Moonbird began as an NFT project in 2021. However, its direction changed after being acquired by OrangeCap Games in 2025. What direction will Moonbird take?

Key Takeaways

Orange Cap Games announced plans to issue tokens after acquiring Moonbird, expanding its ecosystem.

To attract fans to the Moonbird IP beyond mere speculation, various promotions are being offered, including card games, blind box 2.0, and mobile games.

While Moonbird's IP expansion is expected, a clear plan for utilizing $BIRB is needed.

1. Moonbird to advance into a bigger world

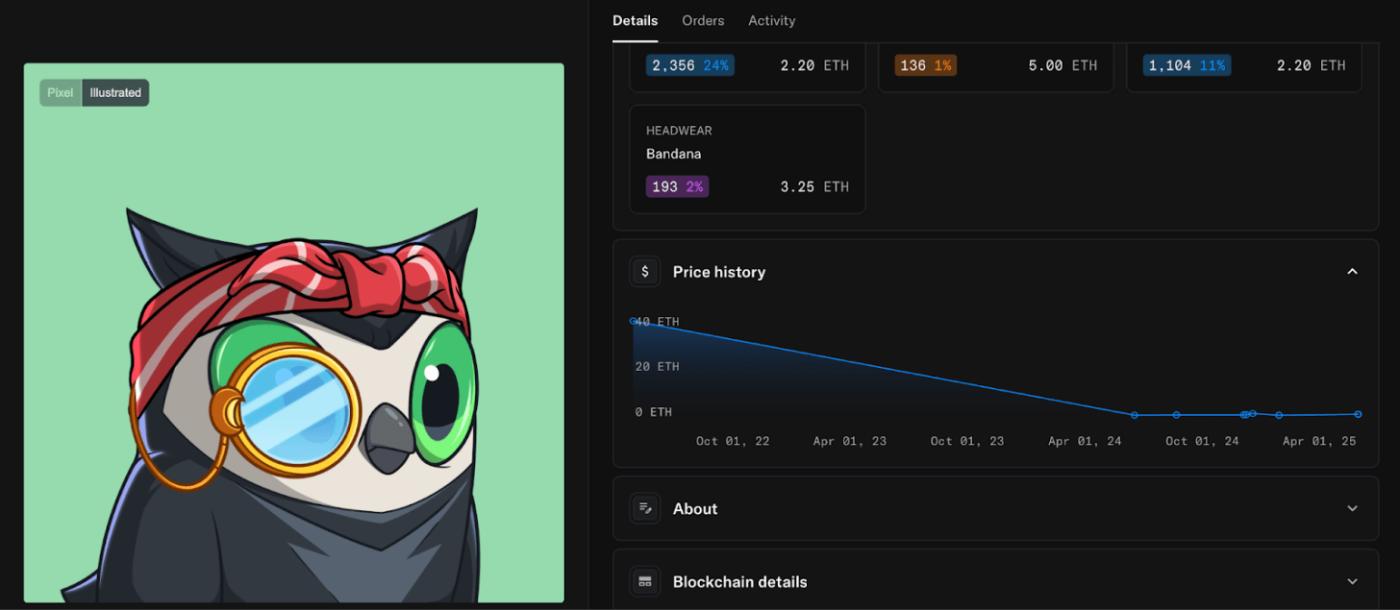

MoonBirds was a popular NFT that traded at 40 ETH in 2021. While the NFT market had been stagnant during the downturn, it has recently gained attention with the announcement of a token launch plan.

But if you're still viewing Moonbird as an NFT itself, you're still stuck in a 2021 perspective. In May 2025, Moonbird entered a new chapter with its acquisition by Orange Cap Games. Orange Cap Games aims to expand beyond simply NFTs into an IP business, centered around Moonbird.

That's why we need to look at the bigger picture, rather than just explaining one Moonbird NFT.

Be the first to discover insights from the Asian Web3 market, read by over 23,000 Web3 market leaders.

