Original article by Odaily Odaily( @OdailyChina )

Author|Wenser ( @wenser2010 )

On January 20, 2026, Trump will mark the first anniversary of his inauguration as the 47th President of the United States. Over the past year, from the crypto market to the global economy, volatility and ups and downs have often seemed to hinge on him alone—a single word can ignite market optimism and drive asset prices soaring; a single word can also become the trigger for a crash, unleashing a chain of "liquidation bombs."

Today, he is known by many as the "crypto president." So, what key actions did Trump take this year to not only defend this title but also gradually solidify it? Looking back, perhaps the following five major events can reveal the answer.

Major Event 1: Unprecedented, the President Issues Meme Coins

On January 18, 2025, Beijing time, on the eve of his presidential inauguration, Trump's official Meme coin, Trump, was officially launched. Within just one day, the price of Trump rapidly rose from $0.5 to around $28, allowing a large number of cryptocurrency traders to earn unimaginable wealth, with some earning profits of millions or even tens of millions of dollars.

As the "eye of the storm," Trump's net worth skyrocketed—due to the launch of the Trump token, his net worth surged by over 400% overnight, reaching a staggering $28 billion . In comparison, Forbes estimated Trump's net worth at only $5.6 billion in November 2024. Furthermore, in less than three days, the market capitalization of the Trump token FDV surged to nearly $80 billion, with its price approaching $80.

After the "Meme Coin Craze" of 2024, the crypto market welcomed the heavyweight political figure of the "US President," which once again raised the "ceiling of influence" of cryptocurrencies, with countless people pinning their hopes of getting rich overnight on Trump and the Trump token.

After all, "the US president issuing Meme coin" is unprecedented in the cryptocurrency industry, truly a groundbreaking event.

But behind the overnight riches lies a ruthless harvest – the countless people's pursuit of "President Meme Coin" can only slow down its decline, but cannot help it continue to rise.

On January 23, most Trump token holders were still breaking even or making a profit/loss of less than $1,000 ; however, by early February, as Trump trading activity waned and prices plummeted, the number of wallet addresses with losses reached a staggering 200,000 .

According to Chainalysis statistics, approximately 810,000 wallets have lost money on Trump tokens, totaling over $2 billion, averaging $2,500 per person. In contrast, as of May 2025, the issuers of Trump tokens (Fight Fight Fight LLC and CIC Digital) have earned over $320 million from transaction fees alone ; not to mention the tens of billions of dollars worth of Trump tokens they control.

The emergence of Trump can be described as an expensive and costly "elective course in cryptography," and its subsequent impact extends far beyond token price performance:

Firstly, after Trump, the market's enthusiasm for celebrity-endorsed coins was reignited. Countless people rushed to buy MELANIA, the Meme coin with the same name as First Lady Trump, and LIBRA, the Meme coin endorsed by Argentine President Milley. Even the President of the Central African Republic wanted to get a piece of the pie, but in the end, they all ended up with liquidity being exploited.

Secondly, Trump became "ironclad evidence of Trump's corruption" in the eyes of Democrats. This accusation was elaborated in a report in the second half of 2025 , and it also marked the beginning of Trump's demonstration of a "crypto-friendly regulatory attitude," and the dispute between the two sides over this issue continues to this day.

Third, the Trump token became the "best medium" for Trump to engage with people in the cryptocurrency industry. On the one hand, Trump used it to convey his "pro-cryptocurrency political stance" to the outside world; on the other hand, Trump became the "currency carrier" for Trump to conduct in-depth exchanges with people in the cryptocurrency industry.

In April 2025, registration officially opened for the "Trump Dinner," a contest open to the top 220 Trump holders. Within days, this triggered $2.4 billion in on-chain transactions , causing Trump's price to surge by 60% and on-chain activity to skyrocket by 200%. Many people were willing to spend millions of dollars just to meet Trump. Ultimately, Trump Meme coin buyers invested approximately $148 million in the holding competition, averaging nearly $4.8 million in Trump per person . Justin Sun ranked first with over 1.43 million tokens .

On one hand, there are retail investors in the market who are paying for the "Presidential Concept Meme Coin"; on the other hand, there is a "crypto dinner" with clinking glasses and toasts, which can be described as a "crypto version of the rich feasting and rotten meat" Trump dinner, revealing the most cruel and extremely real face of life in the crypto market - some are happy and some are sad, only the big players are laughing.

