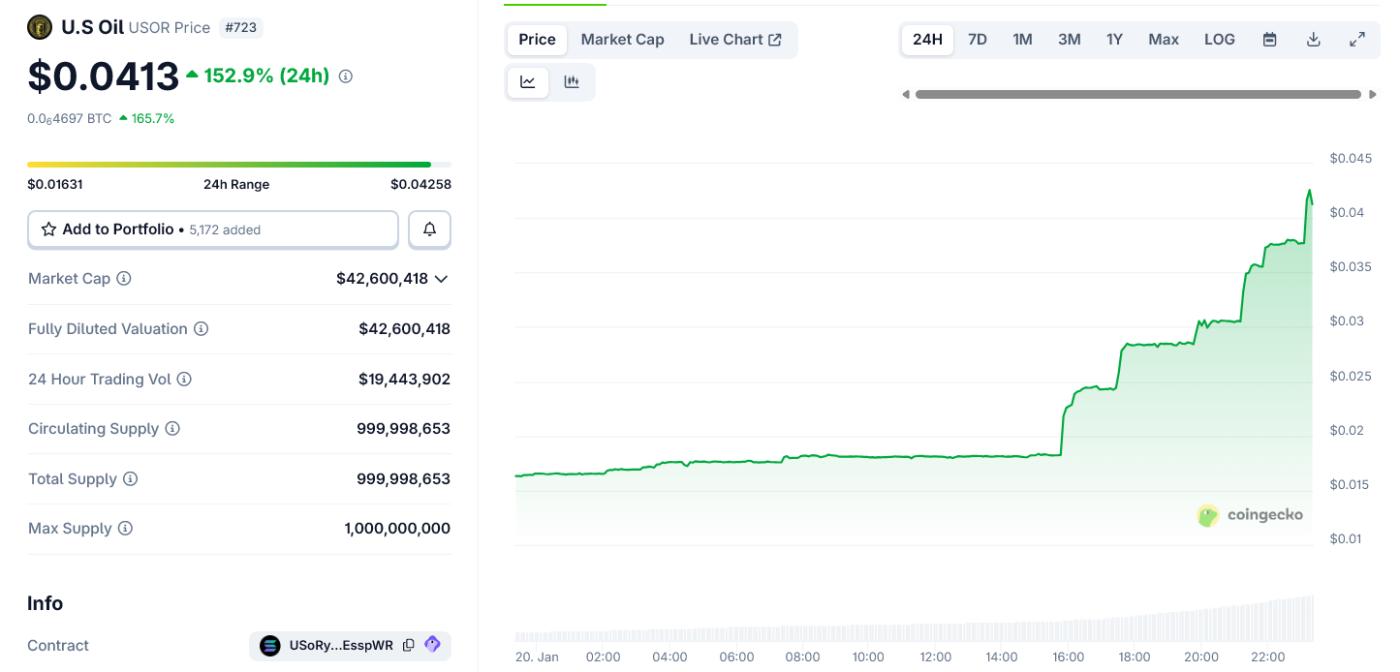

A little-known Token on Solana called “US Oil” (USOR) surged more than 150% in just 24 hours on Monday, pushing Token market Capital up by over $40 million in a short period, as traders capitalized on recent news of the US selling off Venezuelan oil shipments.

This Token has become trending on CoinGecko, although on-chain analysts and traders warn that this surge shows signs of a speculative pump.

Geopolitics becomes a tradable meme .

The rise in USOR prices coincides with increased international attention to the oil market. According to reports, Washington began selling seized oil assets from Venezuela today.

This wave of news appears to have spilled over into the crypto market, with traders quickly associating USOR with a political narrative, even though the Token has absolutely no verifiable link to the U.S. government's oil reserves.

At the peak of the rally, USOR traded above $0.04, with daily volume nearing $20 million.

USOR increased by 150% on January 20th. Source: CoinGecko

USOR increased by 150% on January 20th. Source: CoinGeckoThe price fluctuations of USOR are almost vertical, a pattern that many traders XEM unusual.

The USOR market is primarily centered within the Solana ecosystem, via decentralized exchanges such as Meteora. Many platforms display “anomaly chart” alerts when both volume and price surge.

