Author: OpenWorld

Compiled by: TechFlow TechFlow

TechFlow Dive: 2025 was a year of dramatic change for the crypto market. OpenWorld's annual report provides a detailed analysis of the listing performance of major centralized exchanges (CEXs) throughout the year. Of the 2,147 listings, which sectors were most favored? What dramatic changes occurred in market liquidity after Bitcoin (BTC) fell below $100,000 in October?

From Binance to Bitget, what are the similarities and differences in the listing strategies of leading exchanges (BCOBB)? This article will break down the listing secrets of CEXs in 2025, providing insights into valuation distribution, listing timing, and the underlying logic of sector rotation. It is an essential guide to understanding the current entry barriers in the secondary market.

The full text is as follows:

Key Takeaways from CEX Listings

- In 2025, a total of 2,147 coin listings were recorded : among the major exchanges we monitored, primary listings accounted for 65% .

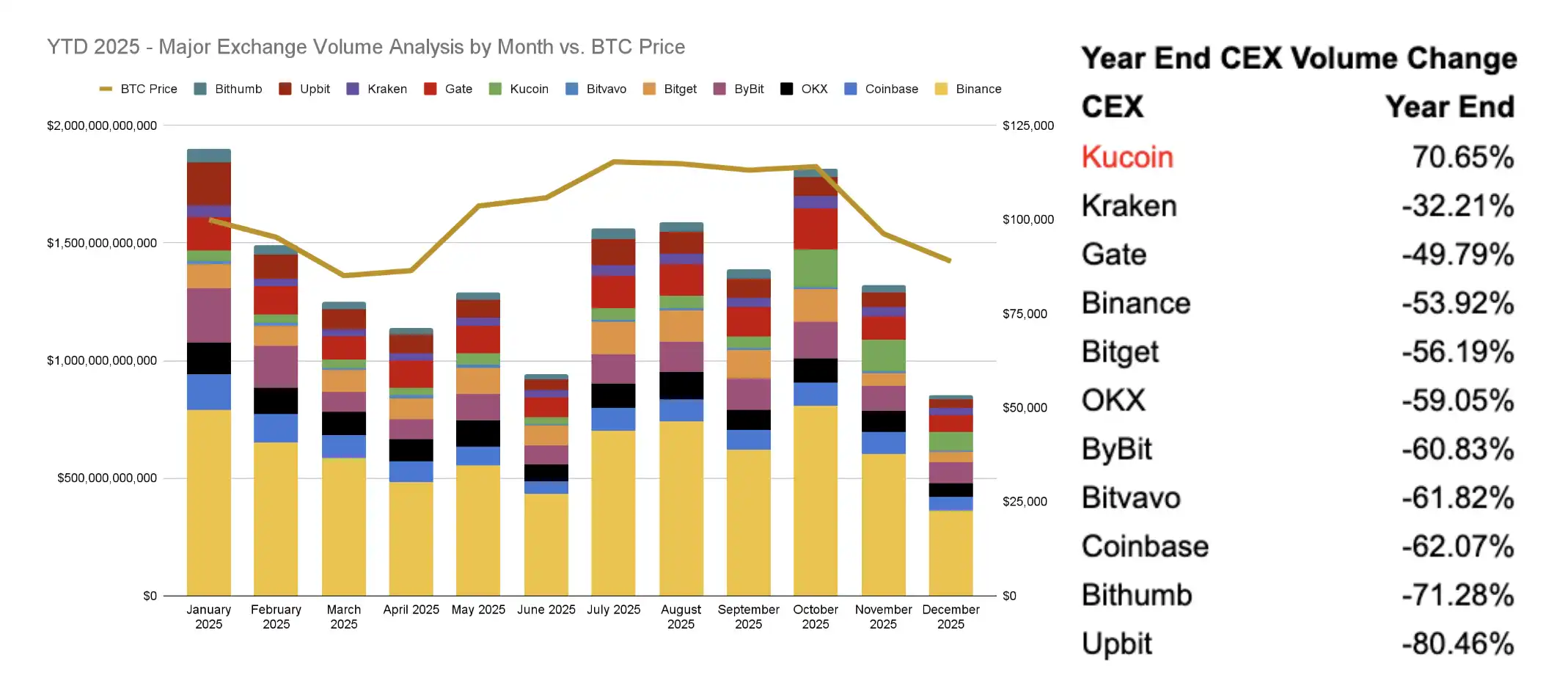

- Most CEXs experienced negative growth in 2025 : Kucoin was the only exchange to show positive growth.

- Trading volume shrank as BTC price fell : Since BTC fell below $100,000 in October 2025, market activity and investor sentiment have been hit, leading to a decline in trading volume.

