Written by: TechFlow TechFlow

On January 14, 2026, USDD's TVL broke through the important $1 billion mark.

This figure may not seem earth-shattering in the context of the $300 billion stablecoin market, but for USDD, it largely signifies that it has begun to sit at the table of core stablecoin players.

TRON has always been a key battleground for the issuance and circulation of stablecoins: according to TRONSCAN data, of the $180 billion issuance scale of USDT, the leading stablecoin, TRON alone accounts for $83.4 billion, with a daily trading volume of about $30 billion and more than 70.69 million holding addresses.

With a large user base, high ecosystem demand, and mature infrastructure, USDD, launched by TRON and designed to cover the decentralized stablecoin market, has long attracted much attention. It is particularly noteworthy that on January 25, 2025, USDD announced the completion of its 2.0 upgrade.

From a technical perspective, this represents a comprehensive breakthrough in the underlying stability, security, and decentralization of stablecoins: from over-collateralization and the Price Stabilization Module (PSM) to decentralized governance, USDD demonstrates its determination to build a model of stablecoins that is trustless, fully decentralized, never frozen, and secure.

When we switch to an ecosystem perspective, we see another model upgrade in USDD: from the initial 20% APY yield subsidy to the current strong and sustainable yield capabilities achieved through multiple measures such as USDD Earn, the yield-generating token sUSDD, deep DeFi integration, and the Smart Allocator yield-sharing program, USDD is rapidly transforming into an yield-generating asset that combines stability and capital efficiency, completing an ecosystem transformation from incentive dependence to real utility.

As we mark the first anniversary of USDD's upgrade, let's delve into the growth story of USDD through data, and at the same time explore a valuable example of the evolution of decentralized stablecoins.

What key metrics did USDD achieve growth over the past year?

