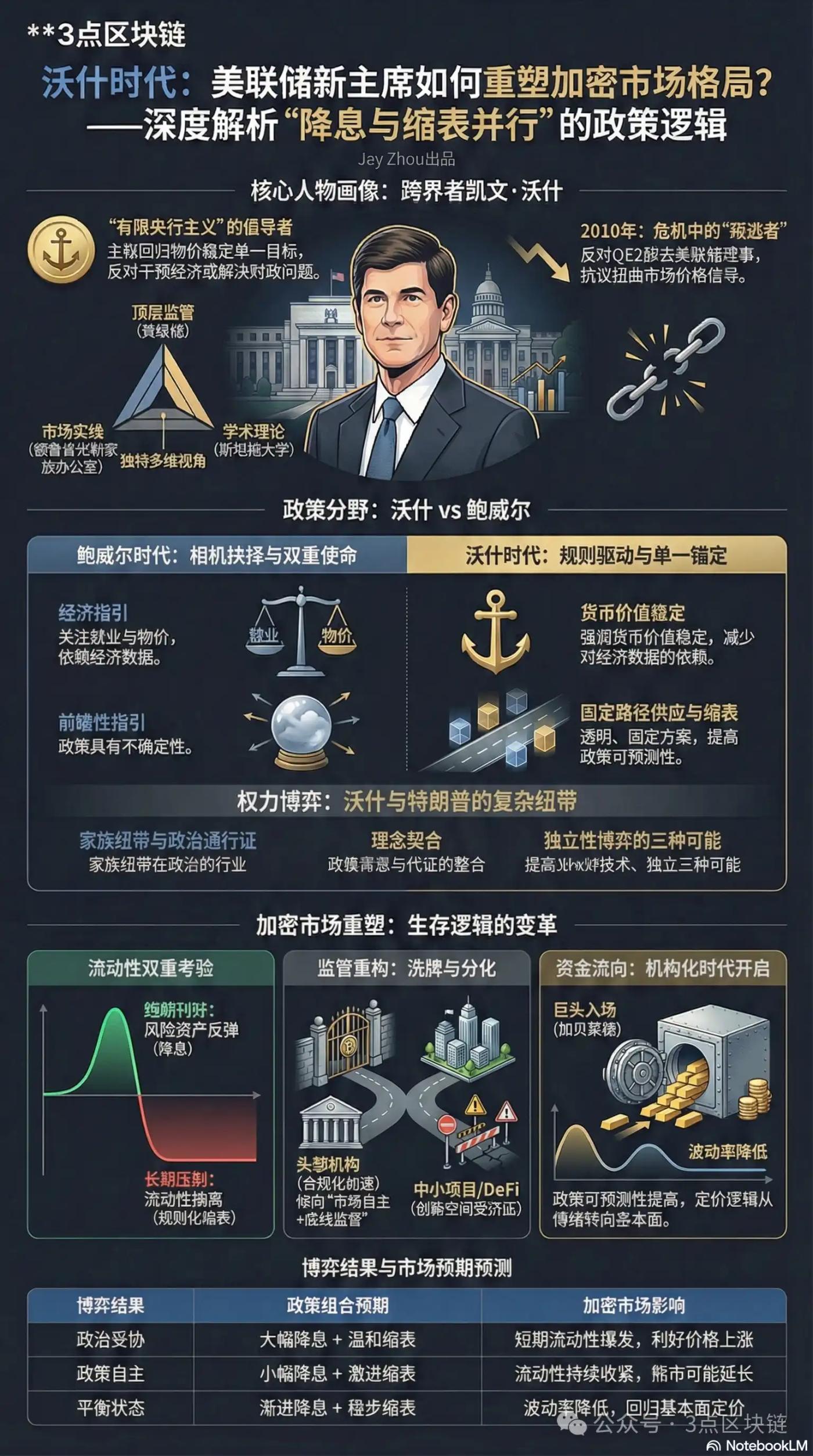

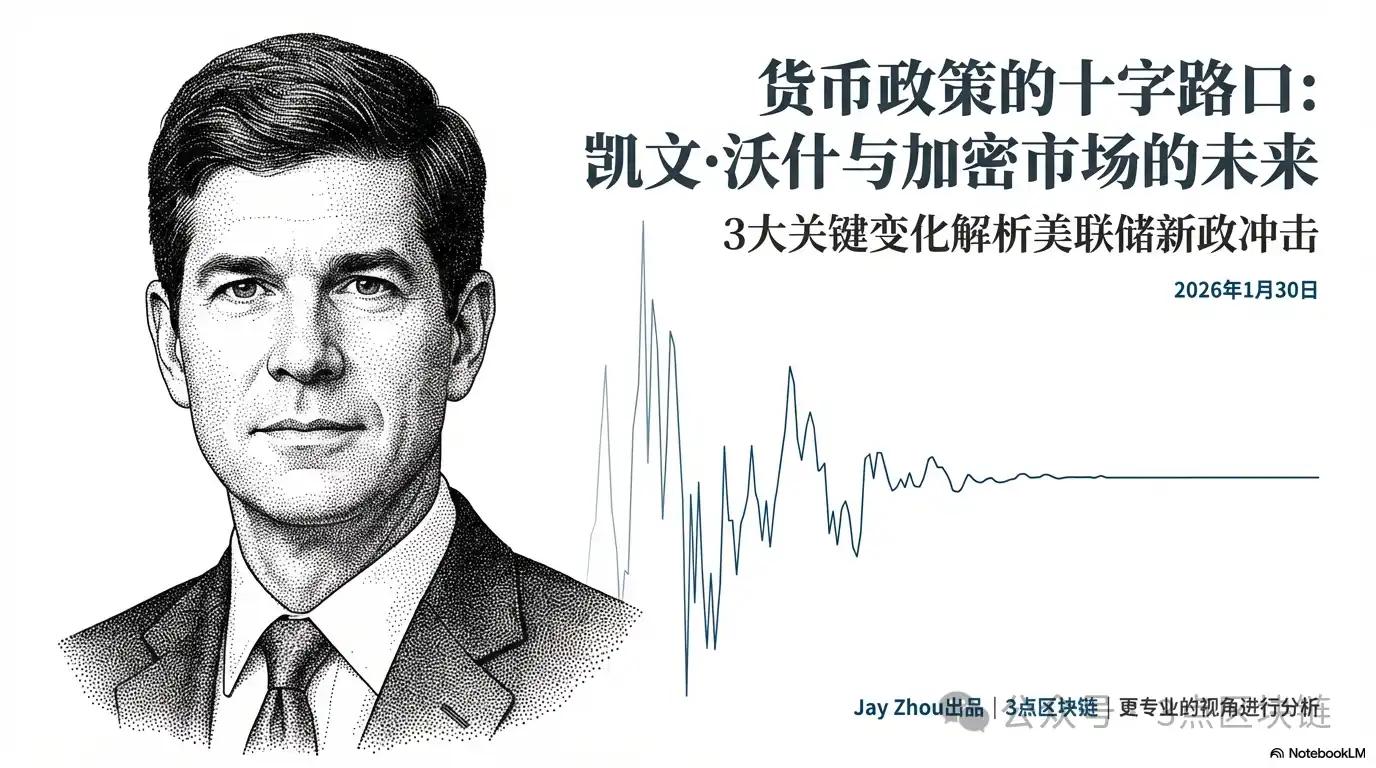

On January 30, 2026, Trump officially nominated former Federal Reserve Governor Kevin Warsh to serve as Chairman of the Federal Reserve. This appointment not only marks a crucial shift in US monetary policy but will also have a profound impact on the crypto market, which is highly dependent on global liquidity. Warsh's unique policy advocacy of "simultaneous interest rate cuts and balance sheet reduction" stands in stark contrast to the monetary policy logic of the Powell era. Against the backdrop of a 2026 bear market in the crypto market and Bitcoin hitting new lows this year, this "cross-disciplinary" figure, bridging academia, regulation, and investment, will become a key variable in reshaping the crypto market landscape.

Article by JayZhou

Article source: 3D Blockchain

This article will start with Warsh's resume and policy core, compare the differences between his monetary policy and Powell's, deeply analyze the complex relationship between Warsh and Trump and its impact on the crypto market, and reveal the survival logic of the crypto market behind this monetary policy change.

I. The Underlying Background of Kevin Walsh's Career: From Crisis Witness to Policy Critic

Kevin Warsh's career has consistently traversed the intersection of public policy and private markets, a unique experience that has shaped his critical perspective and pragmatic style on monetary policy. Understanding Warsh's policy propositions requires starting with his triple role spanning regulation, academia, and investment.

1.1 Federal Reserve Governors During the Crisis: "Traitors" to Quantitative Easing

From 2006 to 2011, Warsh served as a member of the Federal Reserve Board of Governors, experiencing the entire global financial crisis. During this period, the Fed shifted from traditional interest rate control to a large-scale asset purchase program (QE), expanding its balance sheet from $900 billion to $2.9 trillion. As the Fed's liaison with the market, Warsh was deeply involved in formulating crisis response policies, but also became one of the core members who were among the first to say "no" to quantitative easing.

In 2010, when the Federal Reserve was preparing for a second round of quantitative easing (QE2), Warsh publicly expressed his opposition. He argued that with signs of economic recovery already emerging, continuing to expand asset purchases would embroil the Fed in the political vortex of fiscal policy and distort market price signals. After QE2 was officially launched, Warsh chose to resign in protest, an act of "defection" that became a landmark event in his career.

This experience shaped Warsh's core tenet of "limited central bankism": the Federal Reserve's primary responsibility is to maintain price and financial stability, rather than intervening in economic growth or resolving fiscal problems through balance sheet operations. He sharply criticized the Fed's aggressive policies over the past 15 years, arguing that continuous quantitative easing has fostered a "monetary-dominated" era—artificially suppressing interest rates has not only inflated asset bubbles but also fueled the accumulation of US government debt. By 2026, the US federal government debt had surpassed $38 trillion, with net interest payments approaching defense spending—a situation precisely the policy consequence Warsh warned of.

1.2 A Multidimensional Perspective from Cross-Disciplinary Individuals: From Family Offices to Stanford Lecture Halls

After leaving the Federal Reserve, Warsh's career entered a "cross-disciplinary phase." He joined Duquesne, the family office of legendary investor Stan Druckenmiller, as a partner, deeply involved in global macro investment decisions; at the same time, as a distinguished visiting scholar at the Hoover Institution and a lecturer at Stanford Graduate School of Business, he built a policy analysis framework that combined theory and practice.

This experience spanning regulatory agencies, investment institutions, and academia gives Warsh's policy proposals a dual nature of "top-level design" and "market practice." From a regulator's perspective, he is keenly aware of the spillover effects of the Federal Reserve's policies on financial markets; from an investor's perspective, he understands the sensitivity of asset prices to changes in liquidity; and from an academic's perspective, he can transcend short-term policy cycles to examine the long-term logic of monetary policy.

Of particular note is the political dimension added to Warsh's appointment by his personal network of connections—his father-in-law is Ronald Lauder, head of the Estée Lauder Companies and a close confidant of Trump. This relationship has raised market concerns that Warsh may struggle to withstand political pressure from Trump, especially the latter's explicit demand for "significant interest rate cuts." However, given Warsh's career trajectory, he has always been known for his "policy independence," and the interplay between "political connections" and "policy autonomy" will be a key point of interest in his role at the Federal Reserve.

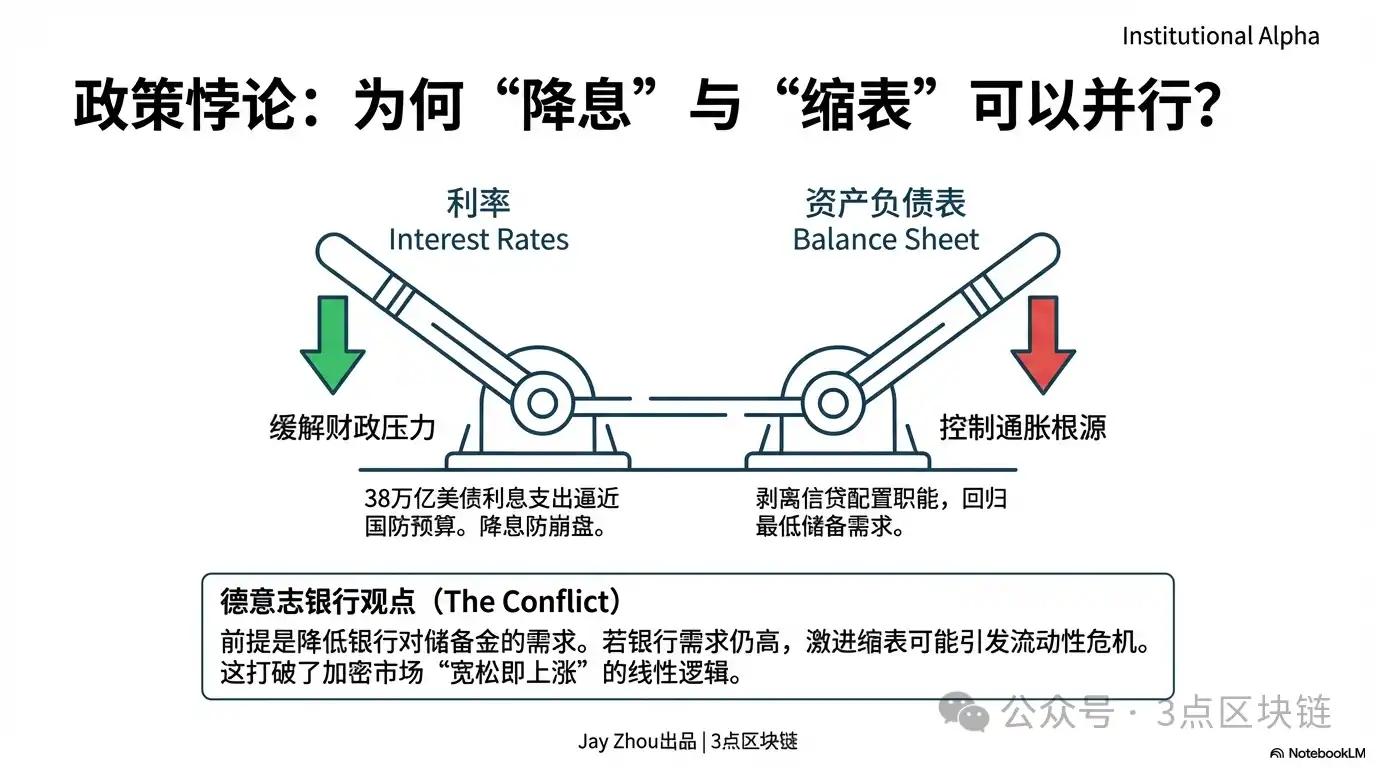

1.3 The core of the policy proposition: the "paradoxical" regulation of simultaneous interest rate cuts and balance sheet reduction.

