Original article | Odaily Odaily( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

RWA sector market performance

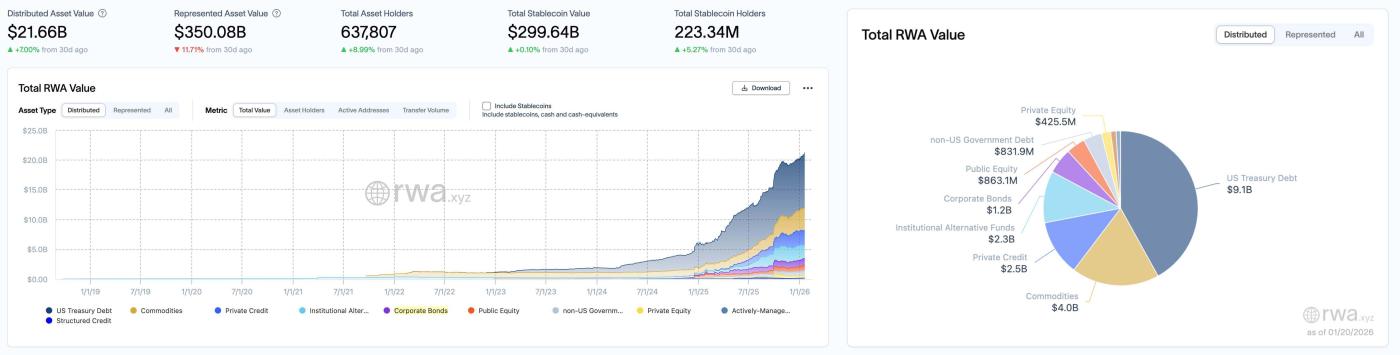

According to the rwa.xyz data dashboard, as of January 20, 2026, the total on-chain value (Distributed Asset Value) of RWA continued its upward trend, increasing from $20.81 billion on January 13 to $21.66 billion, a net increase of $850 million in a single week, representing a week-on-week growth of approximately 4.09% . The broader RWA market also rebounded this period, rising from $282.68 billion last week to $350.08 billion, an increase of $67.4 billion, or 23.84%. User activity on the asset side also surged, with the total number of asset holders increasing from 620,073 to 637,807, a net increase of over 17,700 in a single week, representing a growth rate of 2.86%. Regarding stablecoins, the number of holders increased from 220.12 million to 223.34 million, an increase of 3.23 million, or 1.47%; while the market capitalization rose slightly from $297.68 billion to $299.64 billion, an increase of $1.96 billion, or 0.66%.

In terms of asset structure, US Treasury bonds maintained their absolute dominance, rising from $8.9 billion to $9.1 billion this period, an increase of 2.25%. Commodity assets also continued their upward trend, rising from $3.7 billion to $4 billion, recording an increase of $300 million. Private credit rebounded to $2.5 billion this week after a continuous correction, reflecting a rebound signal; while institutional alternative funds contracted slightly, falling from $2.5 billion to $2.3 billion, a decrease of $200 million. Non-US government debt also rose slightly, from $8.098 billion to $8.319 billion, an increase of 2.73%. Public equity continued to strengthen, increasing from $8.077 billion to $8.631 billion, an increase of 6.87%. Private equity also rose slightly from $420.5 million to $425.5 million, continuing its upward trend.

Trend Analysis (Compared to last week )

This period, the RWA market continued its structural expansion, with both user activity and overall market size rebounding significantly compared to last week. Looking at fund flows, capital previously concentrated in low-risk US Treasury assets is now rapidly diverting towards medium-risk assets such as commodities, equities, and non-US debt. This allocation shift directly signals a moderate increase in market risk appetite. Meanwhile, stablecoin market capitalization and user base continue to grow steadily, laying a solid foundation for future capital flows and asset injections into the market.

Market keywords: on-chain scaling, diversified configuration, structural evolution.

Key Events Review

US senators have submitted over 130 amendments, with stablecoin yields and DeFi becoming the focus.

