Two major cryptocurrency exchanges, Binance and OKX, are reportedly XEM bringing back Tokenize trading services for US stocks.

This move reflects a strategic shift by exchanges to capitalize on profits from traditional financial markets (TradFi) amidst stagnant crypto volume , forcing them to diversify into real assets (RWAs).

The return of Tokenize stocks?

This marks the return of a product that Binance previously tested but discontinued in 2021 due to legal issues. However, if the service is reopened, exchanges will have a competitive advantage in the nascent and rapidly growing market for Tokenize stocks.

In April 2021, Binance launched equity Token for major companies like Tesla, Microsoft, and Apple, issued by CM-Equity AG (a German brokerage firm), with Binance handling the trading operations.

However, the service was discontinued in July 2021 after facing pressure from regulators such as BaFin (Germany) and the FCA (UK). The regulators argued that it was an unlicensed securities product lacking the necessary prospectuses.

At the time, Binance stated that the reason for ceasing operations was a change in business direction. However, according to some recent reports by The Information, Binance is now considering relaunching the service for users outside the US, in order to avoid SEC scrutiny and create a 24/7 marketplace parallel to the US market.

OKX is reportedly also considering similar products as part of its strategy to expand into the RWA sector . However, neither exchange has made an official confirmation, and information regarding the issuing partner, specific list, or timeline remains unclear.

A Binance spokesperson also stated that exploring the stock Tokenize model is the "natural next step" in connecting TradFi and the crypto market.

Why are crypto exchange looking for US stocks right now?

The crypto market in 2026 is witnessing persistently low volume , forcing exchanges to seek new revenue streams.

“The current volume of BTC remains very low in 2026: The Medium daily volume in January was 2% lower than in December, and 37% lower than in November,” researcher David Lawant recently Chia .

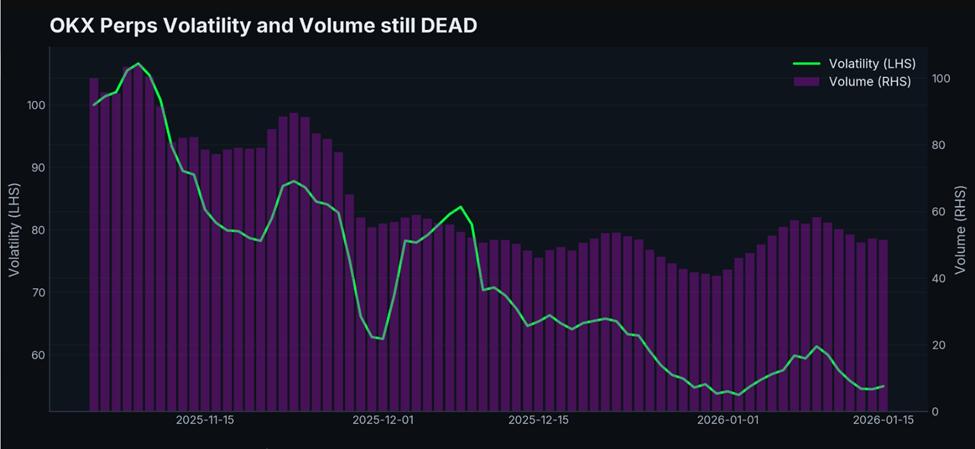

Analysts also noted that the crypto market remained virtually unchanged in January, with volume and volatility remaining at very low levels, similar to the end of December.

Volatility and volume of perpetual contracts on OKX. Source: ApexWhaleNexus on X

Volatility and volume of perpetual contracts on OKX. Source: ApexWhaleNexus on XThis situation is not a period of stable accumulation but rather resembles a " liquidation trap," where the Order Book is too thin, easily increasing risk; just one bad trade can cause significant losses for high-leverage traders.

Meanwhile, US technology stocks like Nvidia, Apple, and Tesla have been continuously surging, attracting crypto investors , especially those holding stablecoins, who want to access the stock market without moving funds out of the ecosystem.

Tokenize stock services allow trading of synthetic assets that mimic day-night stock prices, often backed by custodians or offshore Derivative contracts rather than direct ownership.

Although this market is still small, its growth rate is quite rapid. The total value of Tokenized Stocks is currently around $912 million; data on RWA.xyz shows a 19% increase compared to the previous month. Simultaneously, monthly transfer volume has exceeded $2 billion, and the number of active addresses has also increased significantly.

Indices related to Tokenize stocks. Source: RWA.xyz

Indices related to Tokenize stocks. Source: RWA.xyz“I used to buy NVIDIA shares on Binance Wallet. Actually, the top priority for both exchanges right now should be to launch a precious metals market. Especially silver — besides gold, which is commonly used for storage, other metals don't store value long-term. I'm in China, and even paper silver isn't easy to buy; you can only buy it through ETFs,” one user Chia .

AB Kuai Dong, an expert, also noted that exchanges currently mainly offer spot markets in the form of Futures Contract or third-party Token like PAXG for gold.

Competition is becoming increasingly fierce in the Tokenize asset sector.

This trend is occurring amidst a heating up race to Tokenize real assets. Major players like the NYSE and Nasdaq are now seeking permission to pilot legitimate on-chain stock trading platforms , potentially creating fierce competition with off-chain operating models led by the crypto market.

Robinhood has gained significant market share in the EU (and EEA) region, launching its Tokenize US stock and ETF services from mid-2025. Some notable figures from Robinhood's service include:

- Expand to nearly 2,000 properties with zero commission fees.

- Trading is available 24/5 (gradually transitioning to 24/7 with the planned Layer 2 “Robinhood Chain,” built on Arbitrum), and

- Integrated into a user-friendly application for retail investors.

These points target a young, crypto-savvy user base who want easy access to a wide range of assets. Binance and OKX have the advantage of global scale, a large user base, and a continuously operating crypto infrastructure, allowing them to compete with Robinhood for the leading position in the EU and expand to underserved regions such as Asia and Latin America.

Their crypto-savvy customers are also very willing to embrace Token shares, as this is a natural extension. If implemented, this could spur broader adoption.

This playing field also sees parallel competition between Robinhood and Coinbase , as both are building "all-in-one exchanges" combining stocks, crypto, prediction markets, and other products.

Coinbase recently added features such as commission-free stock trading, prediction markets via Kalshi, and Derivative through its acquisition of Deribit – all moves aimed at Robinhood's strengths in the retail investor market, while Robinhood responded by further developing its crypto services and Tokenize assets overseas.

If Binance and OKX implement this, shares in Token form could become a crucial source of liquidation , attracting Capital back to crypto platforms and linking yields between TradFi and crypto.

However, success depends on global regulation, ensuring liquidation and accuracy in asset tracking, and rebuilding investor confidence after previous outages.