Selected News Highlights

1. Memes rebounded more than 160% in 2 hours, with its market value recovering to $13.69 million.

5. No Backpack airdrop but a separate token release? Mad Lads officially announces snapshot complete.

Featured Articles

In today's stock market boom dominated by quantitative trading, most people believe these cold, algorithmic robots are ruthless harvesters on Wall Street, relentlessly extracting the hard-earned money of retail investors due to emotional misjudgments or information asymmetry at millisecond speeds. However, in the past 48 hours, in an emerging market, the near-perfect profit curves of several top quantitative robots collectively collapsed, while a mysterious account named a4385 raked in a staggering $280,000. This market is called the prediction market, and it was here that a trader named a4385 showcased a meticulously planned hunt against quantitative robots to the world.

Over the past 24 hours, discussions in the crypto market have expanded from macro-level narratives to specific ecosystem events, with concentrated yet clearly divergent focus. Mainstream topics centered on the surge in participation brought about by airdrops and DeFi governance upgrades, while the WLFI governance controversy and the Trove debacle heightened market concerns about transparency and fund security. In terms of ecosystem development, Ethereum strengthened its institutional narrative and stablecoin aspirations, while the Perp DEX sector accelerated competition around incentive mechanisms and fee reduction optimizations, further intensifying the battle for on-chain liquidity.

On-chain data

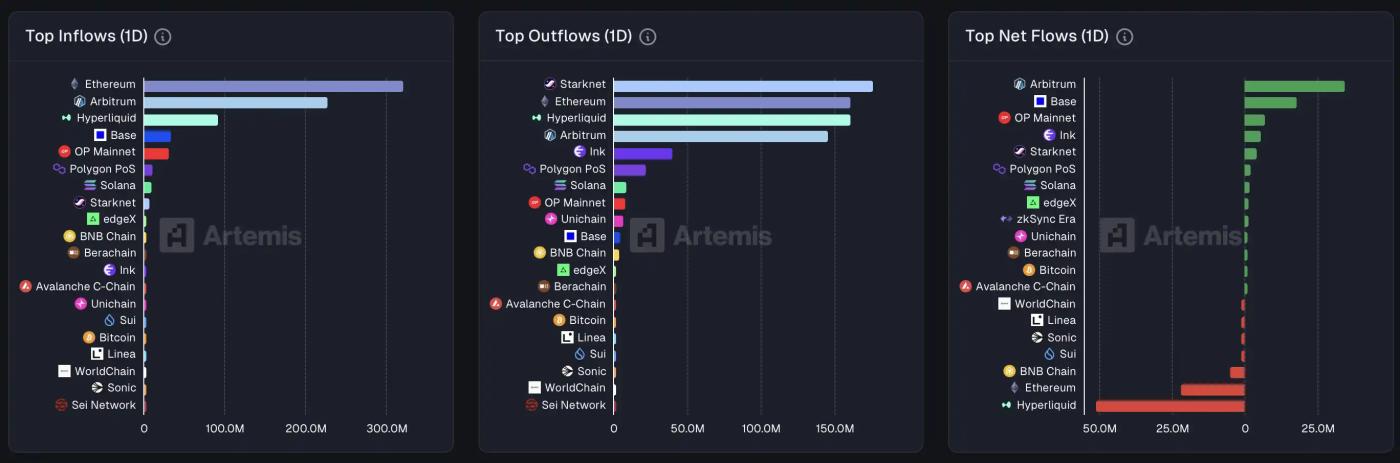

On-chain fund flows last week, January 21