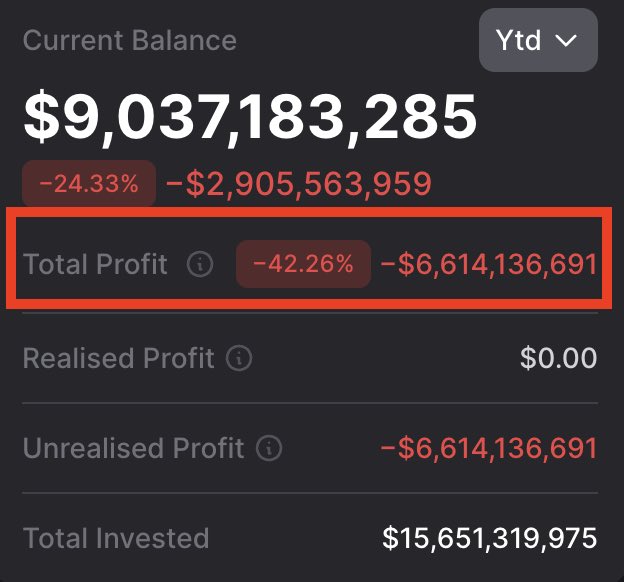

Data shows that BitMine's unrealized Ethereum losses have risen to -$6.6 billion. This is not just a simple paper deficit, but a ticking historical alarm bell. If this loss is ultimately realized, it will immediately become the fifth largest loss in recorded financial history. Many people don't understand the significance of this number. We can look back at the "nuclear explosion" that shook Wall Street in 2021—Bill Hwang's Archegos Capital liquidation. That was the largest single-day loss in human financial history to date. At this moment, BitMine's unrealized losses have reached 66% of the Archegos disaster. Even more intriguing is the word "unrealized." It means the risk has not been fully released, but it also means that enormous uncertainty hangs over the market. When unrealized losses approach historical extremes, should one hold on and wait for a reversal, or cut losses and trigger a chain reaction? BitMine is writing its own story, and the market is holding its breath.

This article is machine translated

Show original

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content