Original title: Your fast money brain will make you lose everything

Original author: @0xPickleCati, crypto trader

BlockBeats Note: This article is an in-depth sharing from crypto trader Pickle Cat. In the Chinese-speaking world, she is more commonly known as "Cucumber Cat." She entered the crypto market at the age of 12 (yes, you read that right, 12 years old), experiencing multiple complete bull and bear cycles. She consistently ranks among the top in real-money trading profits for coin-margined contracts, with accumulated profits exceeding $40 million. Labels such as "Generation Z," "genius," and "female trader" have long accompanied her trading career.

However, this article is not a boastful summary about profits, techniques, or "how to succeed quickly." On the contrary, it is a systematic review of trading, survival, and cognition after experiencing a complete cycle. The core message is simple: Don't let the desire to "make quick money" ruin you. The following is the original text:

Your "get rich quick" mentality is the real culprit preventing you from making big money.

I bought my first Bitcoin in 2013.

As a seasoned investor who has lived to 2026 and experienced over a decade of market cycles, I've seen countless ways this market can destroy and ruin people.

I've discovered that over this long period, there seems to be an undeniable ironclad rule:

That is, in this circle, the definition of "winning" is never how much money you make. Everyone who has been involved in this circle has made money at least once, no matter how novice they are or how small their initial capital; they can become a "genius" for a short time. So what exactly is "winning"? It's making money and being able to hold onto that money many years later.

In other words, if you want to change your fate through the crypto, you must first realize that this is not a competition of "who earns the most" or "who doubles their money the fastest," but a competition of "who survives to the end."

But reality is cruel. Most of the "geniuses" become fuel, and only a small number of people can survive to the next cycle. Among these survivors, those who can truly achieve the snowballing effect of compound interest are extremely rare.

After October 11th, market sentiment returned to the familiar dull period.

That day, I lost many more friends in the crypto whom I thought I could fight alongside for many years. Although this kind of "farewell" has happened countless times, every time I encounter it, I still subconsciously flip through some reflections I have written down over the years.

I think it's time to sort things out. To figure out that ultimate question: what exactly are the qualities that can be replicated to survive in the crypto?

To this end, I also chatted with a few old friends who are still active in the crypto, and that's how this article came about.

This article is my exclusive insight, a labor of love, and it will attempt to explain the following points:

Why are some people able to survive this periodic "sea of blood" while others are defeated and die?

How can you maintain hope when you're suffering terribly in a bear market?

How can you become the person described above?

To fully understand this principle, we must first return to basics and forget what others have told you about this circle.

"The only true wisdom is knowing that you know nothing." — Socrates

The article will briefly explain the history of the crypto and crypto essence. Most newcomers will ignore these elements, because understanding these things is not as satisfying (or painful) as immediately opening a trade and making (or losing) money.

But in my personal experience, it is precisely this overlooked secret that makes people fearless in the face of bull and bear markets, just as philosopher George Santayana said: "He who does not remember the past is doomed to repeat it."

In this article, I will guide you to understand:

I. What exactly triggers a bull crypto, and how do you distinguish between a "market rally" and a "last gasp"? This includes three case studies and a basic set of "judgment criteria" that you can directly apply.

II. What exactly do you need to do to increase your chances of catching the "next big opportunity"?

III. What are the common, replicable traits of those who can survive multiple bloodbath cycles and continue to make money?

If you've ever decentralized your wallet in the crypto, then this article is for you.

I. The real driving force that broke the sideways trend in the crypto

Whenever people ask why the crypto market is stagnant, the answers are almost always the same: A new narrative hasn't emerged yet! Institutions haven't fully entered the market! The technological revolution hasn't happened! It's all the fault of those market makers and KOLs who prey on investors! It's all because so-and-so and so-and-so trading platform/project/company messed things up!

These factors are indeed important, but solving them is never the real reason to end the Crypto Winter.

If you've navigated enough bull and bear markets, you'll see a clear pattern: the resurgence of the crypto market isn't because it's become more like the traditional system, but because it reminds people of the suffocating mess of the old system .

The stagnation in crypto is not due to a lack of innovation, nor is it solely a liquidity issue.

Essentially, it's a failure of collaboration —more precisely, stagnation occurs when all three of the following fail simultaneously:

Capital showed no interest.

• Emotions completely exhausted

The current consensus can no longer explain "why we should care about this circle".

In this situation, the weak prices are not because crypto is "dead," but because there are no new elements that can create synergy among new participants.

This is precisely the root of most people's confusion.

They always believe the next cycle will be triggered by a "better, more groundbreaking" product, feature, or new narrative. But these are merely effects, not causes. The real turning point will only emerge after a deeper level of consensus has been reached.

If you can't see this logic, you'll only continue to be led by the nose by market noise, becoming the easiest prey to be harvested by those manipulators who are manipulating the market.

This is why people are always chasing the "next hot trend," trying to become the ultimate diamond investor, only to find themselves entering the market too late, or worse—buying the most worthless of worthless cryptocurrencies.

If you want to develop a true investment instinct—the kind that allows you to spot opportunities early on, instead of ending up feeling hopelessly lost like a novice investor after every project launches—you first need to learn how to discern:

The difference between consensus and narrative

The truth is, what has pulled the crypto world out of its winter every time is always the same thing: the evolution of consensus.

In this context, "consensus" refers to humanity finding a new way to financialize certain "abstract elements" (such as beliefs, judgment, or identity) through cryptocurrency, and to conduct large-scale collaboration around them.