U.S. senators have submitted more than 130 amendments to the upcoming debate on the Crypto Markets Structure Act this week. The amendments cover stablecoin yield rules, DeFi provisions, restrictions on public officials' involvement in crypto activities, and adjustments to the definitions of digital asset mixers and blenders. The amendments were jointly proposed by Democratic and Republican senators.

The Senate Banking Committee will hold a review meeting this Thursday to discuss and vote on the relevant amendments and decide whether to include them in the bill text, followed by a vote on whether to advance the legislative process. Some amendments show bipartisan support, including proposed changes to the stablecoin yield provisions, such as removing the phrase "solely for holding stablecoins" from the current text and strengthening yield disclosure and risk warning requirements.

The New York Stock Exchange (NYSE) plans to launch a tokenized securities trading and on-chain settlement platform, aiming to support 24/7 trading of US stocks and ETFs, fractional share trading, stablecoin-based fund settlement, and instant delivery, integrating with the NYSE's existing matching engine and blockchain settlement system. According to the plan, tokenized stocks will have the same dividends and governance rights as traditional securities. NYSE's parent company, ICE, is also collaborating with banks such as BNY Mellon and Citibank to explore tokenized deposit and clearing infrastructure to support cross-time zone, 24/7 fund and margin management.

(Recommended reading: "NYSE Plans to Launch 24/7 Tokenized Stock Trading, Competitors Stunned" , "NYSE Launches 24/7 Crypto-Stock Trading: Which Crypto Businesses Will Directly Benefit or Harm?" )

With the Senate Banking Committee hearings approaching, US crypto legislation has entered its final stage. The bill has now seen over 70 amendments, and disagreements surrounding stablecoin yields and DeFi regulation are rapidly escalating, with the crypto industry, banking lobbying groups, and consumer protection organizations all fully involved.

The Senate will amend and vote on the bill on Thursday. The bill aims to clarify the regulatory boundaries between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), define the attributes of digital assets, and introduce new disclosure requirements.

Committee Chairman Tim Scott released the 278-page bill text on Monday, after which lawmakers from both parties submitted numerous amendments. Some proposals involve granting the Treasury Department the power to impose sanctions on "distributed application layers," while other amendments focus on stablecoin yields, which has become the biggest point of contention.

Coinbase CEO Brian Armstrong stated that his Stand With Crypto initiative will score Thursday's amendment vote, saying it will test whether senators "stand on the side of bank profits or on the side of consumer rewards." Industry insiders point out that while the bill still has momentum, its final outcome remains highly uncertain.

(Recommended reading: "The Biggest Variable in the Crypto Market: Can the CLARITY Bill Pass the Senate?" , "CLARITY Deliberations Suddenly Delayed: Why is There Such Significant Divide in the Industry?" )

The Hong Kong Securities and Futures Association stated that the Hong Kong government plans to announce the 2026/2027 Budget on February 25th, focusing on virtual assets and investor protection. Hong Kong has completed the initial regulatory infrastructure in the virtual asset sector, and the next focus should be on the commercial application. By improving liquidity in the RWA secondary market, accelerating product approval, introducing international liquidity, and strengthening practitioner training, Hong Kong can be upgraded from a clearly regulated market to a global virtual asset center with ample liquidity and widespread application, aligning with the national "15th Five-Year Plan" for financial opening and the digital economy strategy.

With stablecoins validating Product-Market Fit (PMF) in 2025, the crypto industry is pushing for the further development of "on-chain dollars," tokenizing assets such as stocks, ETFs, money market funds, and gold as tradable on-chain financial infrastructure modules. Several industry executives predict that the tokenized asset market will grow to approximately $400 billion by 2026.

Hashdex Chief Investment Officer Samir Kerbage stated that the current market size of tokenized assets is approximately $36 billion, and the next phase of growth will stem more from a structural reshaping of value transfer methods than from purely speculative demand. He pointed out that once stablecoins mature as "on-chain cash," funds will naturally flow to investable assets, becoming a bridge between digital currencies and digital capital markets.

