Author: zhou, ChainCatcher

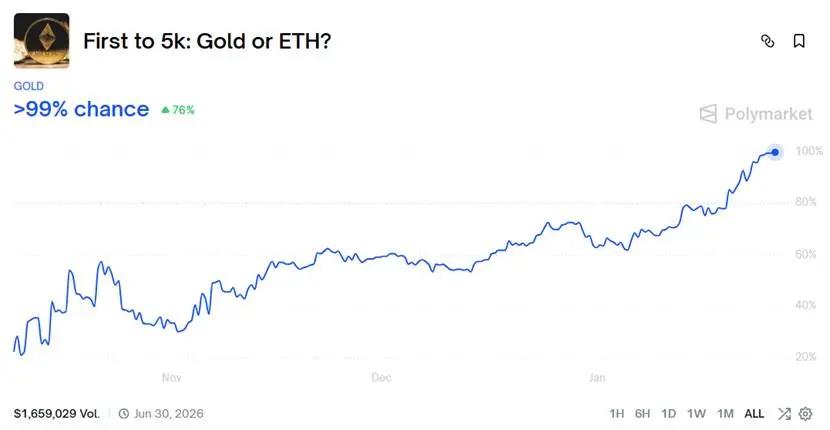

Do you remember that viral prediction event on Polymarket last October?

"First to $ 5,000 : Gold or ETH ? "

At that time, the price of Ethereum once surged to around $ 4,800 , and the market gave it an 80% probability of breaking through $ 5,000 . Many people believed that the golden age of digital currency had arrived.

Three months have passed, and the market has provided its answer today.

On January 26 , spot gold broke through $ 5,100 per ounce, while Ethereum continued to fluctuate between $ 2,800 and $ 3,000 , with the overall crypto market remaining sluggish.

Amid extreme uncertainty in the macroeconomic environment, capital has collectively shifted to the most traditional safe-haven assets, and cryptocurrencies, as highly volatile risk assets, were the first to be sold off.

Gold prices soared, while cryptocurrency market funds voted with their feet.

The rise in gold prices is driven by multiple macroeconomic factors.

First, the signals of hedging against the credit risk of the US dollar are becoming increasingly clear. The Danish academic pension fund Akademiker Pension announced it will liquidate approximately $ 100 million in US Treasury bonds by the end of the month, stating that the decision stems from serious concerns about the US fiscal situation. Sweden's largest private pension fund, Alecta , also disclosed that it has significantly reduced its holdings of US Treasury bonds since the beginning of 2025 , by approximately $ 7.7 billion to $ 8.8 billion. These institutions cite US policy uncertainty and continued debt expansion as the core reasons.

Secondly, geopolitical risks have intensified. Less than a month into 2026 , several major events have already occurred globally, including the US's proposed "forced purchase" of Greenland, the surprise arrest of the Venezuelan president, the imposition of a 25% tariff on countries trading with Iran, and further turmoil within Iran. Coupled with the protracted Russia-Ukraine conflict, geopolitical issues have not eased in the new year but have instead shown signs of deterioration.

Furthermore, inflationary and currency devaluation pressures persist. With the central bank's massive quantitative easing and the monetization of fiscal deficits, the purchasing power of paper money is being continuously diluted. Gold and silver, as hard assets, naturally become the preferred safe havens for capital.

Against this backdrop, institutional views on gold are rapidly turning optimistic. OCBC Bank has raised its year -end gold price target to $ 5,600 per ounce; Goldman Sachs has also significantly revised its forecast, raising its year-end target from $ 4,900 to $ 5,400 .

They emphasize that continued buying by private investors and emerging market central banks is squeezing limited gold supply. Data shows that global central bank net gold purchases will exceed 1,100 tons in 2025 , and are projected to remain at a pace of over 60 tons per month in 2026. Against the backdrop of the Federal Reserve potentially resuming interest rate cuts, gold ETF holdings have also begun to rebound.