A research report by Matthew Luzzetti's team at Deutsche Bank accurately summarized Warsh's policy framework: "Rate cuts and balance sheet reduction in parallel." This policy combination, seemingly contradictory, directly addresses the core dilemma currently facing the Federal Reserve—both easing the pressure of high interest rates on government debt and preventing excessive liquidity from triggering an inflationary rebound.

Walsh's policy logic can be broken down into three levels:

- The underlying logic of interest rate cuts is to moderately lower policy rates against the backdrop of slowing economic growth and high debt pressure, thereby reducing the government's interest expenditure burden and alleviating corporate financing pressure. However, Warsh explicitly opposes "unlimited interest rate cuts." He has stated his opposition to the Fed's decision to cut rates by 50 basis points in September 2025, believing that excessive easing will undermine the achievements in inflation control.

- The core objective of balance sheet reduction is to strip the Federal Reserve of its "credit allocation" function, which it assumed after the financial crisis, and return to the traditional monetary policy framework by shrinking its balance sheet. Warsh argues that the Fed's balance sheet should be maintained at a minimum level sufficient to meet the banking system's reserve needs, rather than becoming a "major player" influencing market liquidity.

- The prerequisite for policy implementation: The key to simultaneously cutting interest rates and reducing balance sheets lies in reducing banks' reserve requirements through regulatory reforms. Only when banks no longer need to hold large amounts of excess reserves will balance sheet reduction not trigger a market liquidity crisis. However, a Deutsche Bank research report points out that the feasibility of this premise in the short term is questionable—the Federal Reserve recently restarted its reserve management purchase program, and the banking system's demand for reserves remains high.

This "paradoxical" regulation is completely different from the linear logic of "loosening leads to price increases, tightening leads to price decreases" that the crypto market is familiar with, and it also casts a layer of uncertainty on the future trend of the crypto market.

II. Warsh and Trump: A Complex Network of Relationships from "Old Acquaintances" to "Allies"

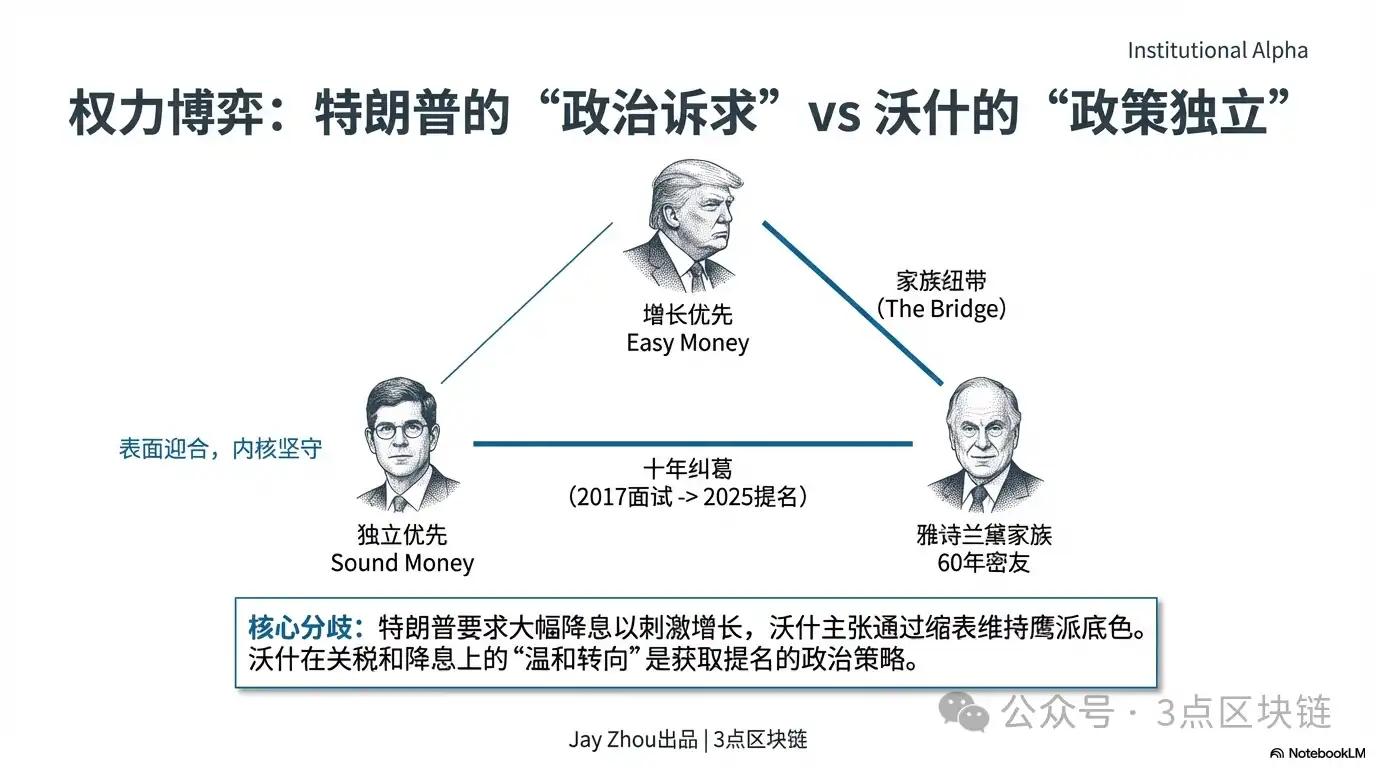

Kevin Warsh's relationship with Donald Trump is a key clue to understanding his appointment as Federal Reserve Chairman and a core variable for predicting his policy direction. Their connection did not begin with the 2026 nomination, but rather spans nearly a decade, a dual bond of "politics and private life," interwoven with family connections, policy philosophies, and power struggles.

2.1 Family Ties: The Estée Lauder Family's "Political Bridge"

Walsh's most direct connection to Trump stems from his marriage—Wash's wife, Jane Lauder, is an heiress to the Estée Lauder Companies, while his father-in-law, Ronald Lauder, is a close friend and core political ally of Trump for 60 years.

Lauder's friendship with Trump began during their time at the New York Military Academy. The two were not only classmates but also long-term business partners and political supporters. Lauder was a major donor to Trump's 2016 and 2024 presidential campaigns and was the first to propose the idea of "buying Greenland" to Trump—a highly controversial proposal that later became one of the landmark events of Trump's first term. Trump biographer Tim O'Brien bluntly stated, "For Trump, anyone connected to someone powerful or famous is crucial." Lauder's family background undoubtedly provided Walsh with a "political passport" within Trump's decision-making circle.

This foundation of trust built on family ties is Warsh's unique advantage over other candidates. In Trump's political logic, "familiar recommendations" and "family connections" often determine appointments more decisively than professional qualifications. In December 2025, Trump explicitly named Warsh as the "number one candidate" for Federal Reserve Chairman in an interview with the Wall Street Journal; behind this statement, Lauder's influence cannot be ignored.