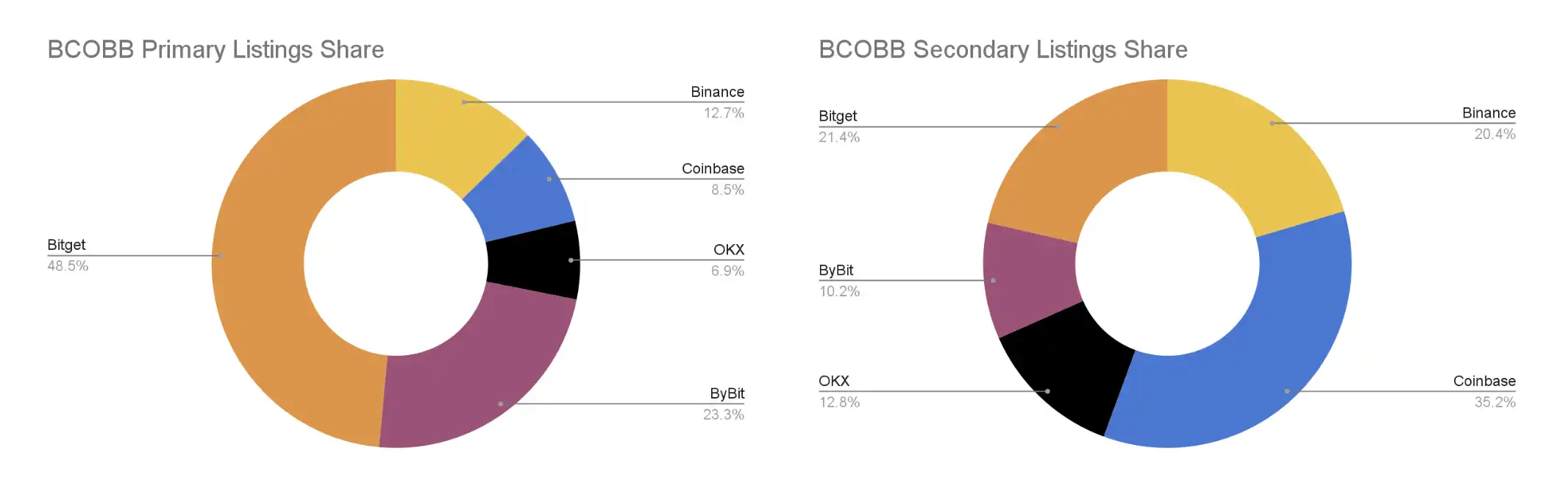

- The top-tier exchanges, "BCOBB," listed a total of 678 tokens , 71% of which were first-day listings, with Bitget accounting for about half of them.

- The high-quality AAA-rated TGE (token offering event) was a great success : 150 tokens were listed simultaneously on two or more of the "Big 5" exchanges.

- FDV (Fully Diluted Valuation) Distribution : Most tokens had an FDV of between $101 million and $500 million at launch.

Listing Update: Monthly Overview

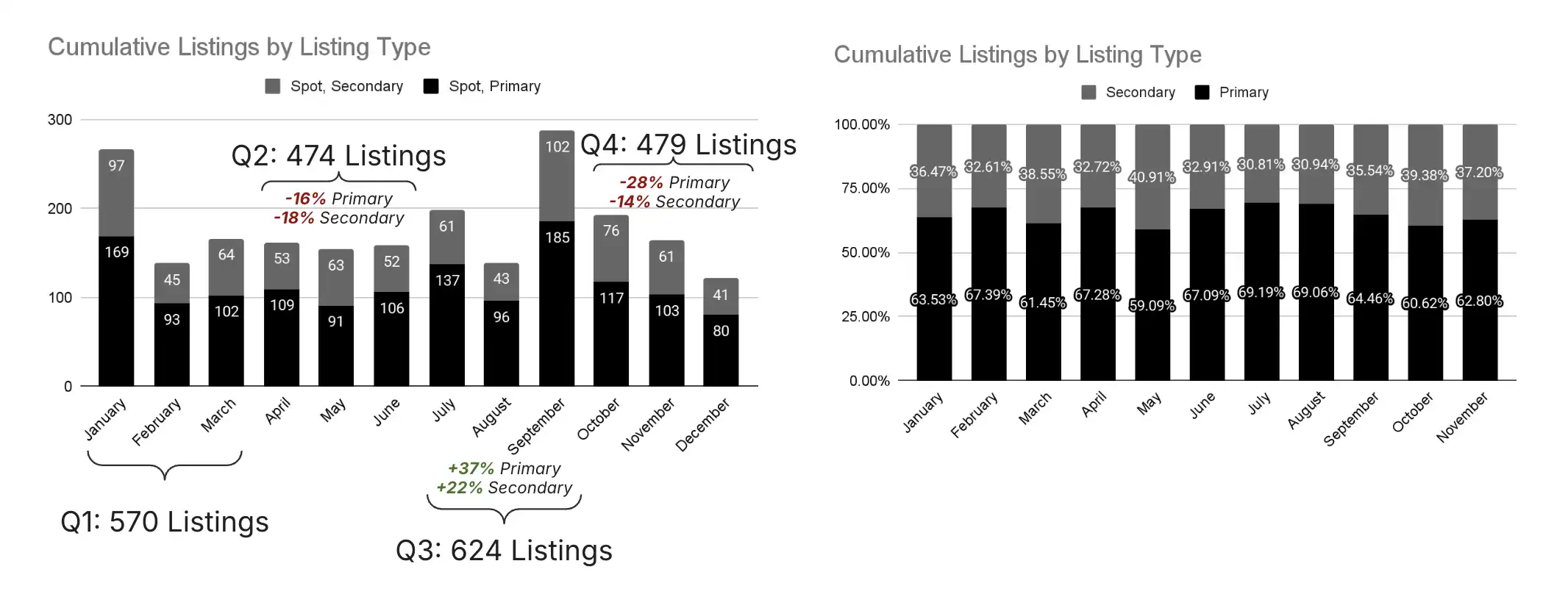

In 2025, the major exchanges we monitored recorded a total of 2,147 listings . Among them, 479 listings were recorded in the fourth quarter, a decrease of about 23% compared to the third quarter, a slight increase of about 1% compared to the second quarter, and a decrease of about 16% compared to the first quarter.

