I love DOVs and structured products as a concept, but I haven't seen them take off yet.

embarassed to say, I still haven't tested @ryskfinance, built by my good friends of the Italian DeFi Mafia.

posting my raw thoughts and user experience below 👇

ahh, excellent! my first UX complaint:

there's no way to buy these KHYPE-PT-19MAR26 contracts from their front end - i have to go to Pendle, and mint them myself.

that means i need to have kHype, which means i'm going to be illiquid or subject to bad execution in an AMM. 2 options:

- wait 7-10 days for staking unlocks to get my Hype out

- minting kHype is worth $32.61 but if I buy it on the AMM then i'm paying $32.73. That's 36 bips of bad execution, plus AMM fees and gas.

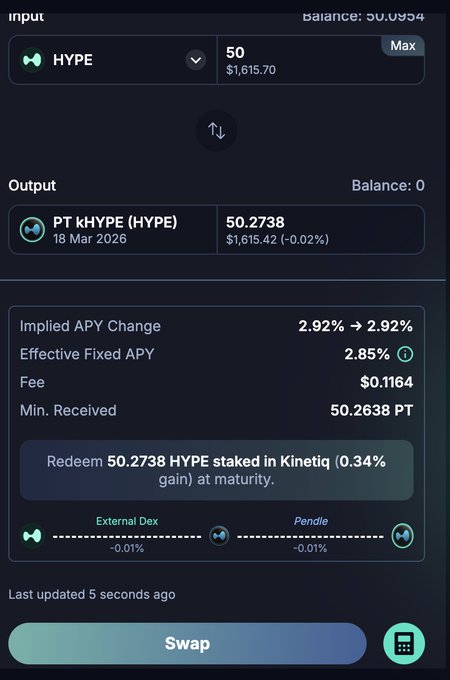

fortunately, hitting Pendle's front end lets me swap Hype to kHYPE-PT-19MAR26 directly, and it completely abstracts my bad execution!

In fact, it almost looks like i'm getting a good deal, except when you realize that the effective APY is 285 bips but the actual % gain i will see at maturity is 34 bips.

Okay but charco, that's simply because you are first transacting in an LST AMM pool and then losing fees+slippage to Pendle's AMM... surely this is the best we can do in DeFi, there's no way to improve from here.

Wrong. Tplus will enable MMs to quote routes like this much tighter due to decreased capital costs and atomicity between HyperCore and HyperEVM.

The KHype will have its own orderbook, and the MMs cost will effectively be reduced to the price for the 7-10 day unstaking hedge - and that's assuming the hedge is costing them something; they would actually profit on the hedge since the funding fee on Hype is positive right now.

Further more, once the PT's are minted, the market maker can trade them in Tplus' orderbook, circumventing Pendle's egregious fees on all subsequent transactions.

Both legs of this swap get significantly cheaper on Tplus, and my effective APY on Pendle goes up. A lot.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content