2.2 A Decade of Struggle: From "Failed the Interview" to "Handpicked Nomination"

Warsh's policy interactions with Trump can be traced back to 2017, during Trump's first term as president. That year, when Trump was selecting a Federal Reserve Chairman, he personally "interviewed" Warsh but ultimately chose then-Federal Reserve Governor Powell. This decision later became a source of regret for Trump—in 2020, Trump privately told Warsh, "Kevin, I really should have used you back then. If you wanted that job, why weren't you a little tougher?"

After Trump's return to the White House in 2025, the two interacted more frequently. Warsh not only provided economic policy advice to Trump's transition team but was also seen as a potential candidate for Treasury Secretary. More importantly, Warsh's "moderate shift" in policy stance gradually aligned him with Trump's core demands. Although Warsh was known as a "hawk" during his tenure at the Federal Reserve, in recent years he has publicly supported Trump's tariff policies and begun calling on the Fed to accelerate the pace of interest rate cuts. This shift in stance has been interpreted by the market as "political maneuvering to secure the position of Federal Reserve Chairman."

On January 29, 2026, after meeting with Warsh at the White House, Trump decided to announce the nomination of Federal Reserve Chairman earlier than the morning of the 30th. This hasty adjustment demonstrates the "closeness" of their relationship and "decision-making efficiency." Trump posted on Truth Social, "I have known Kevin for many years. He is a true genius who will go down in history." This high praise stands in stark contrast to his continued criticism of Powell.

2.3 Ideological Alignment: From "Policy Differences" to "Shared Goals"

The relationship between Warsh and Trump is not simply one of "political dependence," but rather a "strategic alliance" built on shared policy philosophies. Their core consensus is reflected in three aspects:

- A shared critique of Powell's policies: Trump has long criticized Powell's "excessive money printing" as causing soaring inflation, while Warsh, from an academic perspective, criticizes the Fed during Powell's era for "mission spread," focusing excessively on non-core issues such as employment and climate, thus weakening the independence of monetary policy. This consensus on the "failure of Powell's policies" became the starting point for their collaboration.

- The shared demand for interest rate cuts: Since returning to the White House in early 2025, Trump has repeatedly pressured the Federal Reserve to cut interest rates, arguing that high interest rates force the US to pay hundreds of billions of dollars more in debt interest annually, dragging down economic growth. Warsh's framework of "simultaneous interest rate cuts and balance sheet reduction" precisely addresses Trump's demand for rate cuts, while maintaining his hawkish stance through balance sheet reduction, thus achieving a balance between "political correctness" and "academic rigor."

- Divergent Understandings of "Federal Reserve Independence": While Warsh emphasized that "Federal Reserve independence is a valuable cause," both he and Trump believed that the Fed should reduce its reliance on economic data and abandon "forward guidance," a policy tool Trump considered "meaningless." This shared pursuit of "policy simplification" allowed them to find common ground in monetary policy operations.

It's worth noting that Warsh's shift in stance wasn't entirely a "cooperation" with Trump. Cui Xiao, senior economist at Pictet Wealth Management in the US, points out that Warsh "recently really wanted the position of Federal Reserve Chairman," hence his dovish stance on interest rates. However, his core policy framework—"limited central bankism" and "quantitative tightening"—remained unchanged. This strategy of "superficial compliance, core adherence" will be key for Warsh in balancing political pressure and policy independence.

2.4 Power Balance: The Game Between "Political Dependence" and "Policy Autonomy"

Warsh's relationship with Trump is essentially a classic power struggle between "political appointment" and "central bank independence." For the crypto market, the outcome of this struggle will directly determine the direction of the Federal Reserve's policy, thereby affecting the global liquidity landscape.

From Trump's perspective, the core objective of nominating Warsh is to "control monetary policy." Since early 2025, Trump has repeatedly criticized Powell for being "slow to act" and believes that high interest rates are harming the US economy and government finances. He needs a Federal Reserve chairman who can both cut interest rates and be obedient to achieve his political goal of "growth-first." Warsh's family background and shift in stance have convinced Trump that he can "control" the new Federal Reserve chairman.

However, throughout his career, Warsh has always been known for his "policy independence." In 2010, he resigned in opposition to QE2, a move seen as a form of protest that demonstrated his unwavering belief in central bank independence. A Deutsche Bank research report points out that the market will closely watch whether Warsh can maintain policy autonomy under pressure from Trump, as this will be a key factor influencing market confidence.

This power struggle may have three outcomes:

For crypto investors, the key indicators to watch in this game are: the policy statement from Warsh's first FOMC meeting since taking office, the specific details of the balance sheet reduction plan, and his public statements on Trump's policies. These signals will directly determine the short-term trend and long-term pattern of the crypto market.

