Original: " Andre Cronje: The rise and fall of a DeFi god " by Paige Aarhus

Compile: wesely

Interviewed at his home in a gated community in Dubai, Andre Cronje (AC) cut to the chase:

"Eventually, I will most likely end up in prison."

"Can you elaborate?"

"Unfortunately, can't"

"Are you kidding me?"

"No, it's not sarcasm"

This year has been a crazy year for encryption, and the fate AC said has actually befallen another developer — Tornado Cash developer Alexey Pertsev, who has spent four months in a Dutch prison awaiting charges.

The 39-year-old AC, as a well-known figure on the DeFi track, is one of the earliest builders in this field. In the summer of DeFi in 2020, AC launched Yearn Finance, the first revenue aggregator, and played a key role in the rise of liquidity mining. According to data from CoinGecko, its native token YFI jumped from $32 in July 2020 to $43,000 two months later.

AC's follow-up projects also made many people rich, which brought him great fame, but this also became his fatal flaw. After millions of user funds were stolen, his followers turned against each other. In less than two years, the former father of DeFi has become what everyone calls a rug-puller.

"That's the problem with being God, you're not allowed to change any more, you're not allowed to make any mistakes," he said.

He curls up on a dark gray sofa in the spacious rented villa, which is so huge that it even has its own elevator. A few days later, he moved to a hotel due to construction noise, and it was clear he had made the city his home, a shame he refused to be photographed for it.

In conversations with AC and those close to him, a story from the past is also revealed. Many years ago, in the university town of Stellenbosch, Western Cape, South Africa, he was a young computer genius who adopted many stray animals, but was often bullied at school. He dreamed of becoming a defense lawyer. Hope can plead the case.

In conversation, it's easy to get confused by the ethics displayed by AC because they are often inconsistent. Feeling sorry for those who lost money on his project, but suggesting that they have only themselves to blame, AC stated that he never bullied anyone:

"Not once, never," he said.

He alternates between sad and brooding, defensive and humorous, and never takes the family elevator. "I don't like taking risks," he says deadpan.

But in recent hours of interviews, it was difficult to tell whether he believed what he said. This is reminiscent of a TV series "M*A*S*H" in the 70s (Translator's Note: This is an American war comedy TV series, translated as "Army Field Hospital", M*A*S*H is Mobile Army Surgical Hospital), there is a line in the play that Colonel Flagg satirized the CIA: "No one can ask the truth out of my mouth, because even I don't know what the truth is, and I will keep myself in a state of extreme confusion .”

Today, AC seems to be making a comeback again. He joined the Fantom Foundation again, which is responsible for operating the public chain platform Fantom. AC's goal is to build a traditional bank, not for Crypto. But how will he shoulder the burden as his remaining followers look to him to help them survive the crypto winter?

Changes made by Yearn

Turning the time back to the beginning of 2020, when DeFi was just emerging, AC won the support of many developers with iearn.finance (now called Yearn).

Yearn is making a huge splash with its automation of yield optimization for DeFi farming. In the past, users could earn a lot of income by investing their cryptocurrencies in different DeFi protocols to lend or trade. There is nothing wrong with doing this in a good market environment, but chasing returns in this way is called liquidity Yield farming is also very laborious.

Nansen research found that most users who participate in liquidity mining will abandon the agreement after two to three days, so timing is key. Top liquidity mining farmers know when to rush in and when to exit. and proceed to the next protocol. Yearn, on the other hand, can automate this task by pooling users' encrypted assets in smart contracts (called vaults), and then rotating assets in and out of different protocols, including dYdX, AAVE, Compound, etc.

After the launch of Yearn's token YFI in July 2020, Yearn really took off. And AC has won praise from many people for its very fair distribution of YFI . When the token is launched, anyone can deposit liquidity into the Curve yPool or YFI Balancer pool to obtain token rewards.

Unlike the token issuance of general projects, AC has not distributed any YFI tokens to its own team or informed investors. According to Fantom Foundation consultant and former chief marketing officer Michael Chen, before the launch of YFI , only two people knew about it: Chen and Lvan from LobsterDAO, so even if AC is ultimately for money, at least in the debut of YFI he It didn't show up.

