The US dollar is weakening again, and investors are watching closely. As the dollar index falls to its lowest level in four months, concerns about potential yen intervention are growing.

Historical data shows that a weaker dollar has always helped Bitcoin surge, raising the question of whether this price drop could trigger the next Bitcoin bull run.

The dollar index hit a four-month low as discussions about intervention in the yen intensified.

The US dollar index (DXY) has fallen to around 96.8, its lowest level in nearly four months. This leaves the dollar down more than 15% from its 2022 high, and its weakest recent performance since 2017.

However, experts believe the dollar fell more sharply after the US Federal Reserve (FED) contacted major banks to examine the situation in the Japanese yen market. Such checks are often XEM as an early signal of potential intervention in the foreign exchange market.

Shortly afterward, the dollar fell rapidly against the yen, approaching 154 yen/dollar.

Even Japanese officials have indicated they are prepared to intervene if currency fluctuations become unusual. They confirmed they are in talks with the US administration, which has fueled discussions about possible joint action.

What does a weaker dollar mean for Bitcoin?

Bitcoin typically has an inverse relationship with the US dollar. When the dollar weakens, riskier assets like Bitcoin usually benefit. However, the last time the US dollar index fell sharply in 2017, Bitcoin entered a historic bull run, rising from under $200 to nearly $20,000, a 100% increase.

Today, a similar model is emerging.

Cryptocurrency analyst TED recently highlighted that the correlation between Bitcoin and the Japanese yen is at a record high. This means that if the yen strengthens due to government intervention, Bitcoin could also receive support.

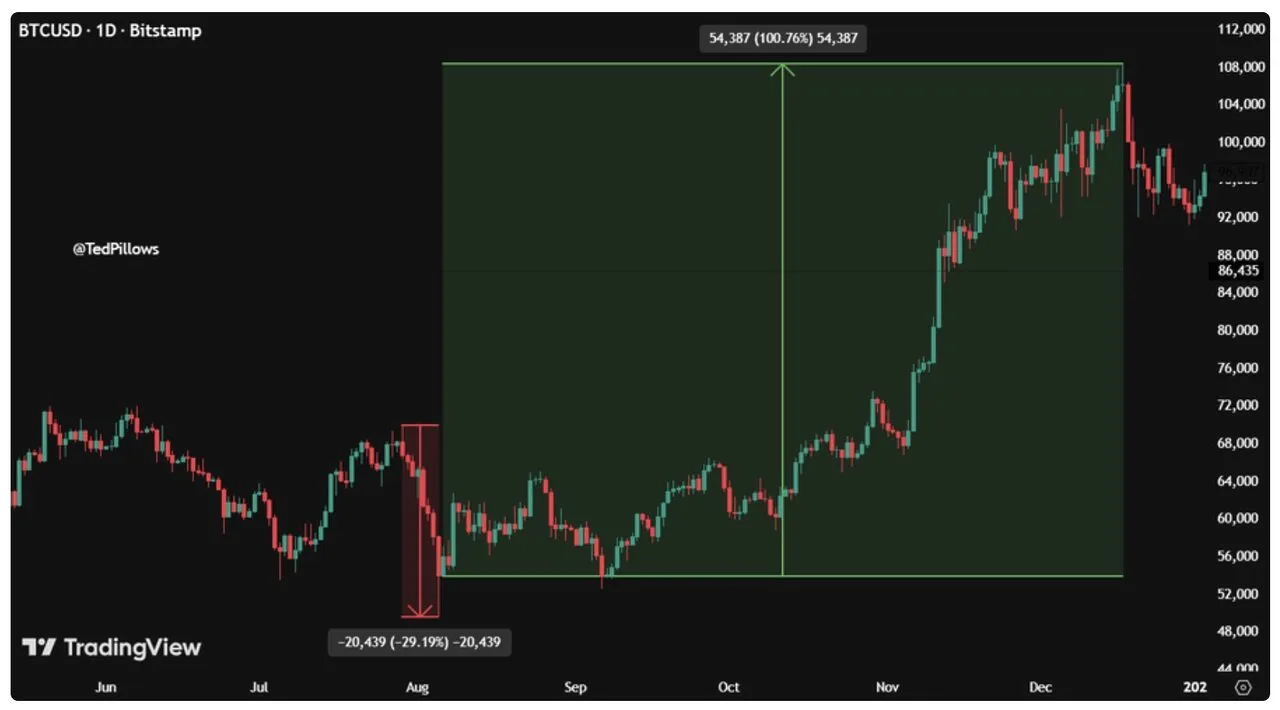

In previous instances of yen-denominated intervention, Bitcoin has often experienced significant volatility, including a 29% drop in a single week followed by a sharp 100% surge that doubled the price in a short period.

Arthur Hayes saw great growth potential in Bitcoin.

Arthur Hayes, co-founder of BitMEX, is still very much He is optimistic if liquidation is restored. He believes that if central banks continue to expand their balance sheets, Bitcoin could rise to $200,000 by March 2026.

From a more optimistic perspective, he believes the $500,000 figure is entirely achievable if global capital flows increase significantly.

Despite increasing speculation, Bitcoin is currently trading at around $87,615, down 1% in the last 24 hours.