Zcash nearly experienced a sharp decline, but buying pressure emerged just in time at the last minute. On the 12-hour chart, a bearish pattern has almost formed, signaling the risk of a deep correction for Zcash .

However, Dip buying pressure created a long lower wick, delaying the decline. The bigger question, however, is whether this truly reflects genuine market sentiment, or merely a temporary defensive move prolonging the inevitable?

A 34% drop was almost inevitable — until buyers showed up.

On the 12-hour chart, Zcash has formed a clear Vai-and- Vai pattern. The breakout level is near $359, and the price even briefly dropped below this level. If confirmed, this pattern would signal a potential further 34% drop.

However, the breakdown has not yet been confirmed.

Strong buying pressure emerged, pulling the price back above the support zone before the candle closed. This resulted in a long lower wick, a classic sign that buying demand appeared at a time when many thought the price would continue to fall. Currently, this wick only indicates that the decline has been temporarily halted, not a trend reversal.

Downward trend pattern: TradingView

Downward trend pattern: TradingViewWant more Token analysis? Sign up for the daily Crypto newsletter compiled by editor Harsh Notariya here .

Momentum is also providing slight support for the price. From January 10th to January 19th, 2024, the price of Zcash appears to be forming lower Dip , while the RSI (Relative Strength Index) indicator is forming higher Dip . This is a common positive divergence on the 12-hour timeframe, often signaling a short-term rebound, especially after sharp drops.

Positive divergence is forming: TradingView

Positive divergence is forming: TradingViewHowever, this divergence signal remains very fragile. To ensure validity, the price of Zcash needs to continue to hold above the $335 level on the 12-hour timeframe. If the candle closes below this level, the signal will weaken significantly and the risk of a return to a downward trend will increase. In short, the buyers have only delayed the negative impact, not completely eliminated the risk.

Whale buying activity and spot money flows are slowing down.

A XEM will explain why prices haven't fallen as sharply as predicted.

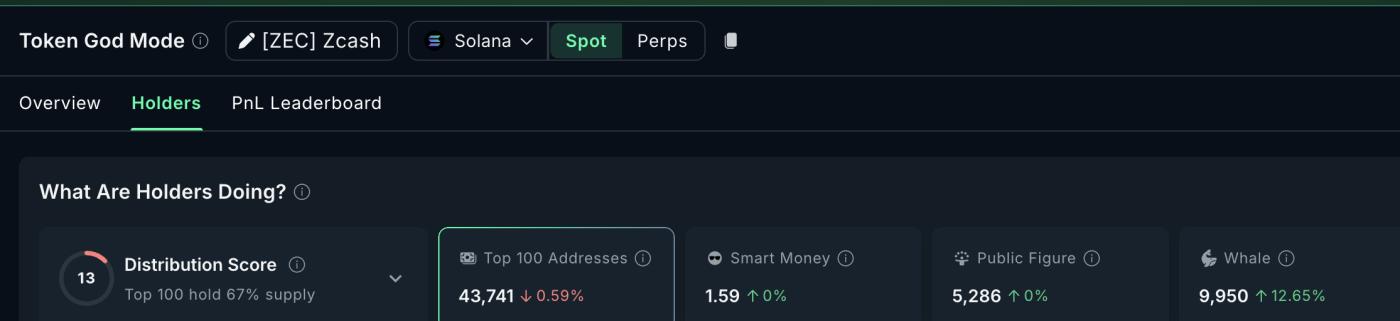

Over the past 7 days, whales have increased their Zcash holdings by 12.65%, bringing the total supply of ZEC held by this group to approximately 9,950 ZEC. This group has been the strongest support during the market sell-off. Meanwhile, the largest wallets (top 100 wallets, or mega whales) have not made significant purchases, indicating that large, long-term investors remain quite cautious.

Zcash Shark: Nansen

Zcash Shark: NansenData from the spot market also reinforces this view.

In late November 2023, Zcash recorded peak daily outflows of nearly $61 million, indicating very aggressive buying pressure. However, this level of activity has now subsided. On January 18, 2024, net outflows from the exchange were only $15.7 million, and on January 19, 2024, they plummeted to just $7.68 million, a decrease of 87% compared to the previous peak accumulation period.

Net cash flow on the spot market: Coinglass

Net cash flow on the spot market: CoinglassBuying pressure is still present, but the pace has slowed considerably.

The Money Flow Index (MFI) indicator also helps to clarify buying activity. The MFI combines price and volume to assess XEM buying pressure is proactive or defensive. On the 12-hour chart, the MFI is forming higher Dip while the Zcash price continues its downward trend.

This model shows that most of the buying pressure comes from retail investors buying when prices fall, rather than chasing sharp price increases. In other words, buyers only participate when they see prices weakening, and are not yet confident enough to bet when prices are high.

Bottom Dip buying continues to emerge: TradingView

Bottom Dip buying continues to emerge: TradingViewThis is crucial. Buying on dips can help prevent sharp plunges, like the one that just occurred near a key support zone. However, without stronger continuation, this move rarely generates a sustained rally.

Currently, demand for Zcash remains, but retail investors are still quite cautious, making careful choices and reacting to market trends rather than feeling an urgent need to buy.

Zcash price levels determine whether holding the price will turn into a reversal.

When a breakout signal is delayed, the specific price zone becomes more important than technical indicators.

The first price zone to watch is between $359 and $350. If Zcash breaks through this area on the 12-hour timeframe, the Vai-and- Vai pattern will be reactivated. At that point, a path back to the $250 price zone will open up, almost completing the predicted 34% drop.

If the buyers continue to defend this area, Zcash is likely to stabilize again in the short term.

On the upside, $450 is the first real test. This area is the right Vai of the bearish pattern. If the price holds above this level, the bearish signals may weaken and the recovery momentum will gain further impetus.

Zcash price analysis: TradingView

Zcash price analysis: TradingViewHowever, the bearish pattern will only be truly broken if Zcash breaks above $559. Before that, any rebound will only be a temporary correction and will not confirm a new uptrend.

Zcash is currently in equilibrium. Buyers have shown a willingness to protect the price, and whales are starting to appear. Buying activity on dips remains quite active, but confidence is no longer as strong as during previous accumulation phases.

The temporary 34% drop has been halted. But whether this trend can be sustained remains to be XEM , depending on investors' next moves, and not just on what they've just done.