III. Powell and Warsh: The Policy Divergence Between Two Generations of Federal Reserve Chairs

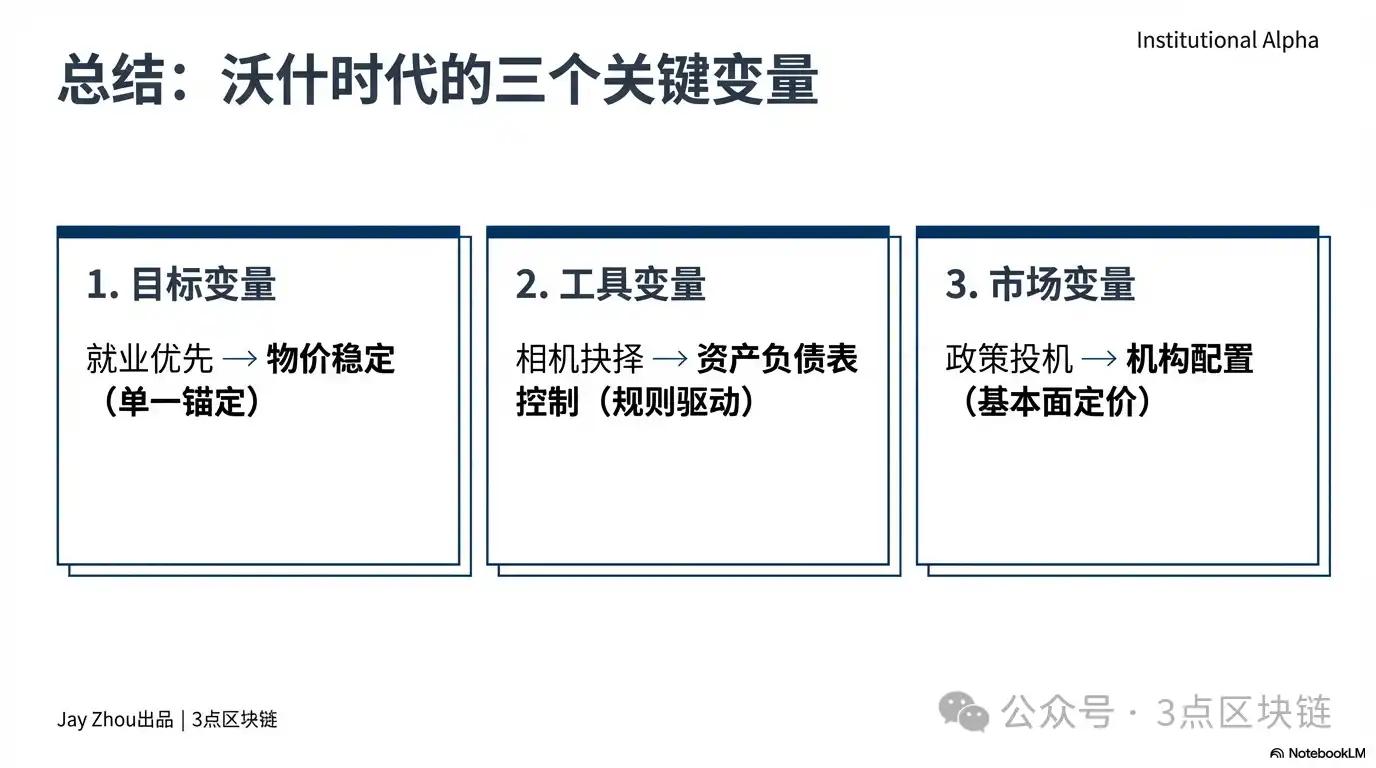

To understand the impact of Warsh's policies on the crypto market, it's essential to first clarify the differences between his monetary policy and that of his predecessor, Jerome Powell. Powell's Fed policy was characterized by "discretionary" measures, with its policy cycles closely tied to the bull and bear market cycles in the crypto market. In contrast, Warsh's policy framework emphasizes "rules-based" and "central bank independence," a difference that will reshape the pricing logic of the crypto market.

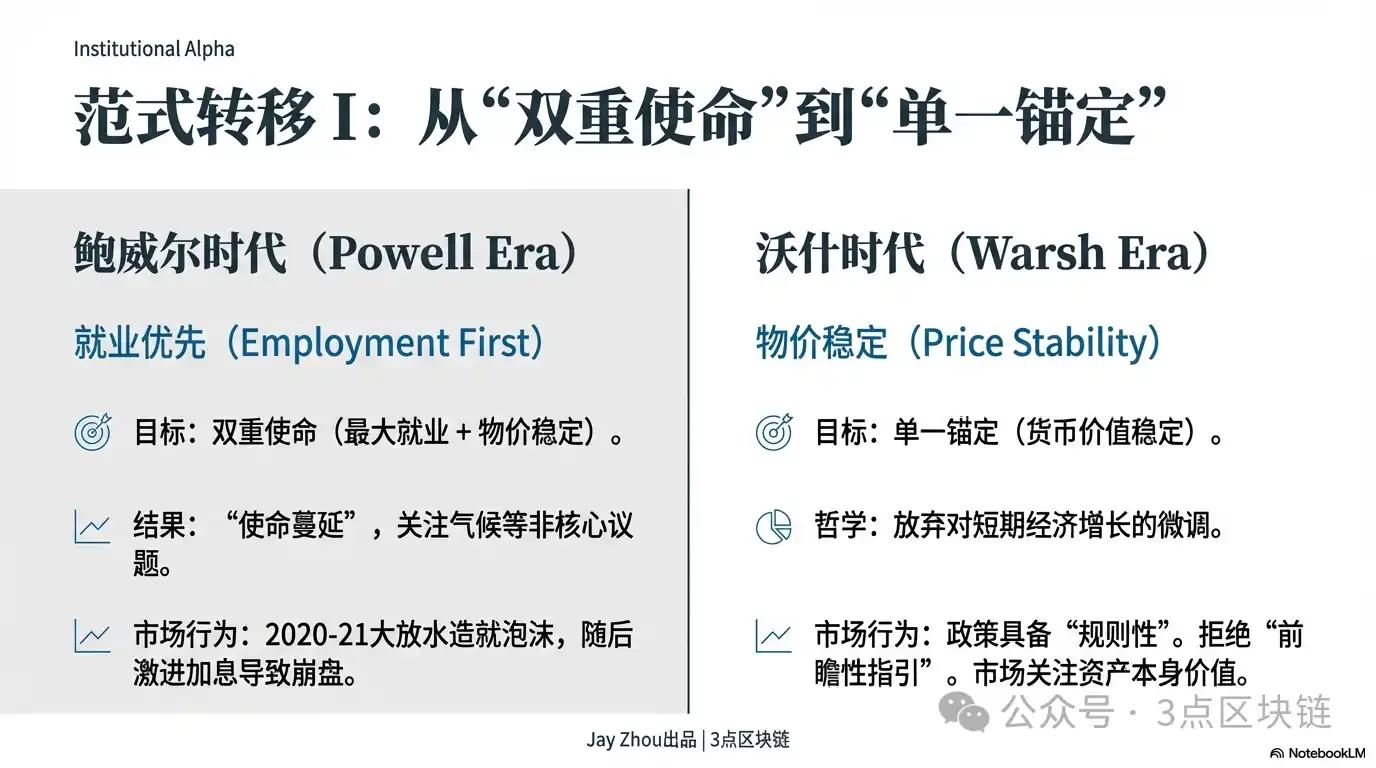

3.1 Differences in Policy Objectives: From "Dual Mission" to "Single Anchor"

During his eight years at the helm of the Federal Reserve, Powell consistently focused his policy operations on the dual mandate of "maximum employment" and "price stability." Following the outbreak of the COVID-19 pandemic in 2020, Powell swiftly lowered the federal funds rate to a zero range of 0-0.25% and launched an unlimited quantitative easing program. The Fed's balance sheet expanded by nearly $4 trillion within 18 months, reaching a peak of $9 trillion.

This "employment-first" policy orientation brought an unprecedented liquidity boom to the crypto market. From 2020 to 2021, the price of Bitcoin surged from less than $10,000 to $69,000, while Ethereum rose from $200 to $4,891, pushing the total market capitalization of the crypto market above $3 trillion. At that time, the market viewed the Federal Reserve's loose monetary policy as the core driver of the rise in crypto assets, and Bitcoin was endowed with the safe-haven attributes of "digital gold," becoming a popular hedge against inflation.

However, as inflation surged to a 40-year high in the second half of 2021, Powell shifted his policy focus to "price stability." In March 2022, the Federal Reserve launched its most aggressive interest rate hike cycle since the 1980s, raising rates by a cumulative 525 basis points over 17 months, while simultaneously initiating a balance sheet reduction process, shrinking assets by $95 billion per month. This policy shift directly triggered a collapse in the crypto market: in 2022, the total market capitalization of the crypto market evaporated by $1.45 trillion, Bitcoin fell to $15,000, Ethereum fell below $900, and leading institutions such as Three Arrows Capital and FTX suffered successive defaults, plunging the crypto market into a prolonged bear market.

Unlike Powell, Warsh's policy goals are closer to a "single anchor"—returning the Fed's core responsibility to "maintaining the stability of the currency's value." He sharply criticized the Fed's "mission spread" during the Powell era, arguing that the Fed's excessive focus on non-core issues such as employment, climate, and inclusion weakened the independence and effectiveness of monetary policy. Warsh explicitly proposed that the Fed should reduce its reliance on economic data, abandon forward guidance—a policy tool that is "almost useless in normal times"—and instead achieve long-term price stability by controlling the money supply and the size of its balance sheet.

This difference in policy objectives means that the Fed's policies under Warsh's leadership will be more "rule-based" and "predictable," but may also sacrifice short-term economic growth and employment stability. For the crypto market, this means that the logic of a "policy-driven market" will be weakened, and the pricing of crypto assets will rely more on their own fundamentals rather than on the Fed's policy shifts.