Please note: consensus is by no means the same as narrative. And this is where the cognitive biases of most people begin.

Narrative is a story shared by everyone.

Consensus is the collective action of everyone.

Narratives are told through words, consensus is built through actions. Events attract attention, consensus retains the crowd.

• Narrative without action → Short-term euphoria

• Only actions without narrative → Evolution of the performance from the audience

When both conditions are met, the true major cycle will begin.

To understand the intricacies of this, you need to take a long-term view and approach it from a broader perspective.

When you quickly go through a brief history of encryption, you will find that:

At the core of all narratives, there is aggregation—and that is consensus.

In 2017, ICOs were the ultimate "organizational" technique of the era. Essentially, it was a coordination mechanism that brought together people who believed in the same story, converging their funds and beliefs in one place.

Basically, it's saying, "I have a PDF and a dream, wanna bet?"

Later, IDO took this "organization" to decentralized trading platforms, turning fundraising into a permissionless, free-play "ritual".

Then came the summer of DeFi in 2020, which brought together "financial labor." We became the back-office staff of that never-closing bank: lending, collateralizing, arbitrage, searching day and night for that 3000% annualized return, praying every night that it wouldn't run away when we woke up.

Then came NFTs in 2021, which brought together not just capital, but also people who resonated with a shared culture, aesthetic, or ideology. At the time, everyone was asking, "Wait, why would I buy an image?" "That's not just an image; it's culture."

Everyone is looking for their own "tribe". Your little picture is your passport, a digital "one of us" badge, which is your ticket to enter advanced group chats and high-end gatherings.

By 2024, in the era of Meme Coin, this trend could no longer be ignored. At this point, people almost stopped caring about the technology. What truly converged were emotions, identity, and collective jokes within the community.

What you're buying isn't just a white paper. What you're buying is that phrase, "Those who know, know, and you understand why I'm laughing (or crying) hehe." What you're buying is a "community" that will make you feel less alone when the price of the coin drops by 80%.

Today, we have the era of prediction markets. They no longer aggregate emotions, but rather judgment and shared beliefs about the future. Furthermore, these beliefs have truly achieved borderless flow.

Take the US presidential election as an example, a global event. But if you're not American, you don't have the right to vote. In prediction markets, while you still can't vote, you can bet on your beliefs. At this point, the real shift becomes obvious.

Cryptocurrencies are no longer just about moving money; they are redistributing power over "who has the final say."

With each cycle, new dimensions are incorporated into this larger system: money, faith, financial labor, culture, emotions, judgment, ____? What will be next?

You'll find that every time the crypto space expands beyond its core, it essentially brings people together in a new way. Each stage brings not just more users, but also a new reason for people to stay—that's the key.

The focus has never been on the token itself; the token is merely a topic that brings everyone together so they can participate. What truly flows within this system are the elements that can support increasingly large-scale native consensus.

To put it bluntly: what's actually flowing through that pipeline isn't "money" at all. It's that we, this group of people, are learning how to reach increasingly larger and more complex consensuses without a boss overseeing us.

To understand this more thoroughly, take a look at the following simple "three-fuel model":

Liquidity (macroeconomic risk appetite, dollar liquidity, leverage capacity, etc.) is like oxygen injected into the market; it determines how quickly prices can move.

• Narrative (why people care, how it is interpreted, the common language) attracts attention and determines how many people will look here.

The underlying structure of consensus (common behavior, repetitive actions, decentralized collaboration methods) affects persistence, determining who will truly remain when prices cease to offer returns.

Liquidity may temporarily drive up prices, and narratives may briefly ignite attention, but only the construction of a new consensus can empower people to take win-win actions that go beyond simple buying and selling.

This is precisely why many so-called crypto bull runs often fail to become true bull runs: they have liquidity and weave good stories, but the actual consensus among people remains unchanged.

So how do we distinguish between a "last gasp" and a genuine "consensus upgrade"?

Don't look at the price first—look at the behavior. True consensus upgrades often show similar signals over time, changing the way we get together to "play".

Each time, we start with the behavior, not the price.

If you want to learn to discern for yourself, simply looking at the concepts is useless. You need to review the history of encryption, learn from it, and summarize it. Only then will you have a chance to discover the key points in the next consensus upgrade.

Below are four parts, including three extended case studies that I have compiled, and finally a basic checklist that can be used to identify whether the next consensus upgrade is coming, and how to determine whether the behavior caused by the narrative will truly be retained.