2. Moonbird Dreaming of the Next Pop Mart

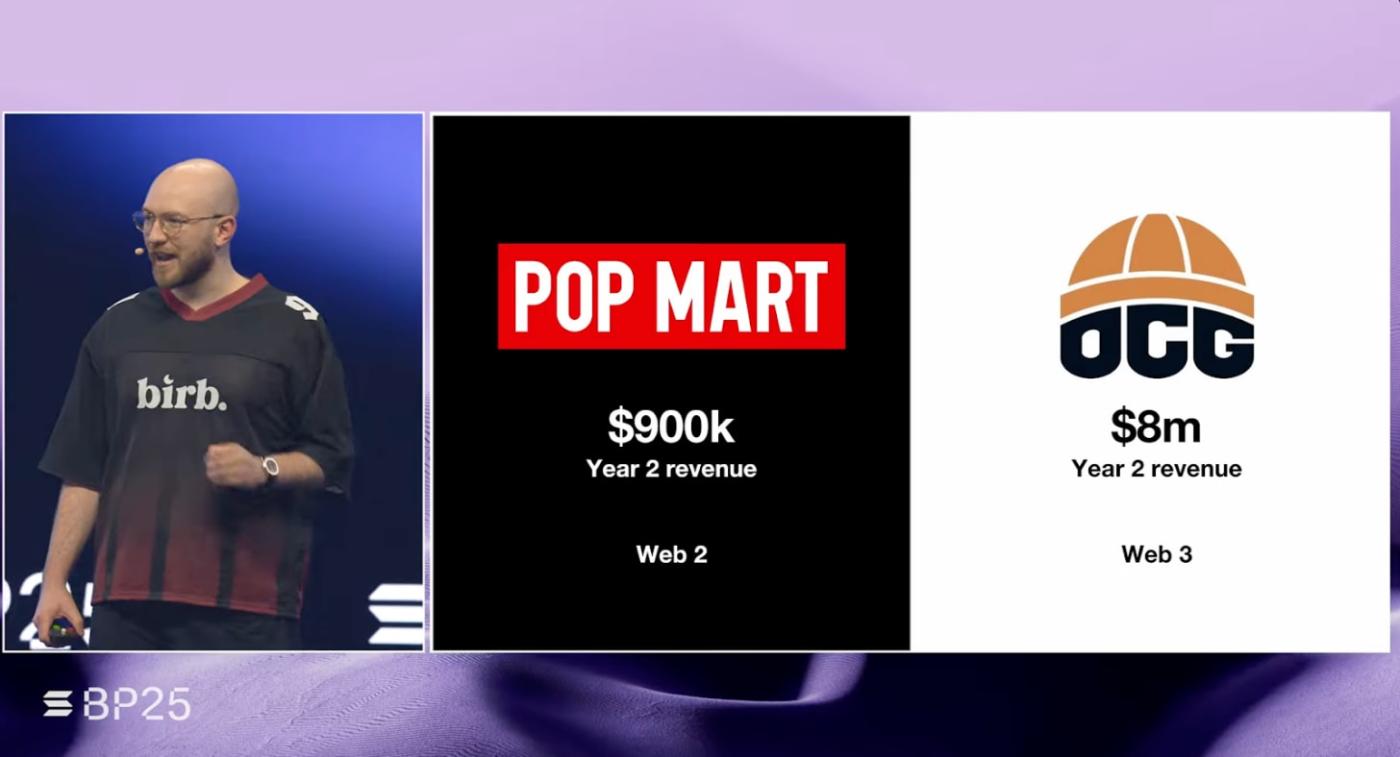

The future that Orange Cap Games dreams of through Moonbird is a ‘second Pop Mart .’

OrangeCap Games CEO Spencer Gordon Sands has expressed his ambition to "become the Popmart of Web3 and grow into a multi-billion dollar company." His career background played a significant role in enabling him to express this ambition.

Having invested early in NFT projects like BAYC, RTFKT, and Cool Cats, he has firsthand experience with how NFTs can grow and fail as IPs. As the largest holder of Pudgy Penguins, he has seen the Puddings appear on TV and enjoyed by the general public, which likely helped him establish his goal of becoming the next Popmart.

As his experience demonstrates, the vision OrangeCap Games envisions for Moonbird is completely different from selling NFTs in the Web3 marketplace. Like Popmart, it aims to secure numerous promising IPs (intellectual property rights) starting with Moonbird and leap forward as an IP-centric comprehensive company.

A prime example of Popmart's success is the character " Labubu ." In fact, Labubu wasn't originally created by Popmart. In 2019, Popmart signed an exclusive contract with a Hong Kong artist and successfully introduced the character to the market.

Popmart isn't simply a reseller reselling other people's products. Like an entertainment agency, they've created their own unique distribution formula through "vertical integration," directly managing every process from artist discovery and IP contracts and development, product planning and manufacturing, and sales through their own channels.

In other words, OrangeCap Games, like PopMart, aims to create a system that delivers multiple IPs through a single distribution layer. Beyond simply producing and selling products, the company is systematically creating a system that can handle any IP, from physical distribution like figures and cards to cultural distribution like offline competitions and digital distribution like games and NFTs.

3. To become a pop mart, you must first make it ‘well’ and then distribute it ‘well’.

These efforts resulted in the card receiving the highest grade of PSA 10 from PSA , the world's largest card grading agency, and immediately led to a collaboration with PSA to issue joint promotional cards.

GTS (Grosnor Trading Solutions) : North America's largest collectibles distributor.

Star City Games : A key distributor of Magic: The Gathering.

Asmodee : The world's third-largest board game and toy distributor

Moonbird products are now available in local hobby shops and toy stores, rather than crypto exchanges. This fulfills the basic requirements for global expansion.

