Bitcoin's plunge shocked everyone. This report explores the causes of this plunge and outlines potential recovery scenarios.

Key Takeaways

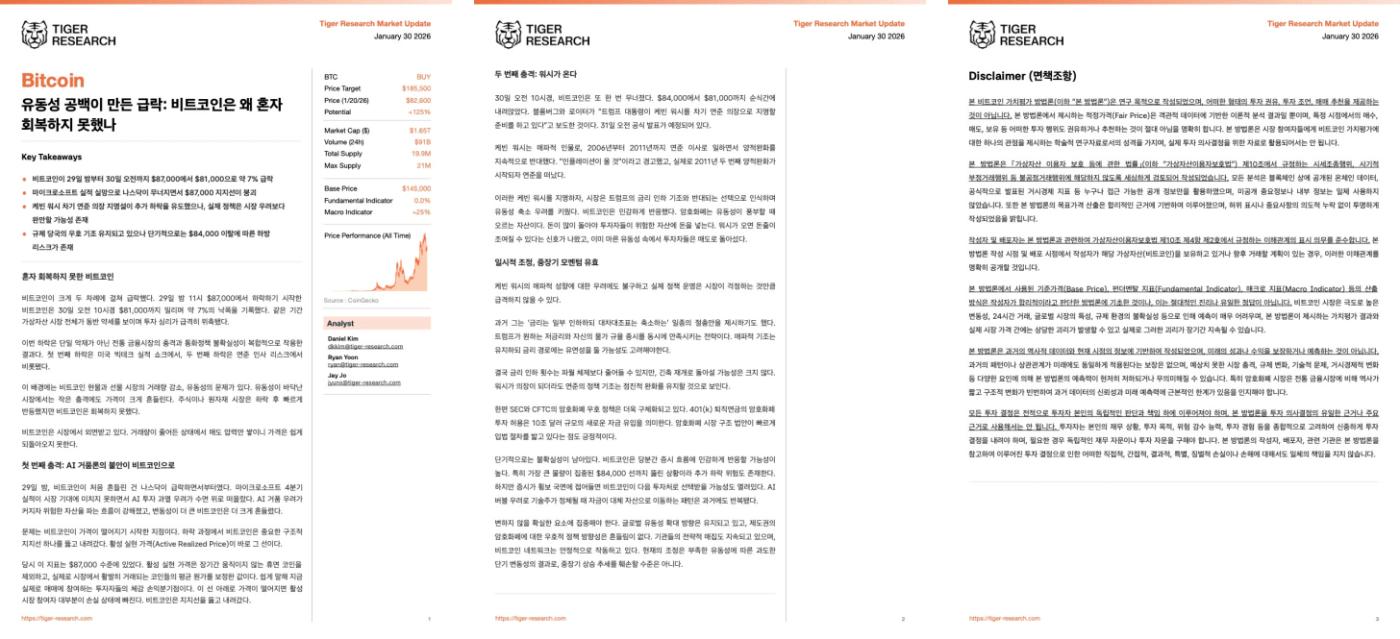

Bitcoin plummeted about 7% from $87,000 to $81,000 from the night of the 29th to the morning of the 30th.

Bitcoin also collapsed below its active real price support level ($87,000) as the Nasdaq collapsed on disappointing Microsoft earnings.

While speculation about Kevin Warsh's nomination as the next Federal Reserve Chairman has fueled further declines, actual policy may be more lenient than market fears.

The U.S. government's cryptocurrency-friendly policy remains intact, and the medium- to long-term upward trend remains valid. However, there is a downside risk in the short term due to a breakout of $84,000.

Bitcoin failed to recover on its own

Bitcoin experienced two major price drops. Beginning its decline from $87,000 at 11:00 PM on the 29th, it fell to $81,000 around 10:00 AM on the 30th, a decline of approximately 7%. During the same period, the entire virtual asset market showed a corresponding decline, sharply dampening investor sentiment.

This decline is not a single negative factor, but rather a result of a combination of shocks to traditional financial markets and monetary policy uncertainty. The first decline stemmed from the earnings shock of US Big Tech companies, and the second stemmed from the Federal Reserve's personnel risks.

This situation stems from declining trading volume and liquidity issues in the Bitcoin spot and futures markets. In markets with dwindling liquidity, even small shocks can cause significant price fluctuations. While stocks and commodity markets quickly rebounded after declines, Bitcoin failed to recover.

Bitcoin is being ignored by the market. With trading volume dwindling and selling pressure mounting, the price is unlikely to recover.

Be the first to discover insights from the Asian Web3 market, read by over 23,000 Web3 market leaders.

First Shock: AI Bubble Anxiety Transforms Bitcoin

On the night of the 29th, Bitcoin first faltered as the Nasdaq plunged. Concerns about overheated AI investments surfaced after Microsoft's fourth-quarter earnings fell short of market expectations. As concerns about an AI bubble grew, selling of risky assets intensified, and Bitcoin, with its greater volatility, slumped even further.

The problem is where Bitcoin's price began to fall. During its decline, Bitcoin broke through a key structural support level: the Active Realized Price (ARP).

At the time, this indicator was at the $87,000 level. The active realized price is the adjusted average cost of coins actively traded in the market, excluding dormant coins that have been inactive for a long time. Simply put, it represents the perceived break-even point for investors currently participating in trading. If the price falls below this line, most active market participants will suffer losses. Bitcoin broke through its support line and fell.

Second Shock: Wash is Coming

At around 10:00 AM on the 30th, Bitcoin crashed again, plummeting from $84,000 to $81,000 in an instant. Bloomberg and Reuters reported that "President Trump is preparing to nominate Kevin Warsh as the next Federal Reserve Chairman." An official announcement is scheduled for the morning of the 31st.