The report points out that the scale of tokenized assets approached $20 billion in 2025, with traditional financial institutions such as BlackRock, JPMorgan Chase, and Bank of New York Mellon deeply involved. Tether CEO Paolo Ardoino believes that 2026 will be a crucial year for banks to move from pilot programs to actual deployment, especially in emerging markets, where tokenization can help issuers bypass the limitations of traditional infrastructure.

Furthermore, Centrifuge COO Jürgen Blumberg predicts that by the end of 2026, the total value locked in on-chain real-world assets (RWA) may exceed $100 billion, and more than half of the world's top 20 asset management institutions will launch tokenized products. Securitize CEO Carlos Domingo points out that natively tokenized stocks and ETFs will gradually replace synthetic asset models and become important high-quality collateral in DeFi.

In his address at the event, Hong Kong's Deputy Financial Secretary Michael Wong addressed the topic of digital and crypto assets. He stated that Hong Kong will further promote the development of stablecoins, but emphasized "stability first, then progress," preventing the inflow of illicit funds and ensuring the robustness of the financial system. Furthermore, Wong pointed out that Hong Kong is actively expanding its gold storage capacity, aiming to increase the total capacity to 2,000 tons within the next three years. A central gold clearing system is currently being established, with the Shanghai Gold Exchange invited to participate, and the system is targeted to be operational this year.

The Bank of Thailand is monitoring USDT "grey money" transactions.

The Bank of Thailand stated that, as part of its crackdown on so-called "grey money," it has discovered, within its monitoring framework, that a significant portion of stablecoin activity on local platforms is linked to foreign entities. Bank of Thailand Governor Vitai Ratanakorn stated that approximately 40% of USDT sellers operating on Thai platforms are foreigners, adding that "they shouldn't be trading in the country." Therefore, stablecoins, along with cash flows, gold trading, and e-wallet fund transfers, will be subject to stricter scrutiny.

According to local media reports, South Korean financial regulators are assessing whether to end the long-standing practice of crypto exchage partnering with only one bank. This review, coordinated by the Financial Services Commission (FSC) and the Fair Trade Commission, aims to evaluate whether the current mechanism exacerbates market concentration. The report notes that the "one exchange, one bank" model is not enshrined in law but rather gradually developed under anti-money laundering (AML) and customer due diligence requirements. Related research suggests that this model may restrict access to banking services for smaller exchanges, thereby consolidating the advantages of leading platforms.

This discussion is also related to South Korea's push for the second phase of legislation on the Basic Law on Digital Assets. The bill plans to allow the issuance of stablecoins in the Korean won, but disagreements remain regarding the regulatory framework and approval mechanism, and its submission has been postponed to 2026.

The Virtual Asset Regulatory Authority of Pakistan (PVARA) announced that it has signed a Memorandum of Understanding (MoU) with SC Financial Technologies LLC, an affiliate of the Trump family's crypto project World Liberty Financial (WLFI), to explore the use of the USD1 stablecoin for cross-border payments and digital settlements. The MoU focuses on technological cooperation, knowledge sharing, and regulatory dialogue, and does not constitute a binding agreement to deploy USD1 within Pakistan's financial system at this stage. Under the MoU's terms, SC Financial Technologies will collaborate with the Central Bank of Pakistan and relevant institutions to investigate how stablecoins such as USD1 can be integrated into the country's regulated payment ecosystem.

According to market sources, Coinbase has launched a custom stablecoin that allows businesses to issue digital dollars that are 1:1 backed.

Franklin Templeton transforms its money market fund into a stablecoin reserve instrument

Franklin Templeton announced the compatibility of its two institutional money market funds with blockchain finance, aiming to position them for the growing market of tokenized assets and regulated stablecoins. This update applies to the Western Asset Institutional Treasury Obligations Fund (LUIXX) and the Western Asset Institutional Treasury Reserves Fund (DIGXX), both managed by its subsidiary, Western Asset Management. Roger Bayston, Head of Digital Assets at Franklin Templeton, stated that traditional funds are already moving onto the blockchain, so the focus is on making them more accessible to a wider audience. The LUIXX fund has been modified to comply with the GENIUS Act, which sets reserve standards for regulated stablecoins. The fund currently holds only short-term U.S. Treasury securities with maturities of less than 93 days, which can be used as a stablecoin reserve instrument. The DIGXX fund has launched a digital institutional equity class designed specifically for distribution on blockchain platforms, allowing approved intermediaries to record and transfer ownership of fund shares on-chain.