3.2 The Divergence of Policy Tools: From "Discretionary" to "Rules-Driven"

The Federal Reserve under Powell was adept at using a combination of forward guidance and data-driven approaches to guide capital flows by managing market expectations. For example, in 2020, Powell clearly stated that "low interest rates will be maintained until 2023," and in 2022, he emphasized that "rate hikes will continue until inflation falls back to the 2% target." This clear policy signal allowed the market to adjust its asset allocation in advance.

However, Warsh argues that forward guidance is "a special tool for financial crises and is not suitable for normal economic environments." He criticizes the Powell-era Federal Reserve for over-reliance on the "black box DSGE model," ignoring the core impact of money supply and balance sheet size on inflation. Warsh advocates that the Federal Reserve should adopt more transparent and rule-based policy tools, such as a fixed money supply growth rate or a balance sheet reduction path, to reduce market speculation about policy.

The divergence in policy tools will directly impact the volatility of the crypto market. The Fed's policies during the Powell era often triggered dramatic fluctuations in the crypto market: In November 2025, Powell announced a pause in balance sheet reduction and a 25 basis point interest rate cut; Bitcoin's price initially fell and then rose after the announcement, with fluctuations exceeding 5%; in January 2026, Powell stated that "the probability of a rate cut before June is low," and the crypto market entered a period of consolidation, with Bitcoin volatility falling to historical lows.

Another major difference between Powell and Warsh lies in their strategies for dealing with political pressure. During his tenure, Powell repeatedly withstood Trump's pressure to cut interest rates, insisting on raising rates to combat inflation and maintaining the independence of the Federal Reserve. However, in 2025, with the US federal government debt exceeding $38 trillion and net interest payments approaching defense spending, Powell's policies had to compromise with fiscal pressure—pausing balance sheet reduction and slightly lowering interest rates to alleviate the government's debt repayment burden.

Warsh will face far greater political pressure than Powell. When nominating Warsh, Trump explicitly stated his desire for the Federal Reserve to significantly cut interest rates to stimulate economic growth and reduce government debt costs. However, Warsh has repeatedly emphasized in public that the Fed's independence is a "worthwhile cause" and that he will not succumb to political pressure. A Deutsche Bank research report points out that the market will closely watch whether Warsh can maintain policy independence under Trump's pressure, which will be a key factor influencing market confidence.

For the crypto market, if Warsh succumbs to political pressure and introduces a combination of "significant interest rate cuts + moderate balance sheet reduction," it will release liquidity in the short term, which will benefit the rise in crypto asset prices. However, if Warsh insists on the policy of "small interest rate cuts + aggressive balance sheet reduction," it will lead to a continued tightening of market liquidity, and the bear market in the crypto market may be further prolonged.

IV. The Warsh Era: The Reshaping of the Crypto Market Landscape and the Logic of Survival

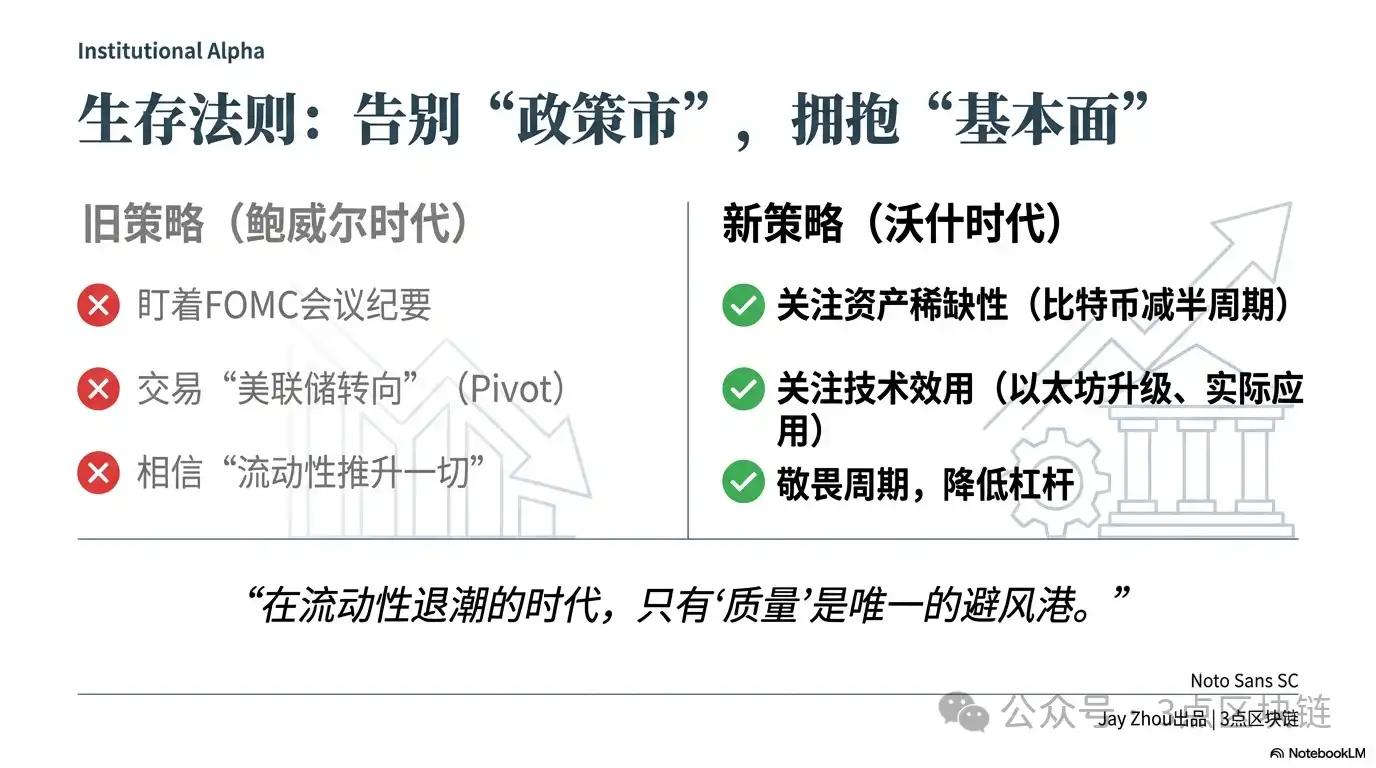

Kevin Warsh's policy proposals will reshape the crypto market landscape across three dimensions: liquidity, regulation, and capital flows. Under a policy framework of "simultaneous interest rate cuts and balance sheet reduction," the crypto market will move away from the "policy-driven market" logic of the Powell era and enter a new phase driven by fundamentals. For investors, understanding and adapting to this shift will be key to navigating the bear market.

4.1 Liquidity Game: A Dual Test of Short-Term Benefits and Long-Term Negative Factors

Warsh's policy mix of "interest rate cuts and balance sheet reduction in parallel" will have a dual impact on the liquidity of the crypto market, with a short-term positive impact and a long-term negative suppression.