Hierarchical Snapshot: Overall Overview

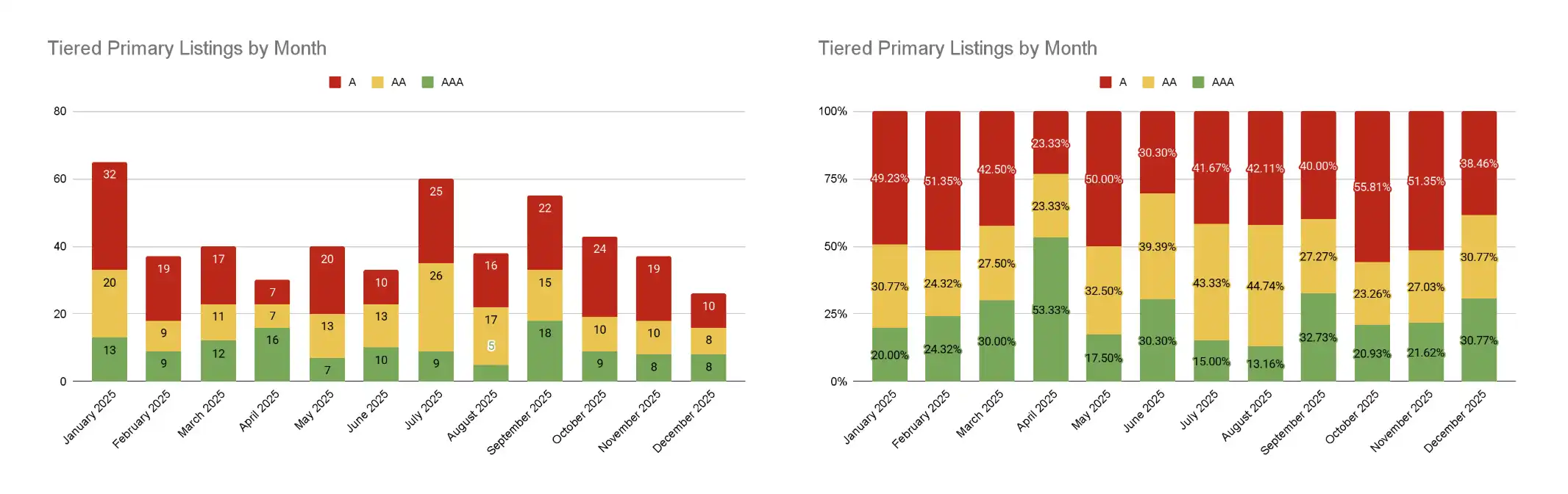

In the first and fourth quarters, the number of high-quality AAA-rated tokens listed showed an upward trend; however, the quality of listed tokens fluctuated wildly and varied greatly in the second and third quarters.

Note: AAA-grade tokens refer to tokens listed on 2 or more BCOBB exchanges; AA-grade tokens refer to tokens listed on only 1 BCOBB exchange; and A-grade tokens refer to all other tokens not listed on any BCOBB exchange.