Kevin Warsh, a hawkish figure who served as a Federal Reserve governor from 2006 to 2011, consistently opposed quantitative easing. He warned that "inflation will come," and indeed, he left the Fed in 2011 when the second round of quantitative easing began.

The nomination of Kevin Warsh, perceived by the market as a departure from Trump's interest rate-cutting stance, heightened concerns about liquidity shortages. Bitcoin reacted sensitively. Cryptocurrencies are assets that thrive on abundant liquidity. Investors need a lot of money to invest in riskier assets. Warsh's arrival signaled a tightening of the money supply, and investors, already facing a liquidity crisis, began selling.

Temporary adjustment, mid- to long-term momentum remains valid

Despite concerns about Kevin Warsh's hawkish tendencies, his actual policy implementation may not be as drastic as markets fear.

In the past, he proposed a compromise: "lower interest rates slightly while shrinking the balance sheet." This strategy simultaneously satisfies Trump's desire for low interest rates and his own emphasis on price discipline. The possibility of maintaining a hawkish stance while maintaining flexibility in the interest rate path should also be considered.

Ultimately, the number of rate cuts may be reduced compared to the Powell era, but a return to tightening is unlikely. Even with Worth as chairman, the Fed's policy stance is expected to remain gradual and accommodative.

Meanwhile, the SEC and CFTC's pro-cryptocurrency policies are becoming more concrete. Allowing 401(k) retirement plans to invest in cryptocurrencies could bring an influx of $10 trillion in new funds. The rapid progress of legislation on cryptocurrency market structure is also encouraging.

Short-term uncertainty remains. Bitcoin is likely to remain sensitive to stock market trends for the time being. Furthermore, given that it has broken through the $84,000 level, where the largest volume is concentrated, there's a risk of further declines. However, if the stock market enters a sideways phase, Bitcoin could become the next investment choice. The pattern of funds shifting to alternative assets when tech stocks stagnate due to concerns about an AI bubble has been repeated in the past.

We must focus on certain factors that remain unchanged. The trend toward expanding global liquidity remains intact, and institutional policies favoring cryptocurrencies remain unwavering. Strategic accumulation by institutions continues, and the Bitcoin network remains stable. The current correction is a result of excessive short-term volatility due to insufficient liquidity and is not likely to undermine the medium- to long-term upward trend.

Be the first to discover insights from the Asian Web3 market, read by over 23,000 Web3 market leaders.

🐯 More from Tiger Research

이번 리서치와 관련된 더 많은 자료를 읽어보세요.Disclaimer

This Bitcoin valuation methodology (hereinafter referred to as "this methodology") was developed for research purposes and does not constitute investment advice, investment recommendations, or trading recommendations of any kind. The fair price presented in this methodology is merely the result of a theoretical analysis based on objective data, and it does not constitute a recommendation or recommendation for any investment action, including buying, selling, or holding, at any specific point in time. This methodology serves as academic research material, providing market participants with a single perspective on Bitcoin valuation, and should not be used for actual investment decision-making.

This methodology has been meticulously reviewed and developed to ensure that it does not constitute unfair trade practices, such as price manipulation and fraudulent trading, as defined in Article 10 of the Act on the Protection of Virtual Asset Users (hereinafter referred to as the "Act on the Protection of Virtual Asset Users"). All analyses utilized only publicly accessible information, such as on-chain data and officially announced macroeconomic indicators, and did not use any undisclosed material or insider information. Furthermore, we declare that the target price calculations used in this methodology were based on reasonable grounds and were prepared transparently, without any misrepresentation or intentional omission of important information.

The author and distributor comply with the obligation to disclose conflicts of interest stipulated in Article 10, Paragraph 4, Subparagraph 2 of the Virtual Asset User Protection Act in relation to this methodology. If the author holds or plans to trade the virtual asset (Bitcoin) at the time of writing or distributing this methodology, he or she will clearly disclose such conflicts of interest.

The calculation methods used in this methodology, including the base price, fundamental indicators, and macro indicators, are based on what the author believes to be reasonable methodologies. However, they are not absolute truths or the only correct answer. The Bitcoin market is extremely difficult to predict due to its extremely high volatility, 24-hour trading, global market characteristics, and regulatory uncertainty. Therefore, there may be a significant discrepancy between the valuation results presented in this methodology and the actual market price, and such discrepancies may persist for an extended period of time.

This methodology is based on historical data and current information and does not guarantee or predict future performance or profits. There is no guarantee that past patterns or correlations will continue to apply in the future, and the predictive power of this methodology may be significantly reduced or rendered meaningless by various factors, including unexpected market shocks, regulatory changes, technological issues, and macroeconomic changes. In particular, it should be noted that the cryptocurrency market has a shorter history and undergoes frequent structural changes compared to traditional financial markets, which fundamentally limits the reliability of past data and its predictive power.

All investment decisions should be made solely at the investor's own discretion and responsibility, and this methodology should not be used as the sole or primary basis for investment decisions. Investors should carefully consider their financial situation, investment objectives, risk tolerance, investment experience, and other factors when making investment decisions. They should also seek independent financial or investment advice when necessary. The author, distributor, or affiliated institutions of this methodology are not responsible for any direct, indirect, consequential, special, or punitive losses or damages resulting from investment decisions made based on this methodology.

Tiger Search Report Usage Guide

Tigersearch supports fair use in its reports. This principle allows for the broad use of content for public interest purposes, provided it does not affect commercial value. Under fair use rules, reports may be used without prior permission. However, when citing Tigersearch reports, 1) "Tigersearch" must be clearly cited as the source, and 2) the Tigersearch logo must be included. Reproducing and publishing materials requires separate agreement. Unauthorized use may result in legal action.