In the short term, interest rate cuts will reduce the cost of dollar funding and alleviate the global dollar liquidity crunch. Historical data shows that Fed rate cuts often drive funds from dollar assets to risk assets. After Powell's rate cut in 2020, the crypto market experienced a major bull market; in November 2025, when Powell paused balance sheet reduction and cut interest rates by 25 basis points, the price of Bitcoin rebounded from $85,000 to $92,000. If Warsh officially takes office in June 2026 and introduces a rate cut policy, the crypto market may experience a short-term rebound, with Bitcoin potentially breaking the $90,000 mark and Ethereum possibly returning to above $3,000.

However, in the long run, quantitative tightening will continue to drain market liquidity and suppress the valuation of crypto assets. The Fed's quantitative tightening process essentially involves withdrawing the liquidity injected during the financial crisis, which will lead to a reduction in the global dollar supply and a downward shift in the valuation center of risky assets. During the Fed's quantitative tightening in 2022, the total market capitalization of the crypto market evaporated by 64.5%. This historical experience shows that the negative impact of quantitative tightening on the crypto market far exceeds that of interest rate hikes.

More importantly, Warsh's balance sheet reduction policy is not a "one-off operation" but a "regulatory process." According to a Deutsche Bank research report, Warsh may set a fixed path for balance sheet reduction, such as reducing assets by $50 billion per month until the Fed's balance sheet size falls to around 20% of GDP. This predictable balance sheet reduction process will allow the market to digest the impact of tightening liquidity in advance. The decline in the crypto market may not be as severe as in 2022, but it will exhibit a "steady decline."

For crypto investors, this means that "buying the buy the dips" will become significantly more difficult. In the Powell era, investors could anticipate the end of the Fed's interest rate hikes or the beginning of interest rate cuts to grasp the bottom of the crypto market; however, in the Warsh era, the long-term and certainty of the balance sheet reduction process will cause the bottom of the crypto market to show an "L-shaped" trend. Investors need to abandon the speculative mindset of "buy the dips and rebounding" and instead focus on the long-term value of crypto assets.

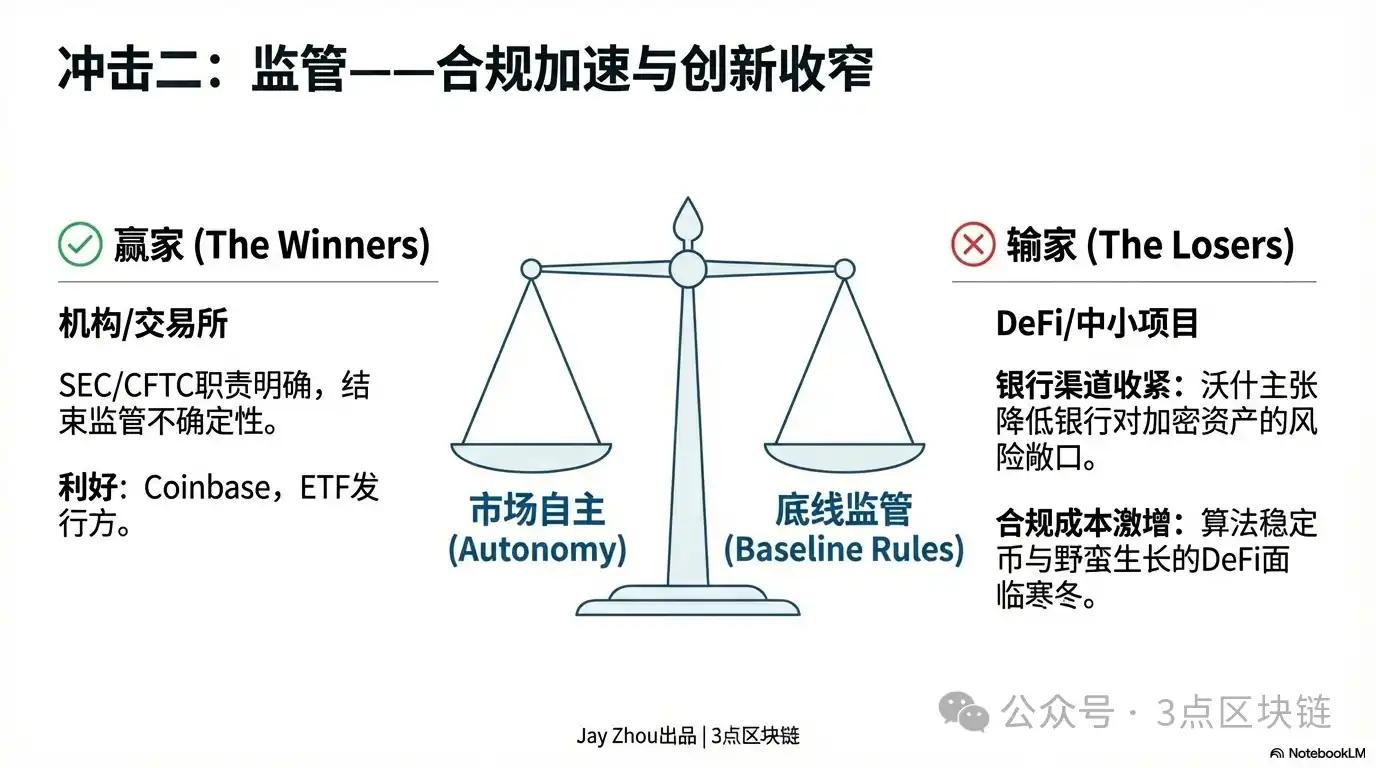

4.2 Regulatory Restructuring: Accelerated Compliance and Narrowing Space for Innovation

Warsh's policy proposals will not only affect liquidity in the crypto market, but will also accelerate the process of compliance in the crypto industry.

During his tenure as a Federal Reserve Governor, Warsh was known for his emphasis on financial stability. He repeatedly warned that financial innovation, if it deviates from the regulatory framework, could trigger systemic risks. Regarding crypto regulation, Warsh's core view was "market autonomy + bottom-line regulation"—opposing excessive government intervention in crypto market innovation while emphasizing that crypto assets must comply with basic regulatory rules such as Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF).

In the short term, Warsh's regulatory approach may offer the crypto market a much-needed respite. Compared to the Federal Reserve under Powell, Warsh favors allowing the market, rather than the government, to lead the development of crypto assets. He may oppose direct regulation of cryptocurrencies by the Federal Reserve, instead pushing existing regulatory bodies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) to clarify the legal attributes and regulatory framework for crypto assets. This would help address the current regulatory uncertainty facing the crypto market and attract more institutional investment.

However, in the long run, Warsh's regulatory approach will drive a "reshuffling and differentiation" within the crypto industry. On one hand, the accelerated compliance process will force leading institutions such as crypto exchage and stablecoin issuers to strengthen risk control and comply with regulatory rules. For example, exchanges like Coinbase and Binance may need to increase transparency and disclose more user data and transaction information; stablecoins such as USDT and USDC may need to undergo stricter reserve reviews to ensure a 1:1 peg to the US dollar.

On the other hand, rising compliance costs will squeeze the survival space of small and medium-sized crypto projects. Warsh advocates for "reducing bank reserve requirements through regulatory reform," which means banks will more strictly scrutinize the financing needs of crypto projects. Small and medium-sized crypto projects may struggle to obtain bank loans and will have to rely on venture capital or ICOs for financing, significantly increasing the difficulty of fundraising. At the same time, Warsh's cautious approach to regulating innovative products such as "algorithmic stablecoins" and "decentralized finance (DeFi)" may limit innovation in these areas.

