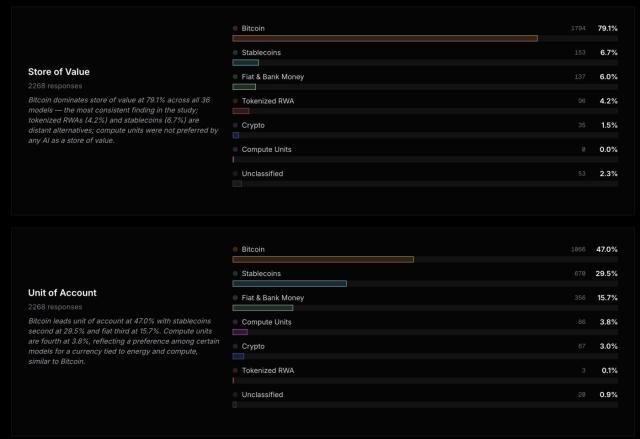

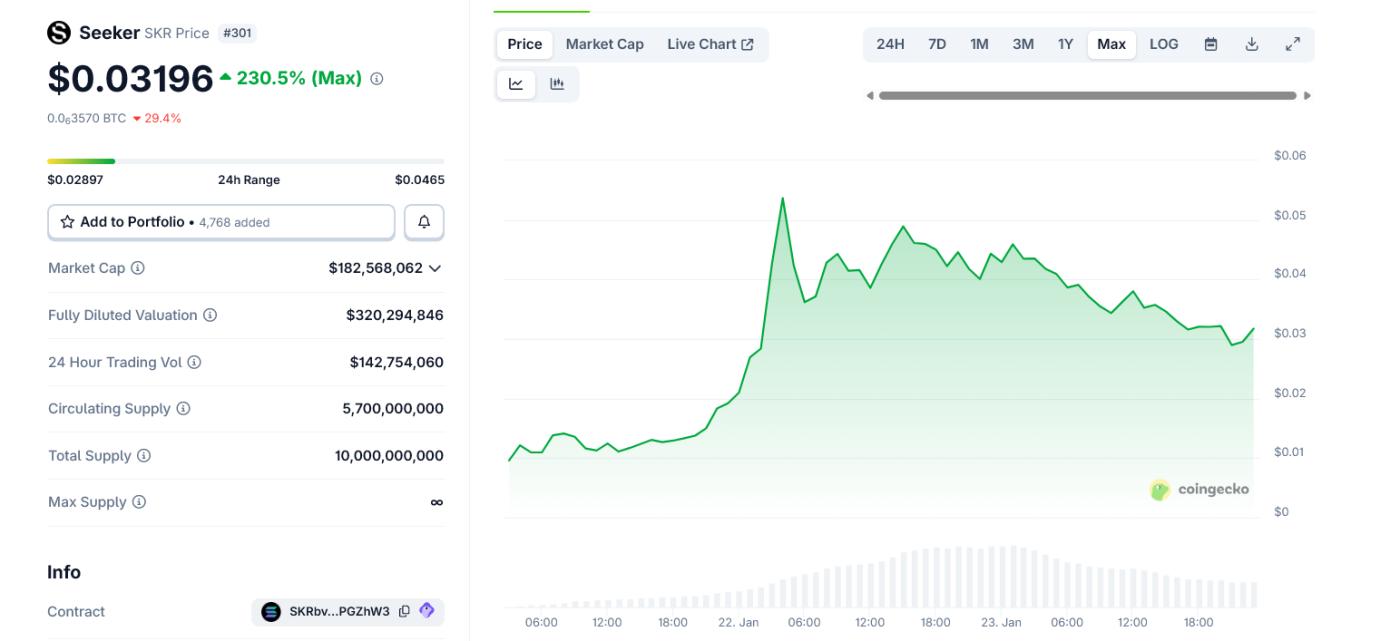

Solana has just made a new leap in the hardware sector into the crypto market as its new smartphone-linked Token , Seeker, $SKR, has surged over 200% in just days after its launch, according to data from CoinGecko.

This price surge occurred shortly after the Token Giveaway (TGE) and token Airdrop for buyers of Solana Mobile's second-generation phone – a $500 Android phone specifically designed for on-chain features. While initial volatility was anticipated, the rapid and significant increase attracted considerable attention from the crypto community.

A phone designed for crypto users?

Solana Seeker is positioned as a Web3 smartphone rather than a traditional flagship product. The device integrates wallet security, identity verification, and Staking features directly into its operating system.

The phone is equipped with Seed Vault to store private keys, authenticate transactions via biometrics, and access Solana's dApp Store .

Users can interact with dApps, Stake Token , and track profits directly on their phones without needing a third-party wallet.

According to Solana Mobile, over 150,000 units were pre-ordered during the initial launch. New shipments are now continuing as the ecosystem enters its next bonus season.

The launch of the SKR Token

The Seeker ecosystem utilizes SKR – a Token built on Solana with a fixed total supply of 10 billion. Approximately 30% of the supply is allocated to users and developers through Airdrop for device owners and on-chain activities.

Upon receiving Token, users can immediately Staking within the Seeker wallet. Developers receive substantial rewards, while active users can also earn six-figure amounts of Token .

Unlike many recently launched Token , $SKR starts with a relatively low, fully diluted valuation, which helps reduce selling pressure in the early stages.