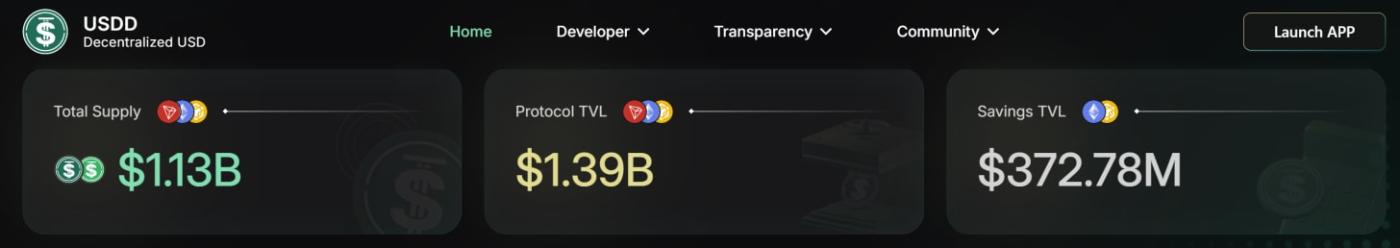

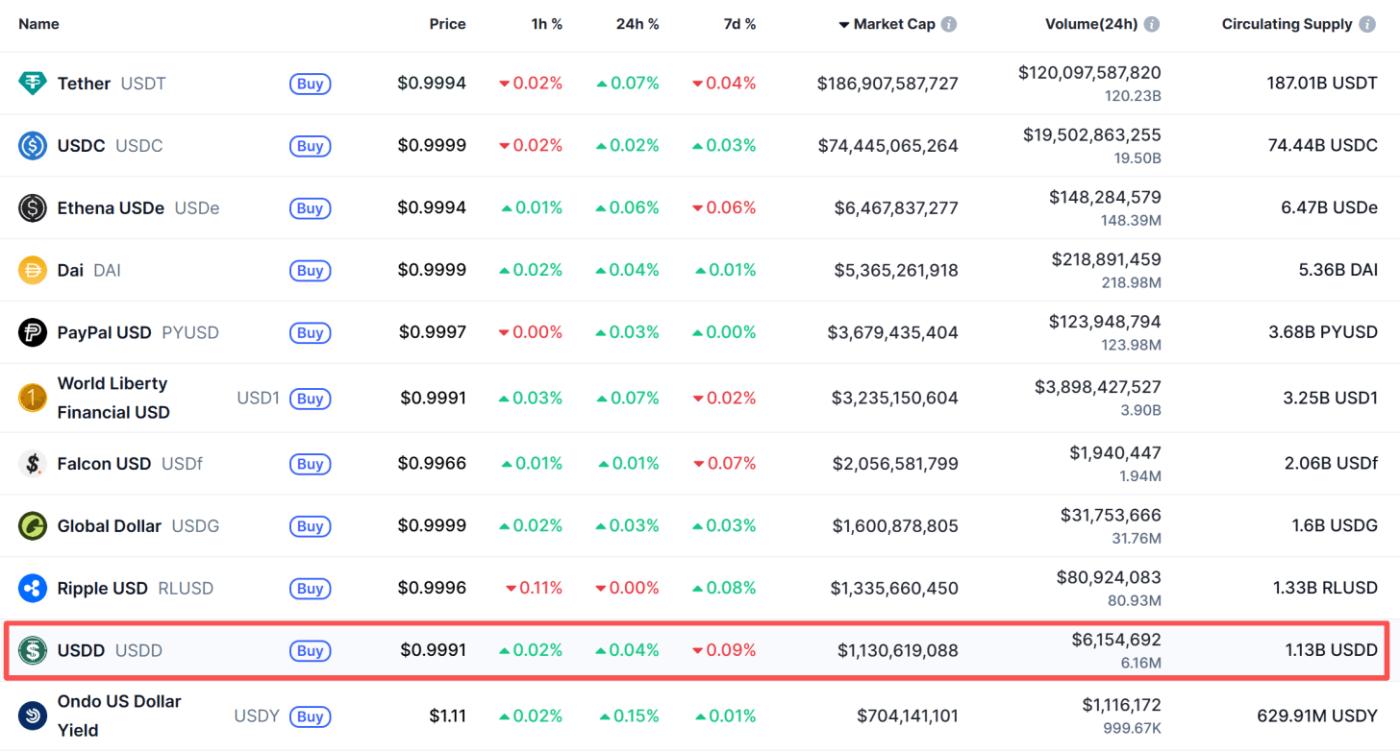

First, there's the breakthrough in TVL. According to official data, USDD TVL has surpassed $1.39 billion, with a supply of 1.13 billion coins. According to CoinMarketCap data, USDD's market capitalization and issuance have both entered the top 10, placing it in the competitive arena of mainstream stablecoins.

However, compared to the size of funds, USDD's data advantage on the user side is more intuitive.

According to CoinMarketCap data, USDD currently has over 462,000 holding addresses. However, a closer look at projects with higher market capitalization and issuance volume than USDD reveals that Ripple USD (RLUSD) has 6,870 holding addresses, Global Dollar (USDG) has 10,370 holding addresses, and PayPal USD (PYUSD) has 100,300 holding addresses, all of which are lower than USDD's 462,000. This further reveals USDD's advantages in user base and distribution efficiency, which is also the core reserve for USDD's future growth.

Behind the impressive data, we also gleaned some equally important information: Over the past year, each period of explosive growth in USDD's data metrics has been accompanied by a gradual transformation on the revenue side.

In February 2025, during the initial phase of the USDD upgrade, with subsidies from TRON, the annualized returns of USDD staking activities in the T1 phase and Huobi HTX USDD earning products reached as high as 20%, prompting the USDD supply to exceed 100 million within two weeks, achieving rapid launch.

In June 2025, USDD launched Smart Allocator, which uses idle reserves to earn real yield to give back to users. To date, Smart Allocator has generated over $9 million in returns.

In September 2025, USDD officially launched its multi-chain deployment, natively deploying to multiple mainstream blockchains such as Ethereum and BNB Chain, significantly improving cross-chain liquidity and user reach efficiency.

