Gold hit a new high overnight, with silver following suit. The idea of gold-plated silver might have been possible before, but that's unlikely now. The crypto dipped last night and then traded sideways; be wary of volatility during Friday's night session. Don't try to predict price movements; use light positions or place pending orders!

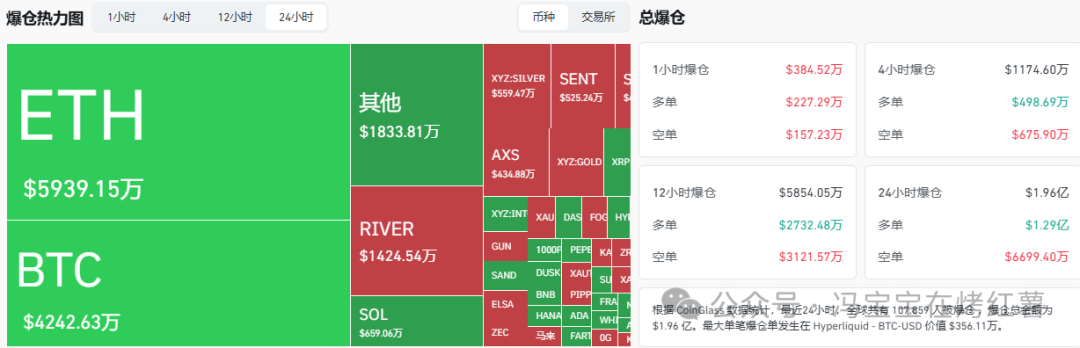

In the past 24 hours, a total of 107,859 people across the internet have had their accounts liquidated, with a total liquidation amount of $196 million. Long positions were liquidated for $129 million, and short positions for $66.994 million.

BTC

Our Bitcoin long position was perfectly timed, with a buy order placed at 88500, and the price dropped to around 88450. We've already profited over 1000 points, so we've set a stop-loss at breakeven and are holding the position. For those who missed out, don't worry, opportunities will come; it's all about how you execute them.

Today's trading strategy:

Pay attention to the 89350 level. If it retraces but does not break through, the rebound is expected to continue on the 1-2 hour chart, with resistance levels around 90400, 91600, and 93300.

If the 1-2 hour chart falls below 89350, the small-scale rebound structure may be broken, and the support levels to watch are around 88470, 87200 and 85300.

