The crypto market is experiencing its darkest moment since the beginning of the year.

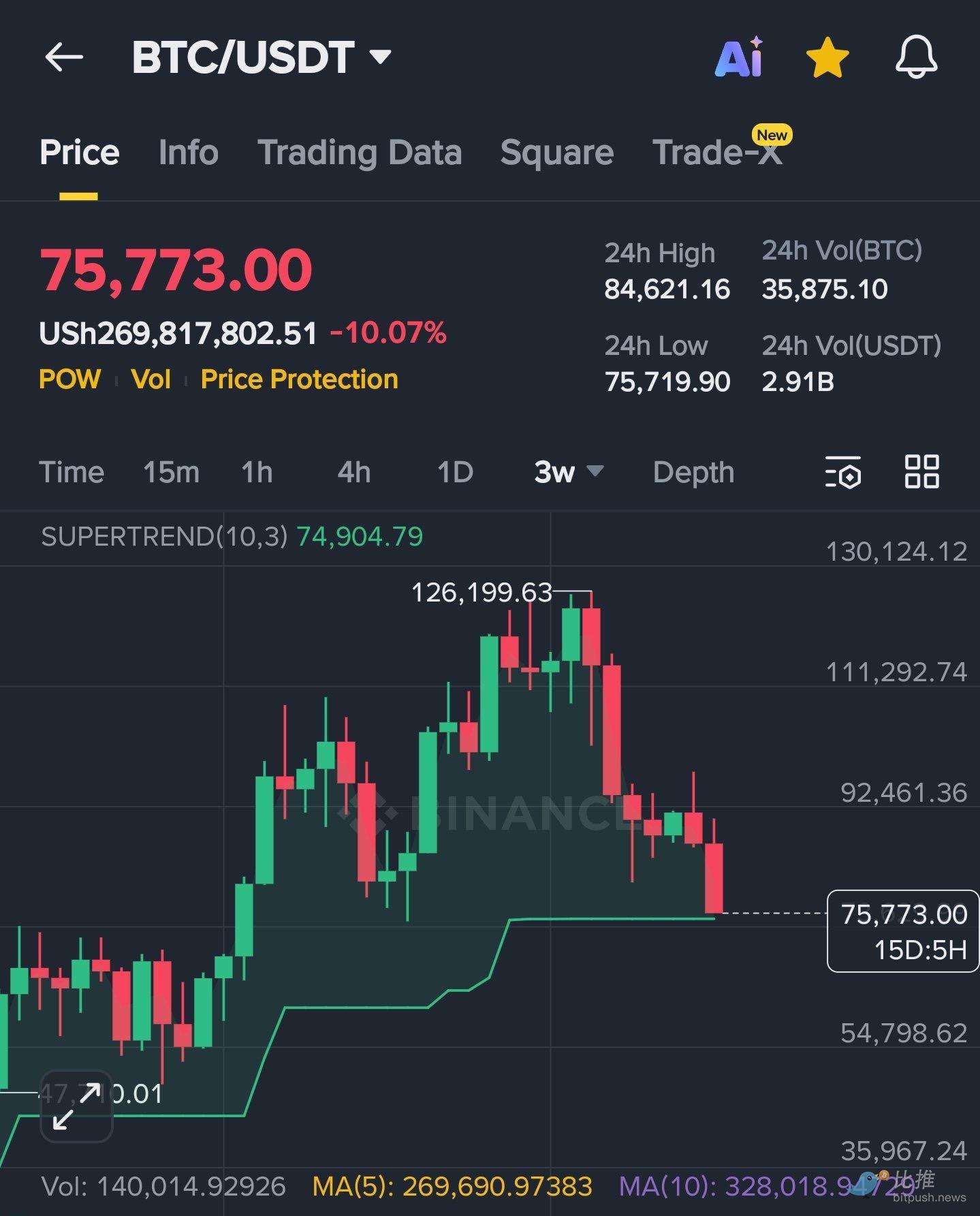

Hit by both tightening macro liquidity and a technical breakdown, Bitcoin (BTC) has accelerated its decline in the past few hours, with its intraday drop widening to 9% at one point, and even falling below the weighted average cost of $76,037 of MicroStrategy ( Strategy ) – the world's largest publicly traded company with the largest holdings of cryptocurrency.

The last time Bitcoin fell below this price level was in October 2023.

As the "Saylor leverage" myth faces substantial challenges, market panic is spreading into deeper waters.

The "cost defense war" has begun.

According to the latest financial monitoring data disclosed by MicroStrategy (MSTR), its average holding price has been significantly boosted to $76,037 due to its aggressive buying of Bitcoin when it was at a high of $90,000 in early 2026.

As the "stabilizing force" of crypto assets, the price of BTC collapsed rapidly from the $84,000 mark during the midday trading session on January 31st (Eastern Time), hitting a low of around $75,000. This means that for the first time this period, the MicroStrategy account, holding approximately 712,600 Bitcoins worth over $50 billion, experienced an overall unrealized loss on its balance sheet.

As the "stabilizing force" of crypto assets, MSTR's stock price has been severely affected, and its high Beta value and leverage effect have become evident in the downward cycle, with the stock price hitting a new 52-week low.

Liquidity Depletion and Sell-Off: A "Death Stomp" in Deleveraging

Analysts point out that this plunge was not accidental. With insufficient liquidity and extremely limited buying demand, the sell-off accelerated significantly in recent weeks, causing Bitcoin's value to fall by more than 30% from its previous high.

Furthermore, macroeconomic uncertainties and the liquidation of highly leveraged positions exacerbated the decline, and this plunge exhibited typical characteristics of "forced liquidation":

Support line collapse: Bitcoin has broken below the upward support trendline that had been in place since the end of December 2025. Once broken, the previously dense support zone ($82,000 – $86,000) instantly turned into heavy resistance above.

Increased trading volume: Unlike the previous gradual decline, trading volume increased significantly when the price reached $78,700. This indicates that a large number of leveraged long positions were forcibly liquidated at high levels, and the market is undergoing a severe "deleveraging" process.

Oversold but unable to rebound: Although the daily RSI has fallen into the deep oversold zone near 20, the market shows weak buying support and no signs of a strong recovery in the short term.

Next stop: The $68,000 "life-or-death red line"?

In this round of sharp declines, analysts are trying to find the true "bottom".

Renowned trader James Wynn warned on the social media platform X that the current decline may only be the beginning of a return to the "baseline".

Wynn points out that the 200-week moving average (MA) around $68,000 is the true ultimate test for Bitcoin.

Wynn points out that the 200-week moving average (MA) around $68,000 is the true ultimate test for Bitcoin.

From a technical chart perspective, if BTC fails to recover the $78,000 level within 48 hours, the possibility of it testing $68,000 will increase dramatically. "If the panic continues, a retest of the $60,000 mark cannot be ruled out. That's the starting line before the big rally in 2025, and also the market's last psychological defense," Wynn added.

From "Frenzy" to "Reset"

This wave of "waterfall cleansing" is an inevitable result of the reset of macroeconomic expectations and excessive leverage expansion. For micro-strategies, although they have entered a period of unrealized losses in the short term, their long-term debt structure (mostly fixed-rate long-term bonds) provides them with a chance to breathe.

But for ordinary investors, the reappearance of expectations of $68,000 or even $60,000 indicates that the crypto market is waking up from the illusion of "heading to $150,000" and re-examining its true pricing in the global macro environment.

Author: Bootly

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush