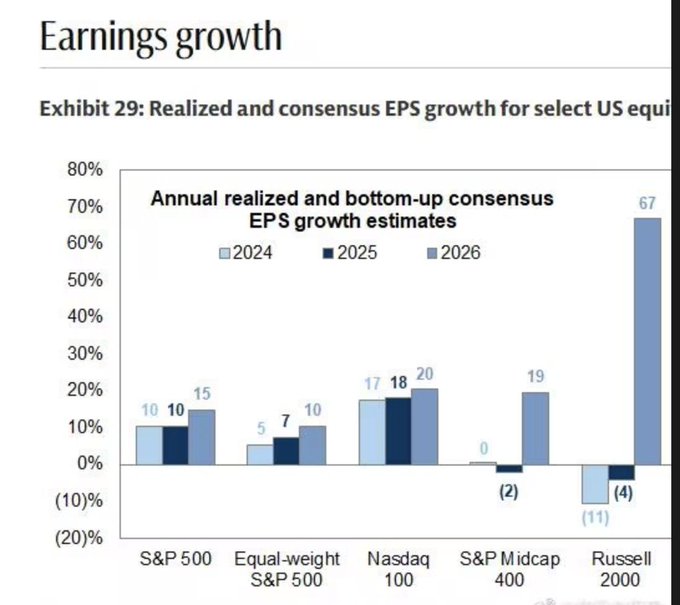

Russell 2000 EPS growth forecast of 67% is a bit exaggerated, but I am indeed more optimistic about the Russell 2000. Any growth stemming from EPS is genuine growth. It's secondary factors like liquidity and interest rate cuts that warrant caution. The structural opportunities brought by the new technology wave are everywhere. Claude's evolutionary pace will continue to accelerate, the marginal cost of software development will approach zero, and the monopoly of large companies will be severely challenged, giving numerous startups opportunities. At the same time, we should see three or four companies fall behind in the MEGA 7 this year, their gross margins being swallowed up by energy and electricity. The infrastructure dividends enjoyed by internet giants for over a decade will be gone forever. Who would have thought that one day the balance sheets of these giants would show electricity and mineral depreciation? A deeper restructuring is still ongoing. There is no such thing as an "old Deng" asset, only an "old Deng" that is out of step with the times.

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content