Extended Case Study 1: The Booming Development of ICOs in 2017 VS Early Trials

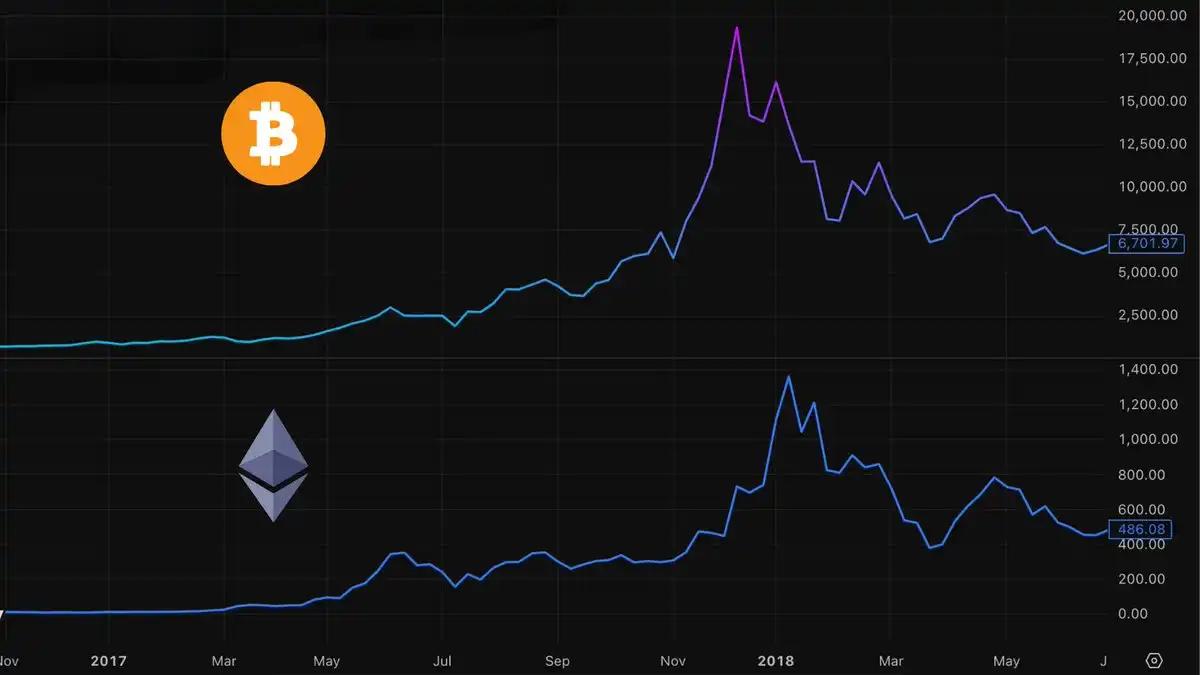

BTC and ETH prices during the ICO boom (mid-2017 - mid-2018)

This marks the first time the crypto world has figured out how to coordinate people and capital on a massive global scale. Billions of dollars are flowing onto the blockchain, not into mature products, but into ideas.

Before this, there were certainly early attempts, such as Mastercoin in 2013 and Ethereum's own crowdfunding in 2014. These attempts were interesting, but remained niche. They had not yet created a behavioral model that could draw everyone into the same orbit and be shared globally.

In the early days of crypto, the gameplay was actually quite simple: mine, trade, hold, and use it to buy things (such as on the dark web).

Of course, there were also many Ponzi schemes that promised "quick riches" at the time, but we didn't have a standardized way to get a group of strangers to bet on the same dream on the blockchain.

The DAO in 2016 was a true "epiphany" moment for crypto. It proved that a group of complete strangers could pool funds using only code. But frankly... the tools were primitive, the technology fragile, and it was ultimately crippled by hackers. The behavioral pattern emerged, but it wasn't sustainable.

Then 2017 arrived, and everything became "mass-producible".

Ethereum and the (now more mature) ERC-20 standard transformed token issuance into a mass production process. Suddenly, the "underlying logic" of the crypto world underwent a revolution:

Financing activities are now fully on-chain, becoming the new normal. White papers have become "investment targets." We traded our "minimum viable product" for a "minimum viable PDF." Telegram has directly become financial infrastructure.

This entirely new "trend" behavior drew in millions and fueled an epic bull market. But more importantly, it permanently reshaped the DNA of the crypto world.

Even after the bubble burst, we never reverted to the "old model." The idea that anyone, anywhere, can crowdfund for a protocol has taken root.

Yes, most ICOs back then were outright scams or Ponzi schemes. This kind of dirty work existed before 2017, and it still exists now in 2026. But the way people collaborate and allocate funds has changed forever; this is what's known as "consensus upgrade."

Extended Case Study 2: The Summer of DeFi in 2020 vs. the Fake Bull Market

BTC and ETH prices during the DeFi Summer (June 2020 - September 2020)

This era also represents a true "consensus upgrade," because even without a dramatic price surge, people are beginning to use crypto assets as "financial instruments." This is a stark contrast to the ICO era—when price increases and user behavior were mutually reinforcing and symbiotic.

Before 2020, aside from the ICO frenzy, the experience in the crypto world was basically "buy, hold, trade, and then pray." (Unless you're a miner... or doing something shady.)

But now, people have gradually developed on-chain muscle memory, forever changing the industry. We've learned:

• Lending: Deposit your crypto assets into the protocol and earn "rent".

• Collateralized borrowing: Gain purchasing power without selling your crypto assets, just like taking out a mortgage on your house.

• Liquidity mining: Move funds to the most profitable areas each week, shifting funds around as needed.

• Become an LP: Put your chips on the table for others to trade, and then take a cut of the transaction fees.

• Revolving mortgage: mortgage, lend, re-mortgage, and re-lend, layering leverage and returns.

• Governance: Actively participate in voting on protocol rules, not just betting on token prices.

During the DeFi summer, even when ETH and BTC traded sideways, the entire ecosystem felt "alive," and its activity level did not depend on a straight price surge.

It shattered the "pure casino" mindset, because for the first time, the crypto world felt like a productive financial system, rather than just a speculative toy.

DeFi projects such as Compound ($COMP), Uniswap ($UNI), Yearn Finance ($YFI), Aave ($AAVE), Curve ($CRV), Synthetix ($SNX), and MakerDAO ($MKR/$DAI) have become "banks of the internet".

Even a radical experiment like SushiSwap is significant. Its "vampire attack" directly drained liquidity from Uniswap, proving that incentive mechanisms can indeed allocate funds like commanding an army.

