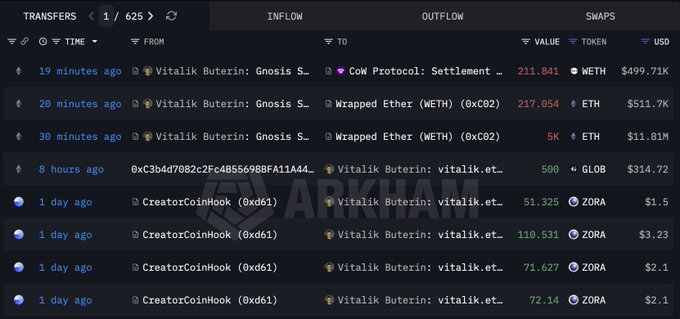

DEV Sell? Don't panic! Let me break it down for you; this is actually a clear separation of finances and responsibilities. I. The Overlooked Signal of "Budget Tightening" Vitalik had clearly foreshadowed several days ago that the Ethereum Foundation (EF) would enter a "budget tightening period." This doesn't mean Ethereum is running out of funds, but rather a strategic reallocation of resources. EF's strategy is clear: tighten its grip and concentrate limited resources on critical core areas, such as the implementation of zkEVM and research into quantum-resistant cryptography. II. The "Great Shift" of 16,384 ETH To achieve EF's "slimming down" without slowing it down, Vitalik adopted a rare "personal pressure" approach. He requested to withdraw 16,384 ETH as a separate budget—the source of the recent frequent on-chain fund changes. Conclusion: The current ETH sale is a necessary liquidity exchange to pay the salaries and R&D costs of relevant developers. From a financial auditing perspective, this is a pre-planned "scheduled expenditure" rather than a sudden "founder's share reduction".

This article is machine translated

Show original

Lookonchain

@lookonchain

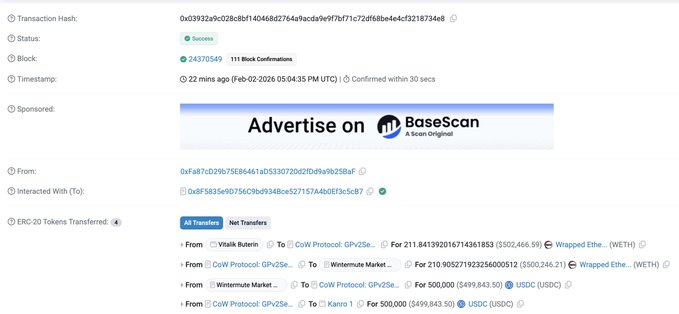

vitalik.eth(@VitalikButerin) sold 211.84 $ETH for 500,000 $USDC ~20 minutes ago and transferred the 500,000 $USDC to Kanro.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content