Crypto bank Anchorage Digital is seeking to raise between $200 million and $400 million in preparation for a potential initial public offering (IPO). The company plans to IPO in 2026. As the first crypto bank to receive a federal charter in 2021, Anchorage Digital aims to become a leading stablecoin issuer following the passage of the GENIUS Act in July 2025.

Anchorage Digital CEO Nathan McCauley stated that the company plans to double the size of its stablecoin team within the next year. A company spokesperson said 2025 is its year of expansion, solidifying its leading position in the institutional crypto space through a series of acquisitions and partnerships, including a planned launch of the USAT token in the US with Tether. In addition, Anchorage Digital offers custody, trading, and staking services and expanded its business in December 2025 through the acquisition of Securitize For Advisors and integration with Hedgey. It completed a $350 million funding round led by KKR & Co. at the end of 2021, valuing the company at over $3 billion at the time.

Bank of America CEO: Interest-bearing stablecoins could lead to a $6 trillion loss in bank deposits.

Bank of America CEO Brian Moynihan stated during the quarterly earnings call that interest-bearing stablecoins could lead to a $6 trillion loss of deposits from the banking system and damage the creditworthiness of small and medium-sized enterprises (SMEs). Citing data from a U.S. Treasury report, Moynihan pointed out that stablecoins have a financial structure similar to money market mutual funds, with their reserves invested in low-risk securities such as short-term Treasury bonds rather than being converted into bank loans. He believes that the widespread adoption of interest-bearing stablecoins will force banks to turn to more expensive wholesale funding, thereby driving up overall borrowing costs. Currently, the U.S. Senate Banking Committee is discussing a draft cryptocurrency bill that proposes to prohibit idle stablecoins from generating interest.

Coinbase CEO Brian Armstrong announced on the X platform that Coinbase has officially withdrawn its support for the bill due to its inclusion of provisions restricting stablecoin rewards, substantially banning tokenized stocks, and limiting DeFi. Armstrong accused the amendments of aiming to eliminate competition for banks by removing stablecoin rewards. As a result, the Senate Banking Committee has postponed its vote, originally scheduled for January 15th.

Tang Bo, Assistant Dean of the Institute of Finance at the Hong Kong University of Science and Technology, stated that gold tokenization is becoming the most promising sector in real-world asset (RWA) tokenization. Gold's value as a safe-haven asset is returning, and tokenization technology will give this ancient asset entirely new financial attributes. Gold tokenization differs from traditional gold ETFs. Gold tokens are certificates with a 1:1 correspondence to physical gold; holders can directly withdraw physical gold from vaults, while ETFs are merely asset certificates. More importantly, gold tokens can generate interest on the blockchain, further revitalizing gold's financial attributes through collateralized lending and other methods.

Opinion: Passage of the crypto market structure bill would be a bullish catalyst.

Alex Thorn, head of research at Galaxy, posted on the X platform that the U.S. Senate Banking Committee will vote on the crypto market structure bill on January 15. The Senate majority is currently 53 to 47, and since a bill typically requires 60 votes to pass, Republicans still need to secure the support of 7 to 10 Democratic senators.

Alex Thorn stated that the bill addresses the classification of DeFi under anti-money laundering rules, the handling of stablecoin reserve yields, protection of non-custodial developers, and the SEC's authorization or restrictions on token issuance. If passed, the bill would be a major bullish catalyst for cryptocurrency adoption; if it fails, while its overall impact on the industry's fundamentals would be relatively small, it could lead to negative market sentiment.