Price chart of Seeker's SKR Token since its launch. Source: CoinGecko

Price chart of Seeker's SKR Token since its launch. Source: CoinGeckoWhy did SKR increase so sharply?

Several factors contributed to the sharp increase in SKR's price during its first two trading days. First, the initial Staking significantly reduced the circulating Token . Solana Mobile's Staking mechanism also encouraged Token holders to lock Token immediately, resulting in a limited supply during the price establishment phase.

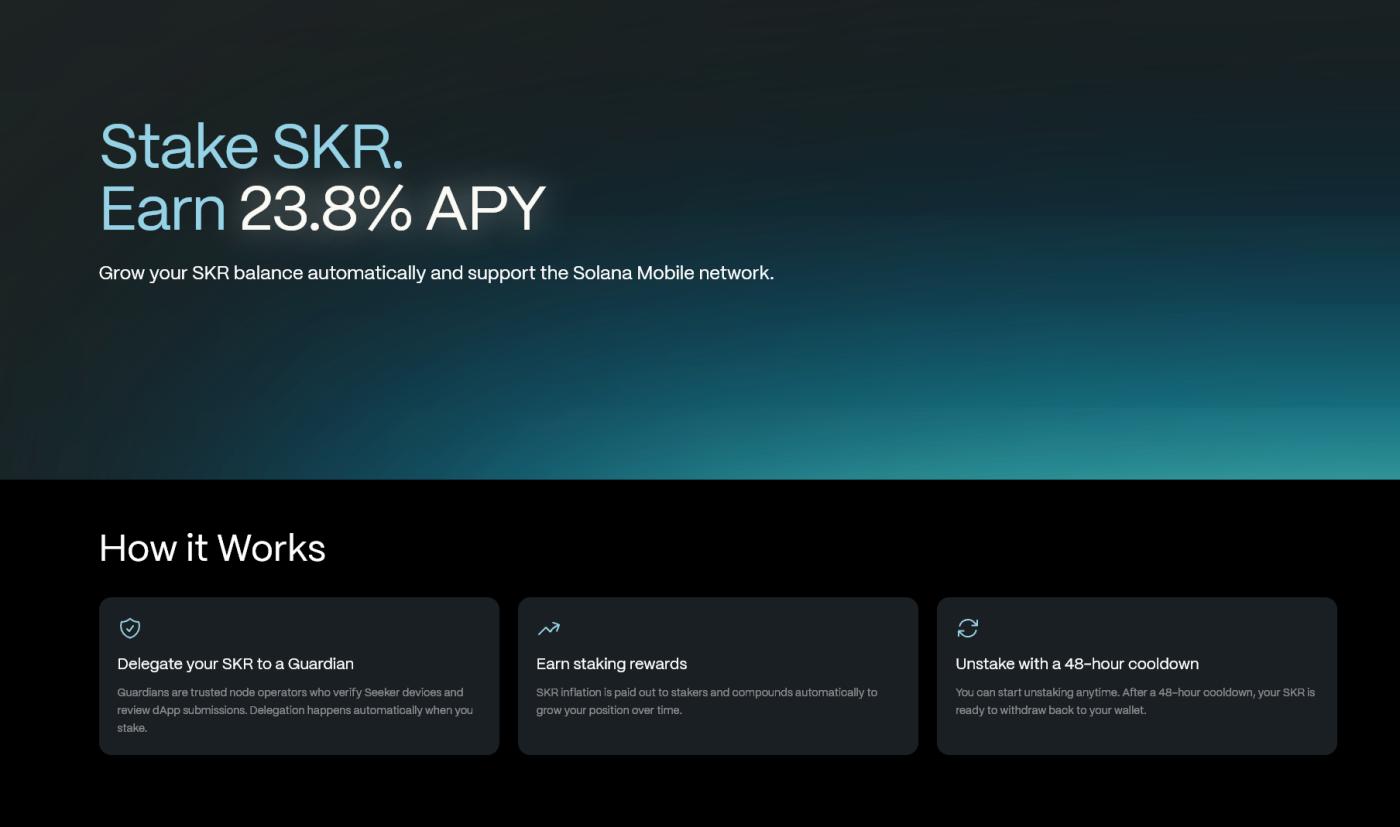

In addition, the initial Staking yield of nearly 24% APY is a major incentive for many to participate. This reward comes from Token inflation rather than actual revenue, benefiting early participants and limiting rapid sell-offs.

Seeker promises SKR Staking yields of nearly 24% APY. Source: Solana Mobile

Seeker promises SKR Staking yields of nearly 24% APY. Source: Solana MobileSimultaneously, the rapid listing of the Token and the large volume facilitated early price determination. Data shows that daily volume at one point exceeded $140 million – quite high compared to the circulating market Capital at the time. Major exchanges like Coinbase and Kraken have listed this Token , even though their market Capital is only close to $200 million.

These factors caused the supply of Token on the market to be "drained" during the short-term launch period.

However, most of the initial demand came from Airdrop, Staking incentives, and low liquidation , rather than actual revenue growth or Token usage activity.

As the remaining Token continue to be distributed and the inflation rate gradually decreases, selling pressure may reappear.

The launch of Seeker is one of Solana 's boldest attempts to combine physical hardware with Token-based incentive mechanisms.

The question remains whether this model will be able to expand beyond its initial target of small retail investors.