And, it's no big deal. Same thing happened in 2011 and 2012 in Europe. The PIIGS (Portugal, Ireland, Italy, Greece, Spain) yields went from 1-8%, all the banks who held the PIIGS debt and corporate debt in those countries were insolvent, and every distressed hedge fund tried to buy this debt at 20 cents on the dollar... BUT.... Banks don't have to mark-to-market, so these losses were never realized. And since global governments bailed out the banks from a liquidity standpoint, everything was fine and these banks never had to sell. Same thing is happening in Japan and the U.S. now. Interest rates are higher, banks are technically insolvent, but as long as the government prints and assumes all of the debt, the consumer and corporate are fine (thus ATH global stock prices). 2008 happened because consumers (via housing) and corporates were way overlevered. The solution was that all of the problems/debt transferred from the consumer and corporates to governments. Consumers and corporate have never been less levered and in better shape, while government balance sheets have never been in worse shape. The solution is just to keep printing, and inflate away your debt problems with growth/inflation. TL/DR -- cash is trash, but the economy ain't gonna crash

Barchart

@Barchart

01-28

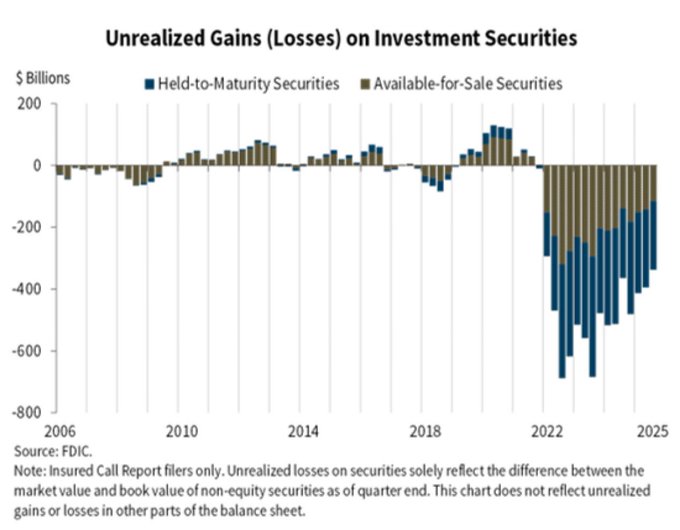

U.S. Banks are now sitting on $337 Billion in unrealized losses

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content