I've figured out Trump's tactics: first, he creates negative news out of thin air, then he creates positive news through tacos, thus completing a perfect harvest.

Yesterday at the Davos Forum, Trump said he would not use force against Greenland or impose tariffs on Europe because of Greenland, and the market immediately rebounded.

Bitcoin has returned to around 90,000, but it is still unstable on the 4-hour chart. Unless it can firmly establish itself above 96,000, there is little hope for a short-term rally. It would be good if it didn't make a new low.

BTC

From a daily chart perspective, BTC broke below the support level with increased volume. Yesterday's volume pattern showed bullish support, while the MACD indicator showed weakening bearish momentum, but overall bearish forces remain strong. A short position can be opened near the support level on a rebound.

On the 1-hour chart, buy on a pullback to 88,000, add to the long at 87,000, stop loss at 865,000, target around 92,000.

On the weekly chart, the candlestick pattern shows a bearish engulfing pattern, indicating strong bearish momentum. The overall trend remains downward, so the strategy is to short on rallies. As long as the price hasn't broken below 87,000, buying on pullbacks is also an long.

ETH

ETH shows signs of bottoming out on a minor scale. After a period of short-term consolidation to repair the indicators, it is expected to rebound, so we are preparing to go long.

The ETH chart shows a sustained decrease in bearish volume, indicating a low probability of breaking below the short-term low. Furthermore, the overnight price spike followed by a recovery suggests ample buy the dips interest, which can be interpreted as a bottoming signal.

The rebound on the 1-hour chart is weak, and another downward move is expected. This can be interpreted as a minor double bottom test, with the target price expected to be in the 2930-2900 range. The plan is to buy in this range, with the stop-loss based on the low of the recent candlestick pattern. If the prediction is correct, there should be a profit of around 200-300 points.

SENT

Alpha at 6 PM, spot at 8 PM. I plan to observe the price at 6 PM to see if it can drop by 20 points. If it does, I will buy. There is no selling pressure in the spot market. I didn't pay attention to the short-selling. The best position is 10. It's currently at 21. If I'm aggressive, I would buy at 15.

FIGHT

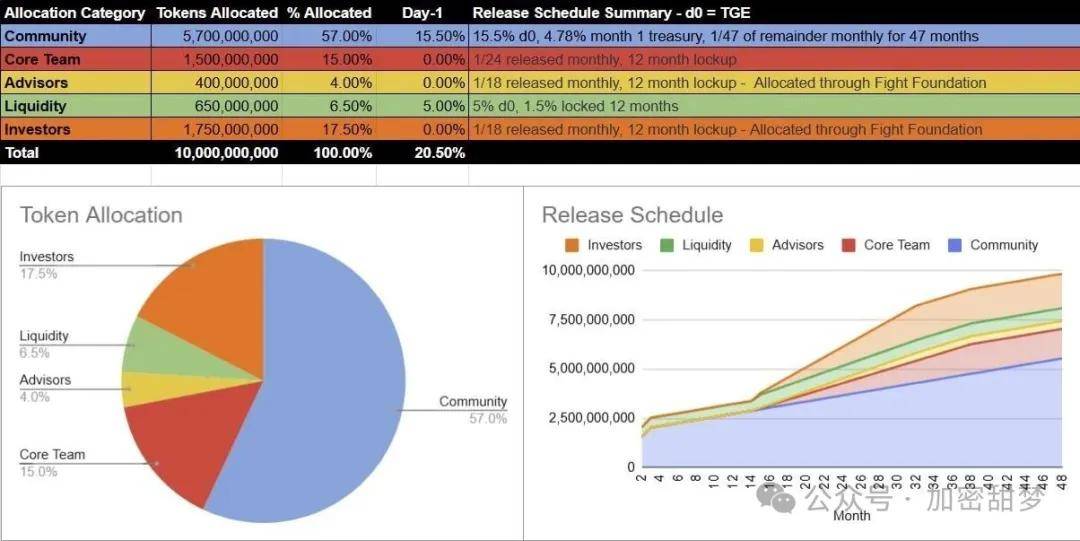

Total token supply: 10 billion; Initial circulating supply: 2.05 billion; Pool price: 0.02U, corresponding to a circulating market capitalization of 41 million and an FDV of 200 million; Pre-market price: 0.025U, corresponding to a circulating market capitalization of 51 million and an FDV of 250 million.

Positive factors: 1. It's a UFC partner; 2. The project has extremely high popularity; 3. The pre-market price has already fallen below the initial offering price; 4. It was previously associated with CZ (China's CEO); 5. The pre-sale oversubscription was very large, and pre-sale enthusiasm was very high; 6. It's listed on Coinbase, indicating good project compliance.

Negative factors: 1. The pre-sale token amount was very high; 2. Institutional round financing was not disclosed; 3. The tokens were relatively dispersed.

The company has a strong background and a decent pre-market capitalization, but the pre-sale cost price was only 0.015 USDT, corresponding to a circulating market capitalization of 30 million USDT, so it's not too bad. Unfortunately, there's no information on institutional financing for reference.

CHZ, SANTOS

There's not much to speculate on right now. Focus more on the World Cup. A pullback in Fancoin is definitely an opportunity. No matter what the overall market does each year, Fancoin will always have its own independent trend. It's about time to buy in batches for spot trading.

From a liquidity and market consensus perspective, I still recommend the leading coin $CHZ and Binance-backed $SANTOS. Other fan coins are also worth considering, but they're really just for fun. Looking at the trading volume of fan coins, you can tell that there's still very little interest; they're still in the accumulation phase. Buying them is met with indifference, while selling them is met with great enthusiasm.

Market conditions change rapidly; entry and exit points should be determined based on real-time market conditions. Follow the trend after a breakout! Regardless of your confidence level, strictly adhere to stop-loss and take-profit strategies! That's all for today! Follow me to stay on track! If you're unsure about future market strategies, follow Sweet Dream on WeChat: RFGH8689