In October 2025, USDD launched sUSDD, further opening up new avenues for interest-bearing scenarios. As an interest-bearing version of USDD, sUSDD offers an annualized return of approximately 12%, and its TVL (total value added) surged to $300 million in just over two months after its launch.

In December 2025, USDD continued to expand its ecosystem partnerships, collaborating with leading exchanges, wallets, and DeFi protocols, including Binance Wallet, significantly broadening its user reach and helping USDD TVL break through the key resistance level of $1 billion TVL.

At this point, it might be easier to understand why these data support the claim that USDD is becoming a strong competitor in the highly competitive stablecoin market:

From a static store of value to a dynamic interest-bearing asset, from relying on subsidies to achieving real yield from the protocol, USDD is striving to wean itself off "subsidy dependence" and gradually learn to "generate its own revenue" this year.

This growth, driven by asset function upgrades and development model evolution, is primarily supported by the strong backing of upgrades in the underlying technical architecture.

The business of stablecoins is essentially a philosophy of trust.

Why would users exchange real money for stablecoins? The key points mostly revolve around: stability, security, and returns.

Before the upgrade, USDDOLD had flaws in these three dimensions to varying degrees because it relied heavily on the "paternalistic management" of the TRON DAO Reserve:

Under the hybrid algorithm + centralized reserve support model, the minting of USDDOLD is completed by TRON DAO Reserve and its whitelisted institutions. The anchoring relies on supply adjustment, arbitrage incentives and excess reserve buffers under the leadership of TRON DAO Reserve. It has a high degree of centralization, low transparency and additional risk of de-anchoring under extreme market conditions.

At the same time, for a long time, USDDOLD users' earnings have relied heavily on subsidies from TRON DAO reserves, which is not a sustainable solution.

The USDD 2.0 upgrade in early 2025 is intended to end this situation.

A fundamental change is that USDD has been upgraded from a hybrid algorithmic stablecoin to an overcollateralized stablecoin. All issued USDD is backed by more than 100% assets, and insufficient collateralization will trigger liquidation. Simultaneously, the upgraded USDD also allows for minting rights, enabling any user to deposit assets into Vaults to mint USDD.

Along with the shift in the stablecoin model comes a series of upgrades to supporting mechanisms:

In pursuit of a more stable price anchor, USDD introduced the PSM module, which allows for seamless, near-zero-fee exchanges between USDD and supported stablecoins. Following support for USDT, USDD's PSM for Ethereum and BNB also supports USDC. This means that when USDD experiences price discrepancies, arbitrageurs will automatically intervene to correct them, further enhancing the stability of stablecoins.

To solidify the foundation of "trustless security," all collateral supporting USDD is publicly available on-chain in the upgraded USDD, allowing for real-time verification. Furthermore, the smart contracts have undergone security audits by third-party auditing firms such as ChainSecurity and CertiK. In addition, USDD is gradually exploring the construction of a comprehensive community-led decentralized DAO governance model.

Once the foundation of "trust" for stablecoins is solidified, the logic of "generating interest and revenue" can operate better: the Smart Allocator, as a key upgrade feature, can deploy the protocol's idle cash reserves to high-quality DeFi protocols that have undergone rigorous screening, earning real yield and giving them all back to the ecosystem. The entire process is transparent on-chain, effectively helping USDD achieve real yield generated within the protocol and gradually break free from its dependence on subsidies.

This chart can help to more intuitively understand this transformation and what changes the USDD upgrade has brought compared to its past form:

Of course, for users, assets need to appreciate in value, and liquidity needs an outlet.

Once USDD has established a foundation of trust, a stable value base, and a sustainable, intrinsically generating revenue framework through upgrades, its growth momentum will focus more on how USDD, as an interest-bearing asset, can be used, combined, and amplified more widely.

The stablecoin sector has no shortage of methodologies for creating "1 dollar," but the real challenge lies in making that 1 dollar more valuable.