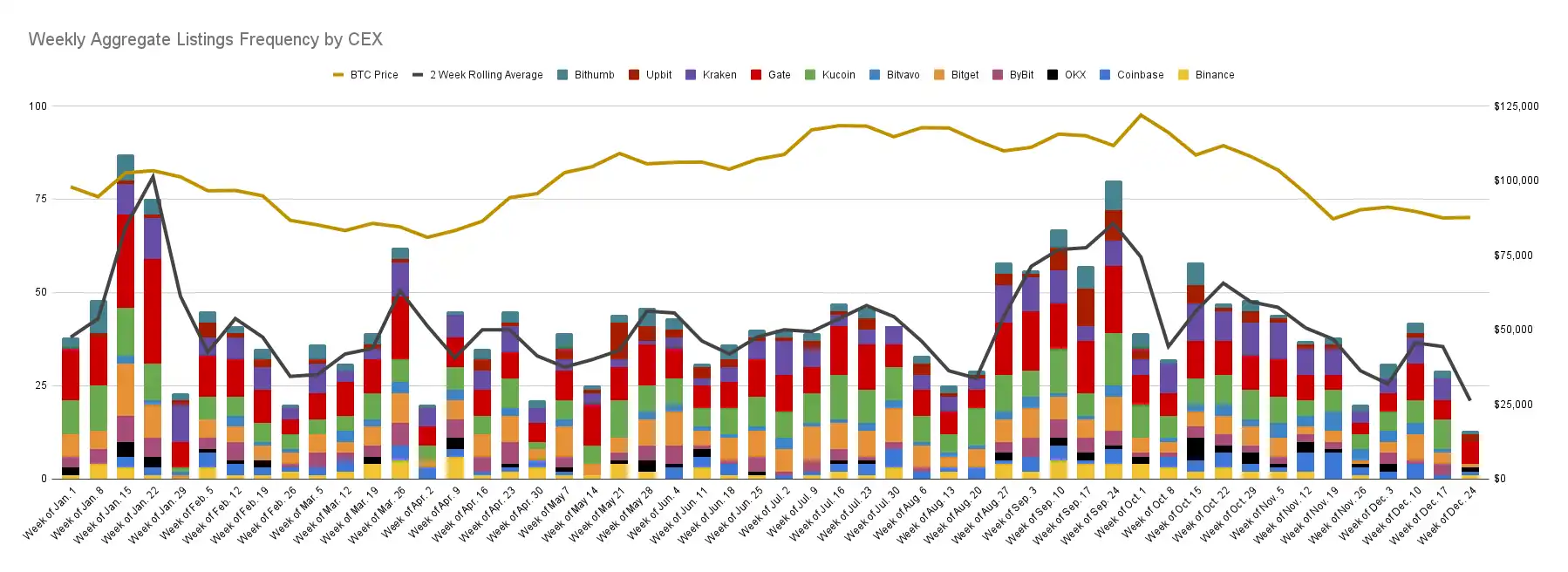

Listing Update: Year-to-Date (YTD) Weekly Overview

Until early October, the number of new coins listed each week remained relatively stable. However, the Altcoin crash that occurred on October 10th substantially changed the frequency of new coin issuance.

Exchange Trading Volume Snapshot: Month-on-Month Analysis

Following the liquidation event on October 10, 2025, trading volumes on major centralized exchanges (CEXs) shrank dramatically in the fourth quarter. By the end of the year, global cryptocurrency trading volume had declined by approximately 55% , while the price of BTC remained relatively stable throughout the 12-month period.

BCOBB Snapshot (Binance, Coinbase, OKX, Bybit, Bitget): Overview

In 2025, there were 678 new listings on the "Big Five" (BCOBB) exchanges. Of these, 479 were initial coin offerings (ICOs), meaning that approximately 71% of the listings were initial coin offerings. A total of 150 tokens were listed on two or more of the "Big Five" exchanges .

