a Russian nesting doll, with layers upon layers. This architecture allows Polymarket to support extremely complex derivatives trading in the future, although currently, the primary market for the general public is a simple binary market.

3.2.2 Technical Advantages of ERC-1155

As mentioned earlier, CTF uses the ERC-1155 standard. Technically, this means that the smart contract has a mapping (ID => Balance) ledger. The ID is a unique identifier calculated using a hash algorithm (Keccak256) and contains information such as the question ID and the result index (Yes/No).

This structure allows for "batch transfers." If a market maker needs to adjust positions in 100 different markets simultaneously, they can complete all operations in a single transaction, significantly saving gas fees and reducing on-chain congestion risks.

3.3 Oracle Layer: Game Theory Design of UMA

All prediction markets face the same ultimate question: Who decides the outcome?

If the results were entered by Polymarket's official representatives, it would become a centralized market maker, posing a risk of malicious activity or absconding with the funds. Polymarket introduced the Optimistic Oracle mechanism from UMA (Universal Market Access), using a sophisticated game theory model to solve the decentralized trust problem.

UMA's design is based on the assumption that most people are honest most of the time, especially when honesty can make money.

Under the UMA mechanism, the confirmation process for market outcomes is as follows:

- Propose: After the event ends, anyone (usually an incentive bot) can propose an outcome (e.g., "Yes") to the contract.

- Challenge Windows: After a proposal is submitted, there is a public consultation period of approximately 2 hours. During this period, if no one raises any objections, the system assumes (optimistically) that the result is correct and proceeds with the settlement accordingly.

- Dispute: If someone believes a proposal is wrong (for example, someone proposes Yes when No is the winner), they can stake a sum of money to challenge it.

- DVM (Data Verification Mechanism): Once a challenge arises, the dispute escalates to UMA's highest court—the DVM. At this point, all holders of UMA tokens will vote.

- The Schelling Point mechanism: Voters vote not only based on facts but also to maintain the system's credibility. If the UMA system is proven to be manipulable, UMA tokens will go to zero. Therefore, to protect the value of their assets, rational holders will tend to cast a vote that reflects objective facts.

- Rewards and penalties: Those who vote correctly will share the deposit of those who voted incorrectly.

This mechanism ensures that as long as the cost of wrongdoing (bribing 51% of all token holders) exceeds the benefits of wrongdoing, the outcome is credible. For Polymarket users, this means that the safety of their funds does not depend on the company's conscience, but on mathematical and economic game theory.

IV. Finally, Supercycles and Regulation

Robinhood CEO Vlad Tenev's concept of a "supercycle" is not unfounded. With the involvement of AI, the prediction market is undergoing a qualitative change.

The main players in the future prediction market may not be humans, but AI agents.

Imagine tens of thousands of AI agents monitoring global news, weather, financial reports, and social media sentiment 24/7. The moment they detect a tiny change in the probability of an event occurring, the AI immediately initiates a trade on Polymarket.

This will lead to two results:

The extreme efficiency of the market: predicting market prices will become the fastest and most accurate channel for all mankind to obtain information, even faster than news media.

An exponential explosion in liquidity: trading volume will no longer be limited by human schedules and attention spans, but will instead be driven by an endless game of algorithms.

However, the regulatory environment will be a key variable determining the industry landscape: if regulators equate prediction markets with gambling, then Polymarket will face significantly increased compliance pressures. Conversely, if it is recognized as a new type of "information derivative," then it will become one of the infrastructures of the global financial markets.

The rise of Polymarket is more than just the success of a cryptocurrency application; it represents a deeper social transformation: the assetization of information. By encapsulating the "future" in code and transforming "judgment" into "transactions," Polymarket is building a decentralized truth machine.

For the average user, understanding how this machine works is easy. It's changing the way we perceive the world—from listening to experts to observing market trends. In this new world, money is no longer merely a symbol of purchasing power; it has become a measure of honesty.

Attached Glossary of Technical Terms