Such a move has won the support of many developers and investors, and this approach is also in line with the spiritual principles of DeFi, so Yearn was also considered by many people as a truly decentralized application at the time. However, as others have pointed out, AC has the ability to be behind the scenes by controlling smart contracts.

It’s hard to know exactly what actually happened in the cryptocurrency legend of Yearn turning paper traders into millionaires overnight, but the proliferation of Yearn-rich tutorials popping up on YouTube reinforces that AC's star status.

On July 16, 2020, the day before YFI was released to the public, Yearn’s smart contract locked cryptocurrencies worth $8.1 million. By August, TVL had jumped to $1.5 billion. In December 2021, YFI ’s TVL peaked at nearly $7 billion.

Token Brice from the DL News affiliate said: "So far I have found an aggregator that can achieve 1% of Yearn's performance."

Discovering and criticizing weaknesses in code is a common behavior in the DeFi industry. AC is also an expert in this area, and it is also his way of entering this industry , has accumulated a lot of fans). His former colleagues called him a genius development programmer who could solve a problem that plagued the entire team in hours, and he could explain it all in a concise manner.

"Many developers can't design systems and express clearly like AC," AC's friend Matt Visser said, "he can walk freely on these two planes."

Yearn is not AC's first foray into encryption. At a meeting held at the Shilla Hotel in Seoul in August 2018, AC joined the Fantom Foundation as a technical consultant and core developer. As a new public chain and open source smart contract platform, Fantom was once touted as being compatible with Ethereum Comparable.

AC said that he discovered Fantom's problems from the beginning, including the project's lack of development talents and the inability to complete lightning-fast transactions per second.

In 2019, the multiple pressures of operational overruns, exorbitant listing fees, and crypto winter depleted the foundation of the $40 million it raised during its 2018 ICO, but Cronje stuck with the project.

"I'm actually not 100% sure why I continued to help at the time," he said.

On a March 2019 episode of the Oh Hey Matty podcast, when AC was asked why so few developers listed on the Fantom site could code, Cronje told the host that those developers had actually left, saying the project The condition is very good. A few months later, he started working on Yearn.

YFI made AC famous, and his Twitter fans surged from less than 5,000 in July 2020 to more than 110,000 in February 2021. Then there is the apotheosis of AC. Last July, Yearn published a eccentric tome "The Blue Pill". This is a 104-page e-book. , and the protagonist happens to be AC himself: "Yearn was not designed by anyone, it comes from AC's gift to all YFI ," the article wrote.

The book gets weirder from here, but it also captures the culture of DeFi: a confluence of social, political and financial interests and a community of preachers who tend to gravitate toward messianic figures (referring to Judaism Messianic view).

AC became one of them, Visser said, "and he played a lot of people's saviors."

"The Blue Pill" portrayed AC as a wise philosopher, and fans portrayed him as God and the omnipotent Marvel villain Thanos. For this, AC said he was unprepared and "painful."

"I'm not allowed to have flaws anymore, one of the things I've always loved is that I speak my mind no matter what," but this habit has now suddenly become a burden.

initial start

AC grew up in a nuclear family with his parents, sister, and pets, and he describes his upbringing as one of "the sameness and the white-picket-fence." with a typical traditional American family).

At the time, his father was a science teacher, his mother was a librarian, and his older sister, Tanja, was five years older. Andre Cronje, Tanja recalls, was a "cute little brother" who loved animals and the outdoors, but threats against AC's family from AC critics led Tanja to request that her current last name not be used in the interview.

According to Tanja, Andre Cronje was creative and intelligent, he didn't need to study hard to get good grades, and as he got older, he became more lonely, playing video games only with a close group of friends.

AC offered a more blunt assessment of himself: "I went to a proper sportsman's school as a very pale, fat, nerdy kid, and I was constantly bullied there."

As an adolescence, he began writing small video games, such as Hangman, in a programming language called Pascal, and in his first computer science class in ninth grade, he encountered a recurring problem: Few people could keep up with Follow in his footsteps, for which he even had a conflict with the teacher at the time.

AC said he had dreamed of becoming a court lawyer and defending cases, having studied law at Stellenbosch University but quickly lost interest in it. "The only thing that kept me going was when we were doing simulations, but those were less than 2% of what we were actually doing."