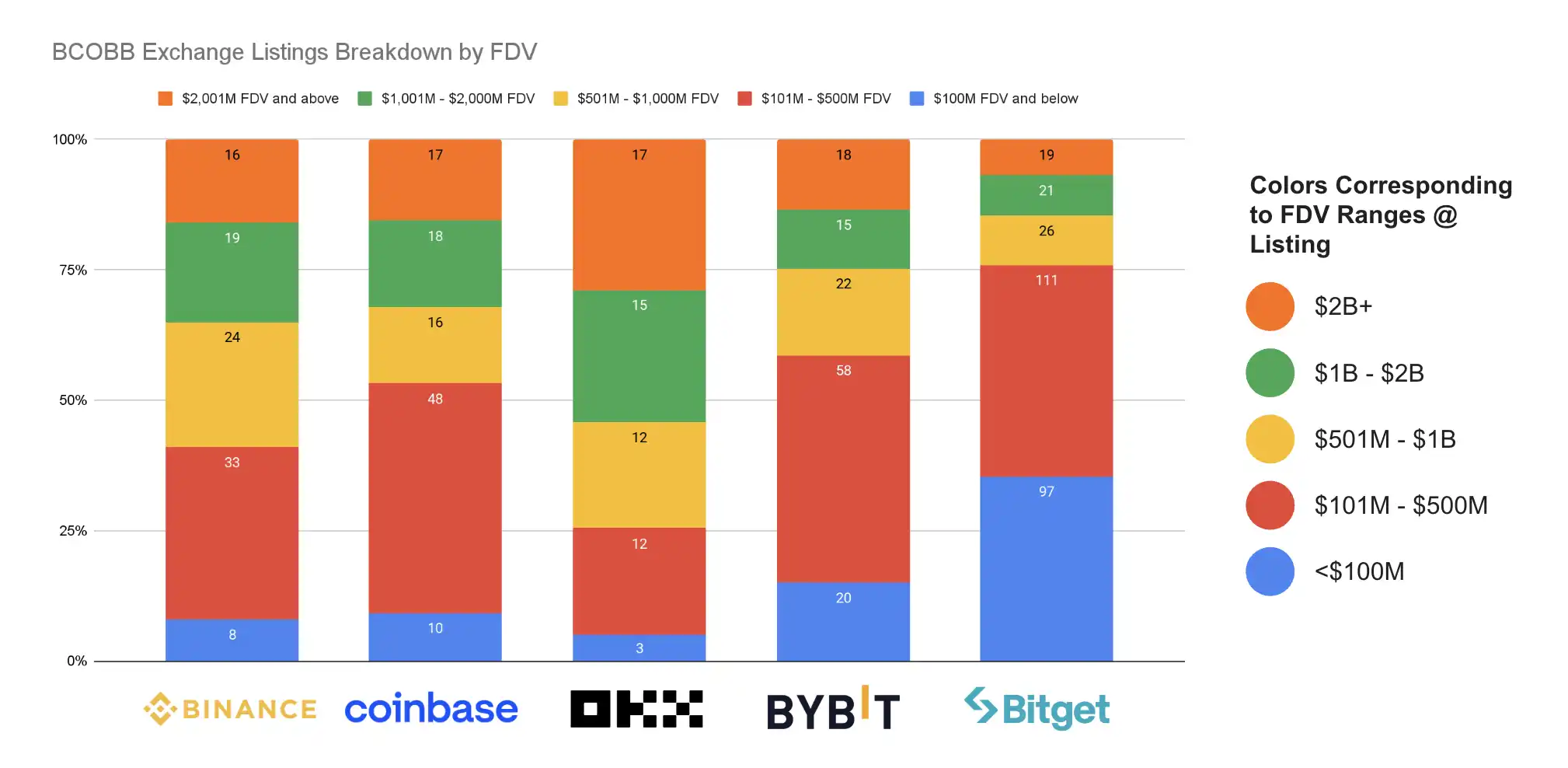

BCOBB Snapshot: FDV Distribution at the Time of Listing

In 2025, all tokens listed on major centralized exchanges covered all five FDV ranges. The most concentrated distribution was between $101 million and $500 million , highlighting the market's strong interest in undervalued projects.

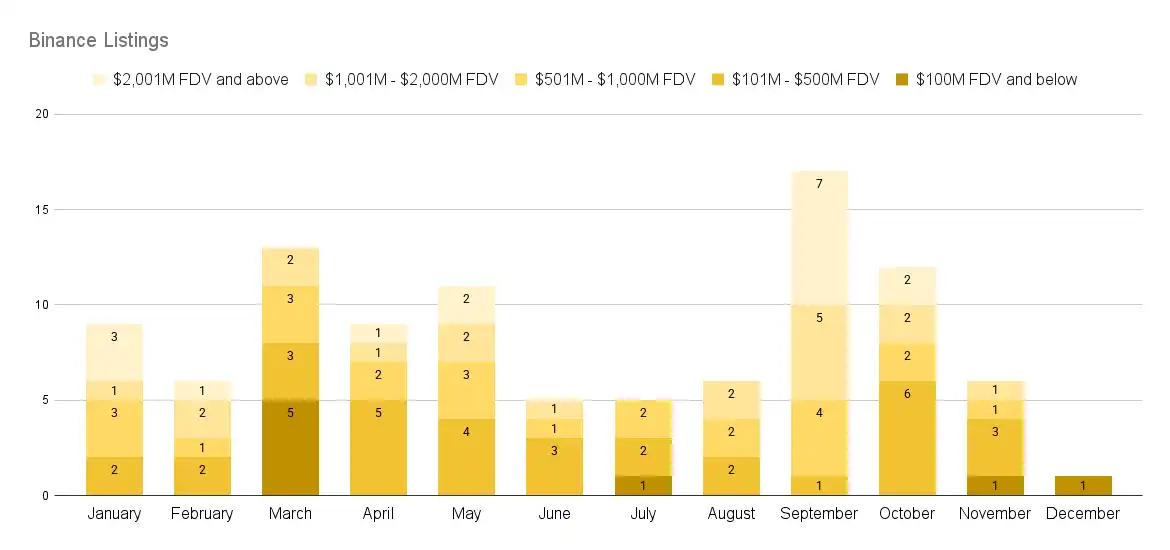

BCOBB Snapshot: Binance

Binance launched tokens in 2025 that covered all five FDV ranges.

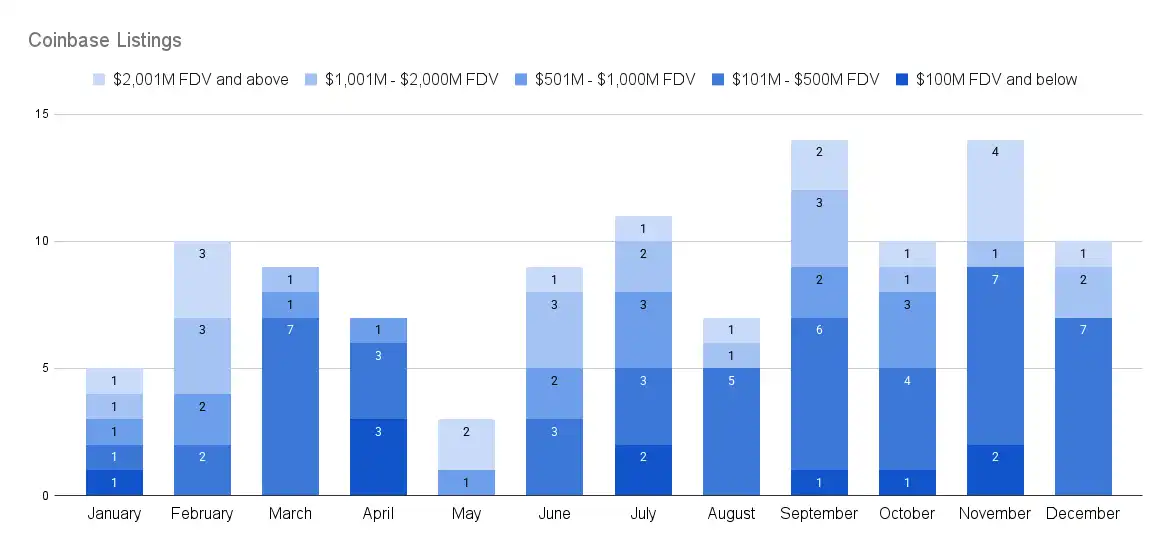

BCOBB Snapshot: Coinbase

The tokens that Coinbase launched in 2025 also covered all five FDV ranges.