Then... what followed was a false revival, a false bull market, a "last gasp".

For example, those imitation farms named after food items—Pasta, Spaghetti, Kimchi. They didn't bring any new coordinated behaviors; most were as fleeting as they appeared.

By 2021, DeFi was still vibrant (projects like dYdX and PancakeSwap were growing rapidly), but the era of rampant growth was over, and people had already moved on to the next shining narrative (NFTs).

Looking back from today's (2026) perspective, you'll find that 2020 was the true birth of the "on-chain economy." Almost everything we do now (from airdropping tokens and chasing TVL to Layer 2 incentive programs) follows the same pattern as in 2020. After the DeFi summer, if a new product can't provide users with a substantial reason to "stay on-chain," it's unlikely to make a splash.

Incentives can indeed boost short-term activity, but if these rewards fail to establish a lasting community habit (a new paradigm), the project will quickly become a ghost town the moment the subsidies run out.

Extended Case Study 3: The NFT Era Revolutionizes Social Habits

The prices of BTC and ETH during the NFT craze (early 2021 - mid-2022). 2021 was a "perfect storm": global quantitative easing and the macro liquidity environment, institutional entry, the NFT explosion, DeFi growth, the public chain wars, and more all resonated at the same time, pushing the market to its peak. This case study will focus on NFTs—one of the most influential core catalysts of this cycle.

If the summer of DeFi was the era of geeks buried in studying liquidity curves, then 2021 was the year the crypto world finally gained "personality." We stopped competing purely for yield and began to pursue a sense of atmosphere, identity, and belonging.

For the first time, digital items are no longer just "things" that can be copied and pasted at will. They have verifiable provenance. You're not just "buying a picture," but a digital receipt that says "you are the original owner," with the entire blockchain serving as your witness.

This completely rewrote the social script. People no longer try to outmaneuver each other in calculations, but rather to flaunt their status.

Today, profile pictures have become passports. Owning a CryptoPunk or a BAYC has become a digital "proof of belonging to a social circle." Your profile picture is no longer your cat, but your ticket to enter the "global elite circle."

At this point, a barrier appears. Your wallet becomes your membership card. If you don't have the corresponding assets, you can't access those private Discord channels, attend exclusive parties, or claim your exclusive airdrops.

There's also IP ownership. BAYC granted commercial rights to the holders and successfully expanded the "ownership revolution" beyond its core. Suddenly, strangers began collaborating around their "ape" to develop merchandise, music, and streetwear.

Most importantly, it attracted a large number of "outsiders." Artists, gamers, and creators who didn't care about annualized returns or liquidation mechanisms suddenly found a reason to own a wallet.

Crypto is no longer just about finance. It has become a native cultural layer of the internet.

From the perspective of consensus and habits:

The collection series will replace the liquidity pool.

What replaces the total value locked is the floor price and social capital.

What replaces the benefits is a sense of belonging.

Of course, a "last gasp" also follows...

First, we witnessed a wave of "imitators".

Once the "BAYC" model was proven successful, imitators sprang up like mushrooms. They had stories, but no soul. Countless similar-looking collectible series emerged, basically all "BAYC, but the main character is a hamster," promising fairytale-like development paths. Most of them became worthless, or rather, worthless air with a price.

Then came the frenzy of "brushing orders".

Platforms like LooksRare and X2Y2 attempted to mechanically apply the logic of "DeFi mining" to NFTs, creating so-called "transaction mining." The result was a group of "scientists" engaging in self-dealing and insider trading. The trading volume on the books appeared astonishing, making it seem like the market had recovered, but in reality, it was all bots engaging in wash trading to profit from the loopholes; genuine investors had long since left.

Finally, there's the frenzy of "celebrities making money off others."

Almost every A-list or B-list celebrity has launched a line of products because their agents told them it was a "new money-printing machine." Lacking any real consensus or community behind them, these projects disappear even faster than trending topics on TikTok.

So, what's the lesson here?

Just like the ICO and DeFi summer, the NFT bubble burst. But the behavioral patterns from that era are permanent, lasting long enough to permanently change the industry.

Encryption is no longer just a digital bank; it has become a native cultural layer of the internet. We no longer ask, "Why do we need a JPEG?", but have begun to understand what these actions mean.

For example:

Brands are beginning to shift towards "digital passports" and "Community as a Service" (CaaS).

In this era of AI saturation, provenance has become the standard for digital authenticity.

• The community-first release model has now become the preferred manual for every new consumer startup.

The habit of collaboration has survived, and we have learned to belong to the digital culture, and we will never regress to the era when we were just "users".

Want to hone your "investment acumen"? What can you do?

Now that you've read one-third of this article, I've provided three detailed case studies to demonstrate how to distinguish between a false consensus upgrade (a "last gasp") and a genuine upgrade.

Without exaggeration, I could write hundreds more pages of case studies on Meme coin and prediction markets, but it's better to teach someone how to fish than to give them a fish. So I've left this part of the analysis for you to review and experience on your own.

Furthermore, failed narratives and failed "consensus upgrades" are also worth studying, such as Metaverse 1.0 in 2021-2022 and SocialFi 1.0 in 2023-2024. Although they only left behind the remnants of a "one-off" phenomenon and did not immediately reshape behavioral habits, this does not mean their end. True "consensus upgrades" are rarely achieved overnight. Just as Mastercoin pioneered ICOs in 2013, it remained dormant for several years until it truly exploded and massively changed industry behavior in 2017. Early failures are stepping stones to understanding.

