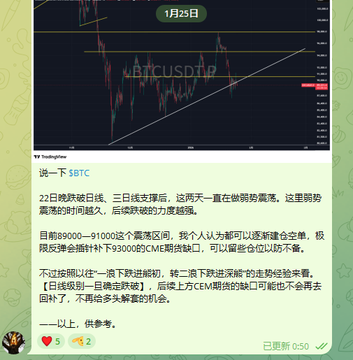

On January 22, after $BTC broke below the daily and 3-day support, I decisively went short and opened my initial position. On January 25, I reminded everyone again in our private group and posted on Twitter as well. At that point, the major trend was already broken—perfect time to start building shorts within the consolidation range, expecting further downside after weak choppy action. Under that tweet and in the market, there was a recurring narrative I never really got: “People say this price action is so obvious, it’s just ‘carving a boat to find a sword’—any fool can see it coming, so this time it’ll be different.” Personally, I don’t buy it. The market doesn’t avoid repeating similar price patterns just because they’ve happened before. It doesn’t care which opinion is the majority, nor does it reward contrarian takes just for being different. To me, *that’s* the real lack of logic and technical substance—pure bias and wishful thinking. And for the record, this isn’t ‘carving a boat to find a sword.’ A break is a break. No guessing, no ego, no stubbornness. Always stay objective and rational, follow and respect the market—it’s always right.

This article is machine translated

Show original

0x桐灿

@0xtongcan

01-25

$BTC

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content