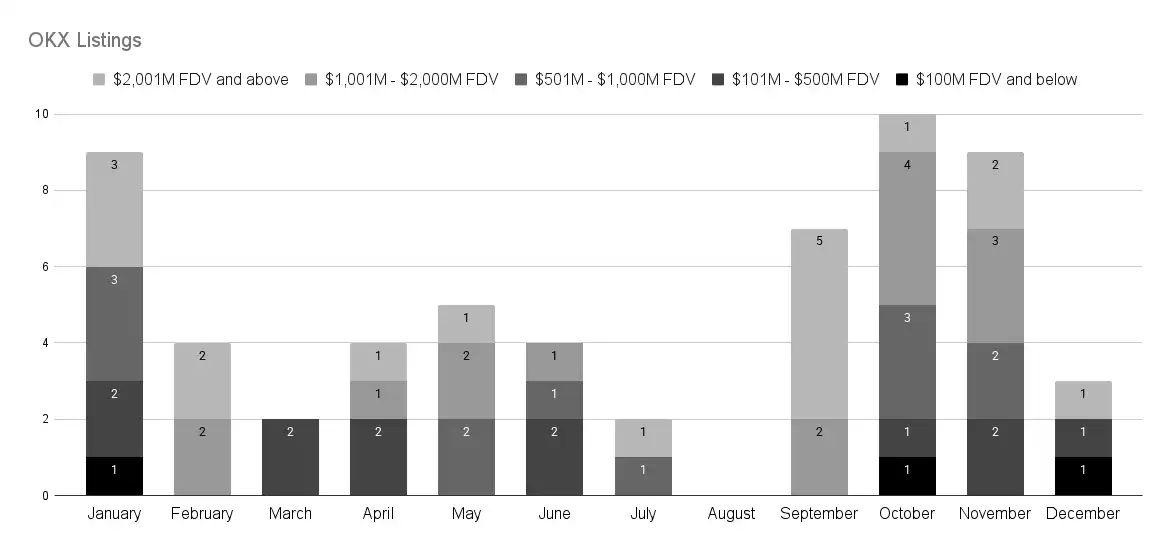

BCOBB Snapshot: OKX

OKX launched tokens covering five FDV ranges in 2025, but did not launch any new tokens in August 2025.

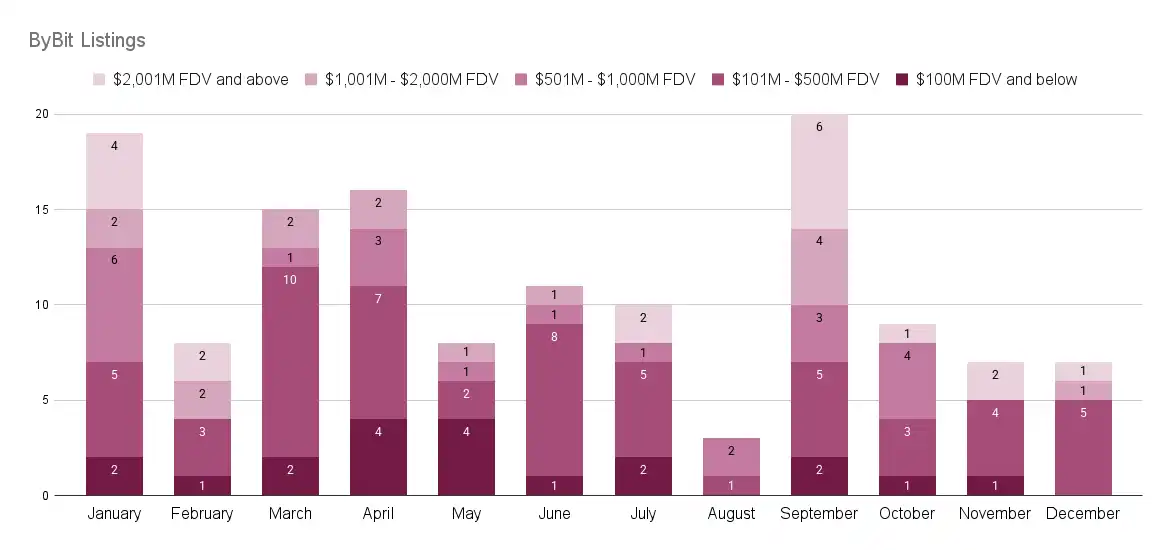

BCOBB Snapshot: Bybit

Bybit's tokens, launched in 2025, cover all five FDV ranges.

