The Road to Redemption for Crypto Giants

Cathie Wood lit the fire.

Haseeb is impersonating the great prophet again, Star Xu is playing the role of Prometheus, combining Chinese and Western medicine, joining forces to burn He Yi and CZ, Carthage must be destroyed, as must Sodom and Gomorrah.

This religious presumption of guilt stems from a pervasive psychological contradiction within the crypto industry.

The entire history of cryptocurrency has been a period of pushing the boundaries of what's right, navigating a gray and ambiguous world. Now, if crypto giants want to come to the fore, they urgently need to address two issues:

- How can one evolve from a rule arbitrageur to a rule follower? For example, if avoiding the "10/11" liquidation comes at the cost of self-sacrifice, how should Binance consider this?

- Seizing the power to set crypto rules and gain tangible benefits for the industry—for example, Coinbase's stance can influence the progress of clear legislation—where does this power come from?

Binance faces an additional identity dilemma. SBF can simply beg for forgiveness by distorting time and space to become a Republican in 2022, but CZ and Binance's Chinese identity and Chinese background constantly face a cycle of Western scrutiny and self-justification.

Rules have value: Even the king of crypto is meat on the chopping block.

The purpose of political science is not to create people, but to explore how to use people naturally.

I'd like to start with a story, an old tale of a dragon slayer who chose to become a dragon himself.

In 1991, as the Soviet Union was on its last legs, history seemed to be heading towards the end of neoliberalism. The United States was serious about governing the world through the United Nations system. Faced with Saddam Hussein's invasion of Kuwait, the United States was authorized by the United Nations to join forces with 35 countries. After only 100 hours of ground operations, they easily defeated Saddam and restored Kuwait's sovereignty.

At that time, the United States received sincere praise from all over the world.

Just two years later, the United States encountered a dark cloud in the Somali capital, failing to achieve its small goal of capturing the warlord and causing a strong backlash from domestic public opinion. From then on, the United States began to lose its moral compass, as if doing good deeds did not bring good results, and doing evil seemed to have no special consequences.

Until the 9/11 attacks in 2001, the United States was completely broken and subsequently became mired in the global war on terror.

This story, told from a macro perspective, is quite interesting. The current crypto dilemma is similar. After finally winning the cold war with Wall Street and the banking industry and gaining a dominant position in tokenization and stablecoins, there are now serious internal disagreements on the right path.

The Black Hawk Down incident directly tarnished America's image, highlighting the adage that good deeds go unrewarded. Binance, which had attempted to save the crypto industry, ultimately chose to create its own private space.

Let's rewind to 2022. At the time of FTX's collapse, Binance once held more than 70% of the CEX market share, but the entire industry was shrouded in an uncertain future.

Binance decided to step in to save the entire industry, and the $1 billion SAFU fund was established at this time. Of course, there was also a little ulterior motive. The main components were its own BUSD and BNB. Recently, it has been famous for responding to Yi Lihua's call to switch its holdings to BTC.

