The market rebounded at a crucial juncture, directly reversing the downtrend, and even the consecutive negative days didn't cause the indicators to deteriorate. If we can just weather the last few days of January, the bulls have a good chance of winning. Hold on for the last stretch, and you'll reap huge rewards!

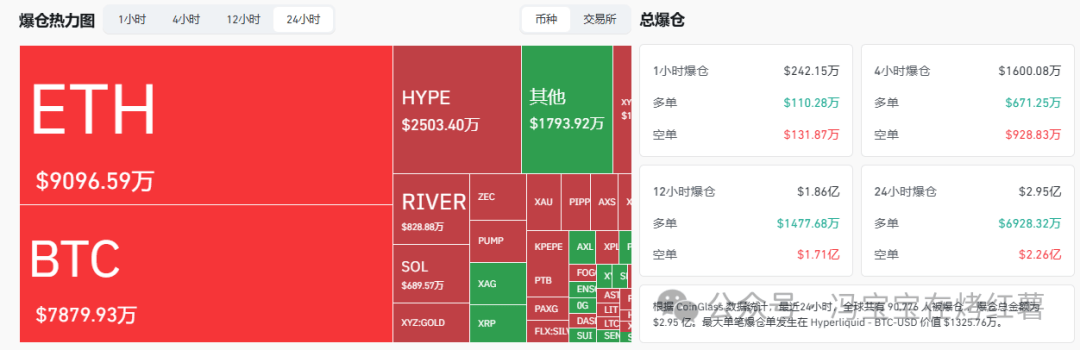

In the past 24 hours, a total of 90,776 people across the network have had their positions liquidated, with a total liquidation amount of $295 million. Long positions were liquidated for $69.2832 million, and short positions were liquidated for $226 million.

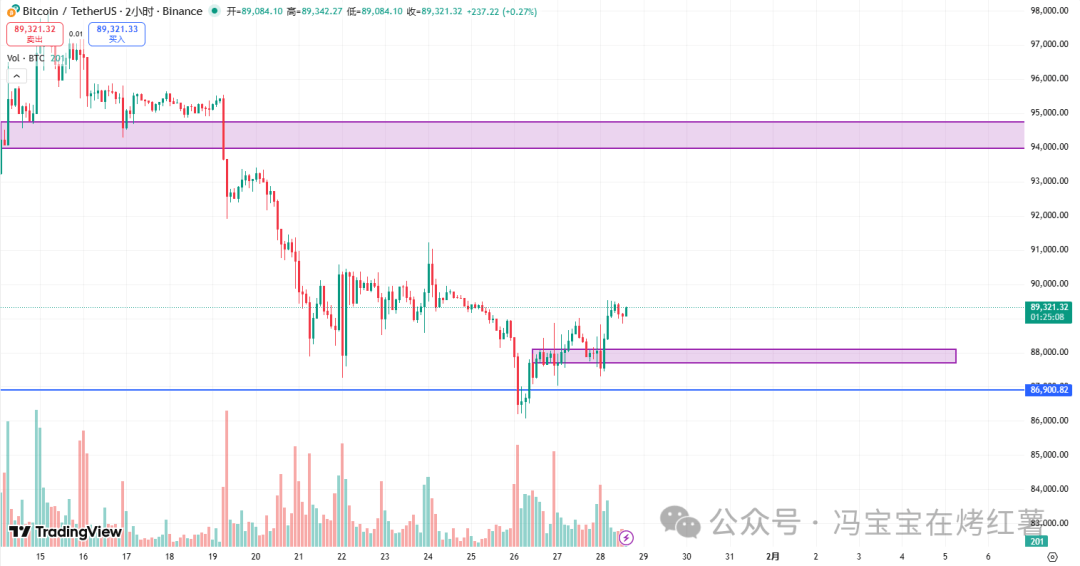

BTC

Bitcoin is currently in a key rebound resistance zone, which is a triple confluence of rising and falling trend lines, a previous important consolidation area, and the 0.382 Fibonacci retracement level. The defense and resistance are extremely strong, and it will be difficult to break through directly and effectively without clear short-term positive news.

If a breakout with significant volume occurs, the price will likely move towards the gap area around 94,000. If it encounters resistance there, it will likely form a short-term high and then fall back. Therefore, rushing to go long or short prematurely is not cost-effective.

Today’s operations:

Yesterday, Bitcoin found support at 87,900, hitting a low of 87,265 before rebounding above 89,000. Today, watch whether the 88,100-87,700 level can act as support again. If it dips, watch for support at 86,900. Resistance is at 90,600.

