Written by: Lawyer Liu Honglin

introduction

In addition to the daily grind faced by traditional internet entrepreneurs, Web3 entrepreneurs now face a new, "hard mode" challenge: token issuance.

For the uninformed public, the highlight of Web3 projects is listing on a stock exchange, after all, they are now "listed companies." But the bittersweet experience is probably only known to those involved.

As a Web3 entrepreneur issuing tokens, you not only have to be wary of the risk of being identified as illegally issuing securities by regulatory authorities and of compliance operations such as setting up overseas project structures and foundations, but you also have to be careful of being scammed by the exchanges that list your tokens.

It's an industry norm for on-chain meme to list on DEXs (Democratic Exchanges) and legitimate projects on CEXs (Consolidated Exchanges). Cryptocurrency exchanges have become the first choice for many entrepreneurs to issue tokens, as they feel it's prestigious. However, what they don't realize is that most cryptocurrency exchanges are just makeshift operations, riddled with bugs and human risks typical of startups. The most common issue is that exchange employees might manipulate token prices through fake trading volumes to exploit project teams and retail investors, making it extremely difficult to guard against.

Mankiw Attorney Liu Honglin will share some insights into the "Dark Forest Theory" within the cryptocurrency exchange industry, drawing on his own observations. He aims to provide psychological support and practical preventative advice for Web3 entrepreneurs preparing to list on exchanges.

Common scams used by exchanges

Contrary to what mainland Chinese people might think, listing on the A-share market is a difficult task. For a Web3 project, listing on cryptocurrency exchanges is not particularly difficult. As long as you have the financial means and are willing to pay the listing fees, you can basically do whatever you want on mainstream exchanges.

In terms of process, firstly, Web3 project teams need to liaise with the listing team of the exchange, fill out and submit a listing application form, and provide a project white paper that introduces the project's goals, technical solutions, team background, market analysis, and token economic model. Secondly, they need to provide a testing and security audit report, as well as a legal opinion issued by a professional lawyer, to confirm the legality and compliance of the token.

In terms of fees, Web3 projects typically need to pay listing fees, which vary from tens of thousands to hundreds of thousands of dollars depending on the exchange. In addition, there are fees for legal opinions and technical audits, with specific costs ranging from several thousand to tens of thousands of dollars depending on the complexity of the service and the provider's pricing. Beyond the basic listing fees, exchanges often use various pretexts to extract more benefits from Web3 projects. For example, they might require projects to provide a certain amount of tokens as market-making margin to ensure liquidity in the crypto market and incentivize exchanges to provide a favorable market environment; or they might offer airdrops or reward platform token holders with promotional activities after listing.

Do you think these overt revenues are all the income of cryptocurrency exchanges? No, there's also covert robbery.

The main reason is that the CEXs (Centralized Exchanges) that trade these decentralized cryptocurrencies are actually just centralized companies. Those familiar with large centralized companies know that they naturally involve issues like data opacity, internal manipulation, and conflicts of interest. As centralized platforms, they possess vast amounts of transaction data and user information, giving them extremely strong market manipulation capabilities. Below are some common market manipulation tactics; you can be sure there's one that will exploit you.

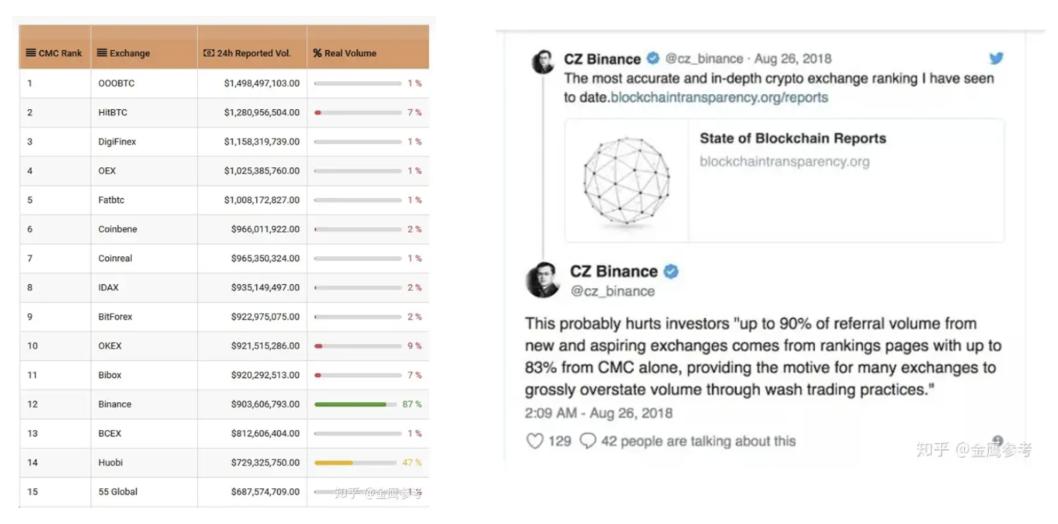

1. Creating Fake Trading Volume: "Excellent" exchanges never just exploit project teams; they also exploit retail investors. The most common method is for exchange employees or affiliates to create fake trading volume through numerous buy and sell orders, attracting more retail investors and thus manipulating token prices. This behavior is commonly known as "volume washing" or "order washing." A previous report by the Blockchain Transparency Institute (BTI) showed that over 80% of the trading volume on the world's top 25 exchanges was created through fake trading. The report pointed out that some exchanges' actual trading volume was less than 1% of their reported volume. Shortly after the report was released, an executive from a leading exchange retweeted and commented: "This is the most accurate and insightful ranking of crypto exchage I've ever seen."