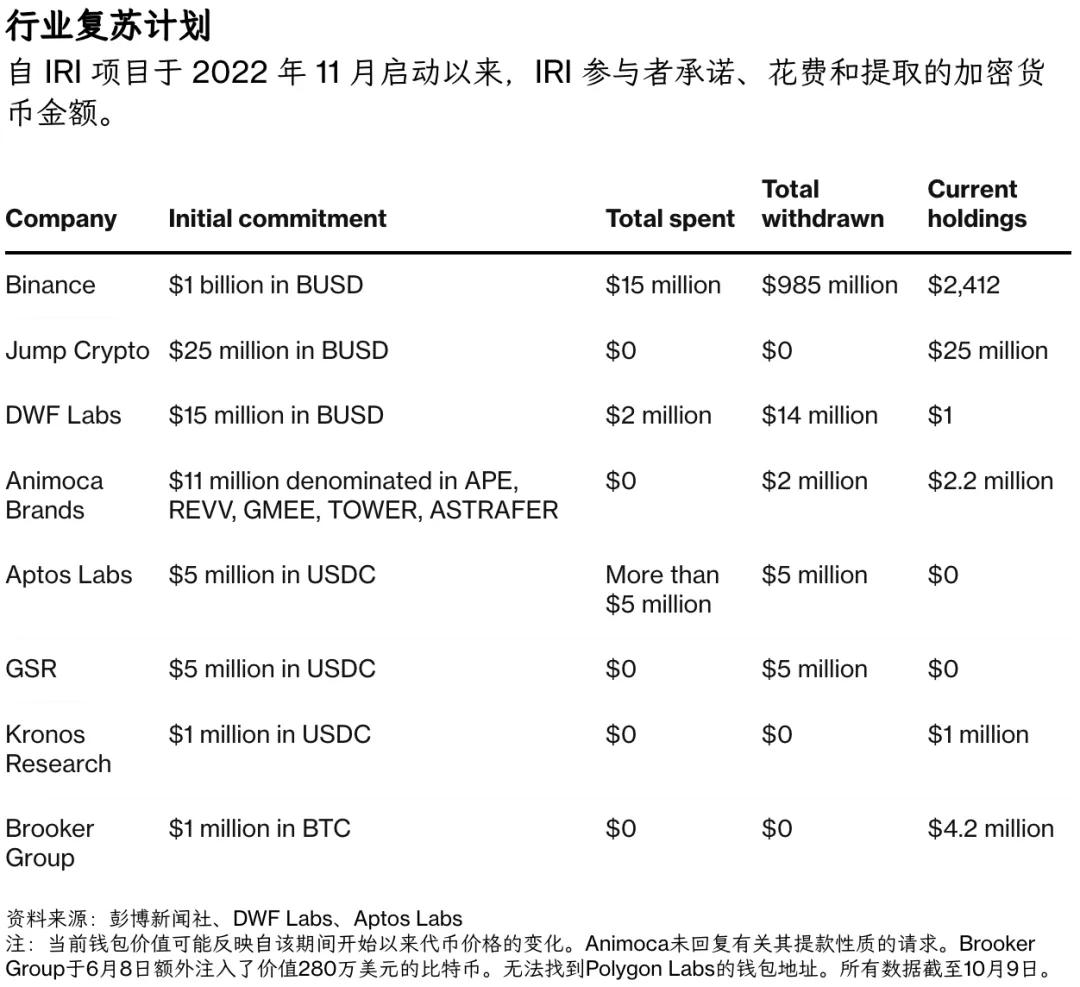

Unfortunately, that's not the whole story. Alongside SAFU, there was also the Industry Recovery Initiative (IRI), a fund designed to unite major projects and exchanges to carry out industry self-rescue plans. Binance pledged to invest at least $1 billion, hoping the overall scale could reach over $2 billion.

The application forms for the IRI program are no longer accessible, perhaps because the industry has recovered.

Image caption: IRI funding details

Image source: @business

In fact, IRI ceased operations as early as 2023, and many of the promised investors, such as market makers like Jump, GSR, and Kronos, did not actually contribute any funds. This is because Binance, the industry leader, only spent $15 million and then withdrew the remaining $985 million.

Moreover, the entire operation of IRI is extremely opaque; you have no idea which projects have received investment or which projects are left with no recourse but to wait for their demise.