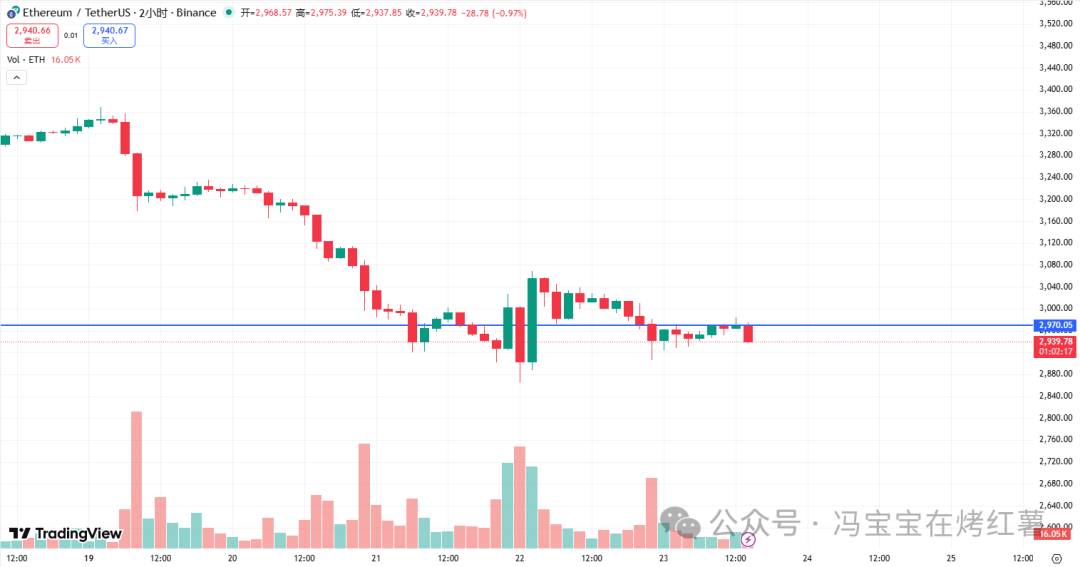

ETH

Ethereum also saw long positions, reaching a high of 2984 today, a small but steady gain. Currently, smaller timeframe indicators have largely recovered. The daily chart showed a significant pullback with increased volume; we just need to wait for the smaller timeframes to gradually drive the recovery. The 4-hour chart also hit a new low; if it forms a W-bottom pattern with a right-side rebound, we'll patiently wait for the pattern to emerge.

Today's trading strategy:

Pay attention to the 2970 level. If it can hold above this level, a rebound may begin on the 1-2 hour chart, with resistance levels around 3025, 3065, and 3110.

If the price fails to rise above 2970, it indicates insufficient short-term rebound momentum, with support levels around 2910, 2863, and 2810.

Copycat

I'll state my judgment directly: the next bull market's 10x growth potential will most likely be seen in the privacy sector. The core logic is that institutional funds have privacy needs, but the market hasn't fully priced them in. This is a structural change that's currently underway; once consensus forms, all that's left is chasing high prices and observing from the sidelines. The most promising privacy targets fall into these categories:

$FIRO

FIRO takes a protocol-first approach, extending beyond just transaction privacy to include private asset issuance, offering significantly greater potential than older privacy coins.

$DCR

DCR's design philosophy is very stable, privacy is optional, CoinShuffle++ is already very mature, and with the addition of the vault mechanism, the project can survive in the long term without relying on hype.

$ZEN

ZEN is no longer satisfied with the label of "privacy coin" and is transforming into privacy middleware and infrastructure, focusing more on B2B products.

$ZEC

ZEC offers one of the few truly institution-friendly privacy solutions, which is auditable and optional. With the advancement of PoS and governance restructuring, the use of transaction shielding is steadily increasing.

$XMR

XMR represents the ultimate in privacy, with absolutely no compromises. Institutions may not love it, but it has always been a core anchor in censorship resistance and real-world use cases.

$DASH

DASH has been undervalued for a long time, and transaction activity is recovering. If Evolution is truly implemented, it will be more like a usable payment and application layer.

$ROSE

ROSE focuses on execution-layer privacy, integrating encrypted computations of data, AI, and RWA, making it more infrastructure-oriented than just a story.