He still dreams of being a worthy debater who can stand up in a confrontation without breaking down. However, the courtroom is a controlled environment, while DeFi and the Internet where it is located is a place of free competition. In addition, the ugly side of online celebrities makes it difficult for him to accept.

Before the release of YFI , AC had been struggling with the growing fan base and the accompanying critics, leading him to say that he would quit the industry completely before the launch of YFI . "The community is full of hostility." AC It was written in a Medium post in February of that year (Translator's Note: The source text has been deleted by AC, and the remaining copy is the Internet).

This time he didn't really quit, but his project started to come under attack.

beginning of the end

In September 2020, AC tweeted information about a new project called Eminence, which he described as a comprehensive platform for online game developers, contributors, and players. Although Eminence was still under development at the time, and the contract had not been tested, eager users wanted to seize potential opportunities like YFI and began to pour into Eminence in large numbers.

Hours after AC tweeted, $15 million was stolen by an attacker who AC said was sleeping. AC attributes this issue to his preference for testing in production (test in prod), which is akin to plugging the hole in a boat while out at sea, where experienced developers can profit. In the incident, hackers pushed up the price of Eminence's native tokens through "flash loans", and then sold them quickly before the price plummeted, and the attacker then sent $8 million to a wallet controlled by AC, making it look like AC's Watch out for theft. AC says he didn't steal users' money, and even if he didn't, it would discredit him.

The feature of DeFi is also its flaw. No one can control it, and no one can be blamed. Users take their own risks. If you don't like it, put your money in the bank, and this is DeFi. “Product testing is just a statement, and if you don’t double-check your blind spots, you could lose all your assets,” he said.

"We didn't disclose these contracts at the time" AC said: "I didn't tell anyone to use these things, you know, if someone loses money for this, fuck u".

AC said the Eminence hack exposed a new "duality" where "people lose money because of me, but that's not something I can reconcile".

Then came CREAM Finance, a name that pays homage to the Wu-Tang Clan song. Cream is a lending protocol where users borrow cryptocurrencies as collateral. In 2020, when AC was working at crave, he published an article on Medium that crave would "cooperate" with Cream to update the agreement. He told DL News that after Cream was plagued by hacks and vulnerabilities, he became an advisor to the company, but that $38 million was stolen from Cream Finance in February 2021, $19 million was stolen in August 2021, and $19 million was stolen in August 2021. In October 2009 another $130 million was stolen.

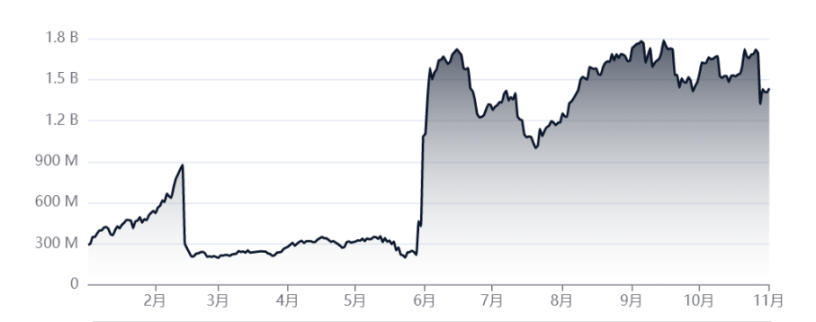

CREAM Finance TVL (January 2021 - November 2021)

Things get worse in 2022, as AC joins forces with Daniele Sestagalli, who goes by the pseudonym Dani, and plans to launch a project called Solidly. But partner Sestagalli revealed in January that he also works with Omar Dhanani, known online as Sifu.

Dhanani pleaded guilty in 2005 to conspiracy to commit crimes involving credit card, bank card and identification document fraud in the United States, and Omar Dhanani changed his name to Michael Patryn to avoid attention. Dhanani later teamed up with Gerald Cotten, co-founder of Canadian cryptocurrency exchange Quadriga, who died unexpectedly in 2019, taking hundreds of millions of dollars in investor funds with them. While Dhanani has not been accused of wrongdoing in connection with the Quadriga exchange debacle, there is no doubt that it has cast a negative light on AC.

Fraudster Dhanani

Solidly will be launched in February 2022. It is an automated market maker application designed to reduce transaction slippage to achieve low-cost transactions. CSO Sesta is responsible for marketing and hype, and AC is responsible for project construction.

