Bitcoin (BTC) and altcoins started the new week with further declines. Factors cited as contributing to this drop include ongoing tensions between the US and Iran, decreased corporate demand, and macroeconomic uncertainty.

While it’s being claimed that a bear market has started for Bitcoin, Coinshares has released its cryptocurrency report stating that there was a $1.7 billion outflow last week.

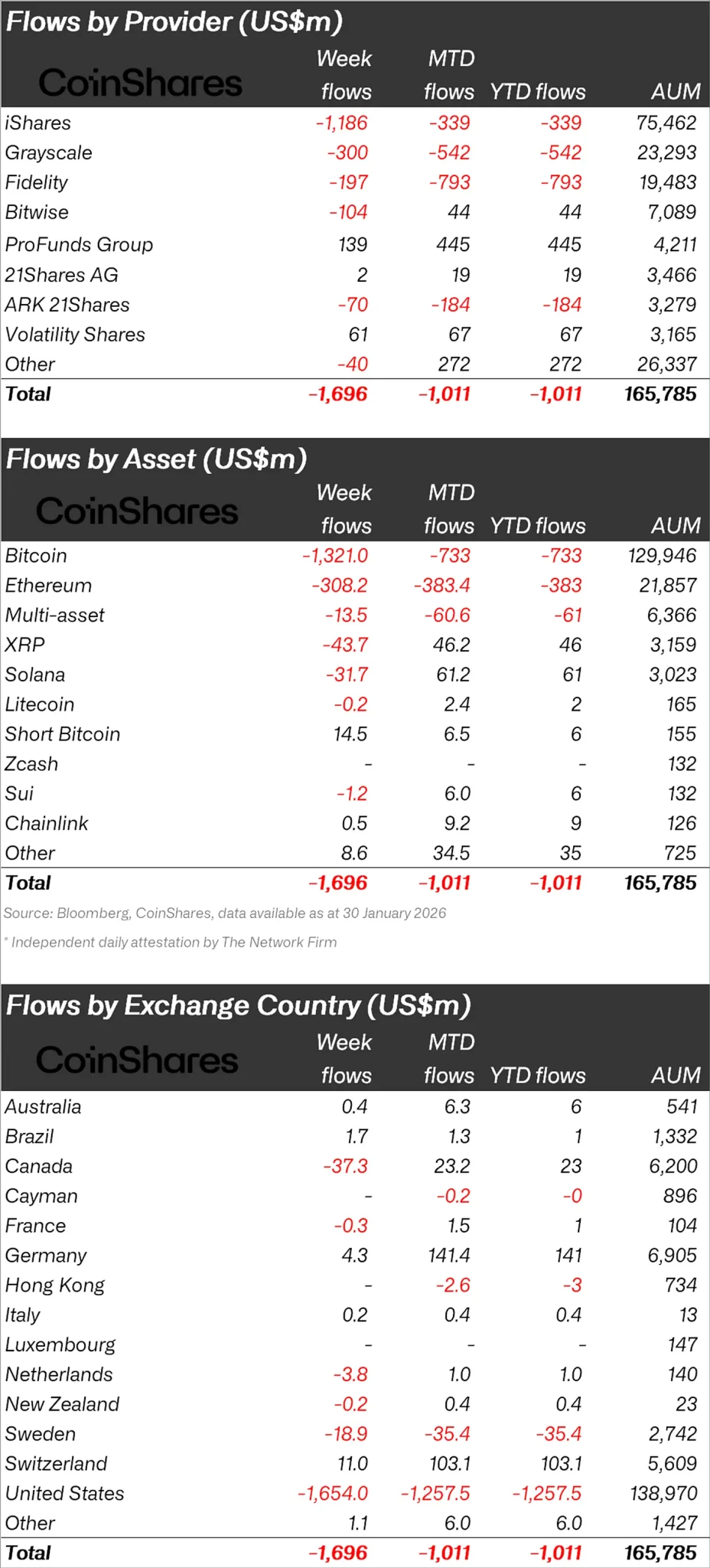

“Weekly outflows of $1.7 billion were seen in cryptocurrency investment products; this has resulted in a net outflow of $1 billion since the beginning of the year and a decrease of $73 billion in assets under management (AuM) since the October 2025 peaks.”

We believe this reflects a combination of various factors, including the appointment of a more hawkish Federal Reserve Chairman, the ongoing large-scale investor sell-offs associated with the four-year cycle, and increased geopolitical volatility.

Exits Concentrated in Bitcoin and the US!

Looking at crypto funds individually, it was observed that the majority of outflows were in Bitcoin.

Bitcoin experienced outflows worth $1.32 billion, while Ethereum (ETH) saw outflows of $308 million.

Looking at other altcoins, we see that inflows have been replaced by outflows. Solana (SOL) saw an outflow of $31.7 million, $XRP $43.7 million, and Sui (SUI) $1.2 million.

“Negative sentiment was prevalent among the participants.”

Bitcoin saw an outflow of $1.32 billion, Ethereum $308 million, while the recently popular $XRP and Solana experienced outflows of $43.7 million and $31.7 million respectively.

In contrast, popular investment products, which have recently benefited from the over-the-chain selling frenzy in tokenized precious metals, attracted attention with an inflow of $15.5 million.

Looking at regional fund inflows and outflows, the US ranked first with an outflow of $1.65 billion.

After the US, Canada experienced outflows of $37.3 million and Sweden $11.1 million.

In response to these outflows, Switzerland experienced a small inflow of $11 million and Germany a small inflow of $4.3 million.

*This is not investment advice.