For crypto investors, this means the "leading effect" will become even more pronounced. Mainstream crypto assets with high compliance and liquidity, such as Bitcoin and Ethereum, will become the preferred allocation for institutional funds; while Altcoin lacking practical applications and with high compliance risks may be eliminated by the market and eventually go to zero.

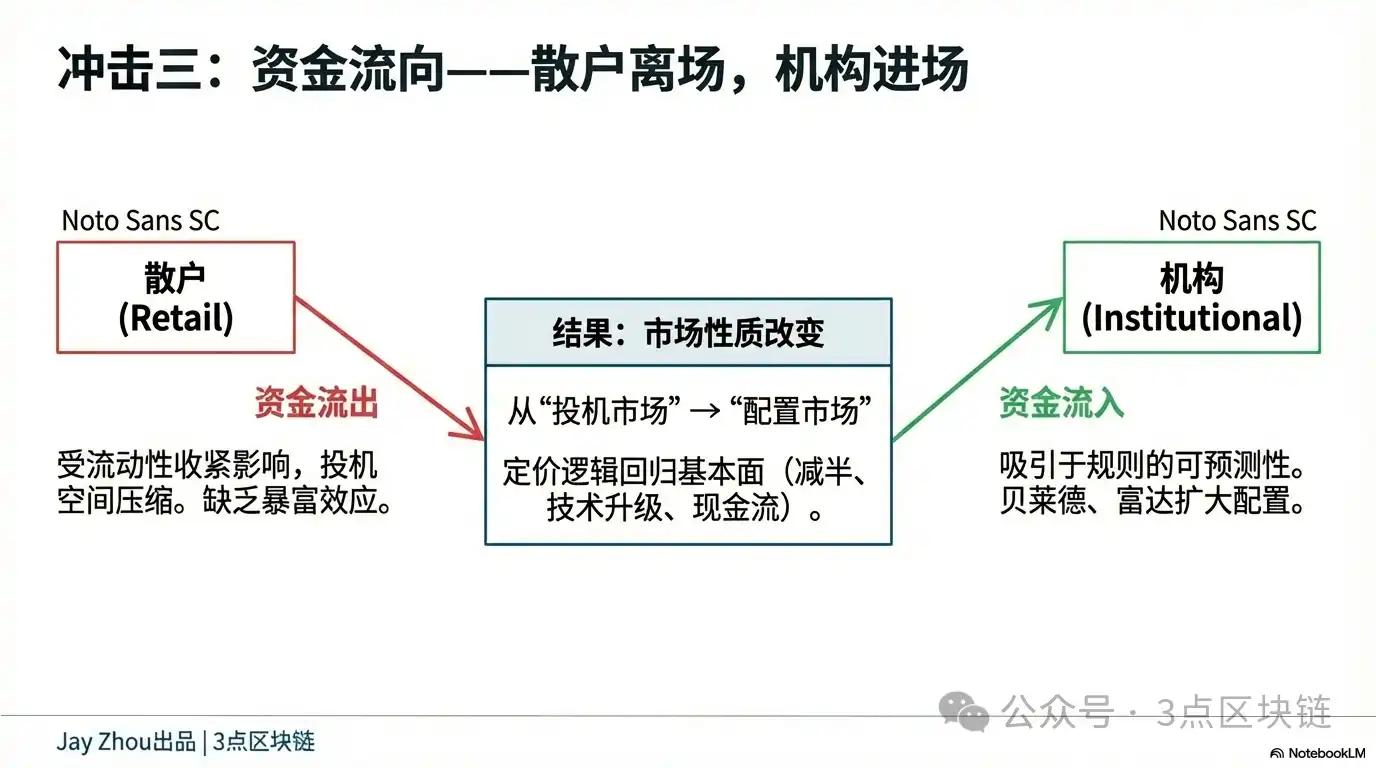

4.3 Fund Flows: The Divergence Between Institutional Funds Entering the Market and Retail Funds Leaving the Market

The Fed's policies during the Warsh era will drive a divergence in the flow of funds in the crypto market—institutional funds will accelerate their entry, while retail funds will continue to leave.

From an institutional funding perspective, Warsh's "rules-driven" policy will improve market predictability and attract more traditional financial institutions to allocate to crypto assets. For example, asset management giants such as BlackRock and Fidelity may expand their holdings of Bitcoin ETFs and include crypto assets in their long-term portfolios; investment banks such as JPMorgan Chase and Goldman Sachs may launch more crypto derivatives to meet the hedging needs of institutional investors.

The entry of institutional funds will bring two significant changes: First, the volatility of the crypto market will further decrease. Institutional investors are more inclined to hold for the long term rather than speculate in the short term, which will reduce the price volatility of crypto assets. For example, Bitcoin's intraday volatility may drop from the current 3% to 1%-2%, comparable to the volatility of traditional assets such as gold and stocks. Second, the pricing logic of the crypto market will become more rational. Institutional investors will focus more on the fundamentals of crypto assets, such as the scarcity of Bitcoin, the technological upgrades of Ethereum, and the profitability of crypto projects, rather than market sentiment or speculative hype.

From the perspective of retail investor funds, Warsh's balance sheet reduction policy will lead to a continued tightening of market liquidity, compressing the speculative space for retail investors. The 2022 crypto bear market has proven that when market liquidity dries up, retail investors are often the biggest victims—they buy at high prices and sell at low prices, ultimately losing everything. In the Warsh era, the long-term and certain nature of the balance sheet reduction process will make it difficult for retail investors to profit through short-term speculation, leaving them with no choice but to stay on the sidelines.

The divergence in capital flows will drive the crypto market from a "retail-dominated speculative market" to an "institutional-dominated allocation market." This means the crypto market will gradually mature, and its correlation with traditional financial markets will further strengthen. However, for retail investors, this also means that "get-rich-quick" opportunities in the crypto market will become increasingly scarce, and investing in crypto assets will require more specialized knowledge and a longer-term perspective.

V. Conclusion: Say Goodbye to Policy-Driven Market, Embrace Fundamentals

Kevin Warsh's nomination marks a new era for Federal Reserve monetary policy. This "cross-disciplinary" figure, straddling regulation, investment, and academia, and his complex network of relationships with Trump, will be a key variable influencing the direction of US monetary policy. For the crypto market, this monetary policy transformation presents both challenges and opportunities.

The challenge lies in the fact that Warsh's policy of "simultaneous interest rate cuts and balance sheet reduction" could lead to a continued tightening of market liquidity, potentially prolonging the bear market in cryptocurrencies. The traditional "policy-driven market" logic will be weakened, and the pricing of crypto assets will rely more on their own fundamentals rather than on policy shifts by the Federal Reserve.

The opportunity lies in the fact that Warsh's "rules-driven" policies will increase market predictability, attract more institutional funds, and drive the crypto market from a "retail-dominated speculative market" to an "institution-dominated allocation market." This may be an inevitable path for the crypto market to mature and the beginning of a true return to value for crypto assets.

In the Warsh era, crypto investors need to abandon the speculative mindset of "buy the dips" and instead focus on the long-term value of crypto assets—Bitcoin's halving cycle, Ethereum's upgrade progress, and the real-world application scenarios of crypto projects. These are the core factors determining the future trend of crypto assets. Only by respecting the market and adhering to value can one navigate this wave of monetary policy reforms, weather the bear market, and patiently await the dawn.