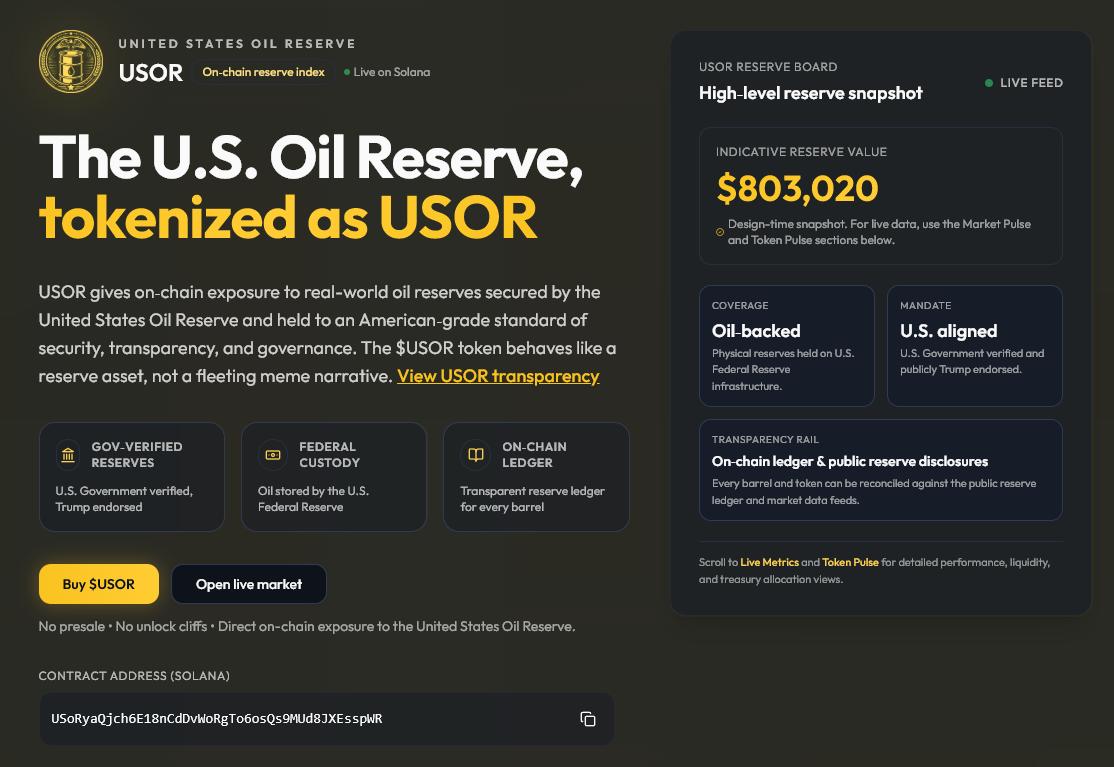

The project's website states that USOR represents an " on-chain reserve index," Tokenize U.S. oil reserves, presenting itself as oil-backed, U.S.-oriented, and operating transparently and publicly.

The project claims to Tokenize US oil reserves but this has not been verified.

The project claims to Tokenize US oil reserves but this has not been verified.However, the project's website provides no credible evidence of custody, legal structure, or formal connection to the U.S. oil storage infrastructure.

Additionally, there is much speculation that this Token may be linked to insiders, as it was released on the same platform as the TRUMP meme coin – Meteora .

The spread of the graph, the evidence is weak, and the warning signs are increasing.

Meanwhile, the crypto community on Twitter has had strongly mixed reactions.

Some traders have suggested that the narrative surrounding this Token is fabricated to capitalize on factual news, pointing to signs such as excessive promotion, clustered wallets, and a lack of natural accumulation.

Others warn that the Token 's branding closely follows geopolitical developments to create a "Rug Pull."

A widely Chia post claimed that USOR provides “ on-chain access to oil reserves from Venezuela,” however, there has been no confirmation from the US government or energy agencies to date.

Many analysts also noted that the timing of its release, branding strategy, and chart pattern of USOR resembled meme coins that capitalized on political news – surging sharply then collapsing just as quickly.

on-chain data Chia by independent watchdog organizations shows that the majority of the Token supply is concentrated in a small group of wallets.

The "bubble map" charts circulating on X also show many large holder connected to each other, raising concerns about centralized control and the risk of becoming a liquid liquidation for later buyers.

Overall, USOR is another example of how macroeconomic and political news can spread quickly to the crypto speculator community.

As the US is readjusting its strategy regarding Venezuelan oil, a segment of the crypto market has capitalized on these narratives – much of which lacks clear evidence.

It's impossible to say whether USOR will be just a short-lived meme trend or will last a long time. What's certain is that investors are still flocking to trade based on the "story," despite growing warnings about the story's authenticity.