Major event two: "A new broom sweeps clean"—layoffs, hiring, and eliminating dissidents.

On January 21, 2025, Beijing time, Trump was officially sworn in as the 47th President of the United States, becoming the third person to be elected President of the United States twice, following Washington, Roosevelt, and Obama.

What followed was naturally the political drama of "a new emperor, a new court." Having the experience of the previous US president, Trump was quite adept at personnel appointments.

The first step was to "make an example of someone." As Trump said at the Bitcoin conference, on his first day in office, he swiftly fired Gary Gensler, the former chairman of the U.S. Securities and Exchange Commission (SEC) who had previously implemented strict crypto regulations, thus solidifying his strong "pro-cryptocurrency" persona.

The second step was to "plant trusted confidants." Within just three months, Trump quickly assembled his personnel team and placed individuals who shared his political views, owned cryptocurrency assets, or held crypto-friendly attitudes into various key government departments. These included White House AI and crypto advisor David Sacks, SEC Chairman Paul Atkins, Treasury Secretary Scott Bessent, and Commerce Secretary Howard Lutnick.

The third step is "a protracted struggle." As the Federal Reserve Chairman appointed by Trump, Powell has long been considered the "backbone of Fed policy," but his hawkish fiscal strategy runs counter to Trump's desire to release liquidity and stimulate economic growth through interest rate cuts. Therefore, the dispute between the two will continue throughout 2025—starting in April 2025, Trump has frequently criticized Powell for needing to cut interest rates sooner ; and by December 2025, the nomination of the new Fed Chairman will remain a major focus affecting the cryptocurrency market and even the US economy.

Looking back at Trump's personnel appointments and management of government departments, it's difficult to see him as a smooth-talking, compromising politician; on the contrary, in terms of the final results, Trump always achieves his political goals through various means, sometimes even at the expense of so-called "greater interests." Last year's farce of a 43-day government shutdown, the "longest shutdown in US government history," was also one of Trump's "political masterpieces."

On the other hand, all of Trump's actions had a very clear objective—to purge the remnants of the Democratic Party from the previous Biden administration and lay the political foundation for crypto-friendly regulation. With these individuals involved, a series of long-standing cases came to an end—the judicial investigations of crypto platforms such as Coinbase, Gemini, Robinhood, Ripple, Crypto.com, Uniswap, Yuga Labs, Kraken, and Polymarket concluded one after another, and the U.S. Department of Justice's National Cryptocurrency Enforcement Team, which had consistently implemented high-pressure regulation, was disbanded. The Biden administration's previous "crypto-crackdown" was a thing of the past.

After all, just like cleaning a house before inviting guests, removing a group of old officials and promoting a group of new "own people" is the only way to make government agencies operate as efficiently as a machine and make sufficient preparations for future legislation and enforcement work that is conducive to encrypted and friendly regulation.

Third major event: "Making history with laws"—establishing a strategic BTC reserve and pushing for legislation on three major crypto laws.

If the first two major events were necessary preparations for "crypto-friendly regulation," then the third is an essential component—implementing crypto-friendly regulation at the legislative and enforcement levels through executive orders and legal provisions. This series of historic breakthroughs is the biggest reason why Trump is called the "crypto president."

The president issued an executive order to use forfeited assets to promote the establishment of a U.S. strategic Bitcoin reserve.

In March 2025, Trump issued an executive order to promote the establishment of a strategic reserve of Bitcoin (BTC) in the United Odaily note: establishing a strategic reserve of BTC through the nearly 200,000 BTC previously confiscated by the US government, and declaring that it would not involve using national assets or increase the burden on the people), its impact was undeniably profound.

On the one hand, the US BTC strategic reserve set an example for many sovereign nations to incorporate crypto assets such as BTC into their national economic systems, further expanding the mainstreaming and popularization of crypto assets like BTC. On the other hand, this move also provided a model for more DAT treasury companies and offered national-level endorsement for the financial strategies of BTC treasury companies such as Strategy and Metaplanet. Subsequently, from July to September 2025, a large number of listed companies followed suit and established BTC treasuries, ETH treasuries, and SOL treasuries, which were also influenced to some extent by this event.