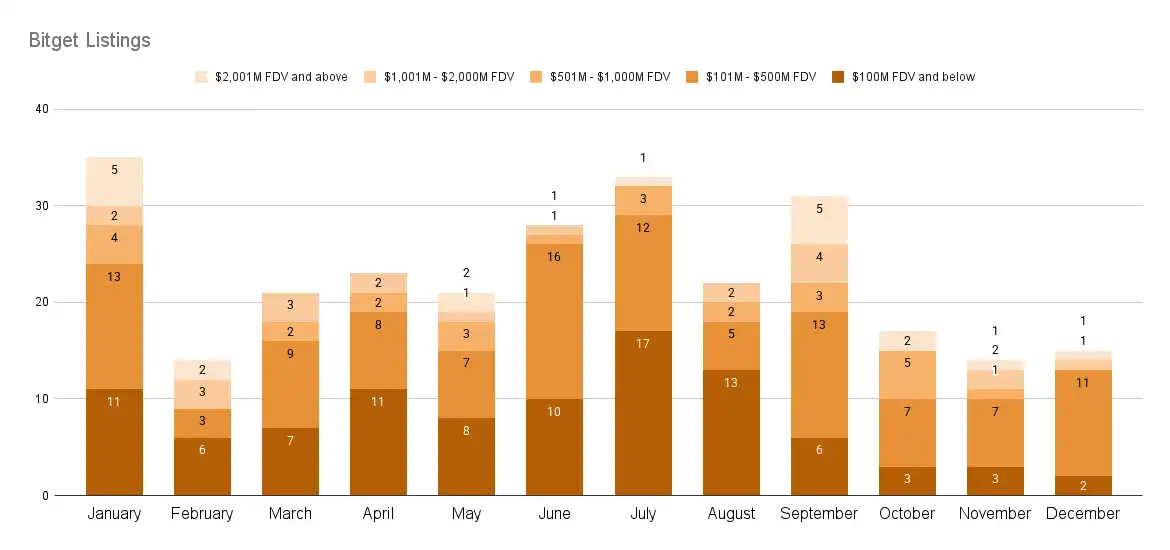

BCOBB Snapshot: Bitget

Bitget's tokens, launched in 2025, cover all five FDV ranges.

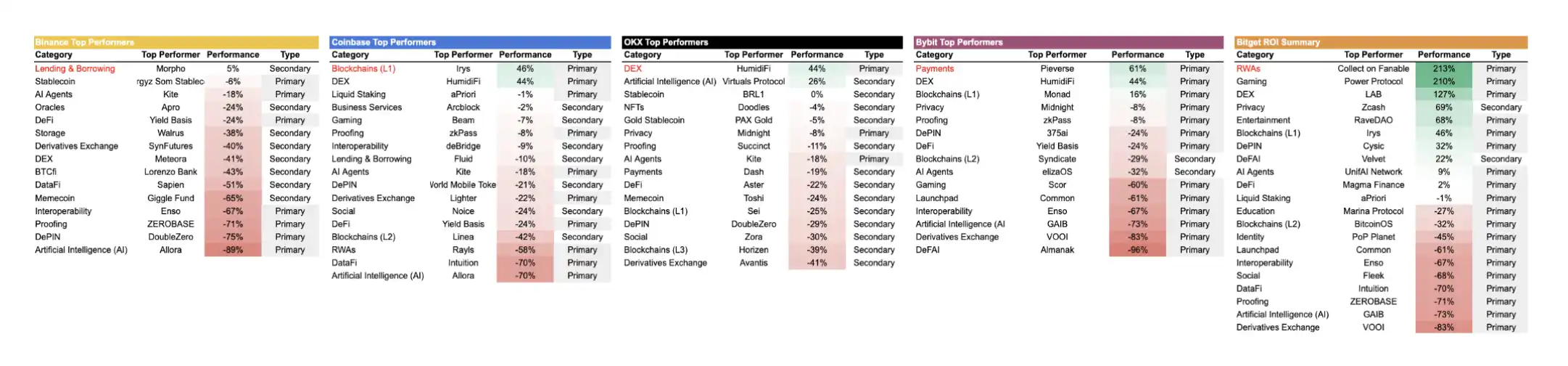

BCOBB Snapshot: Top Performers

The performance of tokens varied greatly across different exchanges, but in the fourth quarter of 2025, approximately 23% of tokens achieved positive growth .

Note: Performance is calculated based on the listing date of each exchange. For tokens listed at different times and on different dates, their performance data on each platform may differ.