Don't ignore it just because it's "cooled down." The next "consensus upgrade" may be something entirely new, or it may be the revival of "old things" that have failed in the past in "some new form." When such a thing happens, this realization will be a great opportunity for you.

The best way to hone your "investment acumen" is to personally put in the practical effort to conduct research, analysis, and verification.

Ask yourself if you understand what the masses are doing. If you can't observe the changes in behavior, then you can't detect the shifts in the tide.

Before concluding Part 1, I've also prepared a basic checklist to help identify whether the next consensus upgrade is imminent. I call it "5 Questions for Investors to Protect Themselves":

1. Were there any "outsiders" present?

A group of participants has emerged whose primary purpose is not to make money; the people you see are no longer just there to speculate on cryptocurrencies. They are creators, builders, or people seeking identity. If the room only contains traders, then the room is essentially empty.

(If you're a trader reading this—well, I am too. You and I both know that PvP alone isn't enough to make this game work.)

2. Can it pass the "excitation decay" test?

Observe what happens when the rewards dry up or prices plateau. If people stay, it means a habit has been formed. If they disappear as soon as the "free lunch" stops, then you're just dealing with a pile of air with price tags.

3. Are they choosing "daily habits" rather than "positions"?

Beginners only look at candlestick charts, while experts observe what people do every day. If they develop daily habits around this system, it's a permanent upgrade.

4. Does the phenomenon of "behavior > experience" exist?

The real transformation happens when tools are still primitive, fragmented, and inefficient. If people are willing to tolerate a poor user interface to participate, then that behavior is "effective." By the time applications become smooth and sophisticated, it's too late.

5. (The most important point!!) Does "powered by love" exist?

This is crucial. The shift is complete when people start defending a system because it forms part of their identity, and not just because they'll lose money.

Therefore, if you only focus on price and endlessly fantasize about aggressively buy the dips at a certain price, you are likely to be the reason why you always "sell the big trend too early," "can't hold on," "always have a mental breakdown," and "can't sleep when you have a position." The reason why a huge green candle appears is because the behavior pattern has already changed several months ago.

Prices are a result of this shift; prices are merely a lagging indicator that finally acknowledges that the world has moved forward.

II. If you can't increase your wealth by 1000, at least increase your knowledge by 10x.

I know what you're thinking right now.

"Okay, I understand the underlying logic now—behavioral changes, collaborative upgrades, and so on. Theoretically, I know what to look for. But when the next consensus upgrade actually happens, chaos and opportunity coexist... So, which things can actually increase 1000 times? More importantly, how can I discover these things early enough to buy them aggressively?"

To be honest, this is the real world, not a fantasy novel, and this question alone is invaluable.

If someone is confident enough to look you in the eye and give you a "5-step wealth secret" they've somehow gotten their hands on, they either want you to help them out so they can help you, or they want you to spend tens of thousands of dollars on their "secret little lessons."

Why do I say that? Because every new cycle is a completely new game of coordination.

You can't expect to use the script from the 2020 DeFi summer and rely on this strategy to predict which meme coins will explode in 2024/2025. Even if you're a top meme hunter today, there's no guarantee that your approach will make you a market savior in 2026.

"Path dependence" has harmed so many people.

(However, nothing is absolute. As long as your last name is Trump, then... you're right, after all, you're both masters of charting. Congratulations on being unparalleled in both fields.)

No one can predict the future, but at the very least, we can lay a solid foundation and build a basic framework so that when a real opportunity comes, we can understand and learn it 10 times faster than others.

Having your own framework doesn't guarantee you'll earn more than in the last round, but it gives you a huge head start compared to newbies who are just there to gamble.

The framework consists of three parts: the underlying logic of the encryption cycle, the encryption knowledge structure, and the value anchoring system.

Part One is now complete. We'll move on to Part Two, which is "What exactly should I learn, and what learning methods are available?"

But a thousand people will have a thousand different interpretations of Hamlet; there is no such thing as "absolute correctness."

Therefore, I have included two of my personal suggestions below.

Recommendation 1: Mengmeng becomes the Conan of the blockchain.

Below is a list of essential basic skills, all of which can be learned 100% online for free. No paid courses or "master" guidance are required. The only things you need to pay for are your determination and time:

First, you need to improve your ability to identify "organized attacks," otherwise you'll always be the one left holding the bag. Learn to skillfully examine wallet history, holding distribution, bundled transactions, and the source and flow of funds, and be able to sniff out any suspicious on-chain activity.

Second, understand market mechanisms to assess potential supply shocks and avoid drastic liquidations. This requires knowing where to find and understand: order book depth, spreads, net inflows/outflows on the trading platform, token unlocking and unlocking schedules, Mcap/TVL ratio, open interest, funding rates, and macroeconomic fund flows, etc.

Third, if you don't want to be devoured alive in the "dark forest," you at least need to know how MEV works, otherwise you won't even know when you're being "sandwiched" (my hard-earned lesson).

If you want to learn more deeply and outpace those around you, you also need to learn to identify fake transactions/volume manipulation/wash trading, arbitrage for points, and "low liquidity/high FDV" traps to the greatest extent possible. If you're participating in airdrops, you need to understand what the anti-Syracist mechanism is.

Another important point is that you should automate some of the tasks related to the information flow, such as various data anomaly alerts, news filtering, narrative filtering, and noise reduction. Now, with Vibe Coding, the basic barrier to entry for all of this has been lowered, and anyone can learn it.

