Gold prices hit a new record high on Tuesday as rising geopolitical tensions and fears of a trade war continued to drive investors toward safe-haven assets.

Gold prices hit a new record high on Tuesday as rising geopolitical tensions and fears of a trade war continued to drive investors toward safe-haven assets.

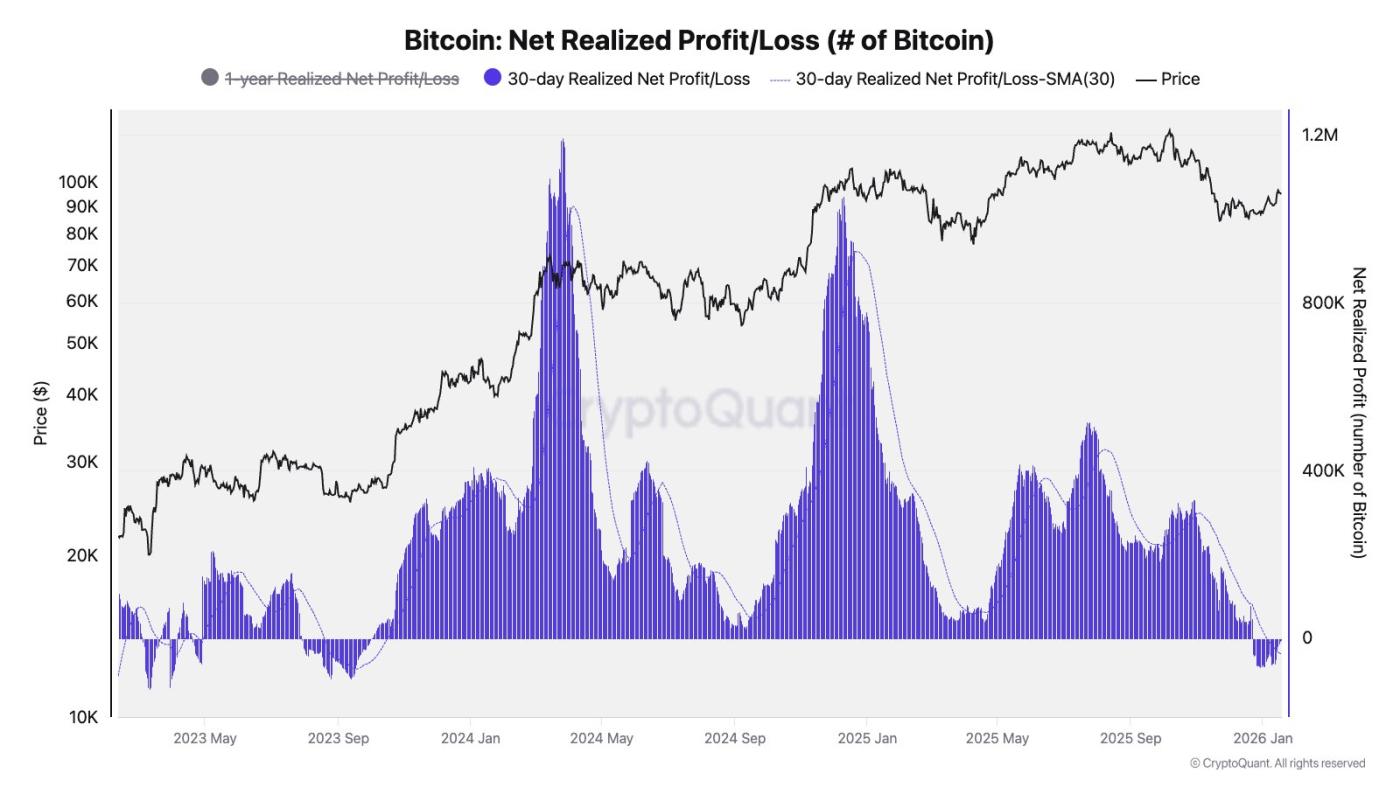

Bitcoin holders have recorded net losses over the past 30 days , marking the first extended losing chain since late 2023, after more than two years of the market mostly seeing realized gains .

According to data Chia by Julio Moreno , Head of Research at CryptoQuant , Bitcoin's 30-day rolling profit/loss ratio has fallen below zero. This suggests that BTC moved on-chain over the past month has been sold off at prices lower than the original purchase price .

“Bitcoin holders are realizing losses in the 30-day cycle starting from the end of December — for the first time since October 2023,” Moreno wrote on X.

The net realized profit/loss ratio reflects the size of the net profit or loss that all holders record when spending (selling) coins, according to CryptoQuant. A negative ratio does not necessarily mean the price will fall, but rather indicates increasing selling pressure from investors who bought at higher prices.

Gold hits new high as global tensions escalate.

Amid renewed pressure on Bitcoin and other digital assets, gold prices surpassed $4,700 per ounce for the first time as geopolitical tensions continued to drive capital towards traditional safe-haven assets.

Specifically, on Tuesday, spot gold prices rose to an all-time high of $4,701.23 per ounce before cooling slightly, while US gold futures contracts also set new records. Silver also surged, trading near its all-time high after briefly touching $94.72 per ounce .

The rise in precious metals occurred amid deteriorating global sentiment following threats of new tariffs from US President Donald Trump . He warned he would impose new trade measures on European allies if Denmark did not agree to cede Greenland, raising concerns about a larger-scale trade conflict.

This contrasting trend has caused the Bitcoin/gold ratio to plummet, now more than 50% lower than its previous peak, according to Bitfinex . “The last time this ratio was in this range, BTC outperformed gold. This is a pair to watch as liquidation in 2026 begins to build,” one analyst wrote on X.

Spot Bitcoin ETFs continue to experience Capital .

US-listed spot Bitcoin ETFs also recorded net outflows of $394.7 million on Monday, according to data from SoSoValue . This ended a four-day chain of Capital that had attracted over $1.8 billion into these products.

“President Trump’s tough trade rhetoric is pushing the market back into a state of overall risk aversion ,” Farzam Ehsani , co-founder and CEO of Valr , said in a note Chia with Cointelegraph .

Mr. Ehsani added that tariff threats and retaliatory measures have historically created " significant headwinds for digital assets as well as other risky assets."