Bitcoin is currently defined by the market as a risk asset, not a safe-haven asset at all. Therefore, while gold has surged in recent days, Bitcoin has been falling continuously. It is currently hovering around 88,000, indicating the end of this rebound. Further declines are expected, likely due to unexpected negative macroeconomic news, as it searches for key support levels.

BTC

BTC rebounded slightly, but the rebound was weak. We can consider going long again with a small stop loss after a second test of the 88,000 level. The larger timeframe has broken down again, and the smaller timeframe shows a dense bearish structure. Be aware of an initial drop . In the next few days, focus on placing orders at the price level after another significant downward move on the larger timeframe.

Short-term resistance lies in the 90180-90883 range (mainly observe whether this area will form the high point of subsequent daily consolidation). For smaller timeframes, the main selling pressure area is 90883-91490 (potential support/resistance, not for speculation).

Short-term support is at 85630~83980 (monitor the market and trade quickly). Place orders in the area of the previous low of 81520 and the main force control line of 77530~75180 as needed, and do not withdraw them.

ETH

Ethereum (ETH) has transitioned from a pattern of "rebound → strong rebound → betting on a reversal" to a downtrend characterized by "EMA turning downwards → respecting overbought signals → continuously decreasing highs and lows." In this state, any judgments based on medium-term holding, buying on long, or the effectiveness of moving average support are no longer valid. Only two viable strategies remain:

1. The contract rebounded to structural resistance and overbought signals, so continue to short.

Second, we should remain completely on the sidelines in the spot market and wait for a new structure to emerge. We should discuss the trend only after the EMA (Effective Moving Average) has converged and leveled off again.

The resistance levels to watch are 3020, 3070, and 3120. Consider shorting around these levels, with targets at 2970, 2920, and 2870.

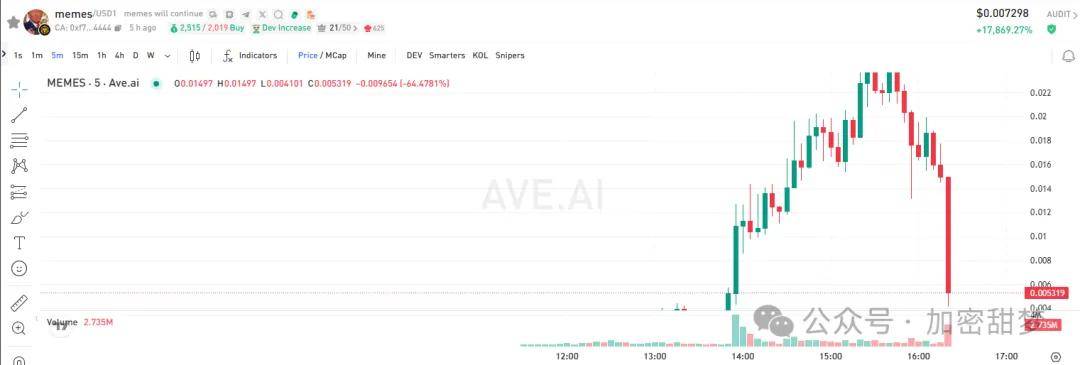

memes

A stock with overflowing sentiment, featuring a few leading stocks, White House news highlights, and sentiment overflowing from the departure of the two leaders, is most likely to be bought at around 500k. If it holds, it indicates that the narrative is accepted by the market.

Scanning the chain reveals the market; even with less than 100k, you can buy some lottery tickets. Watch the monitoring for jumps in popularity and high trading volume; immediately check the news on [website name] to see if there are any leading figures/KOLs (Key Opinion Leaders) involved. If so, invest directly.

MR. TARIFF

The White House angle and Trump's portrait could be used to buy Mr. Tariff's lottery ticket. Previously, SOL was speculated to be worth 6 million, and now Memes is also exploding in BSC. This may attract attention.

GWEI

The company has raised a total of 12 million in two rounds of financing, with a cost of approximately 0.0044 USDT and a FDV of 44 million. It is expected to be listed on ALPHA at 8 PM, with a pre-market price of 0.015 USDT, corresponding to a circulating market capitalization of 19 million and a FDV of 150 million. * Pool price of 0.01 USDT corresponds to a circulating market capitalization of 13 million and a FDV of 100 million.

Strong market control; community airdrops are traceable, but they'll be locked for a month before release. The tokens are almost entirely comprised of those from Beta's Alpha offering. Keep an eye on the opening price. The actual circulating supply shown on Bitget isn't always accurate; we'll confirm later if the project is simultaneously listed on CMC.

There is an airdrop in the community, but it is locked for 30 days. That is to say, only the ALPHA airdrop will cause a price drop at the opening. The rest are in the hands of the project team. The amount of financing is quite large, and the investment institutions are also top-notch. As long as the price can be stabilized, it should not be a problem to reach the next contract position. The market value of the project team's pool is quite reasonable, so I am preparing to find an opportunity to take over.

The market is constantly changing, so entry and exit points should be determined based on real-time conditions. Follow the trend after a breakout! No matter how confident you are, please strictly adhere to your stop-loss and take-profit strategies! That's all for today! Follow me so you don't get lost!

Every market crash is followed by a golden opportunity. Those unsure about future market strategies can follow Sweet Dream (or add WeChat: RFGH8689).