In 2026, almost everyone I know (including those without any CS background) is using homemade tools to filter out junk information and find opportunities. If you're still relying entirely on "manually finding information," that's probably why you're always one step behind.

If you don't invest the determination, time, and effort to build this foundation, you're choosing "hard mode." On a smaller scale, this means you're always a step behind others or miss many opportunities; on a larger scale, it means being scammed, having your money stolen, or being exploited until you finally break down and start learning (or simply give up and quit).

I know, because I've been through the same thing, falling into all sorts of traps, such as being scammed by strangers and "friends," getting caught in various Ponzi schemes, encountering all sorts of bizarre insider trading schemes, backdoor contracts, having my hot wallet stolen, being scammed in over-the-counter trading, and even being victimized by social engineering. And that doesn't even include the three times I was liquidated.

In addition to these "technical" tips, I've also compiled some "social Conan" level tips that you can directly use to avoid being scammed.

Start with the basics: Has the project's official account changed its name more than 10 times? Were its previous accounts associated with any fraudulent or abandoned projects? There are many tools that can check account name change history, so use them. Before investing, verify that the team exists and that the founders and core members have accounts on LinkedIn, GitHub, or other similar platforms.

If they claim to have worked for well-known companies or graduated from prestigious universities, you should verify it. After all, forged Stanford and Berkeley degrees, as well as fake resumes from Meta, Google, and Morgan Stanley, are much more common than people think.

The same applies to claims of "investment from a certain VC," "incubation by," or "partnership with," some "well-known investors" may never have actually provided any funding. Some partners are actually just indirect advisors, yet allow projects to use their logos. This happens far more frequently than you might expect; I've been a victim myself.

In today's AI-driven world, fake interactions are becoming increasingly frequent and harder to detect. Can you spot an abnormal ratio of followers to interactions? Can you identify bot replies or AI-generated chatter on Discord, Telegram, and X?

If you couldn't do any of the above before, at least now you know where to start practicing.

Suggestion 2: Retreat into the world and sincerely cultivate good karma.

To put it simply, you need to know more people. Just like in the "finance circle," "tech circle," or "any circle," connections are your greatest asset.

I could write something like "50 things to look at when researching investment projects," but that would ultimately be a bunch of worthless nonsense. Why do I say that?

Because the true "core information" or alpha, when it still has the advantage of first-hand information, will never be publicly shared.

When a project starts to be heavily promoted by reputable voices in your information feed, you might still make money, but that's no longer the "life-changing 1000x return" you've come to the crypto world to pursue. That "best entry" window has long been welded shut.

This is why, in each cycle, most newcomers full of expectations to strike it rich end up as liquidity and then leave the circle. Because the information they receive is "lagging" news that has been filtered through layer upon layer of private circles.

Therefore, if you don't yet have one (or more) reliable "insider tips," then position management is your only safety net, so you must allocate most of your crypto assets to long-term assets.

Long-term investments don't require as much information asymmetry, nor do they have the agonizing time pressure of short-term trading. They give you breathing room to study public data, and you don't need to be the first to discover patterns. As long as a project survives even 1.5 cycles, you're likely to reap several waves of profits no matter when you enter the market.

At the same time, your long-term goal is to stop being a bystander and start becoming a participant. To do this, you need to have leverage. Aside from your family, the world is based on alliances of interest, and those you admire won't exchange firsthand information with someone who can't offer equivalent value.

You need to become "someone of value" or possess "something of value" in exchange, whether it's expertise, field research, funding, or connections. Nobody is an expert in everything, which is why you can seize this opportunity.

The best approach is to genuinely and enthusiastically immerse yourself in an ecosystem: First, find a job in a project within a field you're interested in, whether you're a developer, operations specialist, or business development professional—"getting started is easier." Working is the fastest way to build a reputation and connect with your target audience.

Of course, having an entry-level web3 job won't give you everything you want right away, but it's a great start.

"But what if I lack experience and can't find a reliable encryption job?"

The good news is that, as of 2026, the crypto industry is still not a "job desert" like traditional finance or tech giants. You don't need an elite degree and two stacks of elite internship experience, or to go through five or six rounds of interviews to get a job.

In this industry, your on-chain experience is your resume. If you have invested a lot of time in experimenting, going All In in, and doing real work, you actually have more relevant experience than most "corporate people" who have switched careers.

What if you don't want to work? Well, you still have two options (which still require a huge amount of effort): If you're super smart and lucky enough to achieve great results on the blockchain, and you're not ready to retire yet, you can "link" that wallet address to your Twitter account. You won't even need to actively socialize; like-minded people will come uninvited. Build a personal brand on X, but the process is arduous and requires personal experience; this isn't a universally applicable suggestion.

There is no free lunch in the world, nor are there reliable shortcuts. 100% effort may not guarantee 100% success, but 100% lack of effort will definitely lead to 100% failure (unless your name is Barron Trump).

III. How to achieve victory through perseverance

Based on personal experience, those who can avoid "swimming naked" during the trough's cycle all share the following two characteristics:

1. They all possess a strong belief independent of price.

2. They have all established multi-dimensional value anchoring systems.

First, we must clarify that belief is not the same as being stubbornly ignorant or blindly believing something because "some big shot" said it.

It's not a case of "no matter what happens in the future, I will never sell it."

True conviction is structural. And structural conviction inherently includes flexibility. You can have tremendous conviction, while also taking profits in stages or adjusting your position sizing.

The key difference is whether you can always and consistently return to this poker table.

You won't leave just because the music stops. The reason you initially came here was never for those red and green candlestick charts; you stayed because of that underlying "why."