The signing of the Genius Act, a stablecoin legislation, consolidates the dollar's hegemony.

In July 2025, Trump officially signed the Genius Act, a stablecoin legislation, thus ushering in a golden age for stablecoins.

Specifically, the bill provides a detailed regulatory definition and implementation guidelines for stablecoins, which previously suffered from ambiguous boundaries and regulatory gaps, covering aspects such as the definition of payment stablecoins, dual licensing regulation, 100% reserve requirements, mandatory transparency disclosure, anti-money laundering compliance, priority protection of users, and clear regulatory authority.

At the same time, this bill is not only the first federal-level stablecoin bill in US history, but also the first cryptocurrency bill signed by a US president, making its historical status and industry significance extremely unique. Of course, the stablecoin system, deeply pegged to the US dollar, once again coincides with Trump's "America First" political strategy, further solidifying the dollar's hegemonic position in the global economic system.

Fueled by the passage of the Stablecoin Genius Act, the price of Bitcoin surged to around $110,000, setting a new all-time high. Meanwhile, the Stablecoin Genius Act also fueled Circle's crypto IPO, helping its stock price jump tenfold from around $30 at the time of its IPO to nearly $300. This single positive development has driven rapid growth in the US stablecoin sector, the Hong Kong stablecoin market, and even the global stablecoin, PayFi, and crypto payment sectors.

Furthermore, under Trump's strong push, two other major crypto bills, the Clarity Act and the Anti-CBDC (Digital Dollar) Act, also passed the House of Representatives, marking a solid step forward in cryptocurrency legislation. As with his previous promises, Trump once again set an example by clarifying the classification and regulatory affiliation of digital assets, promoting the development of the DeFi industry; and rejecting the establishment of a central bank digital dollar, protecting the self-custody rights of American citizens' digital assets.

Although the CLARITY Act has been stalled due to Coinbase's opposition and senators' obstruction of approval, the numerous legal breakthroughs made today are a historic moment compared to previous "historic gaps."

Perhaps Trump, who has served two terms as US president, understands that compared to various law enforcement activities during his presidency, enshrining his policy platform and political will in law through legislation is a more lasting and effective political approach.

Fourth major event: Wielding the tariff weapon, markets experience sharp rises and falls, turning the cryptocurrency market into an insider's stage.

If the above major events demonstrate Trump's influence and benefit the crypto market, then mentioning the "tariff stick" is something that many crypto enthusiasts, including myself, will find hard to laugh about.

The reason is simple: whenever Trump launches a trade war with foreign countries or sends hawkish signals, the crypto market and even traditional financial markets plummet, resulting in massive losses. It's no wonder that many lament that when Trump initiates a trade war with foreign countries, it's ultimately the wallets of crypto users who pay the price.