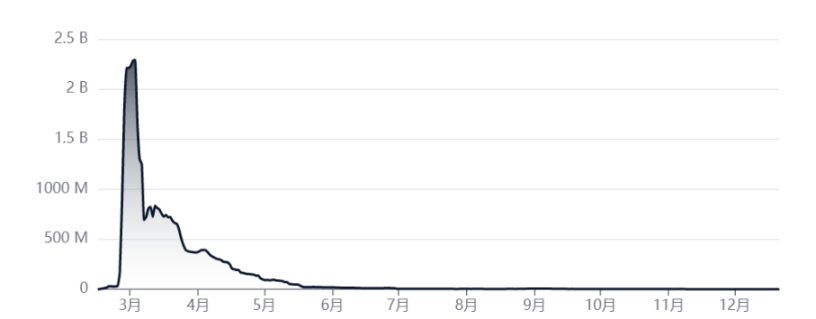

However, due to code errors, the previously touted project functions were not realized. Less than three weeks after the project was launched, AC announced that he would leave the project. Solidly's TVL once reached $2.3 billion, but it fell by nearly $370 million on the day he announced his withdrawal. By June, TVL had fallen to less than $20 million.

"As far as users expect to make money from Solidly, they haven't achieved it. If this is their definition of rug, I can accept it," AC said.

Solidly TVL

This is a curse on AC, Token Brice said, and AC also said that he accepted the word curse. "Andre Cronje was able to create a brand new type of product that didn't exist before, but was in a hurry during execution and screwed up," Token Brice said bluntly.

Visser has a different view, "Excessive reliance on system participants who don't understand code is the source of all troubles. If all players and partners are as reliable as AC's code, then he can become the master of the universe."

fall

In April 2022, AC did the unthinkable: he called for the regulation of DeFi.

Regulation runs counter to the idea of autonomy and decentralization that DeFi stands for. For a community devastated by the Terra/Luna debacle and the Solidly incident, calls for regulation were the last straw. But there was also a lot of opposition. Angry crowds poured into his Telegram and Twitter like a flood. AC announced his retirement again and logged off Twitter. Everything fell silent.

But he broke his silence again in October, when AC called for the laws in DeFi to match the safeguards in traditional finance. Occurring weeks after the FTX debacle, more and more regulators have formally stepped in to regulate the crypto industry.

AC stated that “the intersection between CeFi and DeFi needs to be regulated”. Once a project goes live, it, like the internet itself, has no owners and no bosses. "Faced with possible contract supervision, the regulator will say to you, 'Now you need to stop the contract you developed'; and then you tell him 'I can't stop'; and the other party says, 'Well, if you don't stop, We'll put you in jail; 'I can't stop it, I can't do anything but completely destroy the internet'.

AC reflects on what he has accomplished in the summer of DeFi and how much control he or anyone else can have.

He said all his money came from investing in cryptocurrencies and liquidity mining, and he noticed that his name was often linked to Do Kwon, the founder of blockchain platform Terraform Labs (an arrest warrant was issued in South Korea) and tens of dollars worth of money. Kyle Davies, co-founder of the $100 million cryptocurrency hedge fund Three Arrows Capital, was mentioned along with Su Zhu (the fund collapsed in July).

"It tore my soul, I gave my all to this industry, trying to show them a new model of launching tokens," AC said, "and this kind of evaluation is my final legacy?".

Despite the backlash, he plans to make another comeback, announcing in October that he's working again with Fantom, whose "war chest" has been replenished, including about $100 million in stablecoins.

Another big project that may help explain his recent calls for regulation. Visser said that he and AC are planning to open Universal Assets Bank, a regulated international cryptocurrency bank, "We will build the future of the financial industry," Visser said frankly.

However, Andre Cronje seems uncertain about his future, and life on the cusp has left him with many scars. "I don't have confidence in anyone, I don't trust anyone anymore, and I don't think anyone will act in anyone else's best interest unless there is a transactional motive."

I couldn't tell if he was talking about himself.

When asked what advice would you give to a developer who would take his place? It's best not to do it, and if you do, please remain anonymous and protect your privacy, he said.

He warned that "the regulation of developers is going to get tougher and tougher, and after you deploy these contracts, you can't make any changes to them, or you basically mean going to jail."