Those who can weather economic cycles never ask, "Big shots, is it going up or down today?" They ask, "Even if prices continue to deviate from my views for the next few years, does the underlying logic of this still hold true?"

This difference in thinking led to vastly different results.

The "get rich quick" mentality will not only empty your wallet, but it will also erode your beliefs and destroy your belief system. And rebuilding faith is much more difficult than rebuilding capital.

So what exactly is their "multi-dimensional value system"? And how should you build your own?

First layer: Concept anchoring

Stop focusing solely on candlestick charts and start paying attention to core principles. Ask yourself: What makes this worth holding, even if its price has plummeted?

Think back to the 10 tokens you've traded recently. Now, fast forward two years. Ask yourself: how many of them will still "exist"? And how many will still truly " matter"?

If, when examining a stock, you can't explain why it's worth investing long-term capital in without mentioning "community" or "super bulls going to the moon," then what you have isn't conviction. What you have is just a position.

The second layer: the time dimension.

Most people's behavioral logic is chaotic, and their decisions are easily manipulated by group emotions, as in the following example:

Today, they bought four different Meme coins on a top-secret telegram channel, coins that are supposedly guaranteed to go to the moon.

Tomorrow, they will bet on certain projects on Polymarket because they saw some big names on Twitter shouting out the secrets to wealth.

Suddenly, they disappeared for a while.

Then one day, they suddenly message you privately, inquiring about a certain investment project that's about to be listed on the exchange.

But somehow, they suddenly bought a stock in the privacy sector, without even knowing what that sector was for.

A few days later, they were shouting in the group, "Bull market is coming back quickly!" and "BTC has finished accumulating energy, All In!" They were blindly long on Bitcoin, simply because a news headline said "It will rise to $200,000 next month."

Hey, this isn't strategy, it's just handing your money over to someone else. You might as well lose the Holy Grail for a better chance of winning.

Of course, I've seen people make money doing this, but I've never seen anyone manage to hold onto that money after two months. All they're left with is a glorious past and a 99,999% psychological trauma.

The real problem with these people is that they are easily distracted by noise and lose their own opinions, while also opening up multiple "battlefields" beyond their own capabilities and cognitive scope.

Short-term speculation, medium-term positioning, and long-term investment each require completely different behavioral patterns. Those who can navigate through cycles clearly understand which time dimension each position belongs to and will never allow emotions to spread across dimensions.

They will not negate their long-term beliefs because of short-term price noise, nor will they use long-term narratives to excuse their impulsive short-term operations.

If you're trying to switch from day trading to swing trading, here are some common "self-destructive" mistakes:

1. You tell yourself you're a "long-term investor" now, but you still spend 80% of your time chasing one-off news headlines.

2. Even if you see a negligible 3% pullback that should be within your risk control range, you will still panic.

3. Worst of all, you're still using the mindset of "making quick money in the short term" to allocate your positions and assess risks, causing you to miss out on the major trend again and again.

Anchoring in terms of time breaks the vicious cycle by forcing you to answer an extremely uncomfortable question before clicking "buy": "How long will it take me to admit I'm 'wrong'?"

The third level: Behavior.

You can't just say you "have faith" when things are going well. The real test is when your account is completely wiped out, and when the voice in your head is screaming at you to "do something."

You need to develop a self-questioning framework to predict yourself, rather than the market.

Before entering each trade, you need to go through the following checklist to ensure that your future self won't trip you up in the present:

• When prices drop by x%, do I already have a plan? Am I clear about whether I will remain inactive, reduce my holdings, or exit the market?

Am I the type to let my biases dictate my thinking? During the pullback, am I objectively reassessing my investment logic, or am I subconsciously gathering information just to justify panic selling?

• Am I frequently changing my profit targets? When the price rises by x%, do I become greedy because I "feel it" and keep raising my profit target?

Can I explain my reasons for holding the stock without using the term "popularity"? Besides looking at sentiment and popularity, can I clearly state the reasons behind my holding the stock?

Is this "belief" or "sunk cost"? When a position trades sideways for longer than expected, do I hold onto it because the investment logic still holds true, or because I'm unwilling to admit I'm wrong?

How long is the "recognition time" after I break the rules? When I violate one of my own trading rules, do I immediately realize it and take action, or do I wait until my account is losing a lot of money before I react?

• Am I prone to "revenge trading"? After a loss, do I immediately feel a rush of energy and want to jump into another trade just because "I just lost, so I'm opening another one and I have to make it back"?

The purpose of these questions is not to guess how the candlestick chart will move, but to depict whether your future self will betray your present self when you are under tremendous psychological pressure.

The so-called "behavioral anchors" are essentially pre-processing for stress. Setting actions while calm is to prevent you from acting recklessly when you are desperate.

After all, if you don't have a plan for "playing" trading, then eventually, trading will start "playing" you.

Fourth level: Belief dimension

Have you noticed that the people who "disappear" the fastest are often the loudest ones during a bull market?

"Now is the last chance to buy XX!" "After this, you won't see Bitcoin below 100,000 again!" "Listen to me, eat your fill, eat your fill, and fly high! If you don't buy XX, you're going against the future!"

As prices reversed, these people vanished one by one, their "faith" seemingly never having existed.

This get-rich-quick mentality will not only destroy your investment portfolio through frequent trading, but it will also erode your belief system. And a broken belief system is far more difficult to rebuild than a bank account.