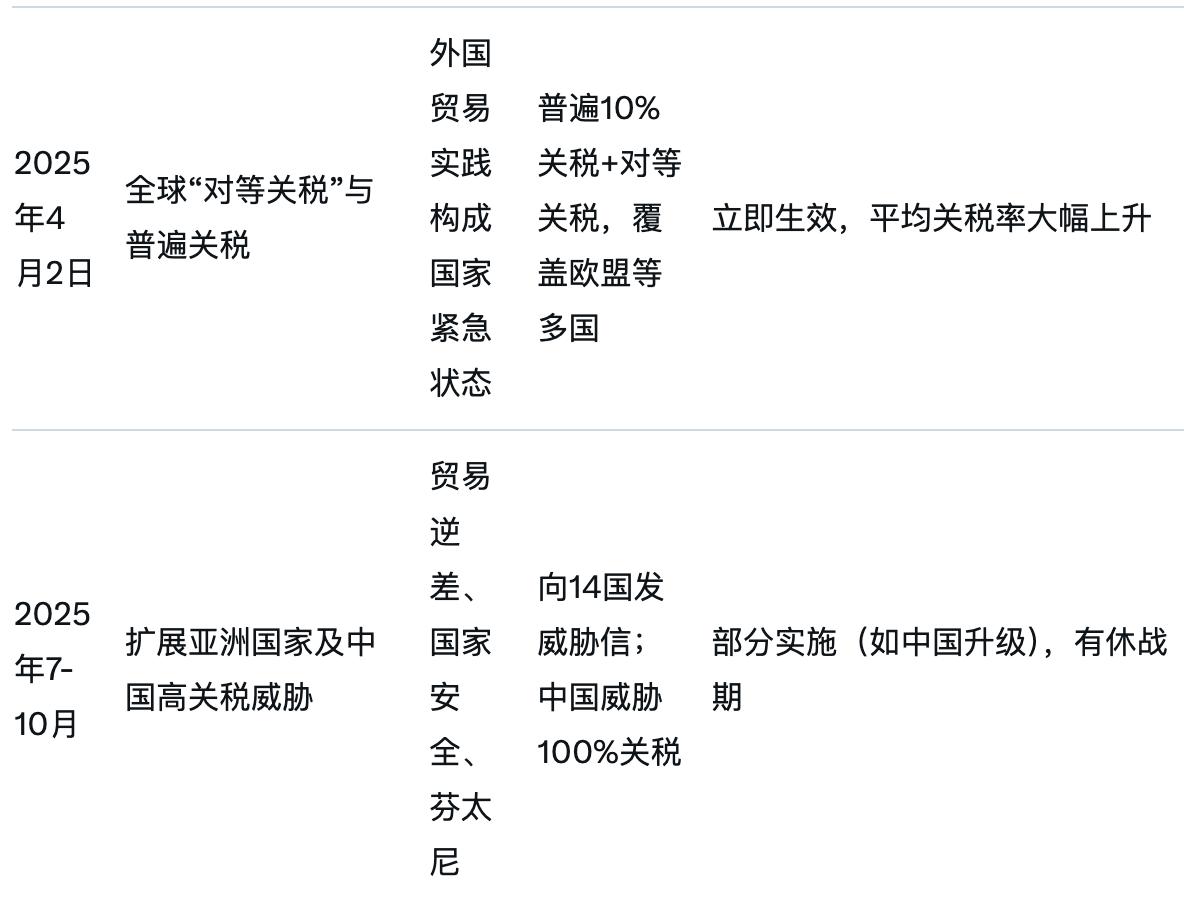

In April, August, and October of 2025, Trump launched three large-scale tariff trade wars, all of which severely impacted the cryptocurrency market.

Last April, Trump initiated global retaliatory tariffs and general tariffs, increasing tariff levels by more than 10% and covering many EU countries; he even proposed raising tariffs on China to 125% and suspending tariffs on friendly countries. As a result, the market capitalization of cryptocurrencies once plummeted by as much as 10% in a single day. The US stock market saw its market capitalization drop by $6 trillion in just a few days, with countless individual stocks suffering massive losses.

Last August, Trump signed a new executive order imposing tariffs of 15% to 41% on imports from 67 trading partners, pushing overall tariff rates to their highest level in over a century. As a result, the cryptocurrency market suffered a setback, with the three major cryptocurrencies—BTC, ETH, and SOL—falling by approximately 5% in a single day, a significant drop from their historical highs. Subsequently, the tariff order was suspended for 90 days.

Last October, Trump launched another tariff war, and Sino-US trade relations cooled again. Affected by this news , BTC once fell by more than 13%, ETH once fell by more than 17%, and countless Altcoin even fell by more than 30%. Coupled with the impact of exchange flash crashes and liquidations, the daily liquidation scale of the crypto market reached as high as $20 billion, and the actual liquidation scale was estimated to be between $30 billion and $40 billion.

According to statistics, in 2025, the average effective tariff rate in the United States rose to 27%, the highest level in nearly 100 years, which triggered policy retaliation from major economies around the world and disruptions to the global economic system's supply chains.

The repeated tariff trade wars have not only caused panic in the crypto and traditional financial markets, but also triggered a chain reaction of declines. Furthermore, the violent market fluctuations caused by tariffs have allowed insiders with access to inside information to engage in long and short trading, reaping huge profits and casting a shadow over the normal order of the crypto market.