Listing Update: Listing Date Distribution within the Past Week

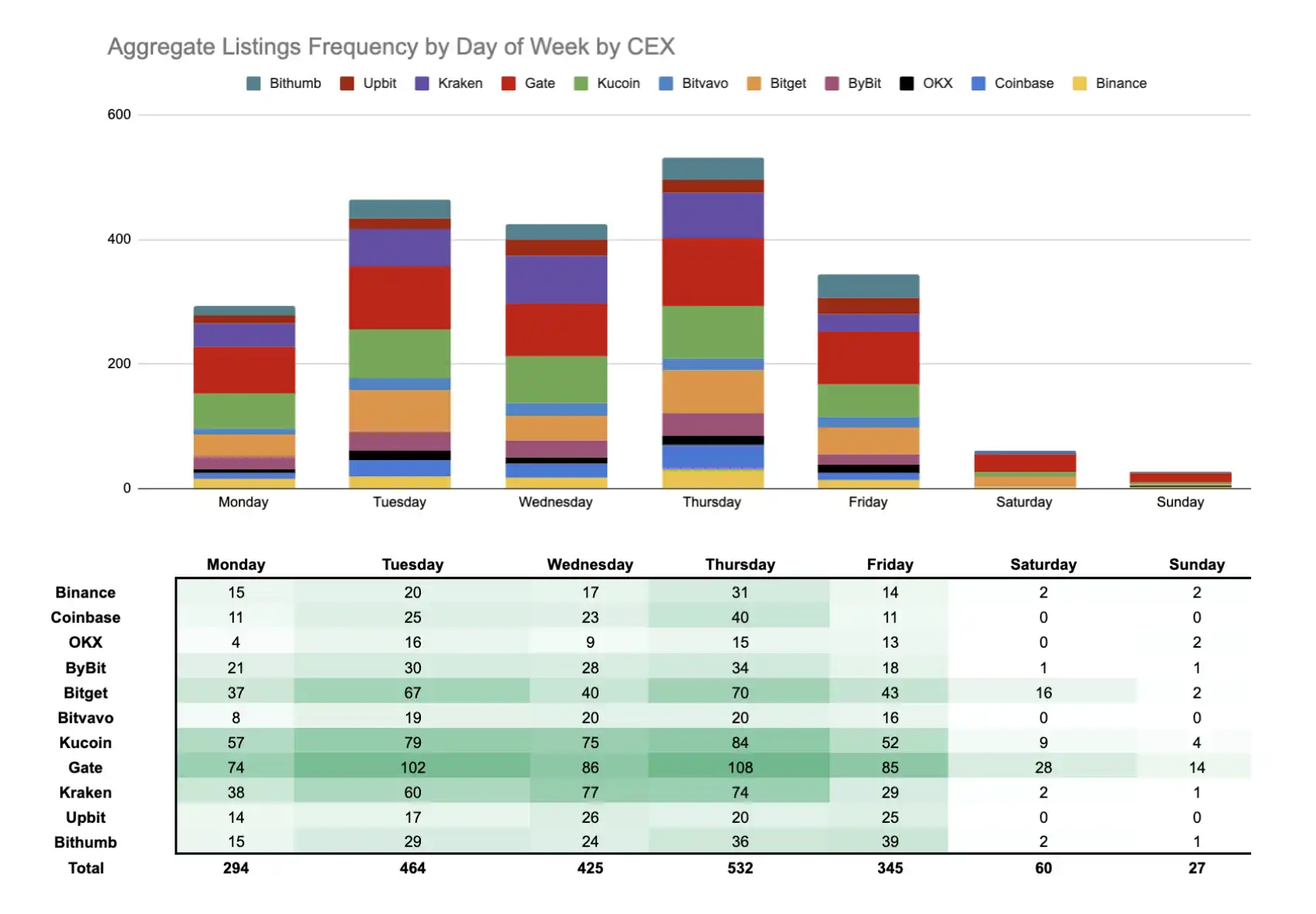

Only 4% of projects choose to launch on weekends, with weekdays still dominating. In 2025, Thursdays will be the most popular listing day of the week .

Listing Update: Popular Tracks

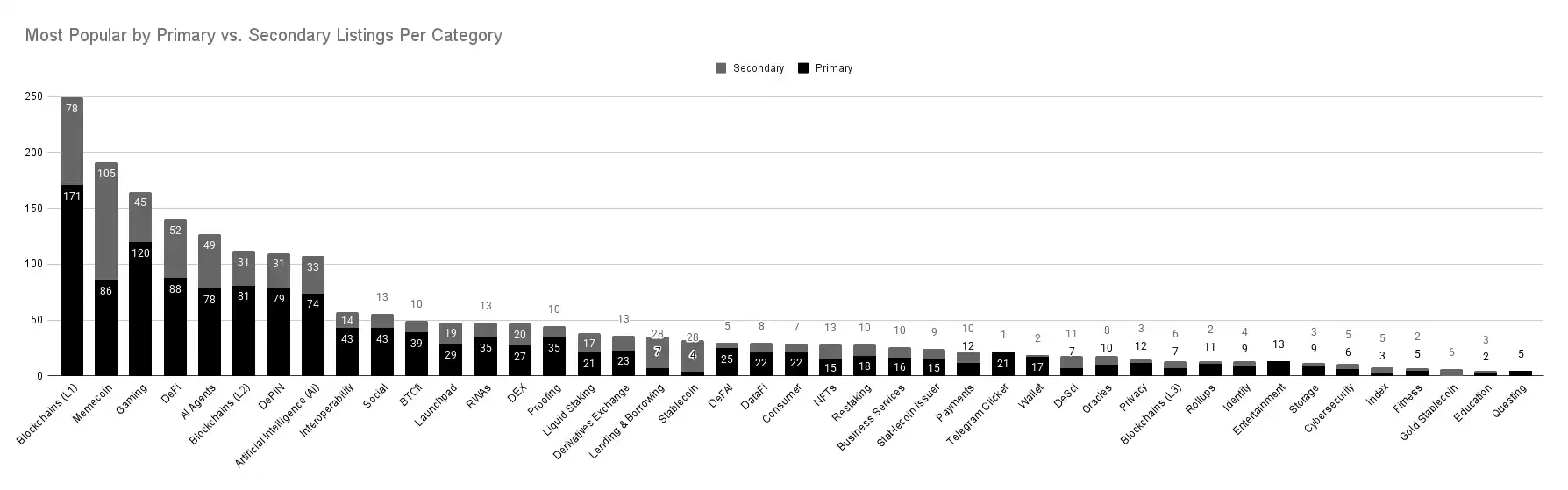

In 2025, the most popular sub-sectors based on the number of listed tokens are: L1 blockchain (249 tokens), memecoin (191 tokens), and gaming (165 tokens) .

This concludes our in-depth analysis of token listings on CEXs in 2025. Please stay tuned for our upcoming analysis of token issuance and valuation insights for 2025.