"Quick money always leads to pathetic overdoing. It's human nature, like animals in Africa feeding on carrion." — Charlie Munger

Sadly, most people exhaust their capital at the peak of the euphoria, and by the time the real opportunity (the real bear market) finally arrives, they have no "ammunition" left.

This is a huge joke: the mindset that draws people into the world of crypto and the desire to get rich overnight are precisely the culprits that kill them from acquiring wealth.

Most people don't even realize what they've lost until years later when Bitcoin surges again, at which point they regretfully ask, "Why couldn't I have weathered that setback? I should have held on."

That's why faith is the most important layer: it's a belief that takes many years to form.

How can you test if your belief is strong enough?

Try this: If someone were to vehemently question your position right now, could you calmly defend it? Can you confront sharp questions head-on instead of avoiding them?

Your beliefs should be extremely subjective and unique.

For some, it's the spirit of cypherpunk: a radical rebellion against regulation and centralized control. For them, crypto is not just an investment, but a glimmer of hope to escape a broken system.

For others, it is another iteration in monetary history : they see the cyclical nature of fiat currency devaluation and financial plunder, and recognize that crypto is the only hedge against traditional systems that collapse in similar ways every century.

For some believers, it is sovereignty, neutrality, or the right to life.

You must find your own "why," not just adopt the ideas of some KOL . I can't tell you what your unique beliefs should be, but I can share mine.

Last year, when I only had 2,000 followers and nobody cared what I said, I wrote a post answering a simple question: Why, after all these crashes and to-zero levels, do I still buy Bitcoin? I call it: "The Fourth Covenant Between God and Mankind."

The three greatest contracts in human history all share a fatal flaw: they were never made for everyone.

The first is the Old Testament, which is bound by blood ties, and ownership is determined before you are born. If you do not belong to the chosen bloodline, you have never been entitled to it.

The second is the New Testament, which talks about love and redemption for all people, but history reveals the truth that words try to conceal: if you were a poor Asian peasant in the 17th century, you would never have the chance to step into a cathedral in your life. The empire would keep you out of the door, and only race, power, and class determined who was worthy of being redeemed.

The third document is the Declaration of Independence, which is the birthplace of the modern world. It promises freedom, equality, and opportunity, but only if you are born in the right land, hold the right passport, and are in the right system.

Of course, "freedom of movement" does exist in a sense, but for most people the cost is too high and the probability is slim. These rules seem to have never been written for ordinary people.

Most people never even reach the starting line; they have to spend their entire lives proving they "deserve," using money, education, obedience, or luck, begging the system to let them "belong" layer by layer.

Now, a fourth contract has emerged: Bitcoin.

This is the first system in human history that doesn't ask who you are.

It doesn't care about your race. It doesn't care about your nationality. It doesn't care what language you speak or where you were born.

There are no priests, no political system, no national borders, and no permission is required, all you need is a private key .

You don't need to be chosen, you don't need to have connections, you don't need to be approved, you don't need to prove yourself to Bitcoin. You either understand it or you don't.

This system doesn't promise you comfort, safety, or guaranteed success; it only offers something that humanity has never truly had before: allowing everyone to face the same rules and have the same access rights at the same time .

For me, this is not an investment argument, not a trade, and not a gamble. This belief is the only reason I have been able to sit still through the ups and downs of the market, endure years of silence, doubt, ridicule, and despair, and still hold on.

If you've patiently read this far...

Congratulations, you have obtained the blueprint for "Survivor".

You learned how to identify "consensus upgrades," you learned how to use the "investigator's toolkit" to improve the success rate of early entrants, and you also learned what elements are needed to build faith and maintain composure.

However, I must honestly tell you : the Tao follows nature, and so it is. No matter how advanced your tools are, if you cannot control the person using them, then it will always be a case of great force leading to a flying brick.

Everything I'm sharing stems from the countless mistakes, lessons, and deep scars I've experienced during my 13 years navigating the market. These fragmented reflections I've written also originate from late-night conversations with friends who, like me, have survived the battlefield.

Flipping through my messy notes, I realized that I had enough material to write a book, with each chapter exploring encryption from a different perspective.

However, these lessons won't make you a master overnight, just as a "quick money mentality" won't truly make you rich.

I've witnessed the downfall of those "geniuses" in every cycle... Losing money wasn't because they weren't smart or made a bad move, but because they all had a " mindset focused solely on making quick money ," coupled with an arrogant but fragile sense of self-worth. Meanwhile, those who were still profiting in 2026, and those who preserved their gains and exited unscathed, shared a common understanding: the token itself was never the point .

The key is the sovereign system we are building, and the personal discipline that belongs to it.

Encryption is the cruelest and most honest teacher on this planet : it forces out the demons within you and finds your weakest traits—whether it's greed, impatience, or laziness. Then it charges you a hefty "tuition fee" for it. I think I've already paid my share, haha. My only hope is that this article will save you from paying the same price .

If you actually read this from beginning to end (instead of letting AI summarize it for you), then I truly believe you have the potential to become one of us survivors who have conquered multiple cycles, and you are the kind of person who can truly master the skills list I gave you in Part Two.

I sincerely hope that you can become one of my new "old friends," a comrade-in-arms who can grow together with me in the next cycle, the cycle after that, and in countless cycles to come, and witness together how Bitcoin will completely revolutionize the world.

To my longtime readers: Thank you. It is your kindness and support that has inspired me to recall my past and share these experiences.

The crypto world may often be frustrating, but it is still worth loving and building.

Well then, I'll take my leave now, and we'll see each other again at the next "consensus upgrade".