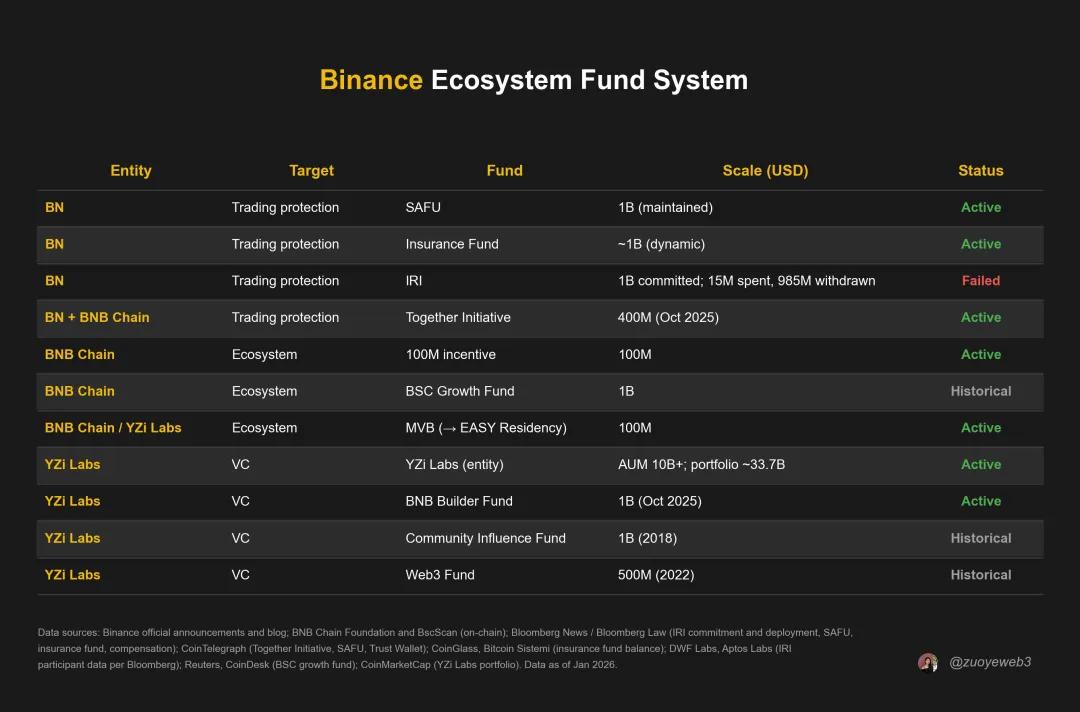

If we delve deeper, IRI is not the only example of Binance making promises but failing to deliver. More recently, there was the $400 million "Together Fund" after 10/11, and further back, there was the $1 billion BSC Growth Fund established in 2021, which, after many years, started spending $50,000 to buy the "I'm coming" Meme coin.

Image caption: Binance ecosystem funds

Image source: @zuoyeweb3

If you take a closer look at the various programs launched by Binance, it seems that they have a particular preference for the number 1 billion. For example, Justin Sun 1 million reward will never be received. Apart from the YZi Labs main fund, Binance has promised various funds of more than 5 billion US dollars, but less than 100 million US dollars has actually been realized.

It can be stated very clearly that after the failure of IRI, Binance actually began a dark process of intercepting industry revenue rather than generating revenue, namely supporting the Binance main site to compete with CEXs and supporting BNB Chain to compete with public chains such as Solana.

This is also the source of Solana co-founder Anatoly's statement that the industry needs an 18-month recovery period. Binance doesn't care about the industry's bull and bear markets or cycles, as long as the BSC ecosystem and the Binance main site maintain trading dominance.

Binance cannot become the rule-maker; it can only reign supreme in its own little corner of the world.

However, Coinbase CEO Armstrong doesn't think so. In his view, instead of obeying the established rules, we should try to tame them. The current struggle with the banking industry over the interest rate of USDC is just the tip of the iceberg. Intervening in politics itself is the real answer.

This doesn't mean Coinbase used an RPG to bombard the mayor's car; Coinbase has a more sophisticated approach—using an engineering and commercial mindset to conduct lobbying work.

Traditional K Street lobbying relies on the connections of retired politicians, commonly known as the political-business revolving door, to influence politics. However, this is considered too low-level in Silicon Valley. From Airbnb to Uber, they all walk the line between innovation and compliance. From this perspective, cryptocurrency is not particularly special.

