Noble, Cosmos' most successful stablecoin project and the native USDC issuing chain, is saying "goodbye" to the Cosmos SDK—is the Cosmos ecosystem really going to die?

Written by: Sanqing, Foresight News

On January 20th, Noble, a Cosmos application chain focused on stablecoins, announced its migration from the Cosmos ecosystem to the independent EVM L1 network. The Noble EVM is scheduled to launch on March 18th, and the team will continue to support Cosmos-based blockchains in the short term. After the migration, Noble's own USDN stablecoin will become a core feature of EVM L1, while the NOBLE token will serve as a governance asset, closely linking protocol decisions and value to stablecoin usage across the network.

Image source: Noble tweet

Subsequently, the founder of Cosmos responded , stating that Noble's transformation is not a departure from Cosmos' vision, but rather a reflection of the core principles of "sovereignty and interoperability." Noble's migration does not mean a disconnect from the Cosmos Hub. On the contrary, through the IBC v2 protocol, the migrated Noble EVM will become a key bridge connecting the EVM ecosystem and the Cosmos economy. He stated, "We are entering an era no longer defined by chains, but centered on liquidity."

Why did Cosmos, the kingpin of stablecoins, choose to leave?

Noble is one of the most successful stablecoin infrastructure projects in the Cosmos ecosystem. It natively issues USDC from Circle to the Cosmos ecosystem chains, distributing USDC securely and frictionlessly across 50+ chains via IBC, and has processed over $22 billion in transactions to date.

The existence of Noble gives the Cosmos ecosystem the competitiveness of a "native stablecoin" and avoids the trust risks of relying on external bridges.

But why is Noble migrating? The official reason given by Noble is quite practical:

The EVM ecosystem holds an absolute dominant position. Over 75% of the stablecoin market is on the EVM chain. Developers, tools, wallets, and dApps are all concentrated on the EVM. Noble wants to build "L1 stablecoin infrastructure," so naturally, it needs to follow the money and people.

The EVM technology stack is more developer-friendly. EVM has mature tool stacks such as Solidity, Remix, and Hardhat, and it's easier to integrate with protocols like Uniswap and Aave. While the Cosmos SDK is powerful, it has a steep learning curve and its ecosystem of tools is relatively underdeveloped.

EVM offers better performance and real-world use cases. Noble EVM prioritizes sub-second latency and is designed for scenarios such as payments, embedded finance, academia commerce, and FX. While Cosmos' Tendermint consensus is reliable, the EVM stack is better suited to mainstream payment chains.

Noble has its own strategic ambitions. Noble doesn't want to be just a "tool" in Cosmos, but rather wants to become an independent, high-performance stablecoin Layer 1, directly competing with other stablecoin public chain projects.

So Noble voted with its feet. Cosmos gave it the initial groundwork, but EVM gave it a future of scaling.

Noble's departure took away half of Cosmos's life.

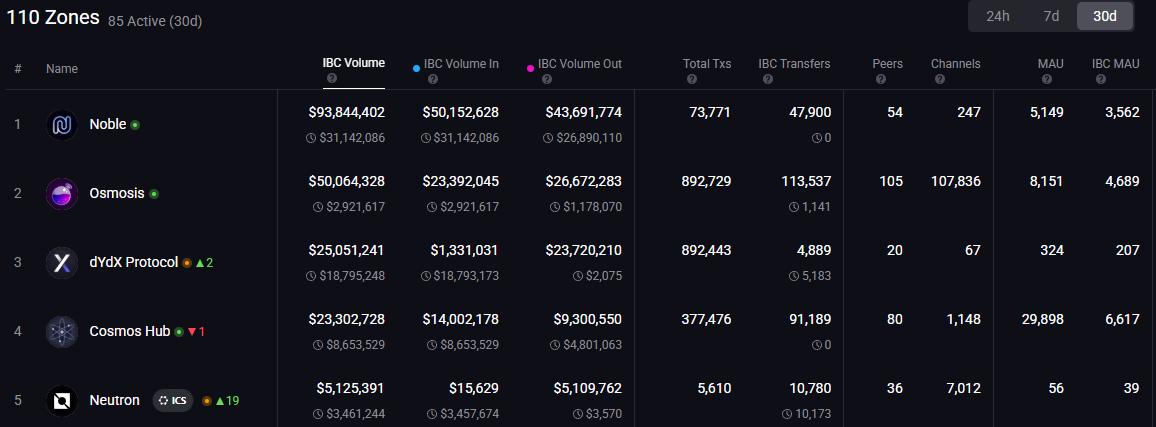

Noble is Cosmos's only "superstar." Noble's 30-day IBC trading volume reached a staggering $93.84 million, 1.8 times that of the second-ranked Osmosis ($50.06 million). Among the 110 zones linked to Cosmos IBC, Noble contributes a significant level of liquidity.

Image source: MAP OF ZONES

Noble acts as a "faucet" for institutional funds. Osmosis has nearly 900,000 transactions, while Noble has only 73,000. This means that the value of a single transaction on Noble is far higher than on other chains. It doesn't handle small-scale exchanges for retail investors, but rather institutional-grade stablecoin settlements and large-scale distributions.