In the crypto market, investment enthusiasm for on-chain gold has also reached new heights. According to Coingecko data, the total market capitalization of tokenized gold has now exceeded $ 525 million, and tokenized silver has also set a record. According to Lookonchain monitoring, a whale who lost $ 18.8 million on ETH in a short period is now doubling down on gold. They spent $ 36.04 million to buy 7,536 XAUT tokens at an average price of $ 4,786 , and currently have unrealized profits of $ 2.3 million.

However, the cryptocurrency market presents a completely different picture. Bitcoin has fallen by 30% from its high last year, while Ethereum has dropped by about 40% . Last week, both Bitcoin and Ethereum spot ETFs recorded huge net outflows: the Bitcoin ETF saw a net outflow of $ 1.33 billion (the second-highest weekly outflow in history), and the Ethereum ETF saw a net outflow of $ 611 million.

As of January 20 , the two largest crypto treasury companies had differing returns. Bitcoin treasury company Strategy (MSTR) held a total of 709,715 BTC , with an average cost of $ 75,979 , resulting in a paper profit of $ 10.813 billion. Ethereum treasury company Bitmine (BMNR) held a total of 4,203,036 ETH , with an average cost of $ 3,857 , resulting in a paper loss of $ 3.232 billion.

Market sentiment is clearly bearish. Peter Brandt, a renowned trader and chart analyst who successfully predicted the 2018 Bitcoin crash, stated that the Bitcoin bear market channel has been completed and a sell signal has been issued again. He pointed out that the price of Bitcoin needs to rise to $ 93,000 to offset the sell signal. Bloomberg analysts even believe that Ethereum is more likely to fall below $ 2,000 in the short term than to return to $ 4,000 .

Fund rotation: Is the day when gold stops rising the day when crypto reverses?

However, the downturn in the crypto market is more of a temporary phenomenon resulting from capital rotation. During periods of extreme risk aversion, funds typically flow into assets with zero credit risk, such as US Treasury bonds and gold, before gradually returning to the stock and crypto markets once the risk peak has passed.

The current surge in gold, silver, and some commodities represents a peak in defensive asset allocation. Once gold approaches institutional target prices and momentum weakens, or if there are signs of easing in a major macroeconomic risk, profit-takers may begin seeking the next high-return opportunity. At that time, crypto assets that have undergone deep corrections and significant leverage shakeouts will be the most natural target for buying.

Specifically for Bitcoin and Ethereum, their respective bottoming signals are becoming increasingly clear.

In the Bitcoin market, massive realized losses on-chain are often a classic bottoming pattern. CryptoQuant data shows that Bitcoin's realized losses have reached $ 4.5 billion, the highest level in three years. The last time this occurred, Bitcoin was trading at $ 28,000 after a brief correction of about a year.

On the institutional front, Bitcoin Treasury has continued to increase its BTC holdings through financing programs, especially after MSCI decided not to remove DAT from its index for the time being, and passive funds such as Vanguard Group followed suit by buying MSTR shares. Arthur Hayes publicly stated that his core trading strategy for this quarter is to long on MSTR and Metaplanet .

Ethereum's situation is similar. On one hand, over 36 million ETH are currently staked, representing nearly 30% of the circulating supply, with the exit queue almost zero, demonstrating validators' long-term confidence in the network through their actions. On the other hand, BitMine recently received shareholder approval to increase the cap on the company's stock issuance to enhance future financing flexibility, and it is highly likely that BitMine will continue to increase its Ethereum holdings.

It's worth noting that Polymarket currently rates BlackRock executive Rieder 's probability of succeeding as Federal Reserve Chairman close to 50% , significantly ahead of its competitors. Market analysts suggest that if this happens, his friendly stance towards RWA and the crypto ecosystem will provide a major boost to the crypto market.

However, history has proven time and again that when precious metal prices go crazy, they are completely irrational.

How high can gold prices rise next? Nobody knows. The thing to do now is not to guess where the top is, much less to short it. In an era of overlapping inflation and credit revaluation, it's difficult to pinpoint a peak for gold.

Loyal crypto investors may simply have to patiently wait for a rotation signal to appear. Hopefully, that day will come sooner than we imagine.