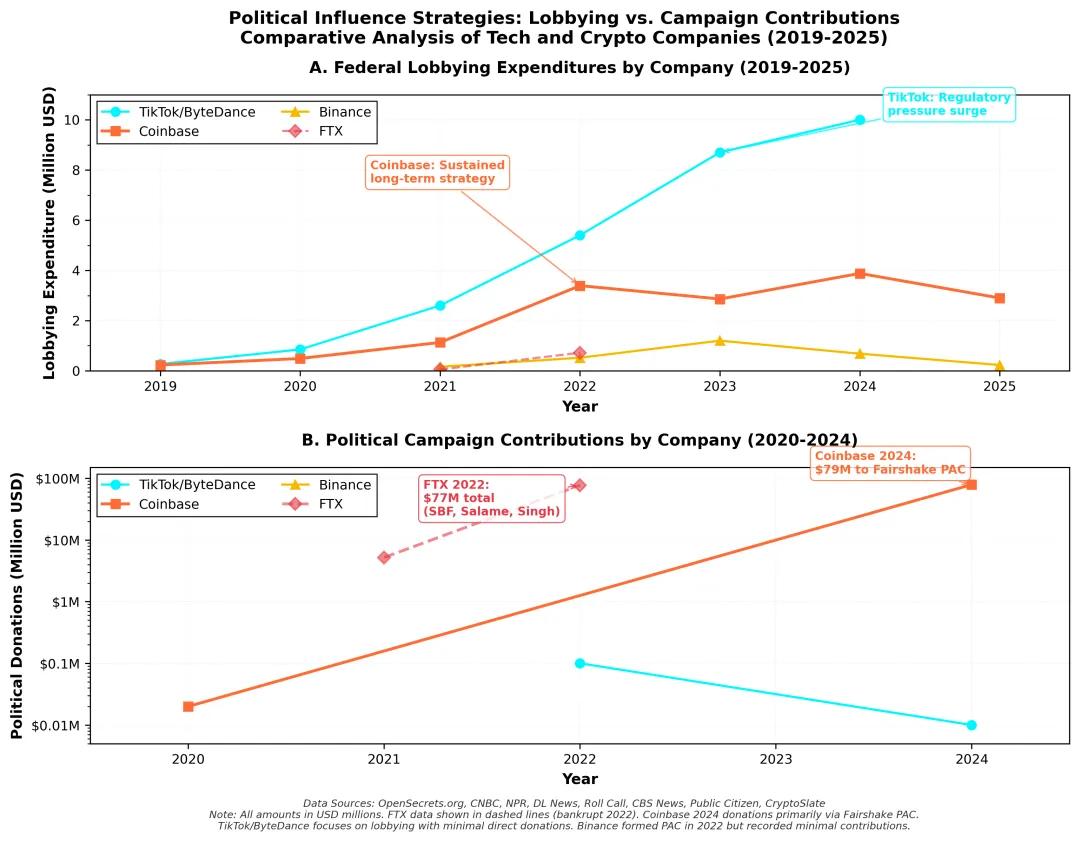

Image caption: Election and donation data

Image source: @zuoyeweb3

However, FTX's SBF and Binance's CZ are both unusual. SBF is overly biased towards the Democratic Party. Although it has transitioned to the Republican Party, according to TIME magazine, it has donated more than $40 million to the Democratic Party, far exceeding the $29 million it donated to the Republican Party.

Binance would rather pay a $4.2 billion fine to a Democratic president and cooperate with a Republican president on a $2 billion USD1-for-MGX equity investment deal, but its investment lobbying amount for 2025 is only $800,000.

Both the top two are shrewd and foolish. Coinbase, whose trading volume is not higher, has overtaken others by not only finding Chris Lehane to form the most powerful lobbying team in history, but also directly partnering with A16Z to create the StandwithCrypto Red and Black List, which directly scores various politicians. Crypto-friendly politicians can receive donations, while unfriendly politicians will not be targeted, but will receive donations from their opponents.