Although IBC connects 110 Zones, only 85 are active. This means that 23% of the chains are essentially defunct. Liquidity is highly concentrated in the top four chains, while projects ranked outside the top ten have seen their monthly transaction volume shrink to the millions of dollars, indicating that the retail vitality of the ecosystem has been severely depleted.

Cosmos Hub boasts approximately 30,000 monthly active users, six times more than Noble (around 5,000). However, the money is actually flowing to Noble. While most Cosmos users stake or remain on the Hub, the actual stablecoin activity that generates value exchange is almost entirely concentrated on Noble.

The soul of the Cosmos ecosystem: How does IBC enable the "blockchain internet" to function?

Cosmos' core narrative is "Internet of Blockchains," and the IBC (Inter-Blockchain Communication Protocol) is what enables this vision.

IBC is Cosmos's most unique and successful invention. It allows independent sovereign blockchains to communicate and transfer funds securely and without the need for trusted third parties, much like TCP/IP on the internet. Its core features include:

Minimal trust: Verify the state of the other party's chain through a light client, without the need for escrow assets or multisignature bridges.

Permissionless Interconnection: Anyone can create channels to support token transfers, interchain accounts, interchain queries, and more.

Universality: Not limited to consensus mechanism, it has been connected to 110+ chains (Map of Zones data), and has even been extended to non-Cosmos chains such as Ethereum and Optimism.

IBC boasts high security, has never been exploited on a large scale, and has facilitated the transfer of hundreds of billions of dollars. Even with controversies surrounding other parts of Cosmos, IBC itself remains a leading interoperability solution in the industry.

However, Noble's migration also exposed IBC's predicament: it interconnected the world, but couldn't retain projects—in the end, everyone wanted to dominate the EVM single chain.

The exodus is confirmed: Which Cosmos projects have died or migrated by 2025-2026?

From 2025 to early 2026, the Cosmos ecosystem experienced a severe wave of project exodus/closures.

Let's start with those projects that have completely shut down or ceased operations. Most of them were already dead by 2025, leaving only the community's regret and sporadic attempts at maintenance.

The privacy blockchain Penumbra shut down completely, with the team leaving. Although the chain was barely kept afloat by a community, it was essentially ignored, becoming a prime example of a "completely dead" blockchain. Pryzm also shut down entirely, and Comdex and Kujira collapsed one after another. The latter even took away sub-projects such as Fusion and Levana, causing the entire DeFi ecosystem to break down.

Stride officially went offline and ceased operations; Quasar and Tower subsequently died out; Picasso/Composable crashed, trapping SOL assets brought in via bridge, leaving users with nothing. Drop abandoned TGE and went offline, Milkyway shut down, Demex failed to recover after the hacking incident, and Evmos was essentially dead.

These projects cover multiple sectors such as DEX, lending, privacy, and NFT, mostly due to sluggish growth, insufficient revenue, team turnover, and the long-term aftershocks of Terra's collapse.

Meanwhile, some projects have chosen to migrate to non-Cosmos stacks, which could be seen as a major backstab to the Cosmos narrative. Besides Noble, Sei also previously decided to abandon its dual-stack architecture during the SIP-3 upgrade, planning to retain only the EVM chain until mid-2026.

Akash is migrating to Solana, while projects such as Elys, pStake, Jackal, and Omniflix are migrating to Base. Stargaze has become an independent chain and plans to migrate to Cosmos Hub. Shade Protocol (renamed Feather) has first migrated to Sei and may further become EVM-based in the future.

The core motivations behind these migrations are almost identical: the EVM ecosystem offers far superior developer tools, liquidity, and market size compared to Cosmos, leading projects to vote with their feet and choose to follow the funding and opportunities.

Another batch of projects, while not dead, have entered maintenance mode or resource redirection, resulting in slow progress.

Osmosis has entered maintenance mode. Although it is still maintaining token economics and other updates, team resources have clearly shifted elsewhere, resulting in a significant drop in activity. Astroport is similar, essentially at a standstill. After the Axelar team was acquired by Circle, the original project's influence has sharply diminished. These projects were once the backbone of Cosmos DeFi, but now they have become a microcosm of the ecosystem's decline.

Mantra has undergone restructuring (layoffs and cost optimization in January 2026) and the collapse of the OM token (a drop of nearly 99%), but the project is still progressing. The ERC-20 OM migration is underway, and features such as RWA vaults and launchpad are under development. IBC-compatible RWA EVM L1 will continue to operate.

Furthermore, numerous DEXs such as Wynd, Hopers, Junoswap, Loop, and TerraSwap shut down in 2024-2025. Retail DeFi essentially died out, with only institutions and RWA holding on.

Map of Zones shows that IBC connects to 110 chains, but IBC traffic is highly concentrated in the top few (Noble, Osmosis, Cosmos Hub). Once Noble's liquidity migrates away, the activity level of the entire ecosystem will be further reduced.

Despite the Cosmos 2026 roadmap's attempt to reverse the decline through EVM compatibility and high-performance upgrades, Noble's "departure" undoubtedly reveals a harsh reality: in the face of liquidity, technological narratives often appear pale and powerless.