In the past 24 hours, a total of 200,064 people worldwide have been liquidated, with a total liquidation amount of $677 million. Bitcoin and Ethereum experienced a two-day downward trend over the weekend, eroding liquidity, followed by a rapid rebound after another significant drop in volume, resembling a high-leverage double liquidation scenario. Currently, it's advisable to observe market movements closely and familiarize yourself with the trading range before taking any action.

BTC

The expected drop in BTC occurred, with the morning session closing with a lower shadow and a bearish candlestick. The weekly chart also closed with a large bearish candlestick. Given the pressure on the weekly chart, the strategy is to continue shorting on any rebound. We need to re-mark the weekly support and resistance levels: support in the 71,000-78,000 range and resistance in the 90,000-98,000 range.

The 4-hour chart has formed a divergence and oversold condition, making shorting unsuitable for short-term trading. The risk-reward ratio is too low, and short-term upside potential is limited. Excellent long entry points are below 83700, while excellent short entry points are above 91000 and 92000.

ETH

Ethereum (ETH) broke through its support line early this morning, ending its symmetrical triangle consolidation. The decline since January 14th clearly shows a five-wave impulsive wave structure, further indicating the start of a new downtrend. Ethereum may experience a short-term rebound, testing the support line before continuing its decline.

The resistance levels to watch are 2900, 2950, and 3000. Consider shorting around these levels, with targets at 2870, 2780, and 2720.

SUI

SUI is a relatively new coin that emerged in this cycle, and it's actually quite difficult to analyze the bottom of such coins. Therefore, I can only offer my analysis based on my intuition, for reference only.

I believe this bear market can be roughly divided into two halves, and correspondingly, the current bear market will also be divided into two halves. The first half may end in March or April, and the second half is expected to end by the end of the year.

SUI may fall to support level 2 (0.56) in the first half of the session, and then rebound to support level 1. In the second half, it may test support level 3 (0.36). The probability of support level 2 being broken in the first half is not very high, and it is still hard to say whether support level 3 will be broken in the second half.

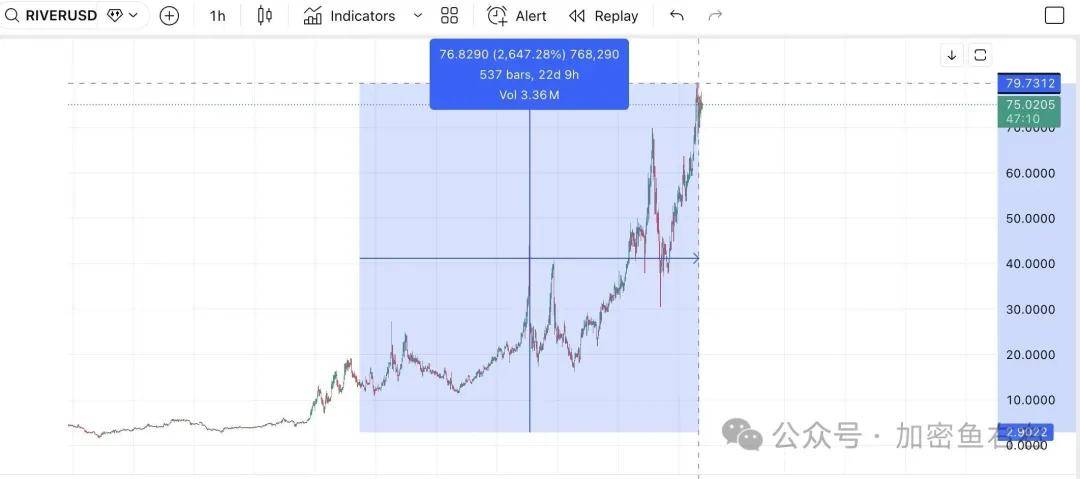

$RIVER

The market has been falling recently. Almost all cryptocurrencies have dropped, but River has been rising against the trend, constantly hitting new highs.

During the pump and dump of $RIVER, the project team maintained a negative fee rate on Binance Futures for an extended period. They could long on the futures market and profit from the fees, using the hourly fee revenue to continue buying and accumulating on-chain spot assets. This way, even without pumping the opposing market, they could slowly whittle down the prices and force the short sellers to surrender.

So I really don't know who would blindly go short now. If you short, you'll lose in the long run. What you need to do now is carefully monitor its funding rates to see if they return to normal levels. If they do, you can try short.

Aircoin

AIR is an air quality visualization platform developed by Vibe Coding, inspired by a woman's own health issues. Its narrative and fundamentals stand out among this group of projects, highlighting its real-world product implementation and social value—a rare "fundamental" project capable of breaking through to mainstream success.

Currently, its market capitalization is very low, at 1.4 million. It has both popularity and appeal, and compared to other projects with market capitalizations of tens of millions, its odds and growth potential seem very attractive.

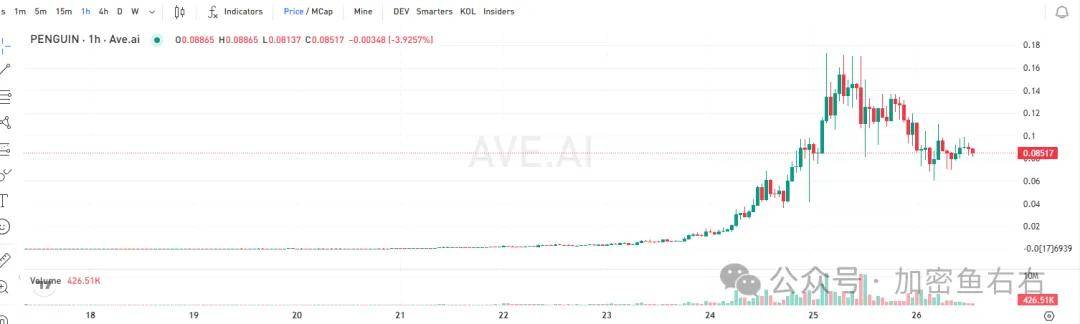

PENGUIN

I'm planning to buy some Penguin shares in batches. Penguin has started to consolidate around a $100 million market capitalization, and it may break through in the next few days. It will be hard to break out unless it reaches $1 billion.

The more you think a leading stock like PENGUIN, which has a super-strong institutional investor, has reached its peak, the higher it will fly. The so-called leading stock is there to drive liquidity, not to adapt to it.

The market is constantly changing, so entry and exit points should be determined based on real-time conditions. Follow the trend after a breakout! No matter how confident you are, please strictly adhere to your stop-loss and take-profit strategies! That's all for today! Follow me so you don't get lost!

For those who are quite confused about the future market strategy, you can follow Tianmeng, WeChat: RFGH8689