The core of American politics is elections, while the Achilles' heel of Chinese officialdom is selection. It was Coinbase's early planning that led to Trump's embrace of Bitcoin during the election.

Failed attempt to enter the US: The small piggy bank hides in the large piggy bank.

When the US says you have ties to the Chinese government, you'd better actually have them.

I also want to tell a story, a story about a group of evil dragons rolling around in the mud.

As Trump was about to enter the White House, Bezos asked his Washington Post to remain neutral in the election, Microsoft urgently disbanded its DEI division, and Zuckerberg restored Trump's Instagram account. However, Peter Thiel had already bet on Trump back in 2020, and Musk chose to defect in 2022.

Ultimately, their outcomes varied. Peter Thiel profited the most, followed by Musk, while the other billionaires fared relatively well. If we include the Koch brothers and the Mellon family of New York, among other super-rich individuals, an interesting fact can be observed during Trump's second term:

Old money is exempt from liquidation; old money has the right to bet on both sides; internet users have the right to oscillate; crypto nouveau riche need to bet cautiously; outsiders are just meat on the chopping block; Sun is cut and cut (FDUSD has difficulty in protecting its rights and has been blacklisted by WLFI); CZ has paid the most money, but is the most uneasy.

Image caption: Binance's path to self-abandonment

Image source: @zuoyeweb3

This unease lingered in CZ's mind, especially since the UAE passport had neither protected his personal safety nor saved the company's reputation from the equity-for-currency rights.

- The Middle Eastern oil-producing countries, represented by the UAE, are essentially America's cash cows. The US doesn't particularly respect their sovereignty, and the reach of this political asylum is extremely limited.

- The Trump family's WLFI and the UAE's MGX are mutually bound together in their investments. The only ones giving up real benefits are Binance and CZ themselves, and this obedience is not sustainable.

MGX in the UAE represents the interests of the Abu Dhabi royal family, which is the fundamental reason why Binance quickly moved from Dubai to Abu Dhabi after receiving its investment. Furthermore, MGX invested $2 billion to purchase USD1 tokens of WLFI, and Binance subsequently received investment from MGX.

According to the Washington Post, WLFI's USD1 technology was entirely developed by Binance. This means Binance provided both funding and technology, along with its own distribution network, while WLFI simply reaped the benefits. MGX even received Binance equity.

The market price for Trump's second term amnesty was $1 million or more, with lobbying firms offering starting bids. In just five months in office, he granted amnesty to 1,600 people, making CZ undoubtedly the top bidder.

However, this kind of protection is ineffective against both Cathie Wood and Musk, who are also Americans. CZ's investment of $500 million in Musk's acquisition of Twitter, accounting for about 1% of Musk's $43 billion investment, does fit the position of a minority shareholder. However, it is hard to say that Binance has a role in Musk's blueprint for the future of Twitter.

The only option is to frantically redirect traffic from Twitter to Binance Square, but those who come to Square are not the source of the crisis on Twitter; at least Star Xu won't be there.

Every drink and every bite is preordained.