OrangeCap Games now has the basics in place to reach people. The next critical step is ensuring that people continue to stay in their ecosystem after purchasing the product.

4. You must persuade consumers to buy.

Creating a good product and ensuring smooth distribution are necessary, but not sufficient, conditions. What would it take to make people choose Moonbird among the countless character products on display?

The success of Popmart's Labubu isn't simply due to its cute design. Orange Cap Games is deploying a variety of strategies to precisely capture people's emotions.

4.1. Trading Card Games (TCGs): How to Create a New Culture

Cards are both collectibles and part of a "card game." Therefore, for a culture to develop that allows cards to become collectibles, they must first become a "game."

Imagine you're creating a new card game. No matter how beautiful the card illustrations are or how high the manufacturing quality, if people don't play it, it's just a pretty piece of paper.

The problem is how to get people to join a new card game.

This can naturally lead participants, but importantly, it acts as a cognitive shift.

In fact, in 2025, OrangeCap Games is gradually increasing the scale of the tournament by implementing this strategy at the large-scale SCG Con tournament with Vibes TCG.

4.2. Blind Box 2.0: Three Experiences, Not One

People who bought it for toy purposes → found TCG cards → entered the game

People who bought it for TCG purposes → received NFT → experienced on-chain assets

People who bought it for NFT purposes → received a physical toy → entered the offline community.

4.3. Expanding Channels for Creating Everyday Touchpoints: Mobile Games

Buying cards requires money, and collecting figures requires interest. But with free mobile games , you can simply install and try them out. While some may invest time and money to build better decks, the barrier to entry remains the lowest.

Consider Angry Birds. The game was simple, but the characters became engraved in the minds of people around the world. Since then, Angry Birds has expanded into movies, merchandise, and even theme parks. The game itself became the starting point for the spread of IP.

The Moonbird mobile game serves the same purpose. Players become familiar with the characters and immerse themselves in the world as they play. Even those who aren't currently interested in buying cards or figures can experience Moonbird through the game.

This is the basis for what will make you reach for a Moonbird product and say, “Oh, that’s the game character” when you come across it in a store someday.

5. $BIRB to Orange Cap Games

OrangeCap Games has the infrastructure and strategy to scale Moonbird. However, the most important question for investors remains: $BIRB What does the token do?

The team describes $BIRB as a "coordination layer," a means for the token to facilitate cultural diffusion and help memes spread quickly. The strategy is to build a brand rooted in real-world business while leveraging the power of cryptocurrencies.

The problem lies in the specifics. What benefits will token holders receive? Revenue sharing from product sales? NFT-linked membership? There's no clear explanation of these mechanisms.

OrangeCap Games' focus is long-term ecosystem growth. Instead of distributing profits to token holders, it reinvests them in the business. The idea is to create a virtuous cycle where physical products gain attention outside the crypto space, and that attention then flows into the crypto community.

The positive aspect is that this isn't a hastily created project for token issuance. The Vibes TCG generates actual revenue, and then tokens are built on top of that. This approach differs from the insubstantial memecoins.

However, the challenges are clear. It remains to be seen whether the token's "cultural diffusion function" will actually work and whether it will translate into token value. Long-term reinvestment strategies may not be attractive to short-term investors.

It remains to be seen whether Moonbird will achieve Pop Mart-level success. However, the project is an experiment demonstrating how NFT IP can be valued in the real world. $BIRB The specific design of the token and its initial performance will determine the success or failure of this experiment.

Be the first to discover insights from the Asian Web3 market, read by over 23,000 Web3 market leaders.

🐯 More from Tiger Research

Read more about this research.

Disclaimer

This report was partially funded by MoonBirds, but was independently researched and based on reliable sources. However, the conclusions, recommendations, forecasts, estimates, projections, objectives, opinions, and views in this report are based on information current at the time of preparation and are subject to change without notice. Accordingly, we are not responsible for any losses resulting from the use of this report or its contents, and we make no express or implied warranties regarding the accuracy, completeness, or suitability of the information. Furthermore, the opinions of others or organizations may differ from or be inconsistent with those of others. This report is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. Furthermore, any reference to securities or digital assets is for illustrative purposes only and does not constitute investment advice or an offer to provide investment advisory services. This material is not intended for investors or potential investors.

Terms of Usage

Tigersearch supports fair use in its reports. This principle allows for broad use of content for public interest purposes, as long as it doesn't affect commercial value. Under fair use, reports can be used without prior permission. However, when citing Tigersearch reports, 1) "Tigersearch" must be clearly cited as the source, and 2) the Tigersearch logo ( in black and white ) must be included in accordance with Tigersearch's brand guidelines. Republishing materials requires separate consultation. Unauthorized use may result in legal action.