Based on the "Stablecoin Toolkit" report released in January 2026 by the Blockchain and Digital Assets Project (BDAP) of the Wharton School, this article provides an in-depth analysis of the stablecoin market, which has become the central nervous system of digital finance, in three parts. [Editor's Note]

◇ "Surpassing Visa's transaction volume"...explosive growth trend

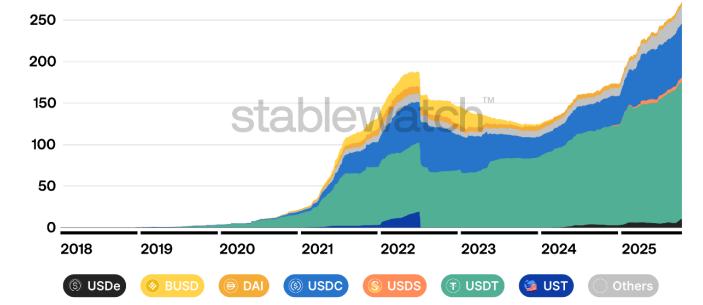

As of January 2026, stablecoins have become an essential element of the digital asset world, playing a bridging role with the traditional financial system. A Wharton BDAP report indicates that the total asset size of the stablecoin market has exceeded $200 billion, a figure that transcends mere market capitalization growth.

The growth in transaction volume is particularly noteworthy. According to Visa's on-chain analytics data, as of June 2025, the total transaction volume of stablecoins reached $34.7 trillion in the past 12 months. This is more than double Visa's annual traditional payment processing volume. Even excluding bot transactions or automated program transactions, the adjusted transaction volume still reaches approximately $7.3 trillion, demonstrating that stablecoins play a real role in economic activity.

Of course, its size is still small compared to traditional money supply such as M1 or bank deposits, but major stablecoins like USDT and USDC maintained their peg to fiat currencies during macroeconomic turmoil such as the US banking crisis in 2023, which became an opportunity to boost market confidence.

◇ Redefinition: Different from CBDC

The previously vague definition of stablecoins has become clearer. The report defines stablecoins as "a publicly available, non-centrally issued digital asset designed to achieve a stable unit of account through economic mechanisms."

This is fundamentally different from central bank digital currencies (CBDCs), which are direct liabilities of the central bank, or deposit tokens based on the fractional-reserve banking system. Stablecoins occupy a position similar to "commercial bank money," not directly subject to the central bank's monetary policy decisions, while providing users with the same functions as central bank money.

◇ Formal entry of institutions and clarification of regulations

Starting in 2024 and 2025, the stablecoin market entered a "regulated" phase. The EU's MiCA regulation began implementation in mid-2024, while the US passed the GENIUS Act in July 2025, establishing a federal-level regulatory framework.

This legal clarity has catalyzed the influx of traditional financial institutions into the stablecoin market. The report cites examples such as Standard Chartered's joint venture to issue a Hong Kong dollar stablecoin and BlackRock's partnership with Circle to manage reserves, pointing out that the boundaries between traditional finance and digital assets are being blurred.

According to a 2025 survey by Fireblocks, 90% of financial institution executives said they were exploring or had already introduced stablecoins. This indicates that stablecoins are no longer the exclusive domain of "crypto-native" companies. Today, stablecoins are transcending the limitations of existing traditional market infrastructure and moving towards becoming a global currency that enables borderless finance.