This article is machine translated

Show original

"Gap Filling in Progress": Target at 74K Hit On Schedule, Where Will BTC's Downtrend End? 🚏

As referenced below, my headline prediction of "74K is inevitable" has already played out in just 2 days—liquidity analysis delivers yet again.

This post covers two key points:

1️⃣ Latest update on BTC's on-chain distribution

2️⃣ Reiteration of post-move scenarios & what to watch next

Let’s dive in 👇

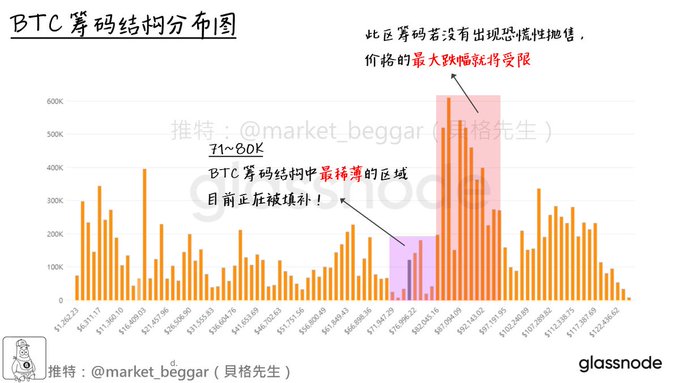

Attached is the URPD chart—showing the on-chain distribution of BTC. For a deep dive into URPD analysis, check:

x.com/market_beggar/status/196...…

As mentioned, two main updates today:

//

1️⃣ State of BTC’s On-Chain Distribution: Thin Area Getting Filled

If you’ve been tracking BTC distribution with me, or reading BeggarChain Weekly, you’ll know:

There’s been a near "vacuum zone" between 71K–80K.

My last URPD share in Weekly #61 made this crystal clear:

x.com/market_beggar/status/201...…

If we treat 71K–80K as a URPD vacuum, price action tends to fill every gap.

If price pumps hard before filling, odds are high it’ll revisit to fill it later.

📖 More on URPD vacuums:

x.com/market_beggar/status/188...…

Translation:

If the sluggishness in price is about filling this vacuum,

Then this revisit to 71K–80K might finally clear the risk for the next major rally—bullish and healthy for the next cycle ✅

//

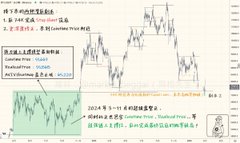

2️⃣ Post-Move Scenarios & Monitoring Roadmap

To save your time, I’ve detailed two main trading scenarios in the quoted thread below—check it out if you want the full breakdown.

Here’s the quick update:

Last night in the US session, BTC hit 74K as expected, sweeping liquidity from the previous low (April 2025 wick).

A lot of you asked:

💬 "Is Scenario 2 happening?"

💬 "Are strong Takers showing up?"

💬 "Is the Stop Hunt complete?"

Since there are so many questions, here’s my group reply 📝:

➡️ Watch if BTC reclaims 74.5K in the next 1–2 weeks

➡️ Watch for strong Taker Buys as it moves above 74.5K

➡️ With this size, Takers won’t show up instantly—expect some chop

➡️ If price just grinds lower, the 74.5K Stop Hunt play might be invalidated

➡️ If so, switch to Scenario 3 (see thread below for details)

If you’re still unsure, hit the comments or join our public chat (link on homepage) for discussion ☕️

//

Here’s a quick and dirty rule of thumb 🔭:

If price chops just below 74.5K, doesn’t break down but also doesn’t reclaim,

Then suddenly prints a fat daily green candle back above 74.5K,

The odds of the 74.5K Stop Hunt working go way up 📈

One thing missing right now is volume.

Ideally, major bottoms come with huge daily volume—but that’s not showing up yet.

Let’s clear up some common misconceptions:

➡️ Big volume is a bonus for a bottom, but not a requirement ❌

➡️ Bottoms often have big volume, but big volume doesn’t guarantee a bottom ❌

That’s all for today—stay patient and wait for that golden trigger moment 🫡

//

📚 More Reading:

BTC Technicals: Rising Downside Risk & Calm Before the Storm

x.com/market_beggar/status/201...…

Storm Arrives: Liquidity Gravity Intensifies, Stop Hunt Imminent

x.com/market_beggar/status/201...…

"74K Inevitable": New Liquidity Gravity Zone Formed

x.com/market_beggar/status/201...…

"Blue Line Power": Strong Support Below BTC & Historical Recap

x.com/market_beggar/status/201...…

//

【Shill Time】

Got a bag of U, but don’t want to buy the dip right now? 💰

Here’s a solid place to park your stablecoins: Bitget Wallet On-chain Yield

✅ Long-term APR = 10%, powered by AAVE + Bitget Wallet subsidies

✅ USDC yield, start with just $1, withdraw anytime

✅ Transparent, no rehypothecation, no recursive lending—low risk

Interested? Register with my invite code below 👇

Invite Code: "3jTNi6" (bind manually)

貝格先生

@market_beggar

02-02

「74K 必到」:新的流動性引力區已然形成⚠️

🪧前言:

本文將結合「Liquidity 分析」和「鏈上分析」的邏輯,

和各位分享我對於後市的 bias,同時附上接下來的完整交易計畫。

週末突如其來的暴跌,再次引燃了市場的悲觀情緒;

但或許你沒發現:新的訊號已悄然而至,74K 的獵取已成高概率事件 ...👇: x.com/market_beggar/…

High-quality Berger!

Thanks Alvin💖

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content