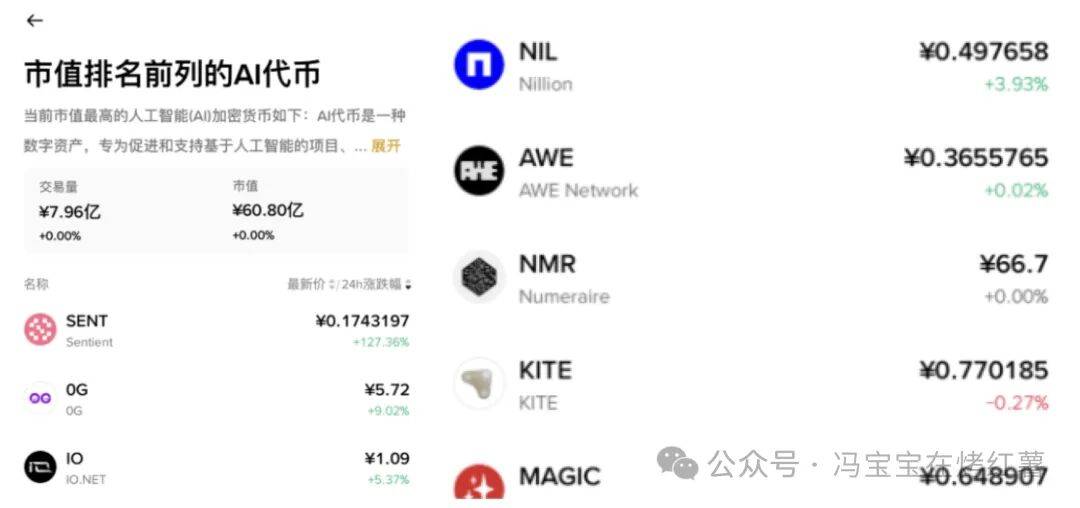

AI track

Bethesda has recently launched a large number of new coins focused on the AI sector, with many being worthless shit coin merely riding the hype. While AI is undoubtedly a core area for speculation in the next bull market, only TAO and VIRTUAL are worth paying attention to in the secondary market. It's advisable to avoid the rest, as many are simply shit coin.

$MANA

The GameFi sector has seen a strong surge, with AXS and SAND having firmly established themselves above the daily MA120, while MANA has yet to reach it. Looking at the daily chart, two consecutive positive days and an upward-sloping MACD from the zero line indicate a gradual exit from the bottoming range, suggesting further upside potential and a potential test of the 0.2 resistance level!

The Era of Liberal Arts Students

It's perfectly timed. BSC's English-language meme platforms have been largely shaken out, with $beepe plummeting and exiting the market. Binance's Alpha lacks a suitable project, $memes' price surge is weak, and $Cryptowinter is outdated; new platforms are poised to fill the gap. Whether $liberal arts students can maintain a million-dollar market capitalization will be crucial, and more Chinese-language platforms may compete for Alpha status.

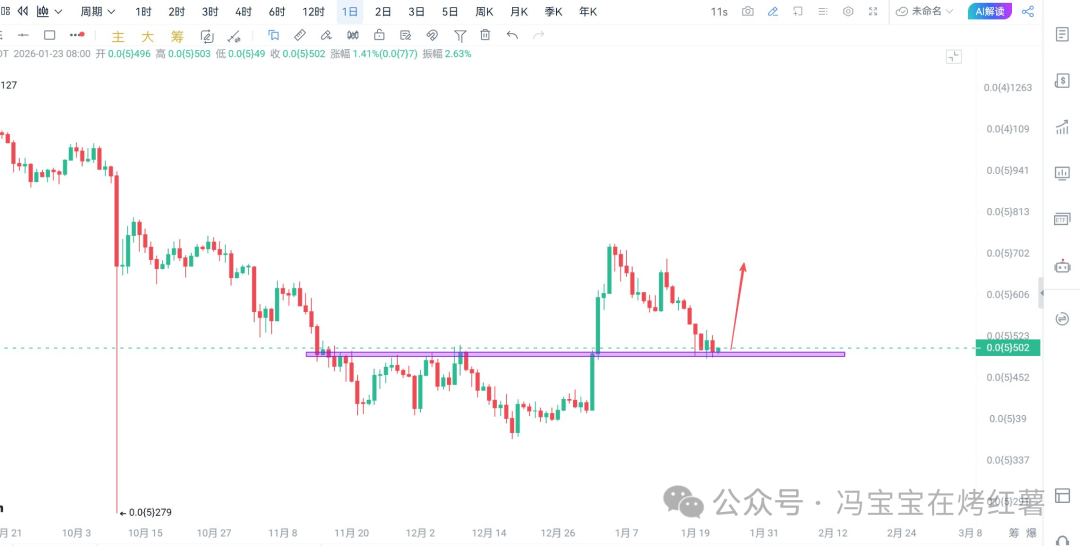

$DASH

DASH typically follows the daily EMA21 moving average. After a breakout, it retraces, holds, and rebounds; after a break below, it bounces back, then falls. It's approaching this moving average again now. Wait for it to be oversold on the intraday chart, find a good entry point to go long, and aim for a rebound to the previous high. Place your stop-loss below the moving average.

$PEPE

Pepe should have reached a support level in the short term; let's see a small rebound first.