Trending Projects

MSX (STONKS)

In short:

MSX is a community-driven DeFi platform focused on tokenizing and trading RWA (Retail Assets and Services) such as US stocks on the blockchain. Through a partnership with Fidelity, the platform achieves 1:1 physical custody and token issuance. Users can mint stock tokens such as AAPL.M and MSFT.M using stablecoins like USDC, USDT, and USD1, and trade them 24/7 on the Base blockchain. All trading, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks aims to bridge the gap between TradeFi and DeFi, providing users with a highly liquid, low-barrier-to-entry on-chain investment gateway to US stocks, building a "Nasdaq for the crypto world."

Latest news:

On January 13th, MSX (Maitong's trading platform) announced a change to its RWA spot trading fee structure, effective immediately. The new system changes from a two-way fee to a one-way fee. Specifically, the fee for buying remains at 0.3%, while the fee for selling is reduced to 0%. This means that users will experience a substantial 50% reduction in overall transaction costs when completing a full "buy + sell" trading cycle. This fee policy is now in effect across the entire MSX platform, covering all listed RWA spot trading pairs.

Previously, MSX published its 2025 year-end review article , "Anchoring the Window of the Times, Building a New Ecosystem for US Stocks on the Blockchain," reviewing the year's interim achievements.

Ondo Finance (ONDO)

In short:

Ondo Finance is a decentralized finance protocol focused on the tokenization of structured financial products and real-world assets. Its goal is to provide users with fixed-income products, such as tokenized US Treasury bonds or other financial instruments, through blockchain technology. Ondo Finance allows users to invest in low-risk, highly liquid assets while maintaining decentralized transparency and security. Its token, ONDO, is used for protocol governance and incentive mechanisms, and the platform also supports cross-chain operations to expand its application within the DeFi ecosystem.

Previous updates:

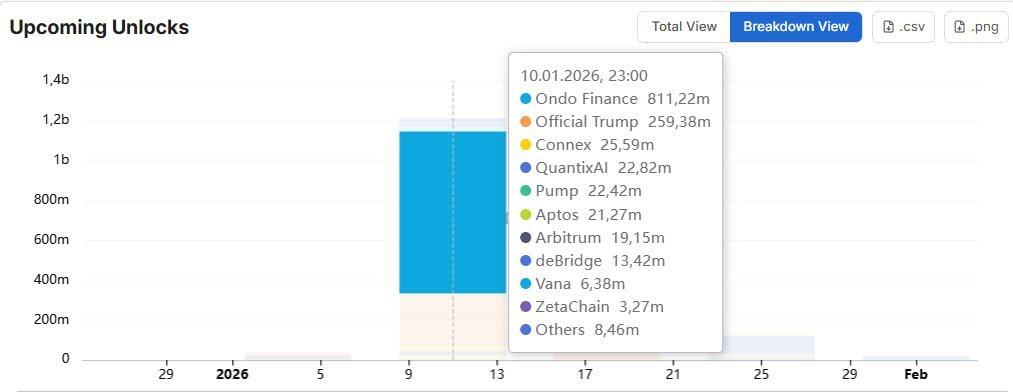

According to onchainschool.pro , more than $1 billion worth of tokens are expected to be unlocked next week, including tokens from several well-known projects such as ONDO, TRUMP, PUMP, and APTOS.

Previously, Ondo Finance announced on the X platform that its tokenized stock and ETF platform will be launched on the Solana blockchain in early 2026, aiming to bring Wall Street liquidity to the internet capital market.

Related Links

RWA Weekly Series

We've compiled the latest insights and market data for the RWA sector.

As large investors become more serious, RWA's liquidity problems become apparent.

Using real data to point out where asset tokenization truly fails: the market structure that supports the operation of these assets has never been truly established.

Why ENA is Becoming a Core Component of On-Chain Synthetic Dollars

This article will explore the mechanisms behind Ethena, its synthetic dollar USDe, and why ENA tokens are becoming a fundamental element of the on-chain economy. It will also explain how the Ethena system operates, its key relationship to the RWA narrative, and the opportunities and risks it presents.