Family, BTC funds have been running out of money this week.

In the past 7 days, spot trading saw an outflow of 1.017 billion yuan, while futures trading alone accounted for 4.933 billion yuan. The outflow from spot trading was 4.8 times that of futures trading. It's clear to anyone with a discerning eye that the market is currently being propped up entirely by futures trading. The wave on the 10th and 11th wiped out a large number of futures traders, and those who buy the dips in the following days were also liquidated. Since then, market fund flows have become extremely sensitive, and any slight disturbance triggers panic.

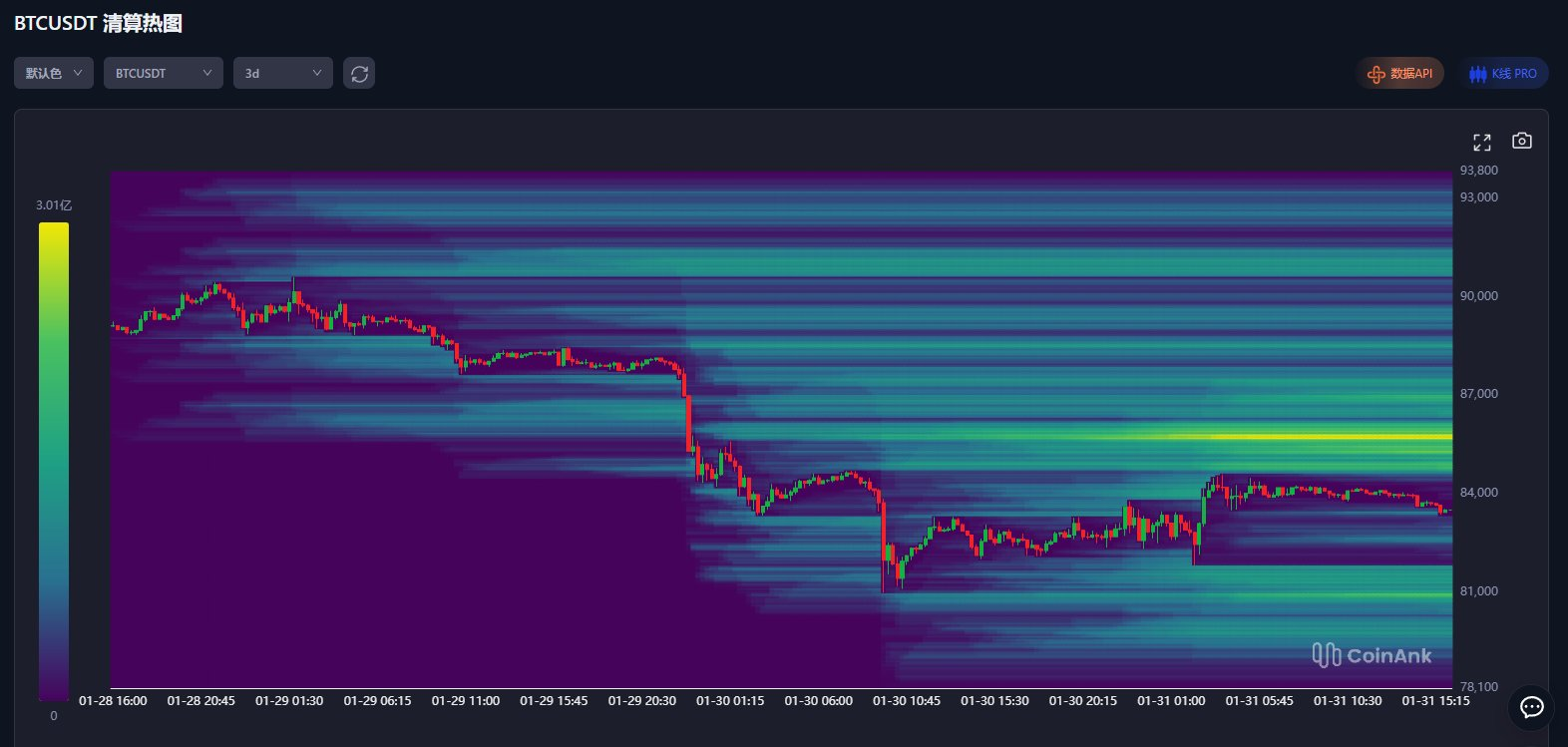

I just checked my watchlist, and apart from BTC and ETH, other altcoins and mainstream coins have started to have negative fees. Short short not only haven't stopped, but they're also adding to their short positions. This clearly shows they want to drive the price below 80k, or even 74k. The liquidation chart over the past 3 days is even more one-sided, with the top being entirely short liquidity.

Currently, over 90% of the market sentiment is pessimistic. BTC's monthly support is at 83k, and today is the last day of January. At such junctures, it's particularly prone to a sharp drop followed by a short squeeze. My advice is to wait until after 6 PM on Sunday. If there's a rebound by then but it doesn't exceed 85k, then you can short freely.

