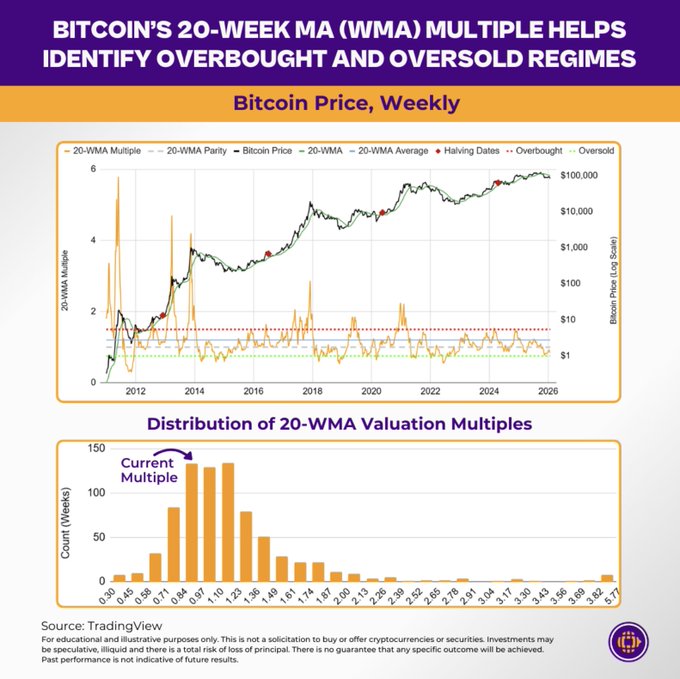

The Gravity of Bitcoin’s 20-WMA Bitcoin’s 20-Week MA (WMA) Multiple Helps Identify Overbought and Oversold Regimes Bitcoin’s price relative to its 20-week moving average (WMA) has historically acted as an important valuation tool highlighting extreme highs and extreme lows. Periods where the multiple rises into the red zone have historically aligned with overbought conditions near cycle peaks, while dips into the green zone have marked oversold conditions and long-term accumulation opportunities. Across cycles, price repeatedly mean-reverts toward the 20-week average, reinforcing its role as a structural anchor for Bitcoin’s trend. The current multiple of 0.84 does represent oversold conditions but has not reached extreme territory based on historic lows. @Bitcoin @BitcoinNews

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content