2. Data Manipulation: The saying "my territory, my rules" applies here; exchanges can use their backend permissions to directly modify the trading data of specific projects, influencing the market performance of tokens. For example, they can manipulate key indicators such as candlestick charts and trading volume to mislead investor decisions. This manipulation often occurs during periods of high market volatility to create a false market impression and induce investors to follow suit. Recently, lawyer Honglin noticed a newly listed project whose price was manipulated by a cryptocurrency exchange, with abnormal data for several consecutive days. Many investors suspect this was due to internal trading and data manipulation by the cryptocurrency exchange.

3. Insider Trading: Using undisclosed market information to engage in insider trading for illegal profits. Exchange employees or affiliates gain advance knowledge of significant market trends and engage in pre-emptive buying and selling to reap huge profits. For example, buying or selling tokens in advance of a new token launch or a major announcement. Just this year, the BOME (Book of Meme) project, which achieved the fastest listing on a certain exchange, was suspected by the media of insider trading by exchange employees. Before the exchange issued a statement, an account withdrew approximately $2.3 million worth of SOL from the exchange platform and purchased 314 million BOME at $0.0074. Subsequently, after BOME was listed on the exchange, its price surged by over 1500%. The exchange then launched an internal investigation, stating that it was unrelated to its employees.

4. High-Frequency Trading and Arbitrage: Many exchanges have their own trading teams or market makers who utilize high-frequency trading technology to perform millisecond-level transactions, profiting from minute price differences and accumulating them into arbitrage profits. High-frequency trading typically uses complex algorithms and high-performance computing equipment to complete a large number of transactions in an extremely short time. In 2017, an exchange attracted widespread attention due to a flash crash in Ethereum (ETH). At that time, the price of Ethereum dropped from $319 to $0.10 in a few seconds before quickly rebounding. Subsequent investigations revealed that this was caused by the high-frequency trading algorithm triggering a large number of sell and buy orders during periods of severe market volatility, resulting in extreme price fluctuations.

How should entrepreneurs respond?

When problems arise, looking inward for the cause is a good way for adults to survive. Since external factors are beyond our control, as entrepreneurs, we must be more careful ourselves. Regarding the above risks, Attorney Honglin offers the following advice:

1. Choose reputable exchanges: When selecting an exchange, prioritize those with a good reputation and transparent operations, avoiding emerging or unknown platforms. Entrepreneurs are advised to assess an exchange's credibility by reviewing publicly available audit reports, user reviews, and ratings from third-party evaluation agencies. Furthermore, communicate with other project teams to understand their actual experiences and feedback across different exchanges. Also, try to avoid listing your token on only one exchange, as this makes it easier for that exchange to engage in opaque practices and price manipulation.

2. Sign a detailed listing agreement: When signing a listing agreement with an exchange, the rights and obligations of both parties should be clearly defined, especially clauses regarding data transparency and operational compliance, to protect your own interests. The agreement should include clauses prohibiting fraudulent trading volumes and data manipulation, and stipulate corresponding liabilities for breach of contract. At the same time, request the exchange to provide regular trading data reports to facilitate independent auditing by the project team.

3. Real-time Market Monitoring: Utilize professional market analysis tools to monitor the token's market performance in real time, promptly identify abnormal transactions, and take appropriate measures. Entrepreneurs are advised to use multiple independent data sources for cross-validation to avoid relying on data from a single platform. Additionally, third-party monitoring services can be introduced to provide 24/7 market monitoring and risk alerts.

4. Legal Counsel Involvement: The importance of a good legal compliance advisory team is no less than that of a market maker, a point many token issuance projects fail to realize. Practical advice is that once you're preparing to launch a token, you must hire lawyers with experience in the blockchain and cryptocurrency field to provide professional services. Professional crypto industry legal counsel can assist in handling legal matters related to exchanges, ensuring that all operations comply with legal regulations. They can not only participate in the formulation and review of listing agreements before listing, helping to identify potential legal risks, but also take timely legal action when problems are discovered. More importantly, they can advise on various issues and mitigate unnecessary public relations crises after listing on exchanges.

5. Community Building and User Education: A strong community is key to success. Every successful Web3 project has a solid user base. Strengthening community cohesion and user investment preferences through online and offline events, educational content, and interactive communication is standard practice. When the market is good, community members are quick to support you, but when the market turns bad, verbal abuse, threats, and even police reports become commonplace. Therefore, Attorney Honglin often earnestly advises Web3 entrepreneurs not to make overly confident statements in the community, as this can create problems for themselves. In the event of unexpected events like exchanges or market makers targeting you, it's advisable to promptly share information on official media accounts to prevent user panic.

Summarize

Overall, there are quite a few old hands eyeing to profit from Web3 entrepreneurs. For us entrepreneurs, besides facing legal and regulatory risks in different countries and regions, we should be even more wary of the pitfalls set by business partners such as cryptocurrency exchanges and market makers. Hopefully, this article will help everyone better understand the stumbling blocks that centralized cryptocurrency exchanges pose to our startup process, recognize these risks, and be more cautious and prepared during token issuance and trading. The road to entrepreneurship is inherently difficult; may everyone avoid these pitfalls and embrace more opportunities and development.