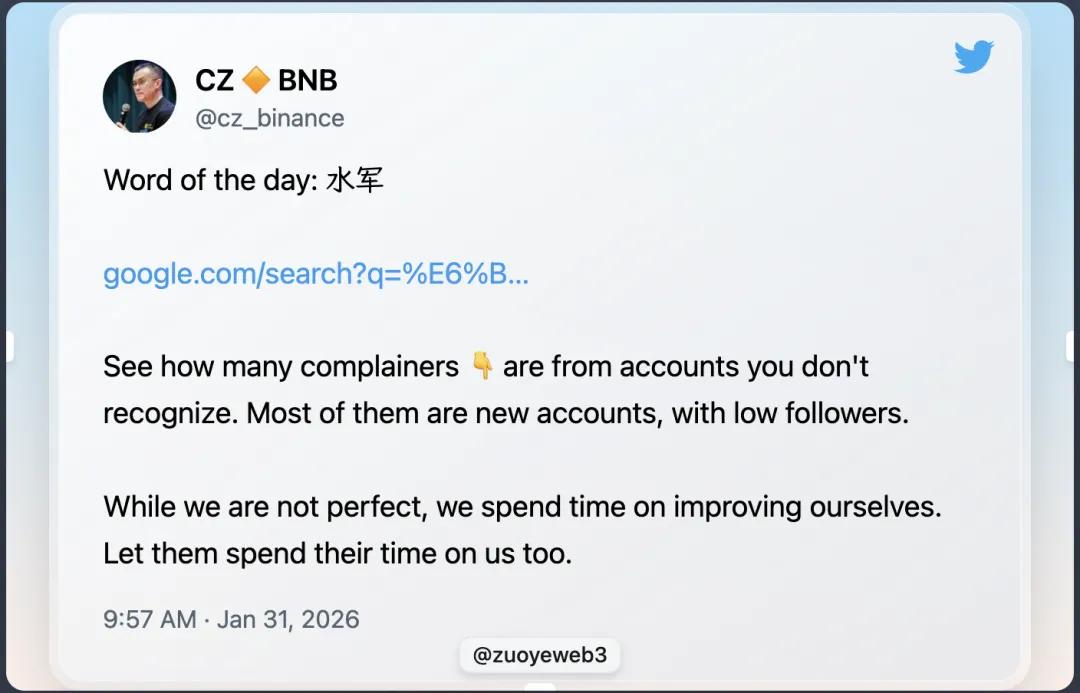

Image caption: Meaning of "water army" (internet trolls)

Image source: @cz_binance

After Binance and CZ's failed attempt to "break into the US," you might be surprised to find that CZ started tweeting in Chinese and even explained the meaning of "water army" to English-speaking CT users, as if CZ's relationship with Chinese users has taken another step closer.

This is not an illusion. Embracing the Chinese market again has become Binance's main theme. The reason is not complicated: don't force yourself into circles you can't fit into.

CZ's mentality is very much in line with that of Chinese people since the reform and opening up: rules are sacred, Western civilization is paramount, and they would never dare to interfere in politics like Coinbase, nor would they dare to gamble and take sides like Musk. In short: they only know how to solve problems, but they dare not create them.

Faced with pressure from the United States, CZ has fallen into a mindset of "because I haven't given enough money, I should give more." In this respect, it is clear that CZ has not understood the art of Trump's deal. Only after the conditions are completely agreed upon should an offer be made.

They dare not participate in the power struggles of the US government and legislation, cannot pursue connections with higher levels, and cannot gain support from grassroots public opinion.

Looking at the situation from all angles, Meng Wanzhou can only pin her hopes on Chinese users, but she is also determined to sever ties with the Chinese government. As a result, the Chinese government doesn't care what the US does to her, and she can neither get personal protection from Meng Wanzhou nor gain commercial benefits from TikTok.

In comparison, TikTok is now divided into three parts: Douyin in China, TT in the US, and TT globally. ByteDance retains a 19.9% stake in the US version of TikTok, while Oracle, MGX, and Silver Lake each hold 15%.

However, TT.US followed the "cloud Texas" model, where ByteDance retained the algorithm ownership and profits. Moreover, after the deal was completed, the American public turned their attention to Oracle, which was the best outcome for ByteDance, as it retained some profits and gained public sympathy.

Oh, and you don't have to pay a huge fine.

Conclusion

The freedom of the British is not the freedom of the French, and the investments of internet upstarts are not the speculation of crypto billionaires.

SBF's clumsy pleading is reminiscent of the summer of 2022, when FTX was once seen as the last hope for crypto, and Coinbase's Armstrong seemed to lack any charismatic authority.

Compared to them, CZ was eliminated early in the collusion of capital and power, and never even became an insider. In the end, he could only reluctantly become a "Canadian of Chinese descent holding a UAE passport," embracing an extremely awkward public image of "fighting for space for Chinese people in the crypto world."

But this never became a reality.