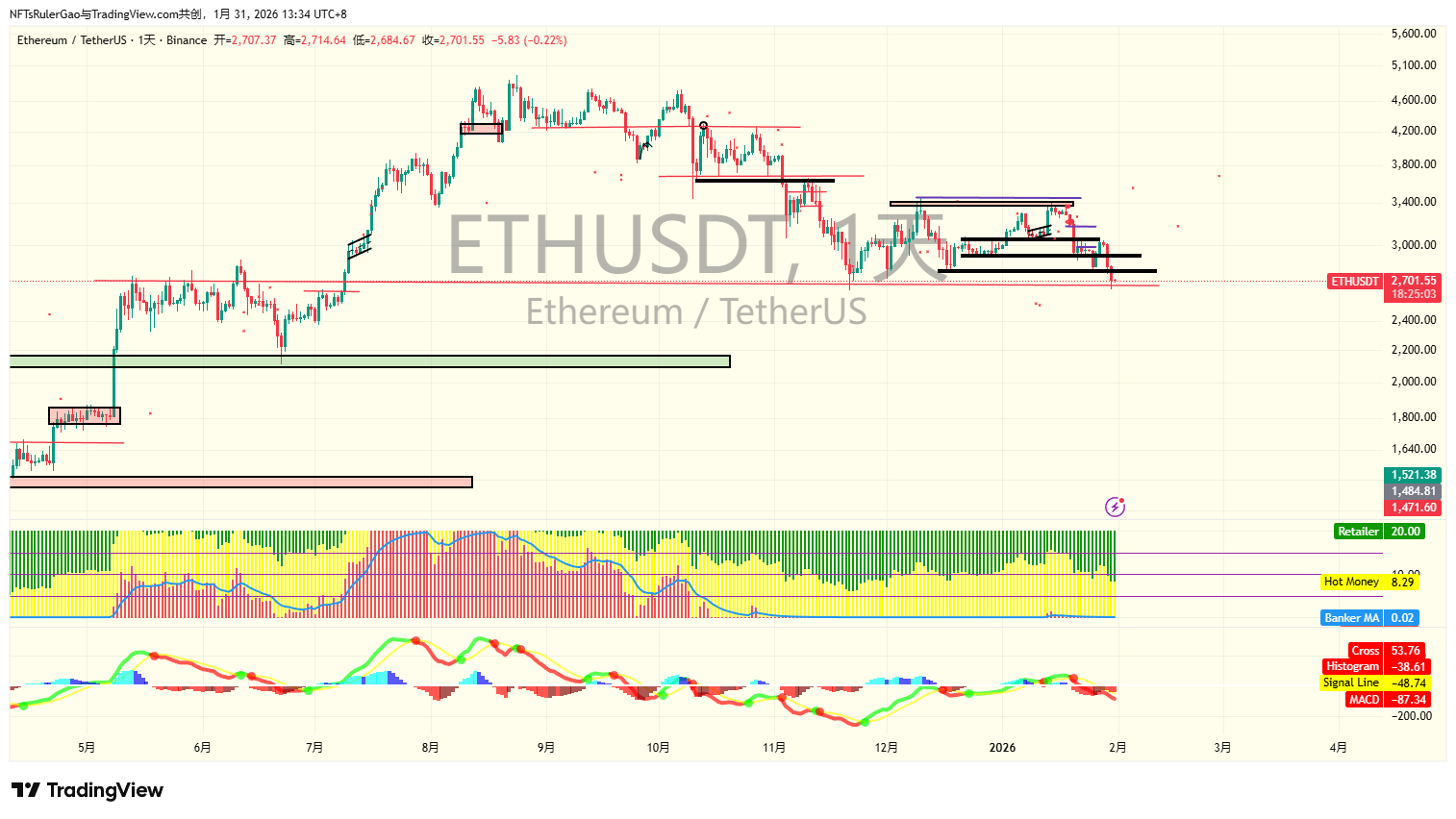

ETH has hit a key support level at the bottom after this drop!

This position is incredibly significant. It's both the low point of the downward spike on November 21, 2025, and the resistance level broken when the price surged to 4900 on July 9, 2025. It's crucial! As long as this position holds, there should be virtually no resistance in reaching around 3050 in February. It all depends on how the market interprets this support. There's also the macroeconomic situation. Trump is currently putting pressure on Iran; whether or not they attack depends entirely on his will. This issue is like a thorn in the side, constantly affecting market sentiment.

I think it's worth a small position around ETH2700, betting that after the market sell-off subsides, funds from gold will flow back into the crypto market. This is a left-side entry point, so a stop-loss is essential, at least $80-100 lower. In other words, place the stop-loss below 2600. Position size is crucial; start with a small position to test the waters, and gradually add to or average down once the trend is confirmed. The best time to buy would be if there's another dip. There's unlikely to be any major market movement over the weekend, so don't make any rash moves; just be patient!

I've been spending countless hours on the blockchain these past few weeks, thoroughly experiencing BSC, SOL, and Base chains. I can clearly feel the overall liquidity is increasing. I often complain about BSC's various issues, but frankly, it's like my own child, and I genuinely hope it continues to improve. My strongest connection is with EGL1; I started following it during the last USD1 competition and even made some money then. This competition saw it continue its strong upward trend—it's truly impressive!

The market is constantly changing, and specific entry and exit points should be determined based on real-time conditions. Follow the trend after a breakout! No matter how confident you are, please strictly adhere to your stop-loss and take-profit strategies! That's all for today! Follow me so you don't get lost! QQ: 2178747366, QQ: 2499660658 ( Add me with a note, and I'll add you to our learning and discussion group).