It's worth noting that the rampant insider trading and Trump's capricious tariff policies have also contributed the buzzword "TACO-style trading" to the crypto market. (Note from Odaily Odaily: Trump Always Chickens Out, referring to Trump's initial tough stance driven by self-interest, followed by a softening of his attitude and a shift to a dovish stance.) Countless crypto whale have capitalized on this expectation to engage in fierce battles between bulls and bears on Hyperliquid and CEX, reaping their share of wealth from the crypto market.

To this day, Garrett Jin, the "10/11 insider whale," remains active in the market and is considered an insider figure within the Trump family or Trump faction. Besides his operations in the contract market, his advance bet on "Trump's pardon of CZ" is also seen as evidence of insider trading.

Fifth major event: Family wealth surges, Binance founder CZ pardoned.

Compared to the somewhat rampant insider trading, another major point of contention surrounding Trump lies in his family's crypto project, WLFI, and a series of highly controversial crypto business ventures. Furthermore, Trump's pardon of CZ last October sparked widespread market discussion.

Trump's "Path to Wealth": Family Wealth Increased by $1.4 Billion in One Year

According to Bloomberg , crypto assets have added approximately $1.4 billion to the Trump family’s wealth over the past year. For the first time, cryptocurrencies now account for about one-fifth of the Trump family’s total net worth of approximately $6.8 billion.

During Trump's second term, the Trump family reaped significant profits through new projects such as the co-founded crypto platform World Liberty Financial (WLFI), its named Meme coin (TRUMP), and the Bitcoin mining company American Bitcoin Corp. (ABTC). World Liberty's platform token WLFI and stablecoin USD1, in particular, saw substantial valuations.

Meanwhile, the stock price of Trump Media & Technology Group has fallen 66% over the past year, partially offsetting gains in crypto assets; its family members have also invested in companies such as SpaceX through venture capital firm 1789 Capital and expanded the Trump Organization’s global real estate licensing business.

As for the Meme coin MELANIA issued after Trump's eponymous token, it's not even worth mentioning. Furthermore, according to a personal financial document disclosed by Trump in June 2025, as of January 2025, Trump himself still held approximately 15.7 billion WLFI tokens, which, at current prices, are still worth approximately $2.6 billion.

In just one year in office, Trump and his family amassed billions of dollars through business expansion, political donations, and various sham events and dinners, prompting many to remark: no wonder they are a US president's family of real estate developers.

Trump exercises presidential privilege to pardon CZ: A reconciliation between crypto regulation and government power.

Another thing worth mentioning separately is Trump's pardon for Binance founder CZ.

On the evening of October 23, 2025, the Wall Street Journal reported that Trump pardoned Binance founder CZ, and had recently told advisors that he sympathized with the rhetoric of political persecution associated with CZ and others. White House Press Secretary Carolyn Levitt stated that Trump "exercised his constitutional power to pardon Mr. Zhao, who was prosecuted during the Biden administration." She added, "The Biden administration's war on cryptocurrency is over." This marked the vindication of CZ's previous four-month imprisonment and Binance's $4 billion fine.

Of course, given Binance's deep business dealings with WLFI (Note from Odaily Odaily: Binance previously received a $2 billion investment from the UAE sovereign wealth fund MGX, with the funds in the form of USD1, a stablecoin issued by WLFI, a crypto project of the Trump family), and Binance's hiring of Ches McDowell, a lobbyist closely associated with Trump Jr., to assist in seeking a pardon, the crypto market and even some Democratic senators in the United States have questioned whether there was bribery or corruption involved , and there is widespread suspicion that the pardon of CZ may have been a political favor.

Today, the matter has come to an end, but speculation and criticism about Trump abusing his power for personal gain and profiting his family continue to rage.

Conclusion: Trump has never changed; he has always been a businessman-politician.

Regardless of external opinions, President Trump remains steadfast, fulfilling his duties and enjoying his power. Throughout his nearly 80-year life, his fundamental character may never have changed—he has always been a businessman who believes in value exchange and prioritizes profit.

As for the title of "Crypto President" and the vision of "making America the world's crypto capital," these are merely byproducts of Trump's efforts to maximize the role of crypto assets.

For this pure-blooded American octogenarian, "America First" remains his guiding principle for survival.

Recommended reading:

A historic moment: Trump officially signs the GENIUS Act.

Trump Pardons Binance Founder CZ: 13 Months from Imprisonment to Complete Freedom