This article is machine translated

Show original

Market Value Revelation: Two Projects, Three Dimensions, A Game of Buybacks

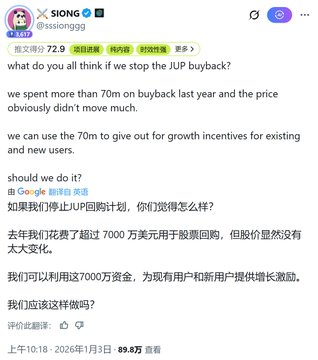

In early January, a tweet from the co-founder of JUP sparked a discussion about token buybacks.

Since January 2025, the project team has begun buying back #JUP, but this has failed to stop the price from falling.

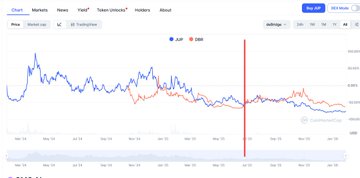

The buyback of #DBR contrasts sharply with JUP's. DBR began its buyback in June 2025, and the effect was immediate.

On one hand, the price rose after the buyback.

On the other hand, a clear dividing line was formed: before the buyback, DBR was weaker than JUP, while after the buyback, DBR was stronger than JUP.

This analysis compares and contrasts the game of token buybacks from three dimensions.

┈┈➤Timing

╰┈✦JUP's buyback started in January 2025.

This clearly coincided with the beginning of a four-year bull market in crypto. However, the reversal was due to Trump.

Trump's tariffs, initiated in 2025, significantly disrupted the macroeconomic environment, triggering a trade war.

Secondly, the tariffs led the Federal Reserve to anticipate inflation, resulting in no interest rate cuts from January to August 2025, and continued balance sheet reduction from January to November. While the degree of liquidity tightening was not high, it still had a negative impact on the speculative market. Most altcoins showed a downward trend in 2025.

╰┈✦DBR buyback starts in June 2025

The DBR buyback will begin after Trump's tariffs and a subsequent easing of tensions between the two sides in the trade war. The US and China began working towards reconciliation in May.

BTC bottomed out in April 2025 and began to rise.

┈┈➤Location Advantage

╰┈✦Jupiter is the leading DEX in the Solana ecosystem

Jupiter is the leading DEX in the Solana ecosystem; this is both its advantage and its limitation.

We know that from November 2025 to Q1 2026, the Solana ecosystem experienced three waves of hype: AI+MEME, AI Agent, and Celebrity MEME. However, after the launch of Trump's token, the overall popularity of the Solana ecosystem has declined.

╰┈✦Debridge is a cross-chain ecosystem

Debridge is a cross-chain ecosystem. For example, during the period of hype surrounding Chinese MEME on the BSC chain, Solana experienced net capital outflows, while the BSC chain saw net capital inflows; Solana's funds flowed to the BSC chain through Debridge.

Therefore, the Debridge ecosystem is not locked to any single public chain, making Debridge's ecosystem and protocol revenue relatively more stable.

Regardless of which ecosystem is popular, funds will flow across chains through Debridge.

┈┈➤JUP and DBR have different buyback ratios

Jupiter uses 50% of its protocol revenue to buy back JUP, while Debridge uses 100% of its protocol revenue to buy back DBR.

Therefore, DBR receives more value support.

┈┈➤JUP and DBR's Buyback Disclosures Differ

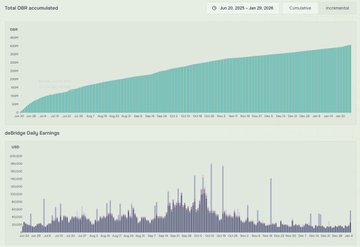

Debridge dynamically discloses protocol revenue and buyback information on its foundation website. Daily protocol revenue and DBR increases from the fund are clearly visible!

You can directly access the foundation website, debridge. See the image above for the foundation profile, or click on "DBR" in the navigation bar on the debridge website to view the site.

The project team has very simply linked the foundation website to "DBR"!

100% buyback + comprehensive dynamic disclosure has won over more people with DBR.

┈┈➤In Conclusion

First, when discussing buybacks, let's not discuss the right or wrong of so-called "market capitalization management."

Next, let's compare the buybacks of JUP and DBR:

First, JUP itself is an excellent project, but its buyback timing was unfortunate, while DBR's buyback timing comprehensively considered the crypto cycle and macroeconomic situation.

Secondly, JUP's buyback is constrained by the rise and fall of the Solana ecosystem; its buyback coincided with a period of low Solana popularity. DBR's buyback, on the other hand, benefits from its broad cross-chain ecosystem, resulting in a more stable effect.

Thirdly, JUP's buyback wasn't thorough enough, while DBR's buyback using 100% of its protocol revenue, coupled with comprehensive and dynamic disclosure, is more likely to win over investors.

I recall @thecryptoskanda discussing buybacks, suggesting their effectiveness is mediocre. However, I believe buybacks are a good remedy for coin prices.

But a 100% buyback is the most potent remedy, and even this potent remedy requires more catalysts.

The timing of the buyback, the stability of the ecosystem itself, how well the buyback resonates with investors, and even its integration with other strategies are all crucial for the buyback to have a significant impact on coin prices.

Well... DBR and Jup plates are too different in size to be really comparable. Repurchase effectiveness isn't about price, but about maintaining sales volume.

Skanda is right, but Jupiter's protocol revenue is also significantly higher than Debrdige's.

If Jupiter could use 100% of its protocol revenue for buybacks and choose a better time to do so, the results would be even better.

This isn't a comparison between Jupiter and Debrdige, but between Jupiter and Jupiter plus a better buyback strategy.

This isn't meant to be praise or criticism, but I think buybacks need to be combined with other strategies.

I originally wanted to quote the post about the plate, but I couldn't find it after searching for a long time. I only remember it being from early January, but I really couldn't find it. So I'm just tagging you here, hope I didn't bother you!

What I mean is that many protocols mistakenly treat tokens like equity, but in reality, all cryptocurrencies operate on a foreign exchange model. They should think like central banks; one-way buybacks are inherently problematic, and there's no such monetary policy.

Agreed. The number of shares is basically fixed if they aren't split, but fiat currency is constantly being issued.

From the central bank's perspective, it's somewhat like the central bank using tools to withdraw base money, but the central bank definitely won't print money and then repurchase it simultaneously. 😆😆😆😆

That's interesting.

OK

learned

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content