The US federal government is facing the risk of a partial shutdown, causing caution in the bitcoin market. However, unlike the complete shutdown that lasted 43 days last year, the smaller scale of the upcoming shutdown suggests that the impact on price may be more manageable.

With six out of twelve spending bills already passed and historical data showing that 60% of lockdown crises are resolved at the last minute, the market now appears to be reflecting a scenario of limited disruption.

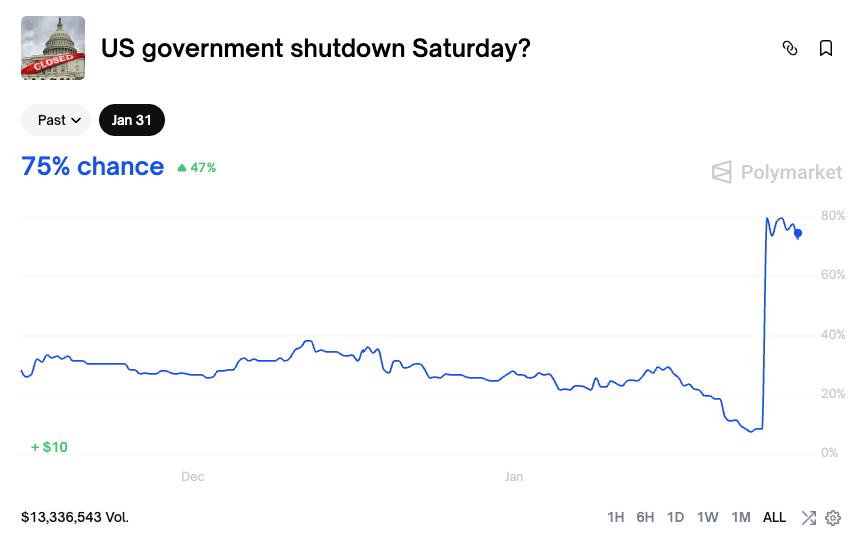

The probability of closing at 75% was set with $13.3 million wagered.

According to the Polymarket prediction platform, the probability of a government shutdown on January 31st was 75% in Asia this morning. Total betting volume exceeded $13.3 million. The main reason is the Democratic Party's opposition to the bill Capital the Department of Homeland Security (DHS).

Senate Minority Leader Chuck Schumer declared, "I will vote against any bill that Capital ICE until the organization is controlled and reformed." If no agreement is reached by midnight on January 30th, several federal agencies will cease operations.

Partial closure: A different scenario than last year.

This shutdown is quite different from the one in October 2025. Back then, all 12 budget bills were blocked, resulting in a record-breaking 43-day government shutdown. This time, however, six spending bills have been signed into law.

According to the Federal Budget Committee, departments such as Agriculture, Veterans Affairs, Commerce, and Energy have secured funding for the entire fiscal year. The Department of Homeland Security (DHS) also currently has approximately $178 billion in reserves from last year's "One Big Beautiful Bill Act," ensuring that the agency's operations will generally not be significantly disrupted.

A market analyst nicknamed “CryptoOracle,” who accurately predicted the shutdown last October, warned that a complete shutdown would severely impact both traditional and digital markets. “The shutdown will drain liquidation first, then the market will recover,” the analyst wrote at the time. “Expect a 30–40% correction in bitcoin — followed by the biggest bull cycle of the decade.” The decline zone the analyst identified was $65,000–$75,000, known as the “fear zone.”

However, CryptoOracle's forecast is based on a scenario of a complete shutdown, similar to what happened in October. With this partial shutdown, market liquidation may not be affected as much as before.

During the complete shutdown last October, the Treasury General Account (TGA) surged to $1 trillion. This drained approximately $700 billion of liquidation from the market. Experts at BitMEX believe this left risky assets "starved of Capital".

This time, half of the spending bills have been passed. The DHS also has $178 billion in reserves. The likelihood of a sharp increase in the TGA and a liquidation tightening like before is likely much lower.

Last-minute deals are still possible.

Historically, government shutdown crises are often resolved at the last minute. According to SGX analysts on X , between 2013 and 2023, only 3 out of 5 shutdowns were true shutdowns — meaning there was a 60% chance of reaching a last-minute agreement.

SGX offered several reasons why a shutdown might be avoided this time: Republicans could separate the DHS budget and pass the remaining bills with a 60-vote threshold; some Democrats might be willing to compromise if the controversial border provisions were removed; and a one-week government shutdown would cost the US economy $4–6 billion and cause a 2–3% market drop—a political risk neither side wants to take.

“Historical patterns + economic pressure + both sides having contingency plans = the possibility of an agreement before January 31, primarily a compromise on DHS,” SGX wrote. “But it’s all still a charade. There are no guarantees.”

Bitcoin holds steady despite market volatility.

Spot bitcoin ETFs recorded net outflows of $1.33 billion in the week ending January 23. However, experts believe the cause stems from multiple factors, including the Federal Reserve's interest rate decision and earnings results from major tech companies, rather than solely concerns about a potential government shutdown.

Bitcoin is currently trading at $89,177 at the time of writing, up 0.9% over the past 24 hours. The price of Bitcoin remains approximately 29% below its all-time high of $126,000 in October.