This article is machine translated

Show original

My Third Year Living on Passive Income: As the first installment of the third year in this passive income series, let me first explain my current asset structure.

After selling 10 Bitcoins last October, over $1 million was channeled into IBKR, used to purchase a sufficient amount of government bonds for future living expenses.

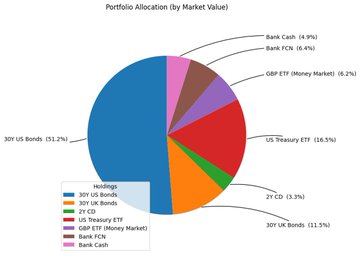

51% was invested in long-term US Treasury bonds, and 10% in long-term UK Treasury bonds (with a higher interest rate of 5.38%), also used to hedge against the risk of dollar depreciation. Money market funds (USD/GBP) and 2-year CD bank deposits account for 30%, used for daily liquidity.

This portfolio currently provides me with approximately $70,000 in pure passive income annually. This is the foundation for our family's future.

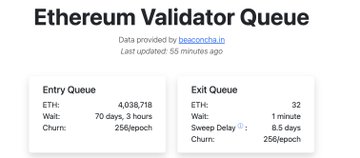

Additionally, my DeFi income mainly comes from Ethereum staking via SaaS. Although the current average APR across the network is only 2.84%, I was surprised to find that the staking queue has reached 70 days, a historical peak, especially given the recent cryptocurrency crash. Isn't that surprising? Okay, back to the main topic, let's look at my passive income for January 2026:

January 2026 DeFi Passive Income:

1. Concentrator $60.8

2. Votium $151

3. LSD $552

4. SAAS $1408 DeFi passive income totaled $2172 USD. There were two small block trades this month, with a total gain of 0.8098 ETH from LSD + SAAS.

January 2026 Real-World Passive Income:

1. 5% Treasury Gilt 2056 UK Gilt Bond, six-month interest of £3493, equivalent to $4808;

2. USD Short-Term Bond Fund SGOV, January dividend of $794;

3. GBP Money Market Fund CSH2, January cumulative gain of £400, equivalent to $550.

Passive income from real assets totaled $6152.

Total passive income in January 2026:

DeFi $2172 + real $6152 = $8324

Active Investment: Due to the sharp decline in cryptocurrencies in the past two days, @protocol_fx's leveraged positions have suffered significant losses, turning from net profit to unrealized loss.

@protocol_fx 1.0 position: Ethereum-based unrealized loss of 14%, leverage ratio 2.18X, risk manageable, very ideal.

@protocol_fx 2.0 position: USDT-based unrealized profit of 1.36%, Ethereum-based unrealized loss of 14.2%, leverage ratio 2.35X, risk also manageable. Soft liquidation will only occur when the Ethereum price drops to 1567.

After selling my cryptocurrencies in October 2025, I still very much hoped that cryptocurrencies would continue their bull market. However, the result is that the four-year cycle, like a ghost in the crypto industry, relentlessly batters everyone involved.

Every time, someone says this time will be different, but the result is always the same…

The AI craze has far surpassed the cryptocurrency industry. But as has been the case for the past decade or so, only those with true faith will experience their own wealth explosion.

Just like gold this year. Actually, there's no difference between those who buy gold and those who buy Bitcoin; both are hedging against the risk of excessive fiat currency issuance. The only difference is in their understanding. I myself am a holder of both, and I believe that in the future, they will converge to some extent.

When the tide goes out, whether you're wearing swim trunks or not doesn't matter. As long as you're still alive!

What matters is whether you're on the boat when the tide rises, and whether your wealth rises with it.

Wishing everyone great wealth and good luck in 2026!

darkforest

@darkforesttri

12-31

靠defi被动收入过活的第二个年头的最后一个月

2025年12月被动收入总结:

1. concentrator $81

2. votium $146.5

3. LSD $734

4. SAAS $1849

5. YB $52.88

5. kraken交易所美元利息$590

6. 美国短债ETF(SGOV)月分红$744

总和被动收入核算美元$4145。 x.com/darkforesttri/…

I rarely pay attention to UK bonds, but this reminds me. How has the correlation between the pound and the US dollar historically been? Does it offer a hedging effect?

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content