Previously, the continuous appreciation of the RMB, leading to the phenomenon that "holding USDT without moving it results in depreciation," served as a vivid example of this viewpoint and also directly revealed a major shortcoming of stablecoins such as USDT:

Essentially, it is a "static dollar," and the holder does not generate any intrinsic income.

What USDD wants to fill is this gap.

As the undisputed leader in the stablecoin market, USDT aims to match USDT in terms of liquidity, global penetration, and usability. However, in terms of returns, USDD aspires to be an advanced, interest-bearing version of USDT.

It allows users to continuously obtain low-risk, stable, and considerable native income without requiring much additional effort.

USDD also has its own set of strategies for creating a "yield-generating version of USDT":

Stake USDD and earn rewards with one click: Through ecosystem partnerships, USDD is leveraging its strengths on both exchanges and DeFi, placing reward entry points in scenarios with high-frequency usage by a large number of users. Users can stake USDD with one click to earn floating annualized returns. Supported platforms include mainstream exchanges such as HTX, Kraken, and Bybit, as well as TRON native DeFi protocols such as JustLend DAO.

sUSDD automatically appreciates, enabling "passive income": Users exchange USDD for sUSDD on Ethereum and BNB Chain at a 1:1 ratio. The value of sUSDD automatically increases over time without manual operation. The returns are directly reflected in the growth of the sUSDD balance. Users only need to perform simple operations and leave the rest to time.

Smart Allocator generates a continuous stream of revenue: it automatically deploys idle USDD cash reserves to highly liquid and reliable DeFi protocols such as Aave, Morpho, JustLend, and Spark to earn interest, platform rewards, and funding fees. All returns will be returned to USDD and sUSDD holders.

Wider DeFi integration and ecosystem collaboration expand the application scenarios : USDD achieves multi-ecosystem penetration through its partner network on the one hand, and creates more income-generating opportunities through integration on the other. Currently, USDD has established partnerships with nearly 30 ecosystem partners, and frequently launches limited-time events with partners to enhance liquidity and usage. For example, participating in USDD-sUSDD liquidity mining on PancakeSwap to share an extra $125,000 in rewards, and participating in Binance Wallet's Yield+ program to share an extra 300,000 USDD in rewards, etc.

As the ecosystem continues to expand, the scenarios for USDD's profitability will become increasingly diverse.

Looking back is not just about paying tribute to the past, but also about calibrating the future.

Having reached the first $1 billion TVL mark and secured its place in the core competition among stablecoins, USDD's next challenge will be:

How can we scale up this proven growth model from 2025 to accommodate even larger amounts of funding and users?

Although there are still many uncertainties ahead, the current direction of USDD is quite clear, and the focus of work in 2026 includes:

On the one hand, we will continue to integrate more DeFi scenarios, introduce richer and more stable yield strategies, consolidate the core narrative of "interest-bearing USDT", and strengthen the yield engine;

On the other hand, we will continue to promote integration with infrastructure, wallets, and exchanges to expand distribution and deepen the user experience.

At the same time, USDD will also focus on community and brand building, and will launch initiatives such as content creation programs, KOL collaborations, and educational projects in the future to enhance its competitive soft power and promote organic growth and deepen user awareness.

Of course, all long-term strategies do not stop at "successful short-term results," but pursue "cross-cycle capabilities":

It took USDD a year to go from 0 to 1 billion to sit at the core of the stablecoin competition.

From 1 billion to 2 billion or even 10 billion, for USDD, perhaps the real game is just beginning.

TechFlow is a community-driven in-depth content platform dedicated to providing valuable information and insightful thinking.

Community:

WeChat Official Account: TechFlow TechFlow

Subscribe to our channel: https://t.me/TechFlowDaily

Telegram: https://t.me/TechFlowPost

Twitter: @TechFlowPost

Add the assistant's WeChat ID to join the WeChat group: blocktheworld

Donate to TechFlow TechFlow and receive blessings and a permanent record.

ETH: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A

BSC: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A