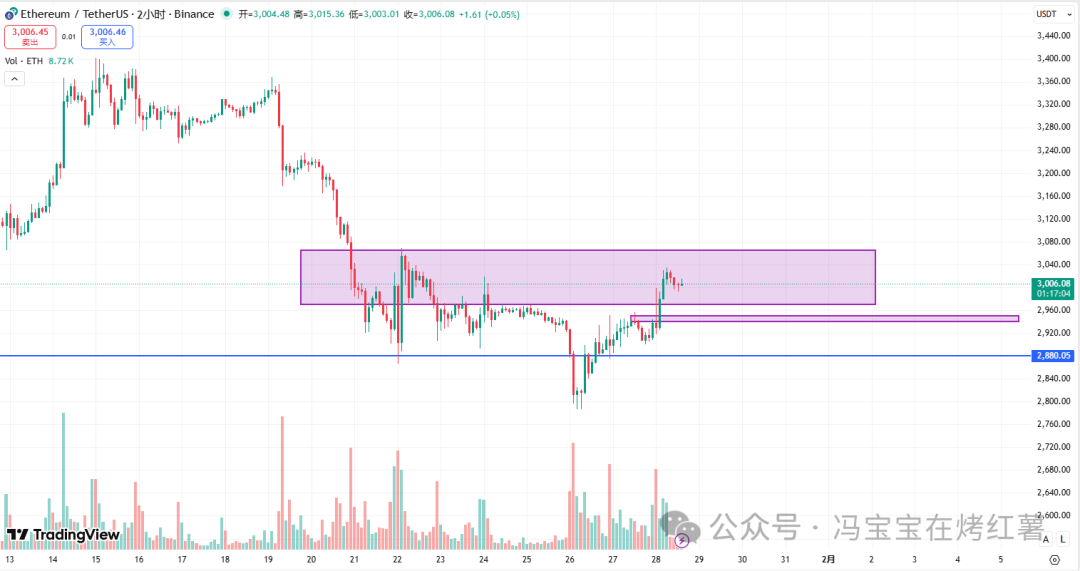

ETH

Ethereum is currently highly correlated with Bitcoin and is approaching a key resistance zone. If it successfully holds above this level, it could have room to fill the gap above and continue its rebound. However, if it encounters resistance, the risk of a synchronized pullback should be noted.

Today’s operations:

Yesterday, Ethereum encountered resistance in the 2970-3065 range and began to pull back. Today, watch for support at 2950-2940, and be aware of support at 2880 if there's a dip. We're still seeing if the first support level can provide further support.

Copycat

Which cryptocurrencies should you invest in in batches during a bear market?

After ten years of formal development in the crypto, the distinctions between crypto representatives such as BTC, ETH, SOL, BNB, XRP, and TRX have become increasingly clear, each with its own market positioning and representing the leader in its respective field.

For many people with large sums of money or those who don't want to get involved in the crypto, investing in these few coins in batches during a bear market is enough, because after a bull market, the returns of these few coins will not outperform 90% of the coins in the market.

Which cryptocurrencies are Binance's top traders and smart money currently bullish on?

Stocks with long positions exceeding 80% include: TUT, TST, HEI, HUMA, SANTOS, ASR, MUBARAK, BANK, ATA, FORM, etc.

Long positions exceeding 75% include: TWT, LTC, UNI, XPL, ZEN, etc.

These are all things you can refer to.

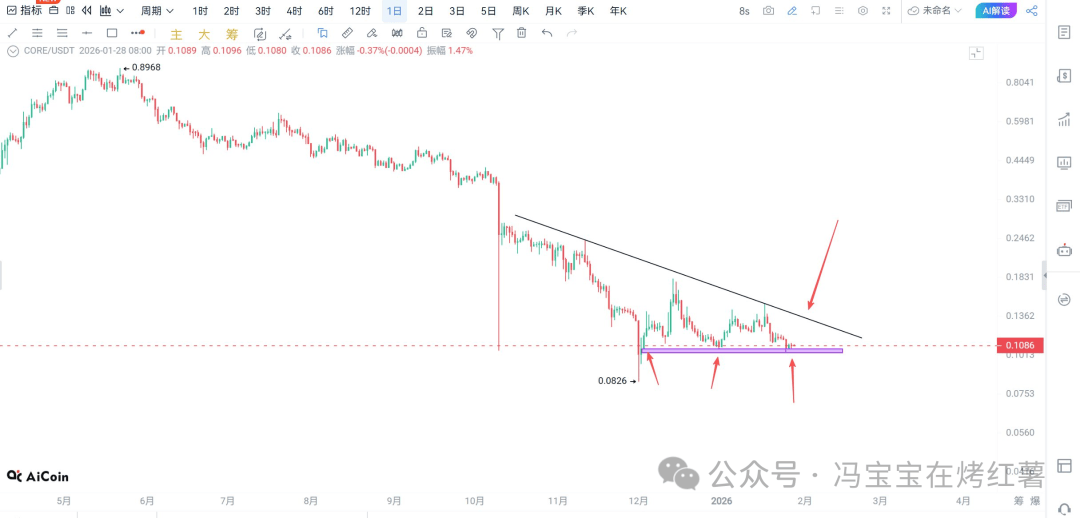

$CORE

In the short term, CORE is showing a converging pattern at this level, with clear support and resistance levels. If it holds and breaks through the resistance level above, the market could rise further.

$UNI

UNI reached strong support on the monthly chart, but the cloud chart didn't fall, consistent with other major cryptocurrencies. The weekly chart hasn't yet formed a bottom and there's still risk. If the daily chart can rally, the weekly chart will likely have completed its bottoming process. It was a leader in the last DeFi cycle, but its large market capitalization and low volatility make it suitable for large-scale investment.

$SUI

In fact, the support and resistance levels of SUI are quite obvious. There is a strong resistance around 2.2, which is not easy to break through. If the support below is broken, it will go even lower. However, the risk-reward ratio of buying at this position is relatively high.

$HYPE

HYPE's surge is a boon to the crypto, validating the narratives of Hip-3 and precious metals, solidifying the value of fundamentally sound projects, and also driving a recovery in the Perpdex sector. $Lit and $Aster have stopped falling, and the crypto is currently lacking a major surge in large-cap tokens. However, given the current high sentiment, chasing the price higher is not advisable; buying on dips is a more prudent approach.

$ASTER

This is beyond what any script could write! Liangxi has lost everything, and ASTER is win big. From earning 100,000 USDT to losing 10,000 USDT! Has Liangxi, the "genius boy," fallen from grace? This ASTER drama has only just begun... Don't forget, ASTER's core logic is similar to Hyperliquid's buyback and burn mechanism.